Free Bill of Sale Document for Texas State

Document Sample

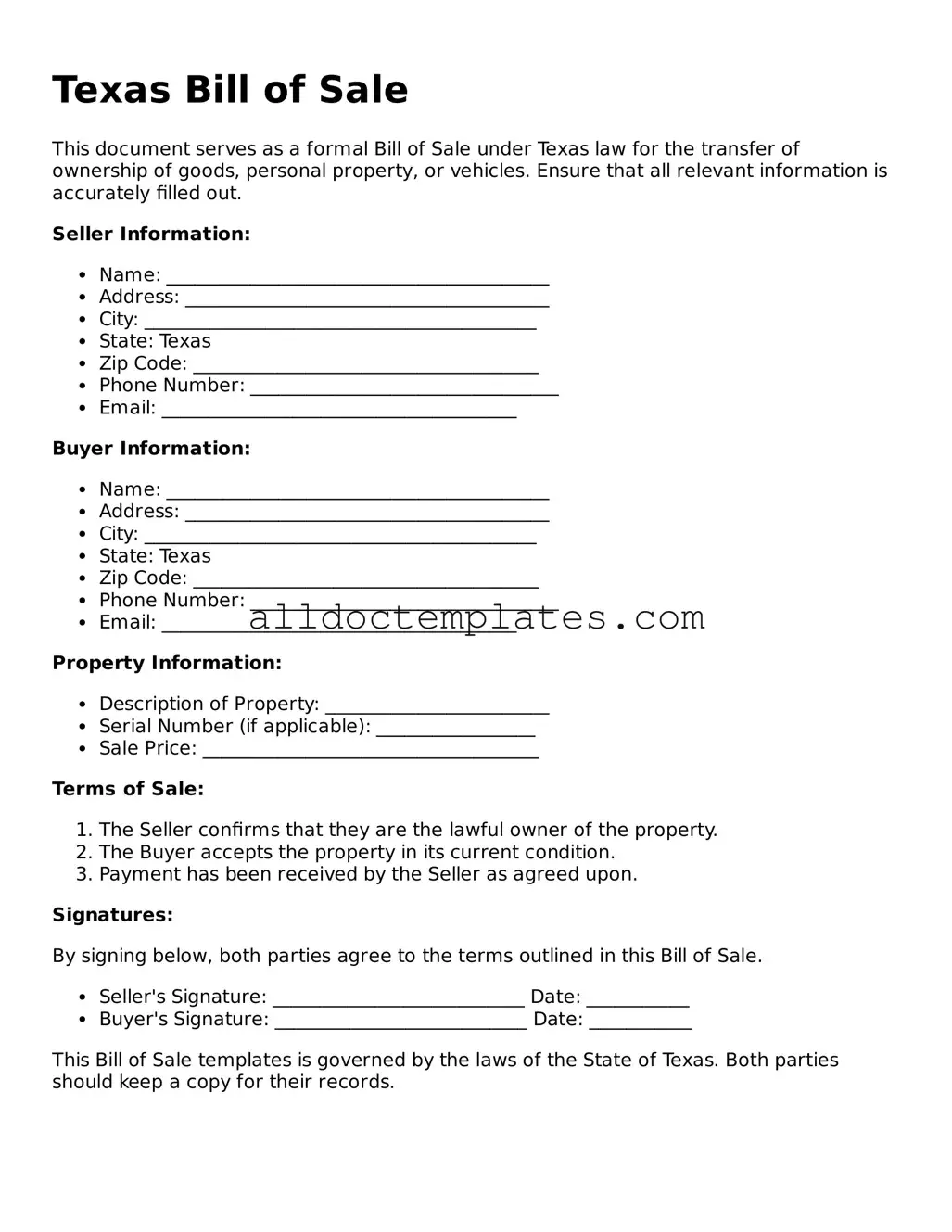

Texas Bill of Sale

This document serves as a formal Bill of Sale under Texas law for the transfer of ownership of goods, personal property, or vehicles. Ensure that all relevant information is accurately filled out.

Seller Information:

- Name: _________________________________________

- Address: _______________________________________

- City: __________________________________________

- State: Texas

- Zip Code: _____________________________________

- Phone Number: _________________________________

- Email: ______________________________________

Buyer Information:

- Name: _________________________________________

- Address: _______________________________________

- City: __________________________________________

- State: Texas

- Zip Code: _____________________________________

- Phone Number: _________________________________

- Email: ______________________________________

Property Information:

- Description of Property: ________________________

- Serial Number (if applicable): _________________

- Sale Price: ____________________________________

Terms of Sale:

- The Seller confirms that they are the lawful owner of the property.

- The Buyer accepts the property in its current condition.

- Payment has been received by the Seller as agreed upon.

Signatures:

By signing below, both parties agree to the terms outlined in this Bill of Sale.

- Seller's Signature: ___________________________ Date: ___________

- Buyer's Signature: ___________________________ Date: ___________

This Bill of Sale templates is governed by the laws of the State of Texas. Both parties should keep a copy for their records.

Form Data

| Fact Name | Details |

|---|---|

| Definition | A Texas Bill of Sale is a legal document that transfers ownership of personal property from one party to another. |

| Governing Law | The Texas Bill of Sale is governed by Texas Property Code, Chapter 2. |

| Types of Property | This form can be used for various types of personal property, including vehicles, boats, and equipment. |

| Notarization | While notarization is not required for all types of sales, it is recommended for vehicle transactions to enhance legal validity. |

| Seller and Buyer Information | The form must include the full names and addresses of both the seller and the buyer. |

| Purchase Price | The purchase price of the property must be clearly stated in the document. |

| Condition of Property | The seller should disclose the condition of the property, including any known defects. |

| Signatures | Both the seller and buyer must sign the Bill of Sale to make it legally binding. |

| Record Keeping | It is advisable for both parties to keep a copy of the Bill of Sale for their records. |

Texas Bill of Sale - Usage Guidelines

Filling out the Texas Bill of Sale form is a straightforward process that ensures both parties have a clear record of the transaction. After completing the form, you will have a legally binding document that can serve as proof of ownership transfer. Here’s how to fill out the form step by step.

- Obtain the Form: Download the Texas Bill of Sale form from a reliable source or visit your local county office to get a physical copy.

- Identify the Parties: Fill in the names and addresses of both the seller and the buyer. Make sure this information is accurate to avoid future complications.

- Describe the Item: Provide a detailed description of the item being sold. Include specifics like make, model, year, and any identification numbers (like VIN for vehicles).

- State the Sale Price: Clearly indicate the amount of money involved in the transaction. This should be the agreed-upon price between the buyer and seller.

- Include the Date: Write the date of the transaction. This is important for record-keeping and any potential future disputes.

- Signatures: Both the seller and buyer must sign the form. This signifies that both parties agree to the terms outlined in the document.

- Notarization (if necessary): Depending on the type of item being sold, you may need to have the document notarized. Check local requirements to see if this step is necessary.

Once you have completed these steps, keep a copy for your records and provide one to the other party. This document will serve as a key reference should any questions arise about the transaction in the future.

Some Other Bill of Sale State Templates

Auto Bill of Sale Form - Document item conditions with a Bill of Sale to avoid misunderstandings.

Sell a Car Without Title - The form is versatile and can be adapted for a variety of transactions and goods.

For individuals seeking to formalize the transfer of personal property, utilizing a reliable template such as the "easy-to-use General Bill of Sale" can simplify the process and ensure all necessary details are included. To obtain this essential document, visit the site for General Bill of Sale access.

Bill of Sale Sample - This document is invaluable in business transactions involving equipment or inventory.

Do You Need a Bill of Sale to Register a Car in Florida - Many states provide specific templates for creating a Bill of Sale.

Dos and Don'ts

When filling out the Texas Bill of Sale form, it's important to follow certain guidelines to ensure accuracy and legality. Here’s a list of dos and don’ts to keep in mind:

- Do provide complete and accurate information about the buyer and seller.

- Do include a detailed description of the item being sold, including make, model, and VIN if applicable.

- Do specify the sale price clearly to avoid any misunderstandings.

- Do sign and date the form in the presence of a witness if required.

- Don't leave any blank spaces; if a section does not apply, mark it as "N/A."

- Don't use outdated forms; always use the most current version of the Bill of Sale.

- Don't forget to keep a copy of the completed Bill of Sale for your records.

Common mistakes

-

Incorrect Seller Information: Failing to provide accurate names and addresses can lead to confusion. Ensure that the seller's full legal name and current address are clearly stated.

-

Missing Buyer Information: Just like the seller, the buyer's information is crucial. Omitting the buyer's name and address can create issues later.

-

Incomplete Item Description: A vague description of the item being sold can lead to disputes. Include details such as make, model, year, and VIN for vehicles.

-

Omitting Sale Price: Forgetting to include the sale price can cause problems with taxes and ownership transfer. Clearly state the agreed-upon amount.

-

Not Including Date of Sale: The date of the transaction is important for legal records. Always include the date when the sale takes place.

-

Failure to Sign: Both parties must sign the document for it to be valid. A missing signature can invalidate the sale.

-

Not Keeping Copies: After filling out the Bill of Sale, it’s essential to keep copies for both the seller and buyer. This helps in future reference and proves the transaction took place.

-

Ignoring State Requirements: Different states have specific requirements for a Bill of Sale. Ensure you are aware of Texas regulations to avoid issues.

-

Not Consulting Legal Help: When in doubt, seek legal advice. A simple mistake can lead to complications, so it’s wise to get guidance if needed.