Free Articles of Incorporation Document for Texas State

Document Sample

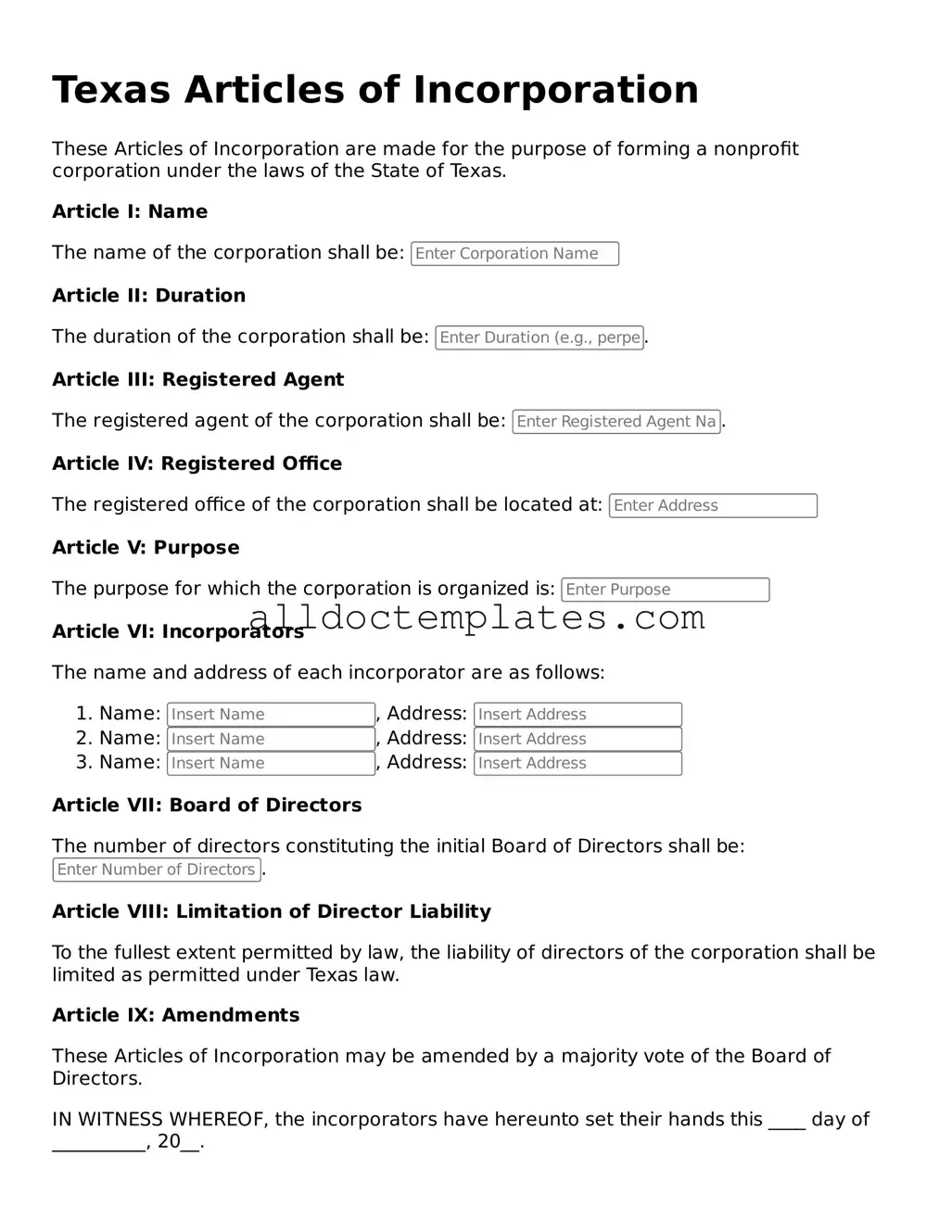

Texas Articles of Incorporation

These Articles of Incorporation are made for the purpose of forming a nonprofit corporation under the laws of the State of Texas.

Article I: Name

The name of the corporation shall be:

Article II: Duration

The duration of the corporation shall be: .

Article III: Registered Agent

The registered agent of the corporation shall be: .

Article IV: Registered Office

The registered office of the corporation shall be located at:

Article V: Purpose

The purpose for which the corporation is organized is:

Article VI: Incorporators

The name and address of each incorporator are as follows:

- Name: , Address:

- Name: , Address:

- Name: , Address:

Article VII: Board of Directors

The number of directors constituting the initial Board of Directors shall be: .

Article VIII: Limitation of Director Liability

To the fullest extent permitted by law, the liability of directors of the corporation shall be limited as permitted under Texas law.

Article IX: Amendments

These Articles of Incorporation may be amended by a majority vote of the Board of Directors.

IN WITNESS WHEREOF, the incorporators have hereunto set their hands this ____ day of __________, 20__.

______________________________

(Signature of Incorporator)

Form Data

| Fact Name | Details |

|---|---|

| Purpose | The Texas Articles of Incorporation is a document that establishes a corporation in Texas. |

| Governing Law | The formation of corporations in Texas is governed by the Texas Business Organizations Code. |

| Required Information | The form typically requires the corporation's name, registered agent, and address. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation, which varies based on the type of corporation. |

| Submission Method | Articles of Incorporation can be filed online, by mail, or in person with the Texas Secretary of State. |

| Approval Time | The approval time for the Articles of Incorporation can vary, but typically takes a few business days. |

| Amendments | Once filed, amendments to the Articles of Incorporation can be made, but require a separate filing process. |

| Public Record | After approval, the Articles of Incorporation become part of the public record, accessible by anyone. |

Texas Articles of Incorporation - Usage Guidelines

Once you have the Texas Articles of Incorporation form ready, you will need to complete it accurately to ensure your business is properly established. Follow the steps below to fill out the form correctly.

- Begin by entering the name of your corporation. Ensure that the name complies with Texas naming requirements.

- Provide the address of the corporation's registered office in Texas. This must be a physical address, not a P.O. Box.

- List the name and address of the registered agent. This person or entity will receive legal documents on behalf of the corporation.

- Indicate the purpose of the corporation. Be clear and concise about the business activities you intend to conduct.

- Specify the duration of the corporation. If it is intended to exist indefinitely, you can state that.

- Include the number of shares the corporation is authorized to issue. This is important for future stock issuance.

- Provide the names and addresses of the initial directors. This information is necessary for the governance of the corporation.

- Sign and date the form. The signature must be from an individual authorized to file the Articles of Incorporation.

After completing the form, you will need to file it with the Texas Secretary of State along with the required filing fee. Ensure that all information is accurate to avoid delays in processing.

Some Other Articles of Incorporation State Templates

Business Formation - Form used to register a new business entity with the state.

It is important for both buyers and sellers to familiarize themselves with the legalities surrounding the transaction process, and one useful resource for this is the Colorado PDF Templates, which offers guidance on how to properly complete the Colorado Mobile Home Bill of Sale form.

Pennsylvania Department of Corporations - Presents a legal framework for decision-making within the corporation.

Dos and Don'ts

When filling out the Texas Articles of Incorporation form, it's essential to approach the process with care. Here are some key dos and don'ts to keep in mind:

- Do provide accurate and complete information about your business.

- Do ensure that your business name complies with Texas naming requirements.

- Do include the correct number of shares your corporation is authorized to issue.

- Do designate a registered agent who has a physical address in Texas.

- Don't leave any sections blank; incomplete forms can lead to delays.

- Don't forget to double-check for typos or errors before submission.

- Don't ignore the filing fees; ensure payment is included with your application.

By following these guidelines, you can help ensure a smoother process in establishing your corporation in Texas.

Common mistakes

-

Incorrect Business Name: One common mistake is failing to ensure that the chosen business name is unique and not already in use. It’s essential to check the Texas Secretary of State’s database to avoid conflicts.

-

Inaccurate Registered Agent Information: Providing incorrect or outdated information for the registered agent can lead to legal complications. The registered agent must be a resident of Texas or a business entity authorized to conduct business in the state.

-

Missing Purpose Statement: The purpose of the corporation must be clearly stated. Vague or overly broad descriptions can lead to confusion or rejection of the application.

-

Improper Number of Directors: Not meeting the minimum requirement for directors is another frequent oversight. Texas law mandates that a corporation must have at least one director, but the number can vary based on the corporation’s structure.

-

Failure to Include Initial Capital Stock Information: Omitting details about the initial capital stock can result in delays. It’s important to specify the number of shares and their par value, if applicable.

-

Incorrect Filing Fee: Submitting an incorrect filing fee can halt the incorporation process. Ensure the fee matches the current rate set by the Texas Secretary of State.

-

Not Signing the Form: A signature is required on the Articles of Incorporation. Failing to sign can lead to the application being rejected.

-

Neglecting to Provide Contact Information: Not including a reliable contact method can create communication issues. It’s vital to provide an email address or phone number for follow-up inquiries.

-

Ignoring State-Specific Requirements: Each state has unique requirements for incorporation. Failing to adhere to Texas-specific guidelines can result in delays or denial of the application.