Free Transfer-on-Death Deed Document for Texas State

Document Sample

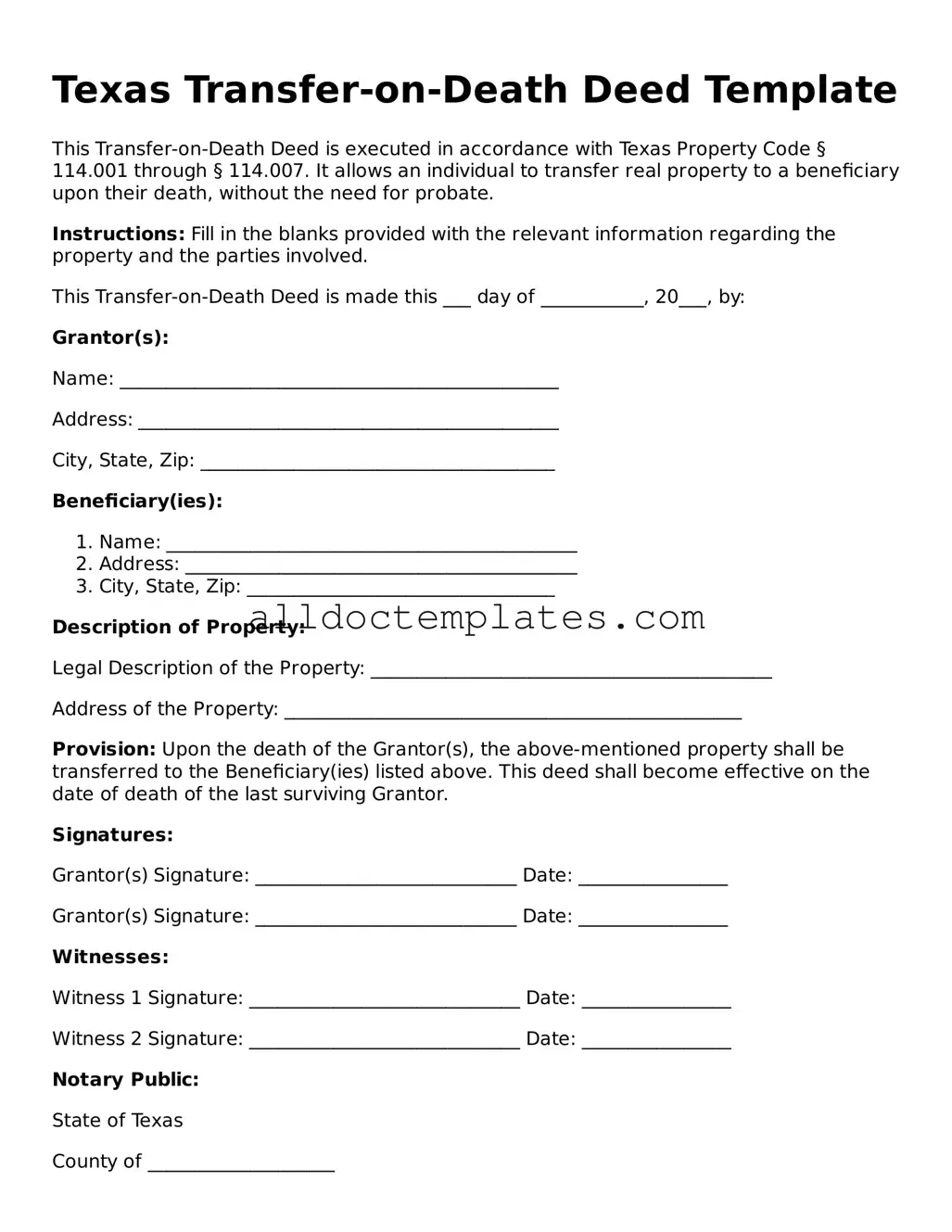

Texas Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed in accordance with Texas Property Code § 114.001 through § 114.007. It allows an individual to transfer real property to a beneficiary upon their death, without the need for probate.

Instructions: Fill in the blanks provided with the relevant information regarding the property and the parties involved.

This Transfer-on-Death Deed is made this ___ day of ___________, 20___, by:

Grantor(s):

Name: _______________________________________________

Address: _____________________________________________

City, State, Zip: ______________________________________

Beneficiary(ies):

- Name: ____________________________________________

- Address: __________________________________________

- City, State, Zip: _________________________________

Description of Property:

Legal Description of the Property: ___________________________________________

Address of the Property: _________________________________________________

Provision: Upon the death of the Grantor(s), the above-mentioned property shall be transferred to the Beneficiary(ies) listed above. This deed shall become effective on the date of death of the last surviving Grantor.

Signatures:

Grantor(s) Signature: ____________________________ Date: ________________

Grantor(s) Signature: ____________________________ Date: ________________

Witnesses:

Witness 1 Signature: _____________________________ Date: ________________

Witness 2 Signature: _____________________________ Date: ________________

Notary Public:

State of Texas

County of ____________________

Subscribed and sworn to before me on this ___ day of ___________, 20___.

Notary Public Signature: ____________________________________

My commission expires: ____________________________

This Transfer-on-Death Deed must be recorded in the county where the property is located to be effective. It is recommended to discuss this deed with an attorney for legal advice specific to your circumstances.

Form Data

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows an individual to transfer real property to beneficiaries upon their death, bypassing probate. |

| Governing Law | The Texas Transfer-on-Death Deed is governed by Texas Estates Code, Chapter 114. |

| Eligibility | Only individuals who own real property can create a Transfer-on-Death Deed in Texas. |

| Revocation | The deed can be revoked at any time before the owner’s death, provided the owner executes a new deed or a revocation document. |

| Beneficiary Designation | Multiple beneficiaries can be designated, and they can receive equal or unequal shares of the property. |

| Filing Requirements | The deed must be recorded in the county where the property is located before the owner’s death to be effective. |

| Tax Implications | Transfer-on-Death Deeds do not trigger immediate gift taxes; however, estate taxes may apply upon the owner's death. |

Texas Transfer-on-Death Deed - Usage Guidelines

Once you have the Texas Transfer-on-Death Deed form ready, it's essential to fill it out accurately to ensure that your property transfers smoothly upon your passing. Follow the steps below to complete the form properly.

- Obtain the Form: Download the Texas Transfer-on-Death Deed form from a reliable source or acquire it from a local county office.

- Identify the Grantor: Write your full name and address in the section designated for the grantor (the person transferring the property).

- Property Description: Provide a detailed description of the property you wish to transfer. This includes the address, lot number, and any other identifying information.

- Identify the Beneficiary: Enter the full name and address of the beneficiary (the person who will receive the property). You can name one or multiple beneficiaries.

- Sign the Form: Sign the deed in the presence of a notary public. Your signature confirms your intent to transfer the property upon your death.

- Notarization: Have the notary public sign and stamp the form, which adds a layer of authenticity to the document.

- File the Deed: Submit the completed and notarized deed to the county clerk’s office in the county where the property is located. This step is crucial for the deed to be legally recognized.

After completing these steps, keep a copy of the deed for your records. It's also wise to inform your beneficiary about the transfer and where to find the document. Proper documentation ensures that your wishes are honored without complications.

Some Other Transfer-on-Death Deed State Templates

What Is a Transfer on Death - The deed should be recorded in local land records to be legally recognized.

For those looking to simplify the process of transferring ownership of a mobile home, utilizing a well-structured Mobile Home Bill of Sale is essential. This legal document not only details the necessary information for both parties involved but also helps to mitigate any potential disputes. To find an easy-to-use template for this important form, consider visiting Colorado PDF Templates, which offers a variety of options tailored to ensure a smooth transaction.

Transfer on Death Deed Form Pennsylvania - Creating a Transfer-on-Death Deed may require specific forms depending on the state.

Dos and Don'ts

When filling out the Texas Transfer-on-Death Deed form, it’s important to keep a few key points in mind. Here are some things you should and shouldn't do:

- Do ensure that you clearly identify the property you wish to transfer.

- Do include the full legal names of all beneficiaries.

- Do sign the deed in the presence of a notary public.

- Do file the deed with the county clerk’s office where the property is located.

- Don't forget to check for any specific local requirements that may apply.

- Don't leave out any necessary details, as this could lead to complications.

- Don't use vague language; be as specific as possible.

- Don't assume that verbal agreements are sufficient; everything must be in writing.

Taking these steps can help ensure that your intentions are clear and legally binding. It’s always wise to double-check your work and seek assistance if needed.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all necessary details on the form. This includes missing names, addresses, or property descriptions. Each section must be filled out accurately to ensure the deed is valid.

-

Incorrect Property Description: A common error is using vague or incorrect descriptions of the property. It is crucial to include the full legal description as recorded in public records to avoid confusion or disputes later.

-

Not Notarizing the Document: Some people neglect to have the deed notarized. Without a notary’s signature, the deed may not be considered valid. This step is essential for the legal recognition of the document.

-

Failure to Record the Deed: After completing the form, individuals often forget to file it with the county clerk’s office. Recording the deed is necessary for it to take effect and to notify the public of the transfer-on-death designation.

-

Not Understanding Revocation: Many people do not realize that they can revoke or change the Transfer-on-Death Deed at any time before their death. Failing to document revocations properly can lead to unintended consequences regarding property transfer.