Free Operating Agreement Document for Texas State

Document Sample

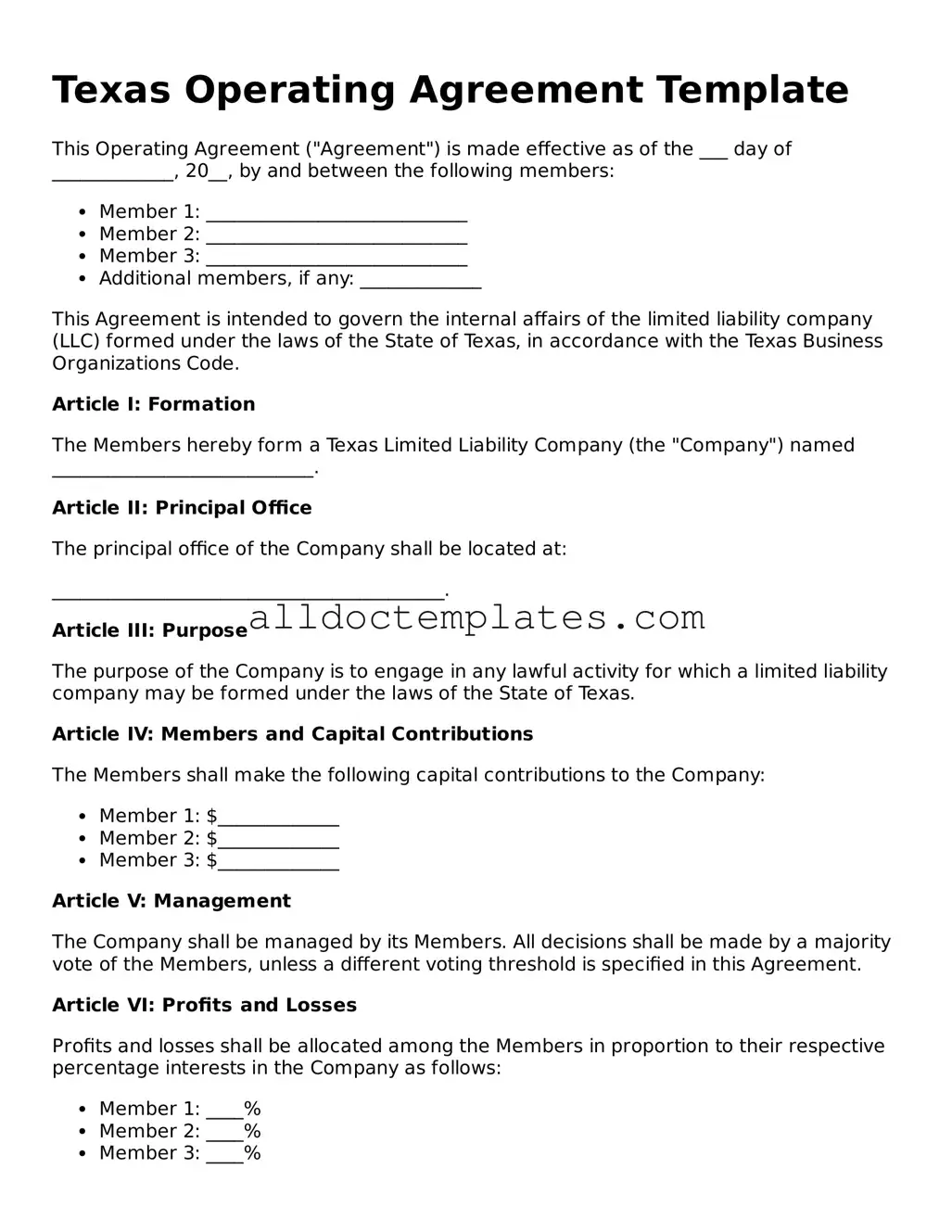

Texas Operating Agreement Template

This Operating Agreement ("Agreement") is made effective as of the ___ day of _____________, 20__, by and between the following members:

- Member 1: ____________________________

- Member 2: ____________________________

- Member 3: ____________________________

- Additional members, if any: _____________

This Agreement is intended to govern the internal affairs of the limited liability company (LLC) formed under the laws of the State of Texas, in accordance with the Texas Business Organizations Code.

Article I: Formation

The Members hereby form a Texas Limited Liability Company (the "Company") named ____________________________.

Article II: Principal Office

The principal office of the Company shall be located at:

__________________________________________.

Article III: Purpose

The purpose of the Company is to engage in any lawful activity for which a limited liability company may be formed under the laws of the State of Texas.

Article IV: Members and Capital Contributions

The Members shall make the following capital contributions to the Company:

- Member 1: $_____________

- Member 2: $_____________

- Member 3: $_____________

Article V: Management

The Company shall be managed by its Members. All decisions shall be made by a majority vote of the Members, unless a different voting threshold is specified in this Agreement.

Article VI: Profits and Losses

Profits and losses shall be allocated among the Members in proportion to their respective percentage interests in the Company as follows:

- Member 1: ____%

- Member 2: ____%

- Member 3: ____%

Article VII: Distributions

Distributions shall be made to the Members at such times and in such amounts as determined by the Members.

Article VIII: Amendments

This Agreement may be amended only by a written agreement signed by all Members.

Article IX: Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Texas.

IN WITNESS WHEREOF, the Members have executed this Operating Agreement as of the date first above written.

___________________________________

Member 1 Signature

___________________________________

Member 2 Signature

___________________________________

Member 3 Signature

Date: ___/___/_____

Form Data

| Fact Name | Description |

|---|---|

| Purpose | The Texas Operating Agreement outlines the management structure and operating procedures of a limited liability company (LLC). |

| Governing Law | This agreement is governed by the Texas Business Organizations Code. |

| Members' Rights | The agreement details the rights and responsibilities of the LLC members. |

| Profit Distribution | It specifies how profits and losses will be distributed among members. |

| Amendments | The document outlines the process for making amendments to the agreement. |

| Duration | The agreement can define the duration of the LLC, whether perpetual or for a specified term. |

| Dispute Resolution | It may include provisions for resolving disputes among members, such as mediation or arbitration. |

Texas Operating Agreement - Usage Guidelines

Filling out the Texas Operating Agreement form is an important step for your business. It helps clarify the roles and responsibilities of each member in your company. Once you have completed the form, it will need to be signed by all members and kept on file for your records.

- Start with the name of your LLC. Write the full legal name as registered with the state.

- Enter the principal office address. This is where your business will be located.

- List the names of all members. Include their full names and addresses.

- Define the purpose of the LLC. Write a brief description of what your business does.

- Specify the management structure. Decide if it will be member-managed or manager-managed and indicate this on the form.

- Outline the capital contributions. Detail how much each member is contributing to the LLC.

- Describe the profit and loss distribution. Explain how profits and losses will be shared among members.

- Include any additional provisions. If there are specific rules or agreements, make sure to write them down.

- Review the document for accuracy. Check all entries to ensure there are no mistakes.

- Have all members sign the agreement. Ensure that each member's signature is dated.

Some Other Operating Agreement State Templates

Is an Operating Agreement Required for an Llc - The document can specify the use of company funds for personal expenses or profit-sharing.

When engaging in the sale or purchase of a vehicle, it is crucial to utilize the proper documentation to facilitate the transfer of ownership. The Colorado Motor Vehicle Bill of Sale form is a vital resource for ensuring that both parties are protected and the transaction is documented accurately. For those looking to access this important form, Colorado PDF Templates offers a convenient solution.

Llc Operating Agreement Pa - The agreement includes details on member contributions, distributions, and profit-sharing arrangements.

Dos and Don'ts

When filling out the Texas Operating Agreement form, it is crucial to follow certain guidelines to ensure accuracy and compliance. Here’s a list of dos and don’ts to help you navigate the process effectively.

- Do read the entire form carefully before starting.

- Do provide accurate and complete information.

- Do consult with a legal professional if you have questions.

- Do ensure all members sign the agreement.

- Do keep a copy of the completed agreement for your records.

- Don't rush through the form; take your time to avoid mistakes.

- Don't leave any required fields blank.

- Don't use vague language; be specific in your descriptions.

- Don't forget to update the agreement if any member changes.

- Don't ignore state-specific requirements; adhere to Texas laws.

Common mistakes

-

Neglecting to Include All Members: One common mistake is failing to list all members of the LLC. Each member should be clearly identified, including their roles and responsibilities. Omitting a member can lead to confusion and disputes later on.

-

Inaccurate Information: Providing incorrect information regarding the business name, address, or member details can create legal issues. It is crucial to double-check all entries for accuracy to avoid complications in the future.

-

Not Defining Ownership Percentages: Another frequent oversight is not specifying the ownership percentages for each member. Clear definitions of ownership stakes help prevent misunderstandings and ensure that profit distributions are handled fairly.

-

Ignoring Amendment Procedures: Some individuals overlook the importance of outlining how amendments to the agreement will be handled. Establishing a clear process for making changes can save time and prevent conflicts down the road.

-

Failure to Address Dispute Resolution: Lastly, many people forget to include a method for resolving disputes among members. Having a clear procedure for conflict resolution can help maintain harmony within the LLC and protect the interests of all parties involved.