Free Last Will and Testament Document for Texas State

Document Sample

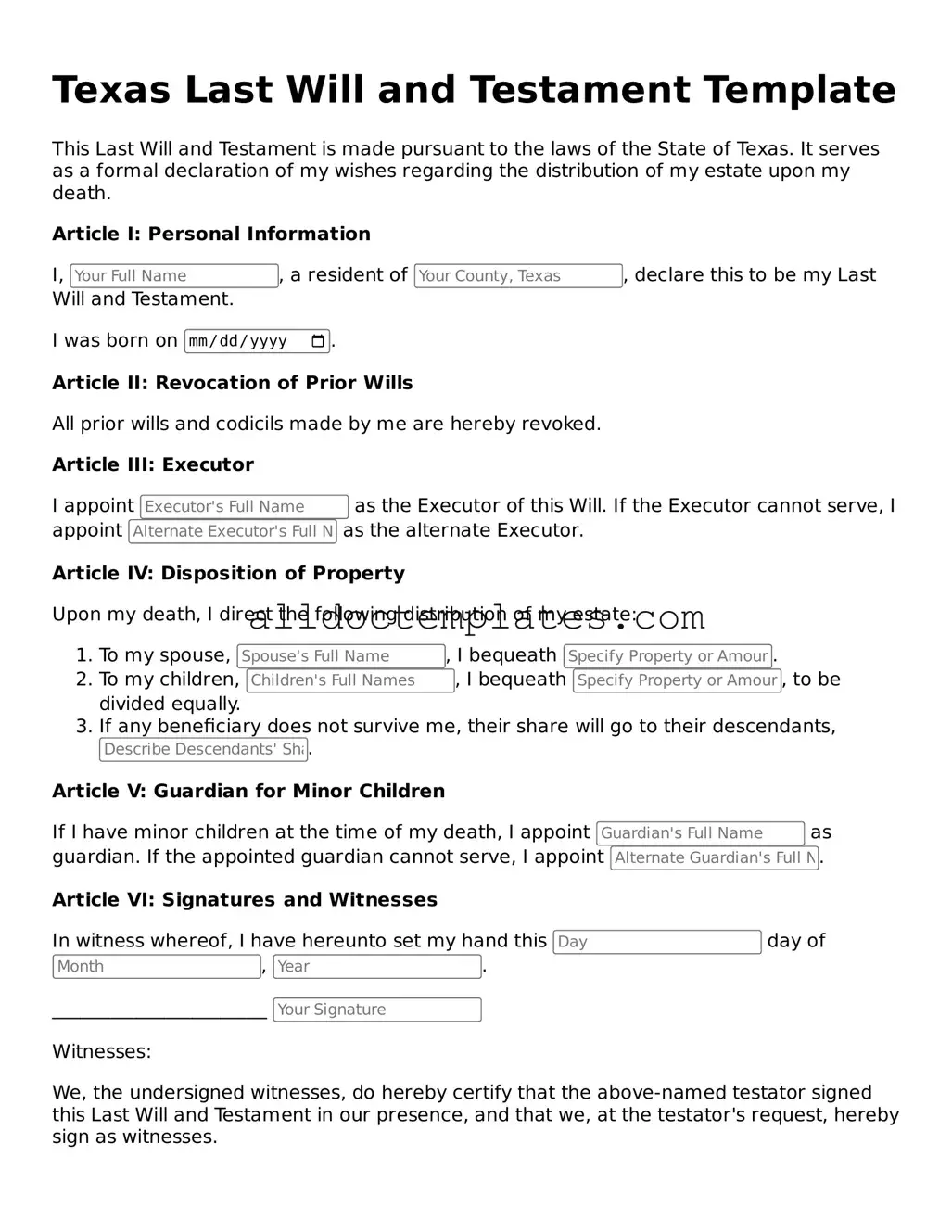

Texas Last Will and Testament Template

This Last Will and Testament is made pursuant to the laws of the State of Texas. It serves as a formal declaration of my wishes regarding the distribution of my estate upon my death.

Article I: Personal Information

I, , a resident of , declare this to be my Last Will and Testament.

I was born on .

Article II: Revocation of Prior Wills

All prior wills and codicils made by me are hereby revoked.

Article III: Executor

I appoint as the Executor of this Will. If the Executor cannot serve, I appoint as the alternate Executor.

Article IV: Disposition of Property

Upon my death, I direct the following distribution of my estate:

- To my spouse, , I bequeath .

- To my children, , I bequeath , to be divided equally.

- If any beneficiary does not survive me, their share will go to their descendants, .

Article V: Guardian for Minor Children

If I have minor children at the time of my death, I appoint as guardian. If the appointed guardian cannot serve, I appoint .

Article VI: Signatures and Witnesses

In witness whereof, I have hereunto set my hand this day of , .

_______________________

Witnesses:

We, the undersigned witnesses, do hereby certify that the above-named testator signed this Last Will and Testament in our presence, and that we, at the testator's request, hereby sign as witnesses.

- _______________________

- _______________________

Article VII: Self-Proving Affidavit

This Will may be accompanied by a self-proving affidavit to ensure its validity under Texas law.

Form Data

| Fact Name | Description |

|---|---|

| Legal Framework | The Texas Last Will and Testament is governed by the Texas Estates Code, specifically Title 2, Chapter 251. |

| Age Requirement | In Texas, individuals must be at least 18 years old to create a valid will. |

| Witness Requirement | Two witnesses are required to sign the will in order to validate it. They must be at least 14 years old and cannot be beneficiaries. |

| Holographic Wills | Texas recognizes holographic wills, which are handwritten and do not require witnesses, provided they are signed by the testator. |

| Revocation | A will can be revoked by creating a new will or by physically destroying the original document with the intent to revoke. |

| Self-Proving Affidavit | A self-proving affidavit can be attached to the will, allowing the will to be validated without the witnesses appearing in court. |

Texas Last Will and Testament - Usage Guidelines

Once you have the Texas Last Will and Testament form ready, you will need to carefully fill it out to ensure your wishes are clearly stated. This process involves providing personal information, designating beneficiaries, and appointing an executor. Accuracy is crucial, as any mistakes could lead to complications later on.

- Begin by entering your full legal name at the top of the form.

- Provide your current address, including city, state, and ZIP code.

- State your date of birth to confirm your identity.

- Designate an executor who will carry out your wishes. Include their full name and contact information.

- List your beneficiaries. Clearly state their names and the relationship to you.

- Specify what each beneficiary will receive. Be as detailed as possible to avoid confusion.

- If you have minor children, appoint a guardian for them and provide their information.

- Include any specific wishes regarding funeral arrangements or other personal matters.

- Review the form for any errors or omissions. Accuracy is essential.

- Sign and date the document in the presence of two witnesses, who must also sign the form.

After completing the form, consider storing it in a safe place and informing your executor and beneficiaries of its location. This will help ensure that your wishes are honored and facilitate the process when the time comes.

Some Other Last Will and Testament State Templates

How to Make a Will in Pennsylvania - Allows individuals to express their sentiments or messages to loved ones.

Writing Last Will and Testament - Allows you to make decisions about the distribution of sentimental items and family heirlooms.

When engaging in a vehicle transaction in Colorado, utilizing the Motor Vehicle Bill of Sale form is crucial for both parties involved. This document not only substantiates the transfer of ownership but also serves as a safeguard against potential disputes. To effectively navigate the process and avoid ambiguities, you can refer to resources such as Colorado PDF Templates which provide comprehensive guides on completing this essential paperwork.

Will Legal - Works as a vital tool for ensuring a smooth transition of wealth across generations.

Dos and Don'ts

When filling out the Texas Last Will and Testament form, there are important guidelines to follow. Here’s a list of things you should and shouldn't do:

- Do ensure you are of legal age and sound mind when creating your will.

- Do clearly identify yourself and state that the document is your Last Will and Testament.

- Do list your assets and specify how you want them distributed.

- Do name an executor who will manage your estate after your passing.

- Don't use vague language that could lead to confusion about your wishes.

- Don't forget to sign the will in the presence of at least two witnesses.

- Don't assume that verbal agreements or informal notes will be legally binding.

By following these guidelines, you can help ensure that your wishes are honored and that the process is as smooth as possible for your loved ones.

Common mistakes

-

Not naming an executor. Failing to designate an executor can lead to complications in the probate process. The executor is responsible for managing the estate and ensuring that the wishes outlined in the will are carried out.

-

Inadequate witness signatures. Texas law requires that a will be signed by at least two witnesses. If this requirement is not met, the will may be considered invalid.

-

Not dating the document. A will should always include the date it was signed. Without a date, it may be difficult to determine which version of the will is the most current.

-

Ambiguous language. Using vague or unclear terms can lead to disputes among heirs. It is important to be specific about who receives what and under what conditions.

-

Failing to update the will. Life changes such as marriage, divorce, or the birth of children can affect the distribution of assets. Regularly reviewing and updating the will is essential.

-

Overlooking digital assets. Many people have online accounts, cryptocurrencies, or digital property. Not addressing these assets in the will can create confusion and complications for heirs.

-

Not considering tax implications. Failing to account for potential estate taxes may result in unexpected financial burdens for heirs. Consulting with a financial advisor can provide clarity.

-

Not discussing the will with family. Open communication about the contents of the will can help prevent disputes and misunderstandings among family members after death.

-

Using outdated forms. Laws and regulations can change. Using an outdated version of the Texas Last Will and Testament form may lead to invalidation of the will.