Free Deed in Lieu of Foreclosure Document for Texas State

Document Sample

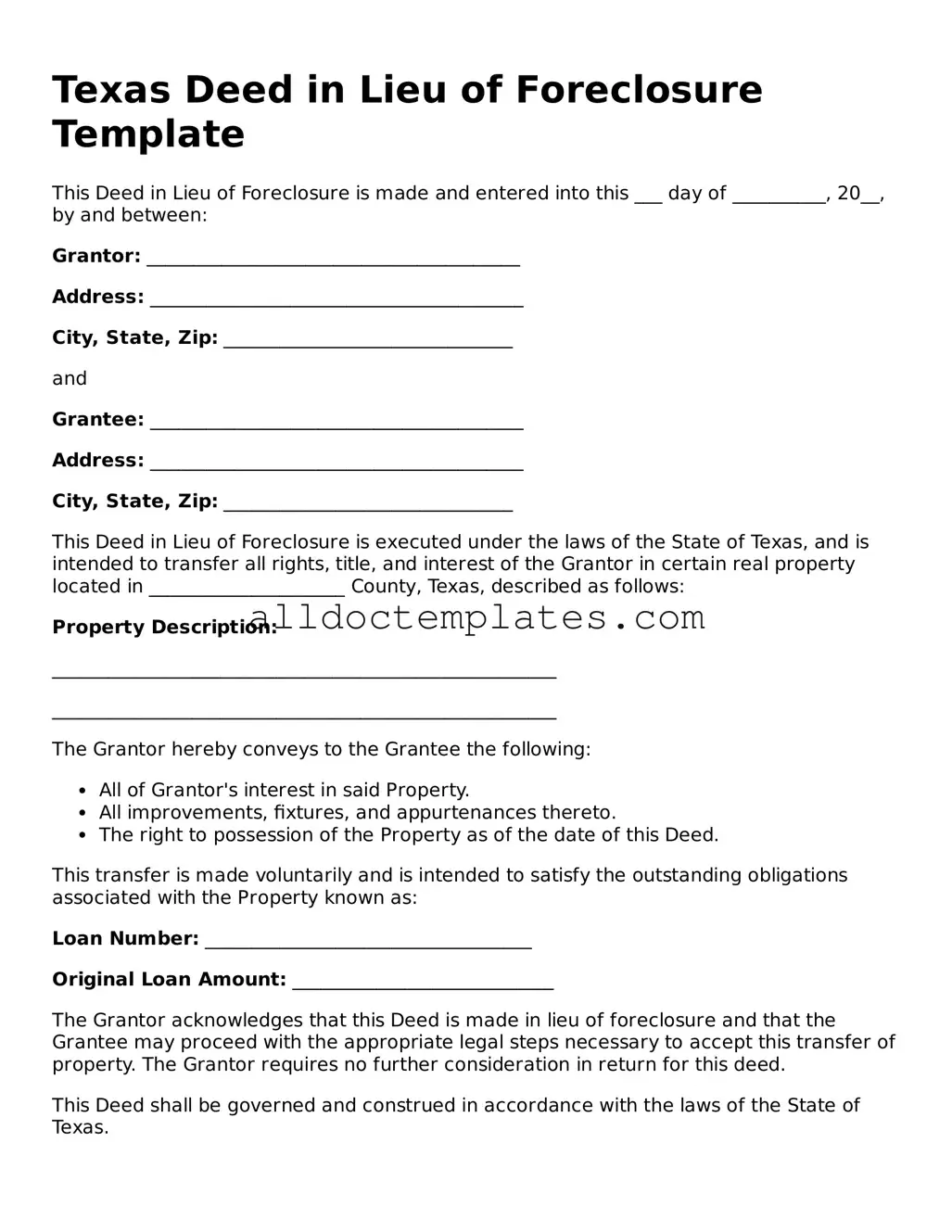

Texas Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made and entered into this ___ day of __________, 20__, by and between:

Grantor: ________________________________________

Address: ________________________________________

City, State, Zip: _______________________________

and

Grantee: ________________________________________

Address: ________________________________________

City, State, Zip: _______________________________

This Deed in Lieu of Foreclosure is executed under the laws of the State of Texas, and is intended to transfer all rights, title, and interest of the Grantor in certain real property located in _____________________ County, Texas, described as follows:

Property Description:

______________________________________________________

______________________________________________________

The Grantor hereby conveys to the Grantee the following:

- All of Grantor's interest in said Property.

- All improvements, fixtures, and appurtenances thereto.

- The right to possession of the Property as of the date of this Deed.

This transfer is made voluntarily and is intended to satisfy the outstanding obligations associated with the Property known as:

Loan Number: ___________________________________

Original Loan Amount: ____________________________

The Grantor acknowledges that this Deed is made in lieu of foreclosure and that the Grantee may proceed with the appropriate legal steps necessary to accept this transfer of property. The Grantor requires no further consideration in return for this deed.

This Deed shall be governed and construed in accordance with the laws of the State of Texas.

IN WITNESS WHEREOF, the undersigned have executed this Deed in Lieu of Foreclosure as of the day and year first above written.

Grantor's Signature: ____________________________

Date: _________________________________________

Grantee's Signature: ____________________________

Date: _________________________________________

Notary Public: __________________________________

My Commission Expires: ________________________

Form Data

| Fact Name | Description |

|---|---|

| Purpose | The Texas Deed in Lieu of Foreclosure form allows a borrower to transfer ownership of their property to the lender to avoid foreclosure. |

| Governing Law | This form is governed by Texas Property Code, Chapter 51. |

| Eligibility | Homeowners facing financial hardship may qualify for this option, provided they have a mortgage with the lender. |

| Benefits | It can help borrowers avoid the lengthy foreclosure process and minimize damage to their credit score. |

| Process | The borrower must negotiate with the lender and complete the form to initiate the transfer of property. |

| Liabilities | Borrowers may still be liable for any remaining debt after the property transfer, depending on the agreement with the lender. |

| Legal Advice | It is advisable for borrowers to seek legal advice before signing the deed to understand all implications. |

Texas Deed in Lieu of Foreclosure - Usage Guidelines

After completing the Texas Deed in Lieu of Foreclosure form, the next steps involve submitting the document to the appropriate parties. This typically includes the lender and any relevant local authorities. Make sure to keep copies for your records and confirm receipt with the lender.

- Obtain the Texas Deed in Lieu of Foreclosure form from a reliable source or your lender.

- Fill in the names of all parties involved, including the borrower(s) and lender.

- Provide the property address, ensuring it matches the legal description of the property.

- Include the date of the transaction in the designated area.

- Clearly state the consideration being given, which is typically the release from the mortgage obligation.

- Sign the document in the presence of a notary public. Ensure all signatures are properly notarized.

- Make copies of the signed and notarized document for your records.

- Submit the original document to the lender and any required local authorities.

Some Other Deed in Lieu of Foreclosure State Templates

Deed in Lieu of Forclosure - Documentation related to the Deed in Lieu should be kept organized for future reference and clarity.

The Colorado Divorce Settlement Agreement form is a legal document that outlines the terms of a divorce settlement between two parties, ensuring clarity and mutual understanding. For those looking for a reliable source to obtain this essential document, the Colorado PDF Templates is an excellent resource that covers various aspects such as property division, child custody, and support arrangements, making it crucial for protecting both parties' rights during the divorce process.

Will I Owe Money After a Deed in Lieu of Foreclosure - The homeowner may need to demonstrate a genuine financial hardship to qualify for this option.

Dos and Don'ts

When filling out the Texas Deed in Lieu of Foreclosure form, it’s important to follow certain guidelines to ensure the process goes smoothly. Here are some key do's and don'ts to keep in mind:

- Do read the entire form carefully before filling it out.

- Do provide accurate information about the property and the parties involved.

- Do consult with a legal professional if you have any questions.

- Do ensure all signatures are present and dated.

- Don't leave any sections blank; fill in all required fields.

- Don't rush through the process; take your time to avoid mistakes.

- Don't ignore any local laws or regulations that may apply.

By adhering to these guidelines, you can help ensure that the deed is completed correctly and that the transition is as smooth as possible.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all required information. This can include missing names, addresses, or property details. Each section must be filled out completely to avoid delays.

-

Incorrect Property Description: A common mistake is inaccurately describing the property. The legal description should match the one on the original deed. Any discrepancies can lead to complications.

-

Not Notarizing the Document: The deed must be notarized to be valid. Some individuals overlook this step, which can render the document ineffective.

-

Failing to Include All Parties: If there are multiple owners, all must sign the deed. Omitting a co-owner can lead to legal issues down the line.

-

Not Understanding the Consequences: Some people do not fully grasp the implications of signing a deed in lieu of foreclosure. It’s crucial to understand how this action affects credit and future homeownership.

-

Ignoring Lender Requirements: Each lender may have specific requirements for accepting a deed in lieu of foreclosure. Not adhering to these can result in rejection of the deed.

-

Submitting the Form Late: Timing is essential. Waiting too long to submit the deed can lead to foreclosure proceedings continuing, which defeats the purpose of this action.

-

Not Keeping Copies: After submitting the deed, it is important to retain copies for personal records. Failing to do so can create issues if questions arise in the future.