Free Tractor Bill of Sale Document for Texas State

Document Sample

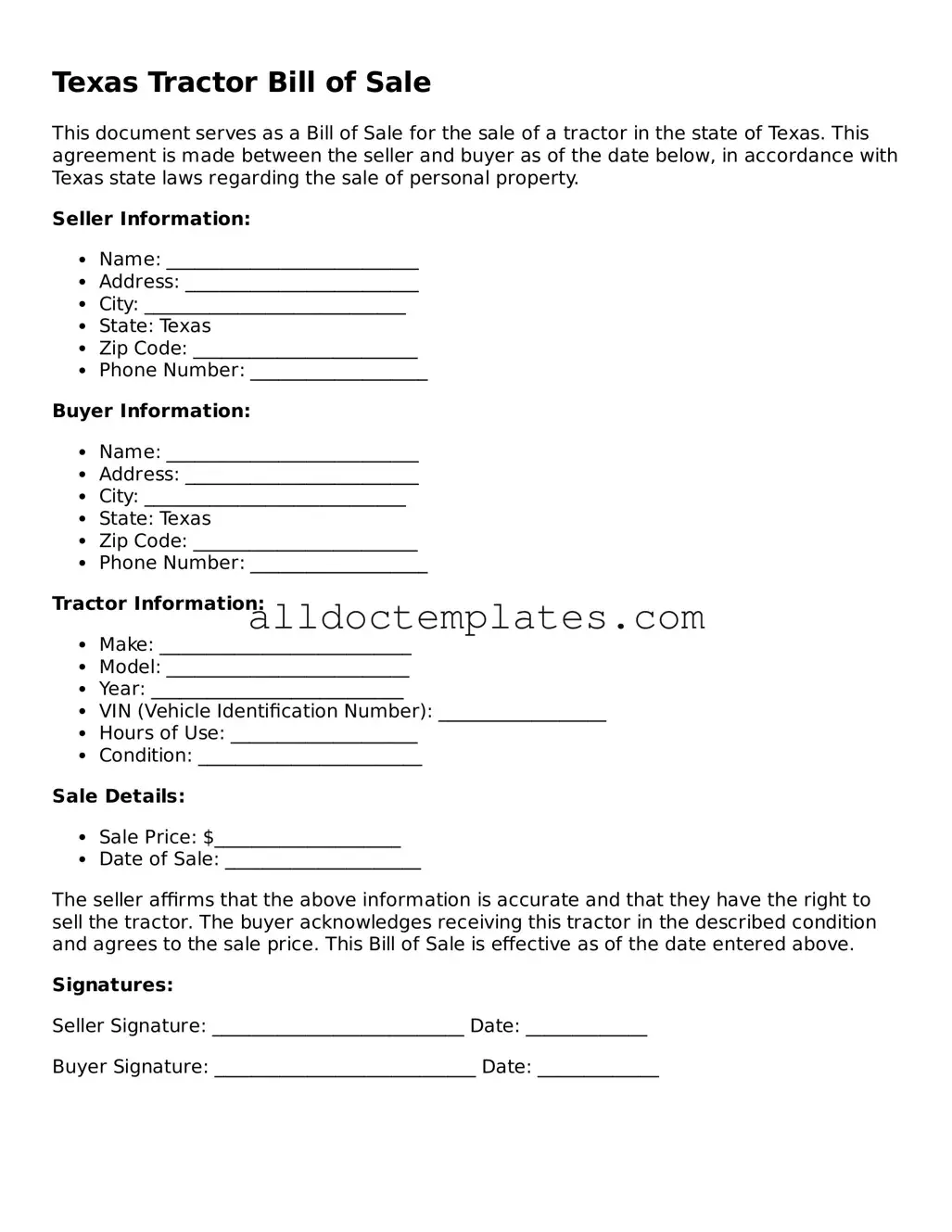

Texas Tractor Bill of Sale

This document serves as a Bill of Sale for the sale of a tractor in the state of Texas. This agreement is made between the seller and buyer as of the date below, in accordance with Texas state laws regarding the sale of personal property.

Seller Information:

- Name: ___________________________

- Address: _________________________

- City: ____________________________

- State: Texas

- Zip Code: ________________________

- Phone Number: ___________________

Buyer Information:

- Name: ___________________________

- Address: _________________________

- City: ____________________________

- State: Texas

- Zip Code: ________________________

- Phone Number: ___________________

Tractor Information:

- Make: ___________________________

- Model: __________________________

- Year: ___________________________

- VIN (Vehicle Identification Number): __________________

- Hours of Use: ____________________

- Condition: ________________________

Sale Details:

- Sale Price: $____________________

- Date of Sale: _____________________

The seller affirms that the above information is accurate and that they have the right to sell the tractor. The buyer acknowledges receiving this tractor in the described condition and agrees to the sale price. This Bill of Sale is effective as of the date entered above.

Signatures:

Seller Signature: ___________________________ Date: _____________

Buyer Signature: ____________________________ Date: _____________

Form Data

| Fact Name | Description |

|---|---|

| Purpose | The Texas Tractor Bill of Sale form is used to document the sale and transfer of ownership of a tractor in Texas. |

| Governing Law | This form is governed by Texas law, specifically the Texas Business and Commerce Code. |

| Required Information | It typically requires details such as the buyer's and seller's names, addresses, the tractor's make, model, year, and Vehicle Identification Number (VIN). |

| Signatures | Both the buyer and seller must sign the form to validate the transaction and transfer of ownership. |

| Notarization | While notarization is not mandatory, it is recommended to add an extra layer of authenticity to the document. |

| Record Keeping | It is advisable for both parties to keep a copy of the completed form for their records and future reference. |

Texas Tractor Bill of Sale - Usage Guidelines

After gathering the necessary information, you will be ready to complete the Texas Tractor Bill of Sale form. This form is essential for documenting the sale and transfer of ownership of a tractor in Texas. Follow the steps below to ensure all required details are accurately filled out.

- Begin by entering the date of the sale at the top of the form.

- Provide the full name and address of the seller. This includes the street address, city, state, and zip code.

- Next, fill in the buyer's full name and address, ensuring to include all relevant details similar to the seller's information.

- Identify the tractor being sold by entering its make, model, year, and Vehicle Identification Number (VIN). This information is crucial for proper identification.

- Indicate the sale price of the tractor. Be clear and precise about the amount agreed upon by both parties.

- If applicable, include any additional terms or conditions related to the sale in the designated section.

- Both the seller and buyer should sign and date the form to validate the transaction. Ensure both signatures are clear and legible.

Once you have completed these steps, review the form for accuracy before submitting it or providing copies to both parties involved in the transaction. Keeping a copy for your records is advisable.

Some Other Tractor Bill of Sale State Templates

Do You Need a Bill of Sale to Register a Car in Florida - Formulating a written agreement reflects due diligence by both parties in the sales process.

Having a clear understanding of the divorce process is essential, and utilizing resources like the Colorado PDF Templates can greatly assist individuals in preparing a comprehensive Divorce Settlement Agreement, ensuring that all terms are fairly outlined and understood by both parties.

Dos and Don'ts

When filling out the Texas Tractor Bill of Sale form, it is important to follow some guidelines to ensure accuracy and compliance. Here are some dos and don’ts to consider:

- Do include the full names and addresses of both the buyer and the seller.

- Do provide a detailed description of the tractor, including make, model, year, and VIN.

- Do specify the sale price clearly to avoid misunderstandings.

- Do sign and date the form to validate the transaction.

- Don't leave any sections blank; complete all required fields.

- Don't use abbreviations that could lead to confusion.

- Don't forget to keep a copy of the completed form for your records.

Common mistakes

-

Incorrect Date: Failing to write the correct date of the sale can lead to confusion regarding the transaction timeline.

-

Missing Signatures: Both the buyer and seller must sign the document. Omitting a signature can render the bill of sale invalid.

-

Inaccurate Vehicle Identification Number (VIN): Entering an incorrect VIN can complicate the registration process and cause legal issues.

-

Omitting Purchase Price: Not including the sale price can lead to disputes about the value of the transaction.

-

Incomplete Buyer and Seller Information: Failing to provide full names, addresses, or contact information can create problems for both parties.

-

Not Including Condition of the Tractor: Describing the tractor's condition is essential. Without this, buyers may have unrealistic expectations.

-

Neglecting to State Payment Method: Clarifying how payment will be made can prevent misunderstandings later on.

-

Not Keeping Copies: Both parties should retain a copy of the bill of sale. Failing to do so can lead to issues if disputes arise.

-

Ignoring Local Regulations: Not checking for any specific local requirements can result in an invalid bill of sale.