Valid Vehicle Repayment Agreement Template

Document Sample

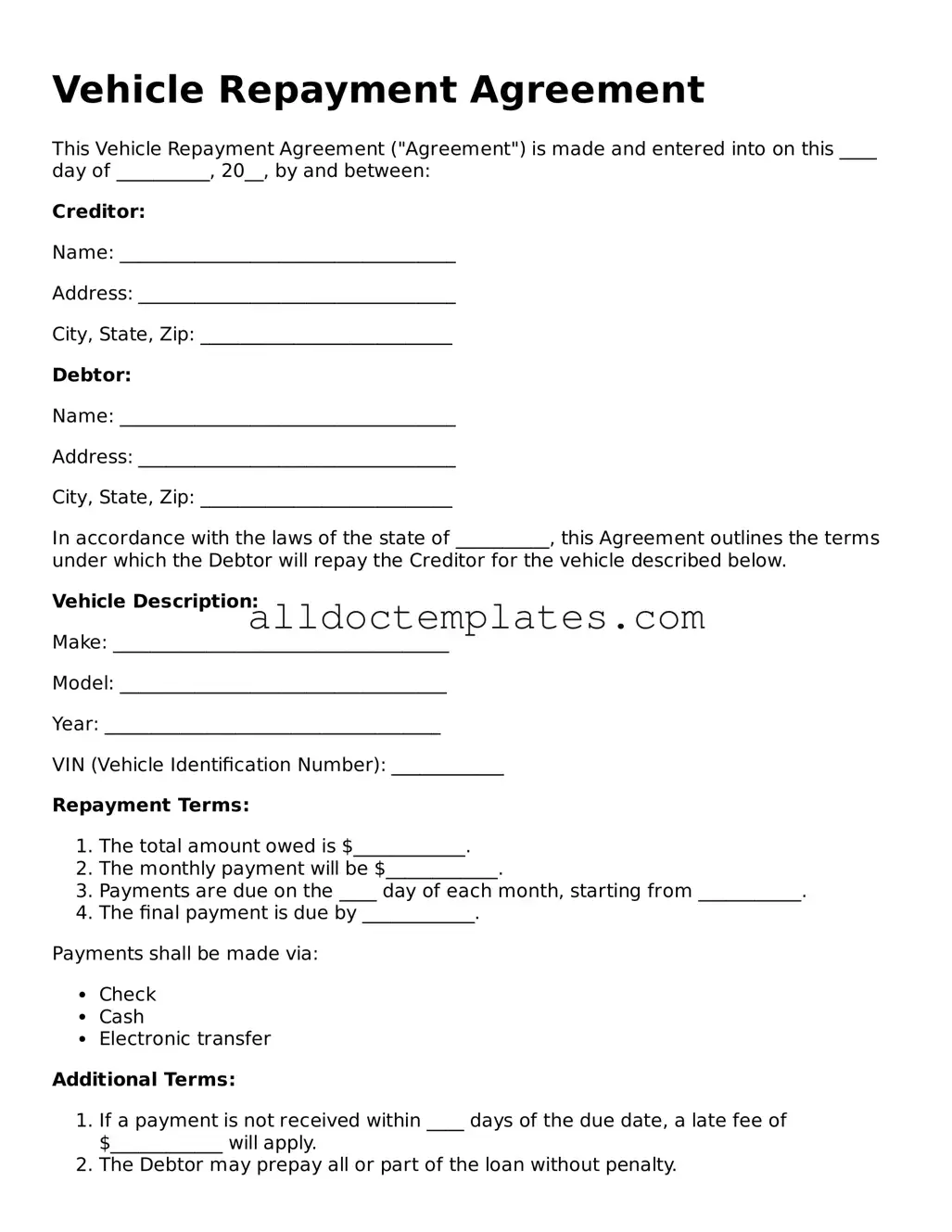

Vehicle Repayment Agreement

This Vehicle Repayment Agreement ("Agreement") is made and entered into on this ____ day of __________, 20__, by and between:

Creditor:

Name: ____________________________________

Address: __________________________________

City, State, Zip: ___________________________

Debtor:

Name: ____________________________________

Address: __________________________________

City, State, Zip: ___________________________

In accordance with the laws of the state of __________, this Agreement outlines the terms under which the Debtor will repay the Creditor for the vehicle described below.

Vehicle Description:

Make: ____________________________________

Model: ___________________________________

Year: ____________________________________

VIN (Vehicle Identification Number): ____________

Repayment Terms:

- The total amount owed is $____________.

- The monthly payment will be $____________.

- Payments are due on the ____ day of each month, starting from ___________.

- The final payment is due by ____________.

Payments shall be made via:

- Check

- Cash

- Electronic transfer

Additional Terms:

- If a payment is not received within ____ days of the due date, a late fee of $____________ will apply.

- The Debtor may prepay all or part of the loan without penalty.

- This Agreement may be modified only in writing and signed by both parties.

Signatures:

By signing below, the parties agree to the terms set forth in this Vehicle Repayment Agreement.

______________________________

Creditor Signature

Date: _______________

______________________________

Debtor Signature

Date: _______________

Form Data

| Fact Name | Description |

|---|---|

| Purpose | The Vehicle Repayment Agreement form is used to outline the terms and conditions under which a borrower agrees to repay a loan secured by a vehicle. |

| Governing Laws | In many states, the agreement is governed by the Uniform Commercial Code (UCC), which regulates secured transactions involving personal property. |

| Key Components | This form typically includes details such as the loan amount, interest rate, payment schedule, and consequences of default. |

| State-Specific Variations | Some states may have specific requirements or additional disclosures that must be included in the Vehicle Repayment Agreement, depending on local laws. |

Vehicle Repayment Agreement - Usage Guidelines

Once you have the Vehicle Repayment Agreement form in hand, it’s important to carefully fill it out to ensure all necessary information is included. Completing this form accurately will help facilitate the repayment process and avoid any potential delays. Follow these steps to fill out the form correctly.

- Read the Instructions: Before you begin, take a moment to read any instructions provided with the form. This will give you a clear understanding of what information is required.

- Enter Your Personal Information: Fill in your full name, address, and contact information at the top of the form. Make sure this information is current and accurate.

- Provide Vehicle Details: Include the make, model, year, and Vehicle Identification Number (VIN) of the vehicle in question. This information is crucial for identification purposes.

- State the Loan Amount: Clearly indicate the total amount of the loan or debt that is being repaid. This should be an exact figure.

- Outline the Repayment Terms: Specify the repayment schedule, including the amount of each payment and the frequency (e.g., weekly, monthly). Be precise with dates.

- Sign and Date the Form: At the bottom of the form, sign and date it to confirm that all the information is accurate and that you agree to the terms outlined.

- Review Your Form: Before submitting, review the entire form to ensure that all sections are completed and there are no errors.

- Submit the Form: Finally, follow the instructions for submitting the form, whether that’s online, by mail, or in person.

Browse Popular Documents

How to Write Up a Bill of Sale for a Boat - Including the hull identification number is crucial for the Bill of Sale accuracy.

Understanding the importance of the Vehicle Release of Liability form can significantly benefit vehicle sellers. This document serves as a safeguard, ensuring that once a vehicle is transferred, the seller is no longer held liable for any future claims or issues related to that vehicle.

Restroom Cleaning Sign Off Sheet - Clear documentation cuts down on potential misunderstandings.

Dos and Don'ts

When filling out the Vehicle Repayment Agreement form, it is essential to approach the process with care and attention to detail. The following list outlines important actions to take and avoid during this process.

- Do read the entire form carefully before starting to fill it out.

- Do provide accurate and complete information in all required fields.

- Do double-check your calculations to ensure that all figures are correct.

- Do sign and date the form where indicated.

- Don't leave any required fields blank; this may delay the processing of your agreement.

- Don't use white-out or any correction fluid on the form, as this may invalidate it.

By adhering to these guidelines, individuals can facilitate a smoother experience when submitting their Vehicle Repayment Agreement form.

Common mistakes

-

Incomplete Information: One common mistake is leaving sections of the form blank. Each part of the form is essential for processing the agreement. Omitting details can delay approval or lead to misunderstandings.

-

Incorrect Vehicle Information: Providing inaccurate details about the vehicle, such as the make, model, or VIN, can cause significant issues. Always double-check this information before submission.

-

Failure to Read the Terms: Many individuals skim over the terms and conditions. Understanding these terms is crucial, as they outline your rights and responsibilities under the agreement.

-

Not Including Supporting Documents: Some people forget to attach necessary documents, such as proof of income or identification. These documents often support your application and are required for processing.

-

Ignoring Signature Requirements: Skipping the signature or forgetting to date the form is another frequent error. This can render the agreement invalid, leading to complications down the line.

-

Misunderstanding Payment Terms: Failing to fully grasp the payment structure can lead to financial strain. Be sure to understand how much you owe, when payments are due, and any interest rates involved.

-

Assuming Automatic Approval: Some individuals mistakenly believe that submitting the form guarantees approval. Each application is reviewed on its own merits, and various factors influence the decision.

-

Neglecting to Keep Copies: After submitting the form, many forget to keep a copy for their records. Having a copy is important for tracking your agreement and for future reference.