Free Real Estate Purchase Agreement Document for Texas State

Document Sample

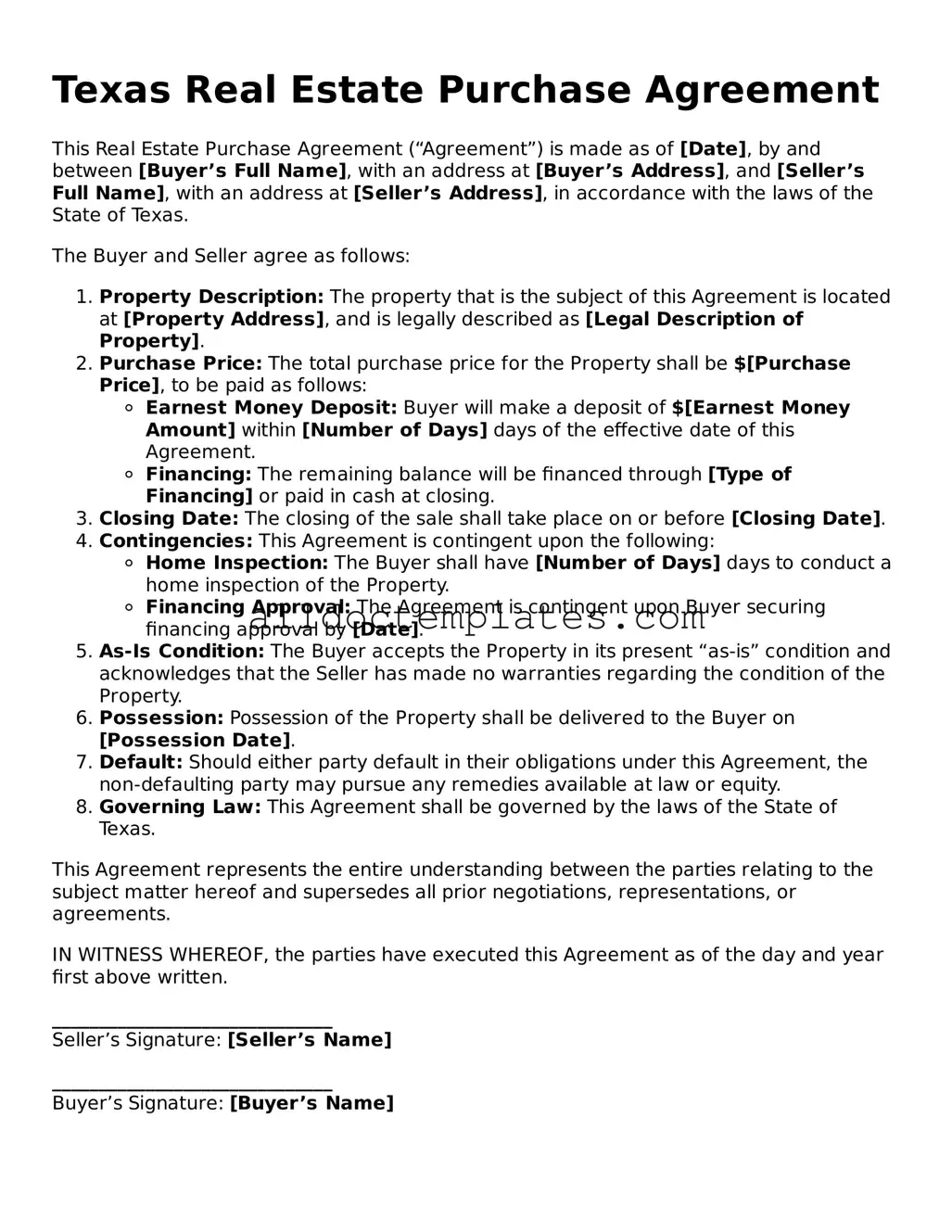

Texas Real Estate Purchase Agreement

This Real Estate Purchase Agreement (“Agreement”) is made as of [Date], by and between [Buyer’s Full Name], with an address at [Buyer’s Address], and [Seller’s Full Name], with an address at [Seller’s Address], in accordance with the laws of the State of Texas.

The Buyer and Seller agree as follows:

- Property Description: The property that is the subject of this Agreement is located at [Property Address], and is legally described as [Legal Description of Property].

- Purchase Price: The total purchase price for the Property shall be $[Purchase Price], to be paid as follows:

- Earnest Money Deposit: Buyer will make a deposit of $[Earnest Money Amount] within [Number of Days] days of the effective date of this Agreement.

- Financing: The remaining balance will be financed through [Type of Financing] or paid in cash at closing.

- Closing Date: The closing of the sale shall take place on or before [Closing Date].

- Contingencies: This Agreement is contingent upon the following:

- Home Inspection: The Buyer shall have [Number of Days] days to conduct a home inspection of the Property.

- Financing Approval: The Agreement is contingent upon Buyer securing financing approval by [Date].

- As-Is Condition: The Buyer accepts the Property in its present “as-is” condition and acknowledges that the Seller has made no warranties regarding the condition of the Property.

- Possession: Possession of the Property shall be delivered to the Buyer on [Possession Date].

- Default: Should either party default in their obligations under this Agreement, the non-defaulting party may pursue any remedies available at law or equity.

- Governing Law: This Agreement shall be governed by the laws of the State of Texas.

This Agreement represents the entire understanding between the parties relating to the subject matter hereof and supersedes all prior negotiations, representations, or agreements.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the day and year first above written.

______________________________

Seller’s Signature: [Seller’s Name]

______________________________

Buyer’s Signature: [Buyer’s Name]

Form Data

| Fact Name | Details |

|---|---|

| Governing Law | The Texas Real Estate Purchase Agreement is governed by Texas property law. |

| Form Purpose | This form is used to outline the terms and conditions of a real estate transaction in Texas. |

| Parties Involved | The agreement typically includes the buyer and seller, both of whom must be identified clearly. |

| Property Description | A detailed description of the property being sold is required, including its address and legal description. |

| Contingencies | The form allows for various contingencies, such as financing and inspection, to protect the interests of the buyer. |

| Closing Date | The agreement specifies a closing date, which is the date when ownership of the property is transferred. |

Texas Real Estate Purchase Agreement - Usage Guidelines

Once you have the Texas Real Estate Purchase Agreement form in front of you, it’s time to fill it out carefully. Each section requires specific information, and accuracy is crucial. After completing the form, it will be ready for submission, which is an important step in the real estate transaction process.

- Begin with the date at the top of the form. Write the date on which you are filling out the agreement.

- Next, identify the buyer and seller. Fill in the full names and addresses of both parties. Ensure that all names are spelled correctly.

- In the property description section, provide the complete address of the property being purchased. Include any relevant details such as the lot number or subdivision name.

- Specify the purchase price. Clearly write the amount that the buyer is offering for the property.

- Outline the earnest money deposit. Indicate the amount of money the buyer will provide as a show of good faith.

- Next, detail the financing terms. If the buyer is using a mortgage, include the type of loan and any relevant terms.

- Fill in the closing date. This is the date when the property transfer will take place.

- Include any contingencies. These might involve inspections, financing, or other conditions that must be met before the sale can proceed.

- Review the additional provisions section. Here, you can add any other agreements or conditions that both parties have discussed.

- Finally, both the buyer and seller must sign and date the agreement. Make sure all signatures are clear and legible.

Some Other Real Estate Purchase Agreement State Templates

How to Make a Purchase Agreement - The purchase agreement includes provisions for closing costs and fees.

Pa Real Estate Contract - Ensures both parties understand their rights and obligations.

Completing the California Release of Liability form is essential for safeguarding against potential legal claims, as it clarifies the responsibilities of all parties involved. By ensuring that participants are aware of the inherent risks of the activity, they consent to waiving their rights to sue for any resulting injuries or damages. For your convenience, you can access the necessary form through All Templates PDF, allowing you to take the proper steps toward protection.

Real Estate Purchase Agreement Pdf - The agreement can include terms for leasebacks if the seller needs extra time to move.

Dos and Don'ts

When filling out the Texas Real Estate Purchase Agreement form, it is essential to follow certain guidelines to ensure accuracy and compliance. Here are ten things to keep in mind:

- Do read the entire form carefully before starting to fill it out.

- Do provide accurate and complete information about the property.

- Do include all necessary details regarding the buyer and seller.

- Do specify the purchase price clearly.

- Do ensure that all dates are filled in correctly.

- Don't leave any sections blank unless instructed.

- Don't use abbreviations or shorthand that could cause confusion.

- Don't forget to sign and date the agreement.

- Don't make any changes without initialing them.

- Don't overlook the importance of reviewing the completed form with a legal professional.

Common mistakes

-

Incomplete Information: Buyers and sellers often fail to fill in all required fields. Missing details like the property address, buyer and seller names, or the purchase price can lead to delays or disputes.

-

Incorrect Dates: Failing to specify accurate dates for contract execution, closing, or contingencies can create confusion. It’s essential to ensure that all dates align with the intended timeline of the transaction.

-

Neglecting Contingencies: Omitting important contingencies, such as financing or inspection clauses, can leave buyers vulnerable. These clauses protect the buyer's interests and should not be overlooked.

-

Ignoring Signatures: All parties involved must sign the agreement. Missing signatures can render the contract invalid. Double-check to ensure that everyone has signed where necessary.