Free Deed Document for Texas State

Document Sample

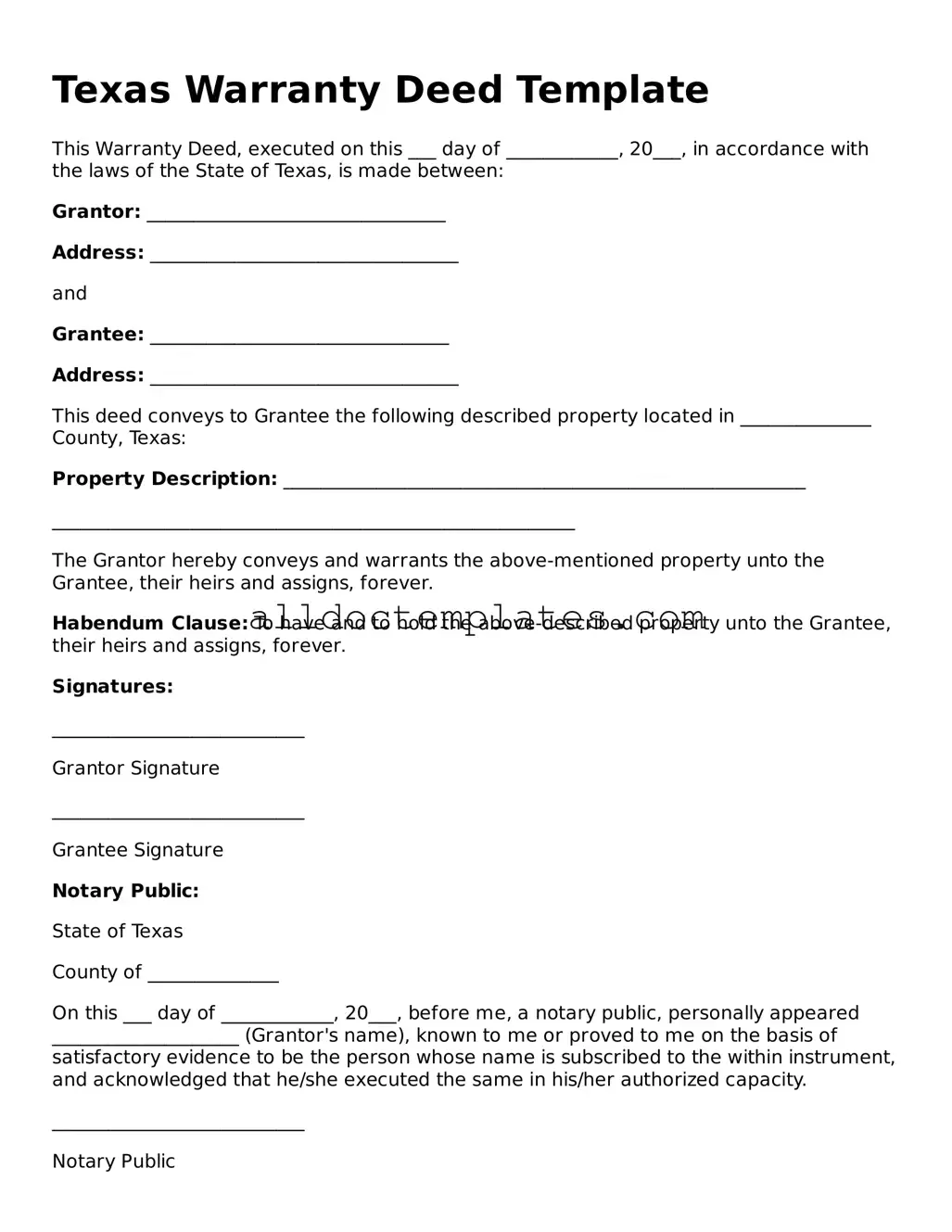

Texas Warranty Deed Template

This Warranty Deed, executed on this ___ day of ____________, 20___, in accordance with the laws of the State of Texas, is made between:

Grantor: ________________________________

Address: _________________________________

and

Grantee: ________________________________

Address: _________________________________

This deed conveys to Grantee the following described property located in ______________ County, Texas:

Property Description: ________________________________________________________

________________________________________________________

The Grantor hereby conveys and warrants the above-mentioned property unto the Grantee, their heirs and assigns, forever.

Habendum Clause: To have and to hold the above-described property unto the Grantee, their heirs and assigns, forever.

Signatures:

___________________________

Grantor Signature

___________________________

Grantee Signature

Notary Public:

State of Texas

County of ______________

On this ___ day of ____________, 20___, before me, a notary public, personally appeared ____________________ (Grantor's name), known to me or proved to me on the basis of satisfactory evidence to be the person whose name is subscribed to the within instrument, and acknowledged that he/she executed the same in his/her authorized capacity.

___________________________

Notary Public

My Commission Expires: _______________

Form Data

| Fact Name | Description |

|---|---|

| Governing Law | The Texas Deed form is governed by the Texas Property Code. |

| Types of Deeds | Common types include General Warranty Deed, Special Warranty Deed, and Quitclaim Deed. |

| Required Signatures | The deed must be signed by the grantor (the person transferring the property). |

| Notarization | A notary public must witness the signing of the deed for it to be valid. |

| Filing Requirement | The deed must be filed with the county clerk in the county where the property is located. |

| Legal Description | A precise legal description of the property must be included in the deed. |

Texas Deed - Usage Guidelines

After obtaining the Texas Deed form, it is essential to complete it accurately to ensure a smooth transfer of property. The following steps outline the process for filling out the form correctly.

- Begin by entering the name of the grantor, the person or entity transferring the property. This should be the full legal name.

- Next, provide the name of the grantee, the individual or entity receiving the property. Again, use the full legal name.

- Include the property address. This should be the complete street address, including city, state, and ZIP code.

- Describe the property being transferred. Include a legal description, which may require referencing a survey or previous deed.

- Indicate the consideration, or the amount paid for the property, if applicable. If the transfer is a gift, state that explicitly.

- Sign and date the form. The grantor must sign in the designated area, and the date of signing should be included.

- Have the form notarized. A notary public must witness the signature and provide their seal on the document.

- Submit the completed deed to the appropriate county clerk's office for recording. Ensure that any required fees are paid at the time of submission.

Some Other Deed State Templates

New York State Deed Form - Deeds can be challenged in court if not properly executed.

For individuals looking to navigate their property transfer options, utilizing a well-structured Arizona Quitclaim Deed form can streamline the process effectively.

Pennsylvania Deed Transfer Form - Understanding the implications of a Deed helps protect property investments.

Dos and Don'ts

When filling out the Texas Deed form, it is important to follow specific guidelines to ensure accuracy and compliance. Below are some dos and don'ts to consider.

- Do provide accurate information for all parties involved in the transaction.

- Do include a legal description of the property being transferred.

- Do sign the deed in the presence of a notary public.

- Do check for any specific requirements based on the type of deed being used.

- Do keep a copy of the completed deed for your records.

- Don't leave any sections blank; all required fields must be filled out.

- Don't use white-out or erasers on the form; corrections should be made by crossing out and initialing.

- Don't forget to include the date of the transfer.

- Don't submit the deed without verifying that all information is correct.

Common mistakes

-

Incorrect Property Description: Many individuals fail to provide a clear and accurate description of the property. This can lead to confusion or disputes later on. It’s essential to include the full legal description, which can usually be found in previous deeds or property records.

-

Missing Signatures: A common mistake is neglecting to have all required parties sign the deed. If the property is co-owned, all owners must sign the document. Without the necessary signatures, the deed may not be valid.

-

Improper Notarization: Some individuals overlook the need for notarization. A deed must be notarized to be legally binding. Ensure that a notary public witnesses the signing of the deed and provides their seal.

-

Incorrect Notation of Grantee: When filling out the name of the grantee (the person receiving the property), errors can occur. Spelling mistakes or using incorrect names can cause issues with ownership. Always double-check the name for accuracy.

-

Failure to Record the Deed: After completing the deed, some forget to file it with the appropriate county office. Recording the deed is crucial as it provides public notice of the property transfer and protects the rights of the new owner.

-

Not Understanding Tax Implications: Many people do not consider the tax implications associated with transferring property. It’s important to understand how the transfer may affect property taxes and to consult a tax professional if needed.