Free Promissory Note Document for Texas State

Document Sample

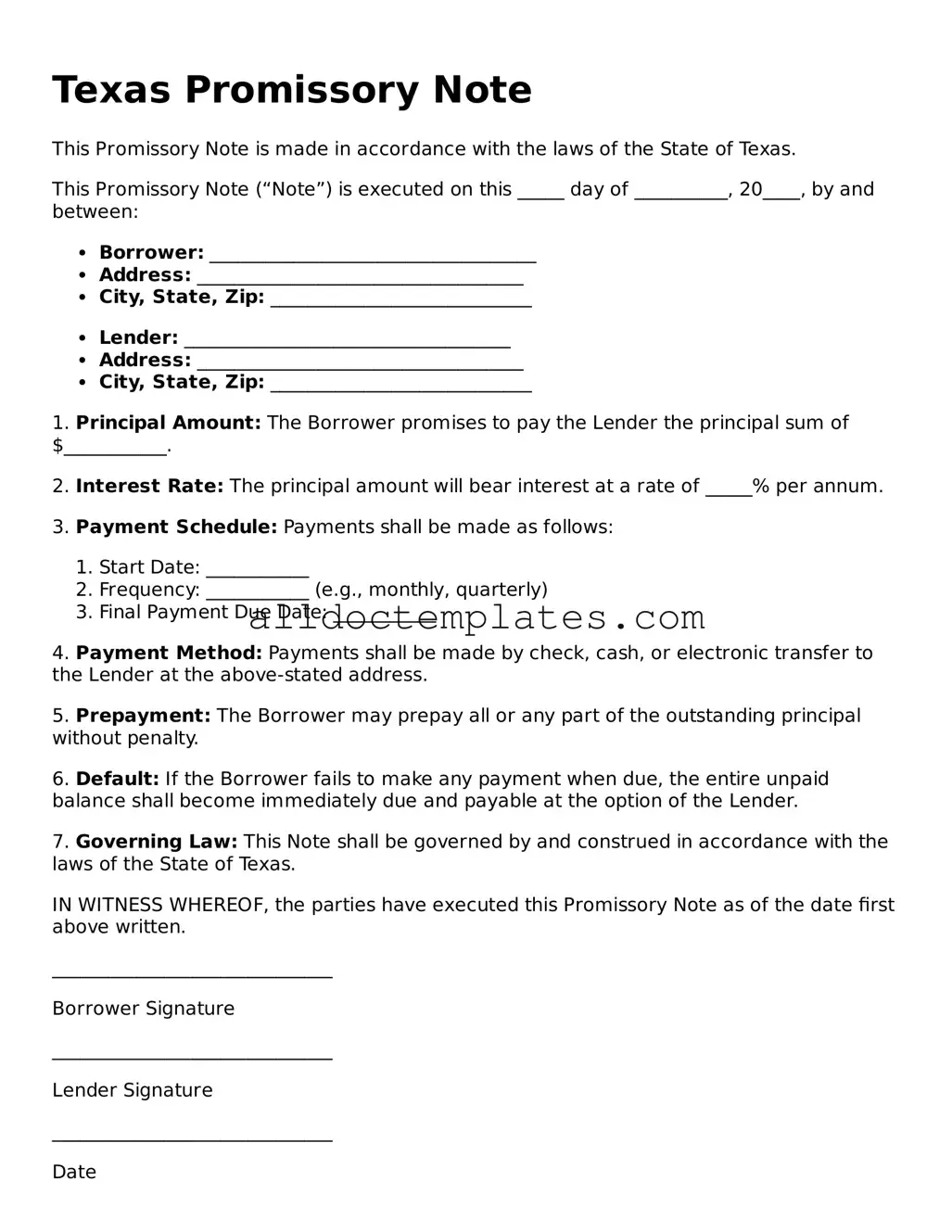

Texas Promissory Note

This Promissory Note is made in accordance with the laws of the State of Texas.

This Promissory Note (“Note”) is executed on this _____ day of __________, 20____, by and between:

- Borrower: ___________________________________

- Address: ___________________________________

- City, State, Zip: ____________________________

- Lender: ___________________________________

- Address: ___________________________________

- City, State, Zip: ____________________________

1. Principal Amount: The Borrower promises to pay the Lender the principal sum of $___________.

2. Interest Rate: The principal amount will bear interest at a rate of _____% per annum.

3. Payment Schedule: Payments shall be made as follows:

- Start Date: ___________

- Frequency: ___________ (e.g., monthly, quarterly)

- Final Payment Due Date: ___________

4. Payment Method: Payments shall be made by check, cash, or electronic transfer to the Lender at the above-stated address.

5. Prepayment: The Borrower may prepay all or any part of the outstanding principal without penalty.

6. Default: If the Borrower fails to make any payment when due, the entire unpaid balance shall become immediately due and payable at the option of the Lender.

7. Governing Law: This Note shall be governed by and construed in accordance with the laws of the State of Texas.

IN WITNESS WHEREOF, the parties have executed this Promissory Note as of the date first above written.

______________________________

Borrower Signature

______________________________

Lender Signature

______________________________

Date

Form Data

| Fact Name | Description |

|---|---|

| Definition | A Texas Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a specified time or on demand. |

| Governing Law | The Texas Promissory Note is governed by the Texas Business and Commerce Code, particularly Chapter 3, which outlines the laws pertaining to negotiable instruments. |

| Requirements | To be valid, the note must include the principal amount, the interest rate (if applicable), the due date, and the signatures of the parties involved. |

| Interest Rates | Texas law allows parties to agree on an interest rate, but it cannot exceed 18% per annum unless specified otherwise in the note. |

| Default Provisions | The note can outline what constitutes a default, including missed payments or bankruptcy, and specify the consequences of defaulting. |

| Transferability | Texas Promissory Notes can be transferred to other parties, allowing the holder to assign their rights to receive payment to someone else. |

| Enforceability | A properly executed promissory note is legally enforceable in Texas courts, meaning the lender can seek legal remedies if the borrower fails to pay. |

Texas Promissory Note - Usage Guidelines

Once you have your Texas Promissory Note form in hand, it's time to fill it out accurately. This document will serve as a written promise to repay a loan, detailing the terms and conditions agreed upon by both parties. Follow these steps to ensure that you complete the form correctly.

- Title the Document: At the top of the form, write "Promissory Note" to clearly indicate the purpose of the document.

- Borrower Information: Fill in the name and address of the borrower. Make sure to include the full legal name to avoid any confusion.

- Lender Information: Next, enter the name and address of the lender. Like the borrower, the lender's name should be complete and accurate.

- Loan Amount: Specify the total amount of money being borrowed. Write this clearly in both numeric and written form to eliminate any ambiguity.

- Interest Rate: Indicate the interest rate applicable to the loan. This can be a fixed or variable rate, so be clear about which one you are using.

- Payment Schedule: Outline how often payments will be made (e.g., monthly, quarterly) and the due date for each payment.

- Loan Term: State the length of time the borrower has to repay the loan. This could be in months or years.

- Default Terms: Describe what will happen if the borrower fails to make payments on time. This may include late fees or other penalties.

- Signatures: Both the borrower and lender must sign the document. Include the date next to each signature to confirm when the agreement was made.

After filling out the form, review it carefully to ensure all information is accurate. Both parties should keep a copy for their records. This will help in maintaining clarity and accountability throughout the loan period.

Some Other Promissory Note State Templates

Free Promissory Note Template Florida - Borrowers can request revisions to terms if both parties are in agreement.

Promissory Note Template California Word - Interest rates in a promissory note can be fixed or variable based on agreement terms.

How to Write a Promissory Note Example - It is essential to use clear and unambiguous language in the promissory note.

In order to complete the homeschooling process effectively, it is important for parents to familiarize themselves with the necessary documentation, including the Colorado Homeschool Letter of Intent. This formal notification must be sent to the school district to confirm the decision to homeschool, as it helps ensure compliance with state regulations. For more guidance on how to draft this essential document, you can refer to Colorado PDF Templates, which provides helpful resources for filling out the form correctly.

Promissory Note for Loan - Customizing a promissory note allows parties to tailor terms to their situation.

Dos and Don'ts

When filling out the Texas Promissory Note form, it's essential to get it right. Here are some key dos and don'ts to guide you:

- Do clearly state the amount being borrowed. Ambiguity can lead to confusion later.

- Do include the names and addresses of both the borrower and the lender. Accurate identification is crucial.

- Do specify the interest rate, if applicable. This helps both parties understand the cost of the loan.

- Do outline the repayment terms. Detail when payments are due and how they should be made.

- Don't leave any sections blank. Each part of the form should be completed to avoid potential disputes.

- Don't forget to sign and date the document. A signature is necessary for the note to be legally binding.

Common mistakes

-

Incorrect Names: One common mistake is failing to accurately write the names of the borrower and lender. It is essential to ensure that the full legal names are used to avoid confusion later.

-

Missing Dates: Not including the date when the note is signed can lead to complications. Always make sure to date the document properly to establish a clear timeline.

-

Improper Loan Amount: Entering an incorrect loan amount is a frequent error. Double-check the figures to ensure they match the agreed-upon amount.

-

Failure to Specify Interest Rate: Omitting the interest rate or writing it incorrectly can create misunderstandings. Clearly state the interest rate to avoid disputes.

-

Neglecting Payment Schedule: Not outlining a payment schedule can lead to confusion about when payments are due. It's vital to specify the frequency and amount of payments.

-

Ignoring Default Terms: Failing to include terms regarding default can be detrimental. Clearly outline what happens if payments are missed to protect both parties.

-

Not Including Signatures: Leaving out signatures from either party renders the note invalid. Ensure that both the borrower and lender sign the document.

-

Missing Witness or Notary: In some cases, not having a witness or notary can invalidate the note. Check if this is necessary for your specific situation.

-

Not Keeping Copies: Failing to make copies of the signed note can lead to issues later on. Always keep a copy for your records to refer back to when needed.