Free Affidavit of Gift Document for Texas State

Document Sample

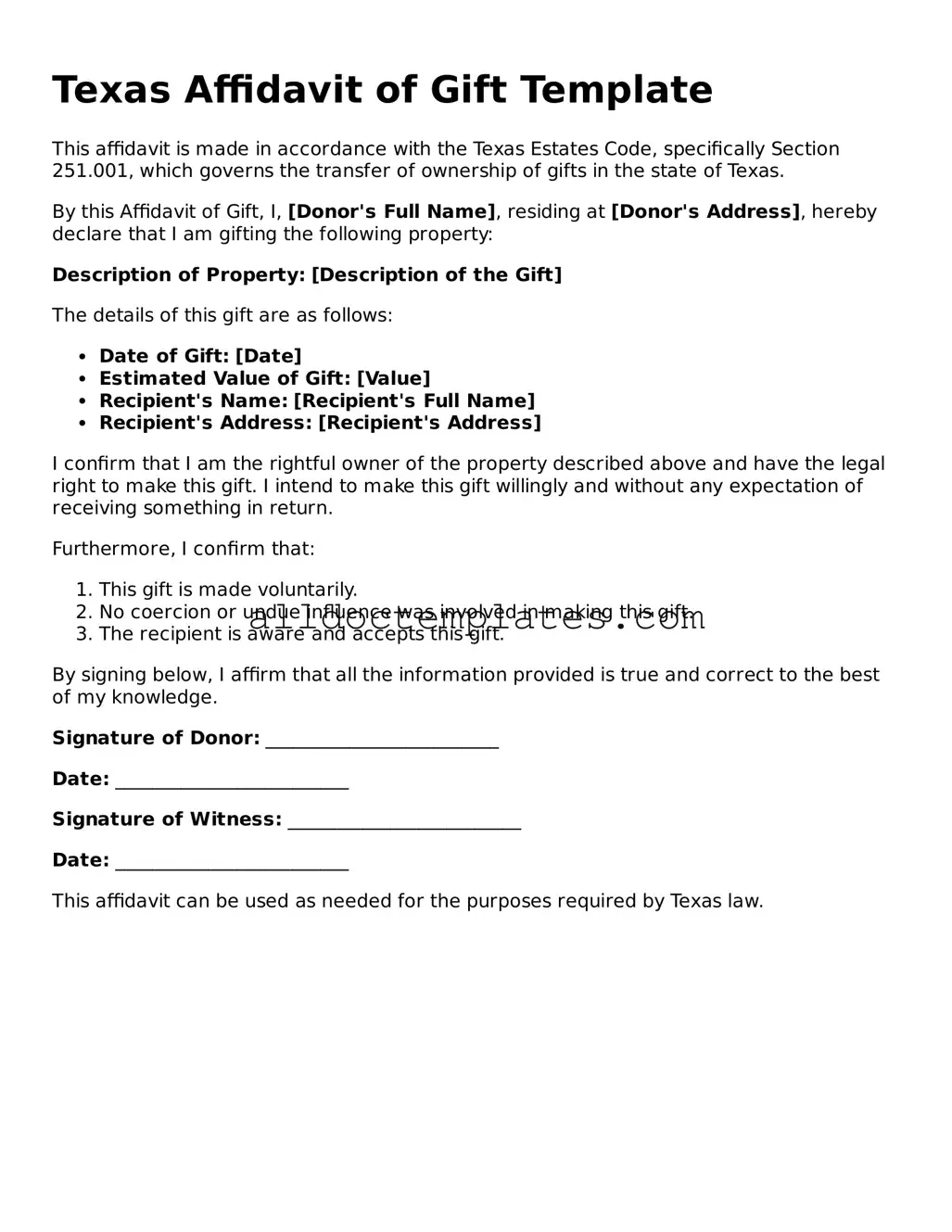

Texas Affidavit of Gift Template

This affidavit is made in accordance with the Texas Estates Code, specifically Section 251.001, which governs the transfer of ownership of gifts in the state of Texas.

By this Affidavit of Gift, I, [Donor's Full Name], residing at [Donor's Address], hereby declare that I am gifting the following property:

Description of Property: [Description of the Gift]

The details of this gift are as follows:

- Date of Gift: [Date]

- Estimated Value of Gift: [Value]

- Recipient's Name: [Recipient's Full Name]

- Recipient's Address: [Recipient's Address]

I confirm that I am the rightful owner of the property described above and have the legal right to make this gift. I intend to make this gift willingly and without any expectation of receiving something in return.

Furthermore, I confirm that:

- This gift is made voluntarily.

- No coercion or undue influence was involved in making this gift.

- The recipient is aware and accepts this gift.

By signing below, I affirm that all the information provided is true and correct to the best of my knowledge.

Signature of Donor: _________________________

Date: _________________________

Signature of Witness: _________________________

Date: _________________________

This affidavit can be used as needed for the purposes required by Texas law.

Form Data

| Fact Name | Detail |

|---|---|

| Purpose | The Texas Affidavit of Gift form is used to document the transfer of property as a gift. |

| Governing Law | This form is governed by the Texas Property Code. |

| Eligibility | Any individual can use this form to gift property, provided they are the legal owner. |

| Signatures Required | The form must be signed by both the donor and the recipient. |

| Notarization | A notary public must witness the signatures for the affidavit to be valid. |

| Tax Implications | Gifts may have tax implications; consult a tax advisor for guidance. |

| Filing | The affidavit should be filed with the county clerk where the property is located. |

| Revocation | The donor can revoke the gift before the transfer is completed. |

| Legal Effect | Once completed and filed, the gift is legally binding and enforceable. |

Texas Affidavit of Gift - Usage Guidelines

After gathering the necessary information, you are ready to complete the Texas Affidavit of Gift form. Ensure that you have all required details on hand to avoid delays. Follow these steps carefully to ensure accuracy.

- Begin by entering the date at the top of the form.

- Provide the name of the donor, including their address and contact information.

- Enter the name of the recipient, along with their address and contact information.

- Clearly describe the item being gifted. Include any relevant details such as serial numbers or unique identifiers.

- Specify the value of the gift. This should be a fair market value estimate.

- Sign the form in the designated area. Ensure that the signature is legible.

- Have the form notarized. A notary public must witness your signature.

Once the form is completed and notarized, keep a copy for your records. The original should be given to the recipient. This documentation is important for both parties involved.

Some Other Affidavit of Gift State Templates

Affidavit for Gifting a Car Florida - Document proving that the gift was made without duress or coercion.

The California Release of Liability form is an essential legal document that provides protection against claims for injuries or damages incurred during various activities. By using this form, participants acknowledge the risks associated with the activity and agree to waive their rights to pursue legal action. To ensure full compliance and protection, it is advisable to fill out the form, which you can find at All Templates PDF.

Dos and Don'ts

When filling out the Texas Affidavit of Gift form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are some dos and don'ts to keep in mind:

- Do read the instructions carefully before starting.

- Do provide accurate information about the gift and the donor.

- Do sign and date the form where indicated.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank.

- Don't use white-out or correction fluid on the form.

- Don't forget to include any necessary documentation.

- Don't submit the form without verifying all information is correct.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all necessary details. This includes missing names, addresses, or the relationship between the donor and recipient.

-

Incorrect Signatures: Signatures must be provided by both the donor and the recipient. Some people overlook this requirement, leading to delays in processing.

-

Not Notarizing the Document: The Texas Affidavit of Gift requires notarization. Failing to have the document notarized can result in the form being rejected.

-

Omitting Date of Transfer: The date on which the gift is made is essential. Some individuals forget to include this information, which can create confusion.

-

Using Incorrect Form Version: It is crucial to use the most current version of the form. Using an outdated version may lead to complications or rejection of the affidavit.