Valid Transfer-on-Death Deed Template

Document Sample

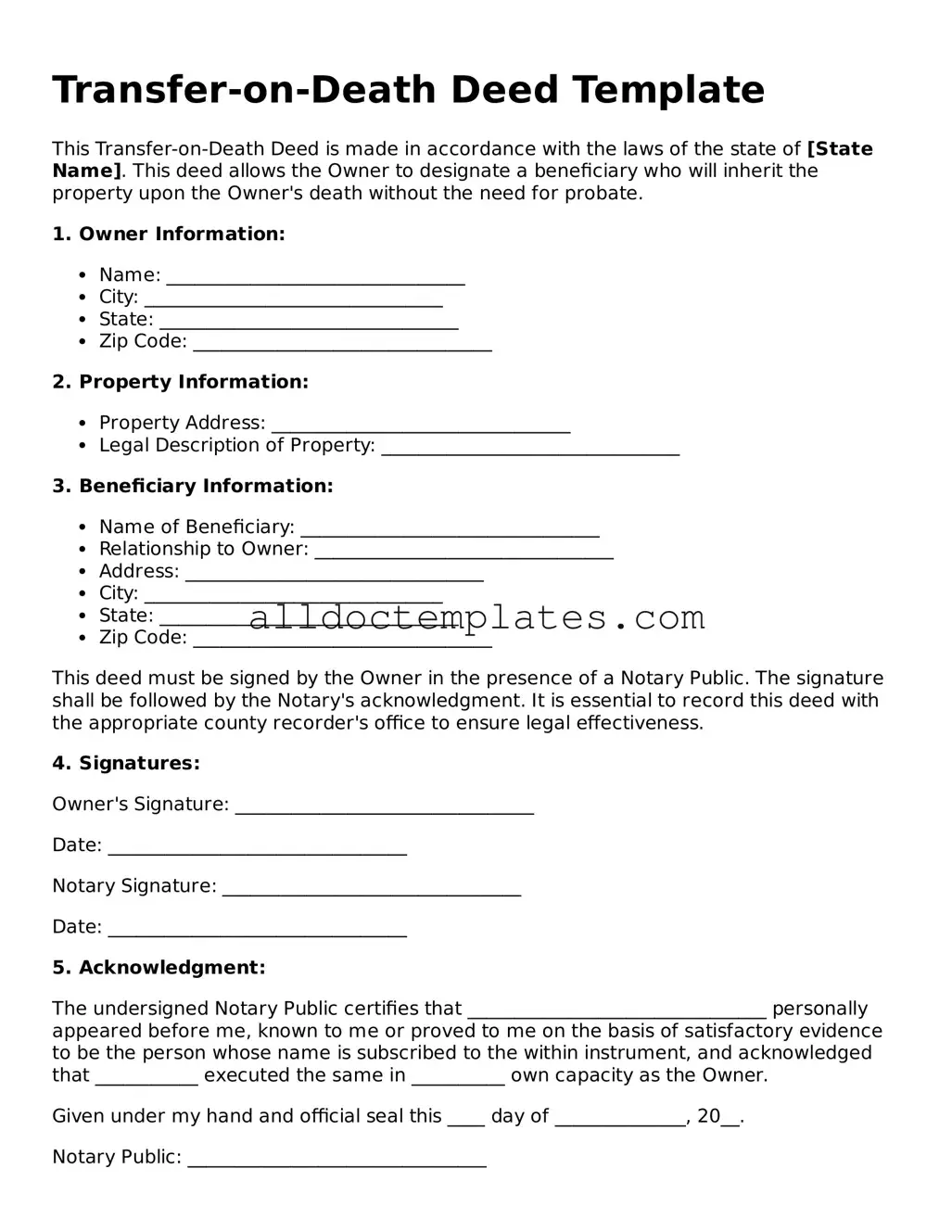

Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made in accordance with the laws of the state of [State Name]. This deed allows the Owner to designate a beneficiary who will inherit the property upon the Owner's death without the need for probate.

1. Owner Information:

- Name: ________________________________

- City: ________________________________

- State: ________________________________

- Zip Code: ________________________________

2. Property Information:

- Property Address: ________________________________

- Legal Description of Property: ________________________________

3. Beneficiary Information:

- Name of Beneficiary: ________________________________

- Relationship to Owner: ________________________________

- Address: ________________________________

- City: ________________________________

- State: ________________________________

- Zip Code: ________________________________

This deed must be signed by the Owner in the presence of a Notary Public. The signature shall be followed by the Notary's acknowledgment. It is essential to record this deed with the appropriate county recorder's office to ensure legal effectiveness.

4. Signatures:

Owner's Signature: ________________________________

Date: ________________________________

Notary Signature: ________________________________

Date: ________________________________

5. Acknowledgment:

The undersigned Notary Public certifies that ________________________________ personally appeared before me, known to me or proved to me on the basis of satisfactory evidence to be the person whose name is subscribed to the within instrument, and acknowledged that ___________ executed the same in __________ own capacity as the Owner.

Given under my hand and official seal this ____ day of ______________, 20__.

Notary Public: ________________________________

My Commission Expires: ________________________________

State-specific Information for Transfer-on-Death Deed Forms

Form Data

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed (TOD) allows property owners to transfer real estate to a beneficiary upon their death without going through probate. |

| Governing Law | In many states, including California, Florida, and Texas, the TOD deed is governed by specific statutes that outline its use and requirements. |

| Beneficiary Designation | Property owners can name one or more beneficiaries in the TOD deed, ensuring that the property is transferred according to their wishes. |

| Revocability | A TOD deed can be revoked or changed by the property owner at any time before their death, providing flexibility in estate planning. |

| Tax Implications | Transfer-on-Death Deeds typically do not trigger gift taxes during the owner's lifetime, as the transfer occurs only upon death. |

| Exclusions | Not all types of property can be transferred using a TOD deed. For example, certain types of jointly owned property may not be eligible. |

| State Variations | Each state may have different requirements for executing a TOD deed, such as notarization or witness signatures, so it's essential to consult local laws. |

Transfer-on-Death Deed - Usage Guidelines

Once you have the Transfer-on-Death Deed form ready, it’s essential to fill it out accurately to ensure the intended transfer of property occurs smoothly. Follow these steps carefully to complete the form correctly.

- Begin by writing your name and address in the designated fields at the top of the form.

- Next, provide a description of the property you wish to transfer. This should include the full address and any relevant details that identify the property.

- Identify the beneficiary or beneficiaries. List their full names and addresses clearly. If there are multiple beneficiaries, ensure that each name is distinctly separated.

- Include your signature at the bottom of the form. This step is crucial, as it validates the deed.

- Have the form notarized. This adds an additional layer of authenticity and is often required for the deed to be legally recognized.

- Finally, file the completed deed with the appropriate local government office, usually the county recorder’s office, to make it effective.

After completing these steps, the Transfer-on-Death Deed will be ready for processing. Ensure that you keep a copy for your records, and inform the beneficiaries about the deed to avoid any confusion in the future.

More Types of Transfer-on-Death Deed Templates:

Deed of Gift Property - Gift Deeds can affect tax situations for both the donor and the recipient.

In the context of end-of-life care, it is crucial to understand the significance of a Colorado Do Not Resuscitate (DNR) Order form, as this legal document ensures that an individual's wishes regarding resuscitation efforts are honored. For those looking to access and fill out this important paperwork, resources like Colorado PDF Templates can provide the necessary guidance and templates to facilitate the process, allowing individuals to make informed decisions about their healthcare preferences.

New Jersey Quitclaim Deed Form - This form allows one party to give up any claim to a property.

Lady Bird Deed Form Michigan - The Lady Bird Deed may include language that specifies conditions for the property's future use.

Dos and Don'ts

When filling out a Transfer-on-Death Deed form, it’s important to approach the process with care. Here are five things you should and shouldn’t do to ensure the form is completed correctly.

- Do ensure that you are eligible to use a Transfer-on-Death Deed for your property.

- Do provide accurate information about the property and the beneficiaries.

- Do sign the deed in the presence of a notary public to validate the document.

- Do keep a copy of the signed deed for your records.

- Do check your state’s specific requirements for filing the deed.

- Don't leave any sections of the form blank; incomplete forms can lead to issues.

- Don't use outdated forms; always use the most current version available.

- Don't forget to inform your beneficiaries about the deed and its implications.

- Don't assume that the deed will automatically transfer the property without proper filing.

- Don't neglect to consult with a legal professional if you have questions or concerns.

Common mistakes

-

Incorrect Property Description: One common mistake is failing to provide a complete and accurate description of the property. It’s essential to include the full legal description, not just the address. This ensures that the deed is valid and can be executed without issues.

-

Not Naming Beneficiaries Clearly: When filling out the form, individuals sometimes make the error of not clearly naming the beneficiaries. This can lead to confusion or disputes later. Always use full names and consider including additional identifying information, such as relationship to the property owner.

-

Improper Signatures: The deed must be signed by the property owner. However, some people forget to sign or have someone else sign on their behalf without proper authorization. This can invalidate the deed. Ensure that the signature is clear and matches the name on the property title.

-

Failure to Record the Deed: Even after correctly completing the form, individuals often neglect to record the Transfer-on-Death Deed with the appropriate county office. Without this step, the deed may not be enforceable. Recording the deed ensures that it is part of the public record and can be acted upon when the time comes.