Fill in a Valid Stock Transfer Ledger Form

Document Sample

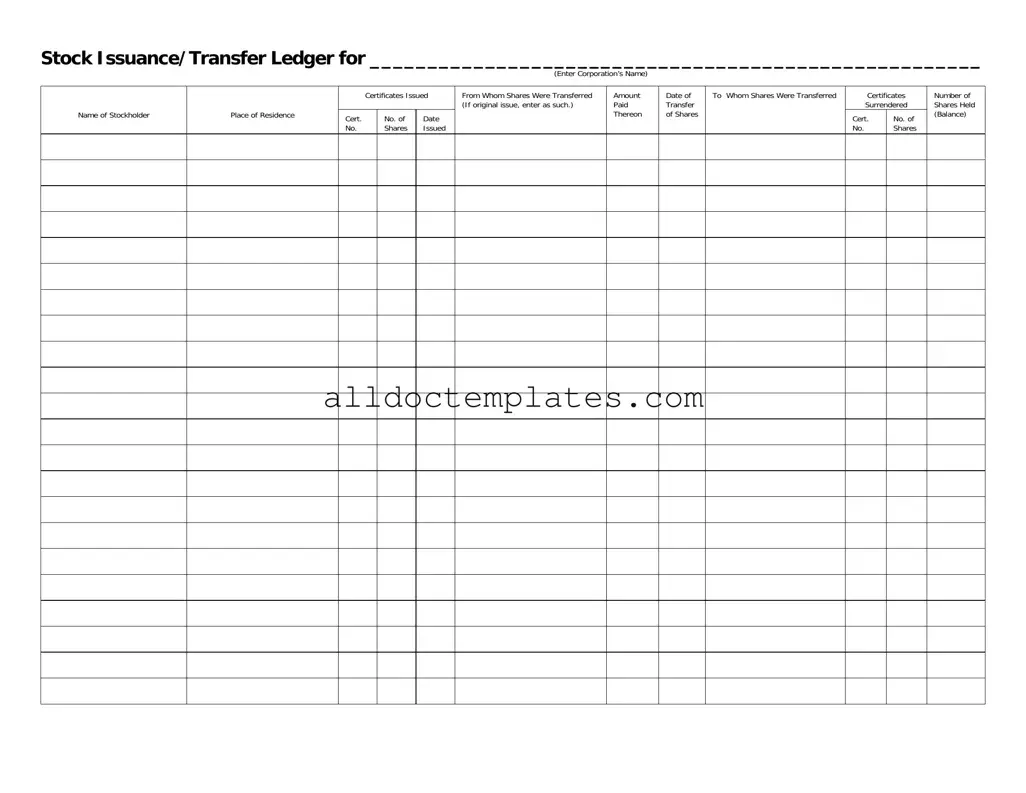

Stock Issuance/Transfer Ledger for _____________________________________________________

(Enter Corporation’s Name)

Name of Stockholder

Place of Residence

Certificates Issued

Cert. |

No. of |

Date |

No. |

Shares |

Issued |

From Whom Shares Were Transferred (If original issue, enter as such.)

Amount

Paid

Thereon

Date of

Transfer

of Shares

To Whom Shares Were Transferred

Certificates

Surrendered

Cert. |

No. of |

No. |

Shares |

Number of Shares Held (Balance)

Document Information

| Fact Name | Description |

|---|---|

| Form Purpose | The Stock Transfer Ledger form tracks the issuance and transfer of shares in a corporation. |

| Corporation Name | The form requires the name of the corporation at the top for identification. |

| Stockholder Information | It includes the name and place of residence of the stockholder receiving shares. |

| Certificates Issued | The form records the certificates issued, including their numbers and the date of issuance. |

| Transfer Details | It captures details about the transfer, including the amount paid and the date of transfer. |

| Original Issue Note | If shares are newly issued, the form allows the user to note this explicitly. |

| Surrendered Certificates | The form requires information on any surrendered certificates during the transfer process. |

| Balance of Shares | It shows the number of shares held after the transfer, providing a clear balance for stockholders. |

Stock Transfer Ledger - Usage Guidelines

Once you have the Stock Transfer Ledger form ready, you will need to complete it with the necessary information. This form requires details about stockholders and the transactions related to stock issuance and transfer. Follow the steps below to fill out the form accurately.

- Begin by entering the name of the corporation at the top of the form in the designated space.

- In the section labeled "Name of Stockholder," write the full name of the stockholder involved in the transaction.

- Provide the "Place of Residence" for the stockholder. This should include the city and state.

- In the "Certificates Issued" section, indicate the total number of shares that have been issued to the stockholder.

- Next, fill in the "Cert. No." with the certificate number corresponding to the shares issued.

- Enter the "Date" when the shares were issued.

- In the "From Whom Shares Were Transferred" section, specify the name of the individual or entity from whom the shares were originally issued. If this is the original issue, write "original issue."

- State the "Amount Paid Thereon" for the shares being transferred.

- Record the "Date of Transfer of Shares," which indicates when the transfer took place.

- In the "To Whom Shares Were Transferred" section, write the name of the individual or entity receiving the shares.

- Indicate the "Certificates Surrendered" by providing the certificate number of the shares being surrendered.

- Fill in the "No. Shares" field with the number of shares being surrendered.

- Finally, calculate and enter the "Number of Shares Held (Balance)" after the transfer has been completed.

Common PDF Forms

How to Make a Doctor Excuse for Work - Provides peace of mind regarding attendance issues related to health.

A Colorado Durable Power of Attorney form is a legal document that allows you to appoint someone to make decisions on your behalf if you become unable to do so. This trusted individual, known as your agent, can handle various matters, including financial and healthcare decisions. For more information and to access the form, you can visit Colorado PDF Templates. Understanding how this form works is essential for ensuring your wishes are respected during challenging times.

What Information Must Be Listed on a Job Application? - Detail the work you performed to outline your skills and responsibilities.

Dos and Don'ts

When filling out the Stock Transfer Ledger form, it is important to follow specific guidelines to ensure accuracy and compliance. Below is a list of things you should and should not do.

- Do enter the corporation's name clearly at the top of the form.

- Do provide complete information for each stockholder, including their name and place of residence.

- Do accurately record the certificate numbers and the number of shares issued.

- Do specify the date of transfer and the parties involved in the transaction.

- Do indicate the amount paid for the shares and ensure it matches your records.

- Do keep a copy of the completed form for your records.

- Do review the form for any errors before submission.

- Don’t leave any sections blank; all fields must be filled out.

- Don’t use abbreviations or shorthand that could lead to confusion.

- Don’t forget to sign the form if required.

- Don’t alter any information after it has been entered; if changes are needed, start a new form.

- Don’t submit the form without double-checking for accuracy.

- Don’t ignore the instructions specific to your corporation's requirements.

- Don’t assume that the information is correct without verifying it first.

Common mistakes

-

Incomplete Corporation Name: Failing to enter the full and correct name of the corporation can lead to confusion and potential legal issues. Ensure that the name matches exactly as registered with the state.

-

Missing Stockholder Information: Omitting the name or place of residence of the stockholder can invalidate the transfer. It is essential to provide accurate and complete details for all parties involved.

-

Incorrect Certificate Numbers: Entering the wrong certificate numbers or failing to include them can complicate the transfer process. Double-check that all certificate numbers correspond with the issued shares.

-

Failure to Document Transfers: Neglecting to fill out the section regarding the transfer of shares, including the date and amount paid, may result in disputes later on. Each transfer should be clearly documented to ensure transparency.