Free Gift Deed Document for Texas State

Document Sample

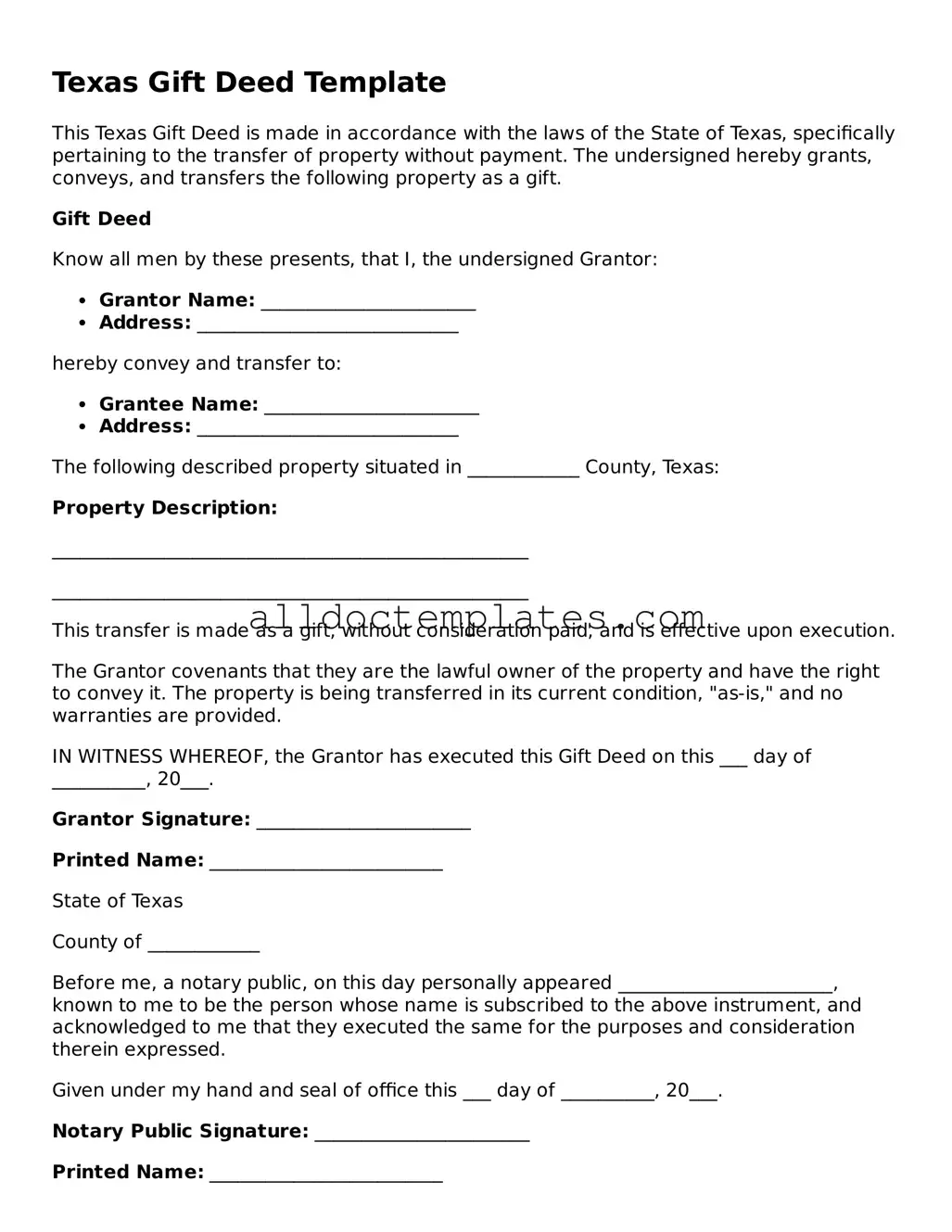

Texas Gift Deed Template

This Texas Gift Deed is made in accordance with the laws of the State of Texas, specifically pertaining to the transfer of property without payment. The undersigned hereby grants, conveys, and transfers the following property as a gift.

Gift Deed

Know all men by these presents, that I, the undersigned Grantor:

- Grantor Name: _______________________

- Address: ____________________________

hereby convey and transfer to:

- Grantee Name: _______________________

- Address: ____________________________

The following described property situated in ____________ County, Texas:

Property Description:

___________________________________________________

___________________________________________________

This transfer is made as a gift, without consideration paid, and is effective upon execution.

The Grantor covenants that they are the lawful owner of the property and have the right to convey it. The property is being transferred in its current condition, "as-is," and no warranties are provided.

IN WITNESS WHEREOF, the Grantor has executed this Gift Deed on this ___ day of __________, 20___.

Grantor Signature: _______________________

Printed Name: _________________________

State of Texas

County of ____________

Before me, a notary public, on this day personally appeared _______________________, known to me to be the person whose name is subscribed to the above instrument, and acknowledged to me that they executed the same for the purposes and consideration therein expressed.

Given under my hand and seal of office this ___ day of __________, 20___.

Notary Public Signature: _______________________

Printed Name: _________________________

My Commission Expires: _____________

Form Data

| Fact Name | Description |

|---|---|

| Definition | A Texas Gift Deed is a legal document used to transfer property ownership as a gift without any exchange of money. |

| Governing Law | The Texas Gift Deed is governed by the Texas Property Code, specifically Chapter 5. |

| Requirements | The deed must be in writing, signed by the donor, and acknowledged before a notary public. |

| Consideration | No monetary consideration is required for a gift deed, distinguishing it from other types of property transfers. |

| Tax Implications | Gift tax may apply depending on the value of the property and the relationship between the donor and recipient. |

| Recording | To protect the interests of the recipient, the gift deed should be recorded in the county where the property is located. |

Texas Gift Deed - Usage Guidelines

Filling out the Texas Gift Deed form is a straightforward process that allows you to transfer property without any exchange of money. After completing the form, it will need to be signed and notarized before being filed with the appropriate county office. Follow these steps to ensure you fill out the form correctly.

- Gather Necessary Information: Collect details about the property being gifted, including the legal description, the address, and the current owner’s information.

- Identify the Parties: Clearly list the name of the person giving the gift (the donor) and the name of the person receiving the gift (the recipient).

- Fill in the Form: Start by entering the date at the top of the form. Then, fill in the donor’s and recipient’s names and addresses in the designated sections.

- Describe the Property: Provide a complete legal description of the property. This may include lot number, block number, and subdivision name, as well as any additional identifying information.

- Include Consideration: Although this is a gift deed, you may need to state that the property is being given for love and affection or specify any nominal consideration.

- Sign the Document: The donor must sign the deed in the presence of a notary public. Ensure that all signatures are clear and legible.

- Notarization: Take the signed form to a notary public who will verify the identity of the signer and notarize the document.

- File the Deed: Submit the notarized deed to the county clerk’s office in the county where the property is located. Be prepared to pay any applicable filing fees.

Once you have completed these steps, the Gift Deed will be officially recorded, and the transfer of property will be recognized. Keep a copy of the filed deed for your records.

Some Other Gift Deed State Templates

Transfer Deed to Family Member - The recipient, known as the grantee, receives full rights to the property upon completion.

For those navigating the complexities of divorce, having a comprehensive understanding of the Colorado Divorce Settlement Agreement form is essential. This form serves as a foundation for both parties to agree on various elements such as property division, child custody, and support arrangements. For more detailed information and resources, you can visit Colorado PDF Templates, which provides helpful templates and guidance to ensure that both parties' rights are effectively protected throughout the divorce process.

Dos and Don'ts

When filling out the Texas Gift Deed form, it is important to follow certain guidelines to ensure the process is completed correctly. Here are six things to do and avoid:

- Do: Ensure that the grantor and grantee's names are clearly stated.

- Do: Include a legal description of the property being transferred.

- Do: Sign the form in the presence of a notary public.

- Do: Keep a copy of the completed Gift Deed for your records.

- Don't: Leave any sections of the form blank; complete all required fields.

- Don't: Forget to check state-specific requirements that may apply.

Common mistakes

-

Incomplete Information: Many people fail to provide all required information on the Gift Deed form. Missing details such as the full names of both the donor and the recipient can lead to complications. Ensure that every section is filled out completely.

-

Incorrect Property Description: Accurately describing the property being gifted is crucial. Some individuals mistakenly provide vague descriptions or omit important details like the property address or legal description. This can create confusion and may render the deed ineffective.

-

Not Signing the Deed: A common oversight is forgetting to sign the Gift Deed. Both the donor and the recipient must sign the document for it to be valid. Without signatures, the deed cannot be legally recognized.

-

Failure to Record the Deed: After completing the Gift Deed, some individuals neglect to file it with the county clerk’s office. Recording the deed is essential for public notice and protects the recipient’s ownership rights. Without this step, the gift may not be legally enforceable.