Fill in a Valid SSA SSA-44 Form

Document Sample

Form |

Page 1 of 8 |

Discontinue Prior Editions |

|

Social Security Administration |

OMB No. |

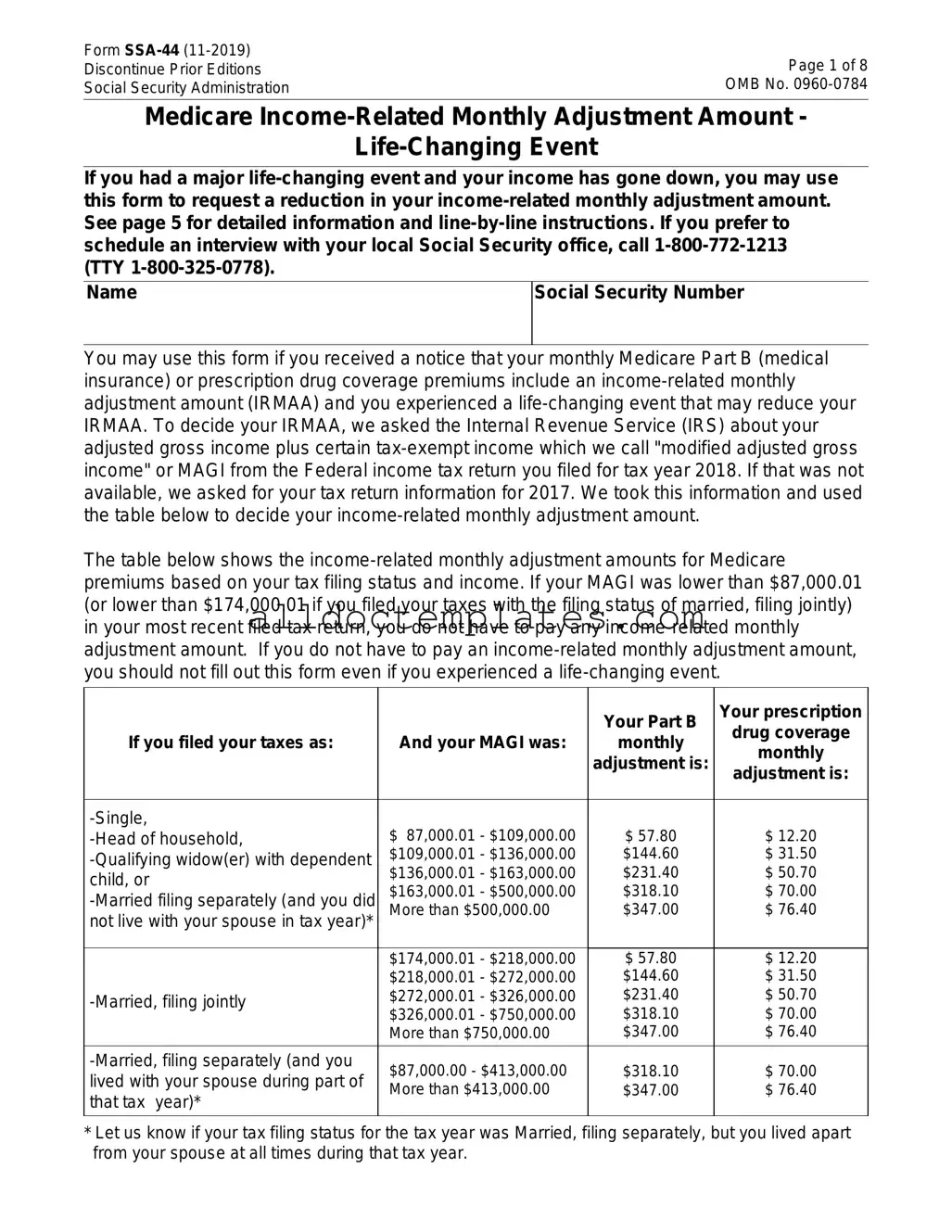

Medicare

If you had a major

Name

Social Security Number

You may use this form if you received a notice that your monthly Medicare Part B (medical insurance) or prescription drug coverage premiums include an

The table below shows the

|

|

Your Part B |

Your prescription |

|

|

|

drug coverage |

||

If you filed your taxes as: |

And your MAGI was: |

monthly |

||

monthly |

||||

|

|

adjustment is: |

||

|

|

adjustment is: |

||

|

|

|

||

|

|

|

|

|

$ 87,000.01 - $109,000.00 |

$ 57.80 |

$ 12.20 |

||

$109,000.01 - $136,000.00 |

$144.60 |

$ 31.50 |

||

child, or |

$136,000.01 - $163,000.00 |

$231.40 |

$ 50.70 |

|

$163,000.01 - $500,000.00 |

$318.10 |

$ 70.00 |

||

More than $500,000.00 |

$347.00 |

$ 76.40 |

||

not live with your spouse in tax year)* |

|

|

|

|

|

|

|

|

|

|

$174,000.01 - $218,000.00 |

$ 57.80 |

$ 12.20 |

|

|

$218,000.01 - $272,000.00 |

$144.60 |

$ 31.50 |

|

$272,000.01 - $326,000.00 |

$231.40 |

$ 50.70 |

||

$326,000.01 - $750,000.00 |

$318.10 |

$ 70.00 |

||

|

||||

|

More than $750,000.00 |

$347.00 |

$ 76.40 |

|

$87,000.00 - $413,000.00 |

$318.10 |

$ 70.00 |

||

lived with your spouse during part of |

||||

More than $413,000.00 |

$347.00 |

$ 76.40 |

||

that tax year)* |

||||

|

|

|

||

|

|

|

|

*Let us know if your tax filing status for the tax year was Married, filing separately, but you lived apart from your spouse at all times during that tax year.

Form |

Page 2 of 8 |

STEP 1: Type of

Check ONE

Marriage |

Work Reduction |

|

Divorce/Annulment |

Loss of |

|

Death of Your Spouse |

Loss of Pension Income |

|

Work Stoppage |

Employer Settlement Payment |

|

Date of |

|

|

|

mm/dd/yyyy |

|

STEP 2: Reduction in Income

Fill in the tax year in which your income was reduced by the

Tax Year

2 0 __ __

Adjusted Gross Income

$ __ __ __ __ __ __ . __ __

$ __ __ __ __ __ __ . __ __

Tax Filing Status for this Tax Year (choose ONE ):

Single |

Head of Household |

Married, Filing Jointly |

Married, Filing Separately |

Qualifying Widow(er) with Dependent Child

STEP 3: Modified Adjusted Gross Income

Will your modified adjusted gross income be lower next year than the year in Step 2?

No - Skip to STEP 4

No - Skip to STEP 4

Yes - Complete the blocks below for next year

Yes - Complete the blocks below for next year

Tax Year |

Estimated Adjusted Gross Income |

|

Estimated |

2 0 __ __ |

$ __ __ __ __ __ __. __ __ |

|

$ __ __ __ __ __ __. __ __ |

|

|

|

|

Expected Tax Filing Status for this Tax Year (choose |

ONE ): |

||

Single

Single

Married, Filing Jointly

Head of Household

Head of Household

Married, Filing Separately

Qualifying Widow(er) with Dependent Child

Form |

Page 3 of 8 |

STEP 4: Documentation

Provide evidence of your modified adjusted gross income (MAGI) and your

1.Attach the required evidence and we will mail your original documents or certified copies back to you;

OR

2.Show your original documents or certified copies of evidence of your

Note: You must sign in Step 5 and attach all required evidence. Make sure that you provide your current address and a phone number so that we can contact you if we have any questions about your request.

STEP 5: Signature

PLEASE READ THE FOLLOWING INFORMATION CAREFULLY BEFORE SIGNING THIS FORM.

I understand that the Social Security Administration (SSA) will check my statements with records from the Internal Revenue Service to make sure the determination is correct.

I declare under penalty of perjury that I have examined the information on this form and it is true and correct to the best of my knowledge.

I understand that signing this form does not constitute a request for SSA to use more recent tax year information unless it is accompanied by:

•Evidence that I have had the

•A copy of my Federal tax return; or

•Other evidence of the more recent tax year's modified adjusted gross income.

Signature

Phone Number

Mailing Address

Apartment Number

City

State

ZIP Code

Form |

Page 4 of 8 |

|

|

THE PRIVACY ACT

We are required by sections 1839(i) and

We rarely use the information you supply for any purpose other than for determining a potential reduction in IRMAA. However, the law sometimes requires us to give out the facts on this form without your consent. We may release this information to another Federal, State, or local government agency to assist us in determining your eligibility for a reduction in your IRMAA, if Federal law requires that we do so, or to do the research and audits needed to administer or improve our efforts for the Medicare program.

We may also use the information you provide in computer matching programs. Matching programs compare our records with records kept by other Federal, state or local government agencies. We will also compare the information you give us to your tax return records maintained by the IRS. The law allows us to do this even if you do not agree to it. Information from these matching programs can be used to establish or verify a person’s eligibility for Federally funded or administered benefit programs and for repayment of payments or delinquent debts under these programs.

Explanations about these and other reasons why information you provide us may be used or given out are available in Systems of Records Notice

Paperwork Reduction Act Statement - This information collection meets the requirements of 44 U.S.C. § 3507, as amended by section 2 of the Paperwork Reduction Act of 1995. You do not need to answer these questions unless we display a valid Office of Management and Budget control number. We estimate that it will take about 45 minutes to read the instructions, gather the facts, and answer the questions. SEND OR BRING THE COMPLETED FORM TO

YOUR LOCAL SOCIAL SECURITY OFFICE. The office is listed under U. S. Government agencies in your telephone directory or you may call Social Security at

Form |

Page 5 of 8 |

INSTRUCTIONS FOR COMPLETING FORM

Medicare

You do not have to complete this form in order to ask that we use your information about your modified adjusted gross income for a more recent tax year. If you prefer, you may call

Identifying Information

Print your full name and your own Social Security Number as they appear on your Social Security card. Your Social Security Number may be different from the number on your Medicare card.

STEP 1

You should choose only one

|

Use this category if... |

|

|

|

Marriage |

You entered into a legal marriage. |

|

|

|

|

|

|

Divorce/Annulment |

Your legal marriage ended, and you will not file a joint return |

|

|

with your spouse for the year. |

|

|

|

|

|

|

|

Death of Your Spouse |

Your spouse died. |

|

|

|

|

|

|

Work Stoppage or Reduction |

You or your spouse stopped working or reduced the hours |

|

|

that you work. |

|

|

|

|

|

|

|

|

You or your spouse experienced a loss of |

|

|

|

property that was not at your direction (e.g., not due to the |

|

|

Loss of |

sale or transfer of the property). This includes loss of real |

|

|

property in a Presidentially or |

|

|

|

Property |

|

|

|

disaster area, destruction of livestock or crops due to natural |

|

|

|

|

|

|

|

|

disaster or disease, or loss of property due to arson, or loss |

|

|

|

of investment property due to fraud or theft. |

|

|

|

|

|

|

Loss of Pension Income |

You or your spouse experienced a scheduled cessation, |

|

|

termination, or reorganization of an employer's pension plan. |

|

|

|

|

|

|

|

|

You or your spouse receive a settlement from an employer |

|

|

Employer Settlement Payment |

or former employer because of the employer's bankruptcy or |

|

|

|

reorganization. |

|

|

|

|

|

Form |

Page 6 of 8 |

INSTRUCTIONS FOR COMPLETING FORM

STEP 2

Supply information about the more recent year's modified adjusted gross income (MAGI). Note that this year must reflect a reduction in your income due to the

Tax Year

•Fill in both empty spaces in the box that says “20_ _". The year you choose must be more recent than the year of the tax return information we used. The letter that we sent you tells you what tax year we used.

•

•

•

Choose this year (the "premium year") - if your modified adjusted gross income is lower this year than last year. For example, if you request that we adjust your

1.Your income was not reduced until 2020; or

2.Your income was reduced in 2019, but will be lower in 2020.

Choose last year (the year before the "premium year," which is the year for which you want us to adjust your IRMAA) - if your MAGI is not lower this year than last year. For example, if you request that we adjust your 2020

Exception: If we used IRS information about your MAGI 3 years before the premium year, you may ask us to use information from 2 years before the premium year. For example, if we used your income tax return for 2017 to decide your 2020 IRMAA, you can ask us to use your 2018 information.

• If you have any questions about what year you should use, you should call SSA.

Adjusted Gross Income

•Fill in your actual or estimated adjusted gross income for the year you wrote in the “tax year” box. Adjusted gross income is the amount on line 7 of IRS form 1040. If you are providing an estimate, your estimate should be what you expect to enter on your tax return for that year.

•Fill in your actual or estimated

Filing Status

•Check the box in front of your actual or expected tax filing status for the year you wrote in the “tax year” box.

Form |

Page 7 of 8 |

INSTRUCTIONS FOR COMPLETING FORM

STEP 3

Complete this step only if you expect that your MAGI for next year will be even lower and will reduce your IRMAA below what you told us in Step 2 using the table on page 1. We will record this information and use it next year to determine your Medicare

Tax Year

•Fill in both empty spaces in the box that says “20 _ _ ” with the year following the year you wrote in Step 2. For example, if you wrote "2020" in Step 2, then write "2021" in Step 3.

Adjusted Gross Income

•Fill in your estimated adjusted gross income for the year you wrote in the “tax year” box. Adjusted gross income is the amount you expect to enter on line 7 of IRS form 1040 when you file your tax return for that year.

•Fill in your estimated

Filing Status

•Check the box in front of your expected tax filing status for the year you wrote in the “tax year” box.

STEP 4

Provide your required evidence of your MAGI and your

Modified Adjusted Gross Income Evidence

If you have filed your Federal income tax return for the year you wrote in Step 2, then you must provide us with your signed copy of your tax return or a transcript from IRS. If you provided an estimate in Step 2, you must show us a signed copy of your tax return when you file your Federal income tax return for that year.

We must see original documents or certified copies of evidence that the

Form |

Page 8 of 8 |

|

|

|

|

Evidence |

||

|

|

|

Marriage |

An original marriage certificate; or a certified copy of a public record of |

|

marriage. |

||

|

||

Divorce/Annulment |

A certified copy of the decree of divorce or annulment. |

|

|

|

|

Death of Your Spouse |

A certified copy of a death certificate, certified copy of the public record of |

|

death, or a certified copy of a coroner’s certificate. |

||

|

An original signed statement from your employer; copies of pay stubs; |

|

Work Stoppage or |

original or certified documents that show a transfer of your business. |

|

Note: In the absence of such proof, we will accept your signed statement, |

||

Reduction |

||

|

under penalty of perjury, on this form, that you partially or fully stopped |

|

|

working or accepted a job with reduced compensation. |

|

|

|

|

|

An original copy of an insurance company adjuster’s statement of loss or a |

|

Loss of Income- |

letter from a State or Federal government about the uncompensated loss. If |

|

the loss was due to investment fraud (theft), we also require proof of |

||

Producing Property |

||

conviction for the theft, such as a court document citing theft or fraud |

||

|

||

|

relating to you or your spouse's loss. |

|

|

|

|

Loss of Pension |

A letter or statement from your pension fund administrator that explains the |

|

Income |

reduction or termination of your benefits. |

|

|

|

|

Employer Settlement |

A letter from the employer stating the settlement terms of the bankruptcy |

|

Payment |

court and how it affects you or your spouse. |

|

|

|

|

STEP 5 |

|

Read the information above the signature line, and sign the form. Fill in your phone number and current mailing address. It is very important that we have this information so that we can contact you if we have any questions about your request.

Important Facts

•When we use your estimated MAGI information to make a decision about your

•If you provide an estimate of your MAGI rather than a copy of your Federal tax return, we will ask you to provide a copy of your tax return when you file your taxes.

•If your estimate of your MAGI changes, or you amend your tax return for that reason, you will need to contact us to update our records. If you do not contact us, we may have to make corrections later including retroactive assessments or refunds.

•We will use your estimate provided in Step 2 to make a decision about the amount of your

•IRS sends us your tax return information for the year used in Step 2; or

•You provide a signed copy of your filed Federal income tax return or amended Federal income tax return with a different amount; or

•You provide an updated estimate.

•If we used information from IRS about a tax year when your filing status was Married filing separately, but you lived apart from your spouse at all times during that year, you should contact us at

Document Information

| Fact Name | Description |

|---|---|

| Purpose | The SSA-44 form is used to request a reduction in the amount of monthly Social Security benefits due to a change in income. |

| Eligibility | Individuals who receive Social Security benefits and experience a significant decrease in income may be eligible to use this form. |

| Filing Process | The form can be submitted online, by mail, or in person at a local Social Security office. |

| Supporting Documents | Applicants must provide documentation that supports their claim of reduced income, such as pay stubs or tax returns. |

| Impact on Benefits | Filing the SSA-44 may lead to a temporary or permanent adjustment in benefit amounts, depending on the individual's circumstances. |

| State-Specific Forms | Some states may have additional requirements or forms related to income adjustments; for example, California adheres to the Social Security Act, which governs such processes. |

| Deadline | There is no strict deadline for submitting the SSA-44, but it is advisable to file as soon as income changes occur to ensure timely adjustments. |

SSA SSA-44 - Usage Guidelines

Completing the SSA-44 form is an important step in your process. After filling it out, you will need to submit it to the Social Security Administration for review. Ensure that all sections are filled accurately to avoid delays.

- Begin by downloading the SSA-44 form from the Social Security Administration's website or obtain a physical copy.

- Read the instructions carefully to understand what information is required.

- Fill in your personal information, including your name, Social Security number, and contact details.

- Provide information about your income and any changes that may have occurred since your last report.

- Include details of your living situation, such as household members and any changes in your living arrangements.

- Sign and date the form at the designated area to certify that the information is true and complete.

- Make a copy of the completed form for your records before submission.

- Submit the form either online through the SSA website, by mail, or in person at your local Social Security office.

Common PDF Forms

10-2850c - This form helps VA assess your qualifications for employment in their healthcare system.

For couples in California considering a separation, understanding the nuances of a Marital Separation Agreement is vital. This document ensures clarity regarding the division of assets and responsibilities, making the process smoother. You can learn more about it in this important guide to the Marital Separation Agreement.

Irs 433-f Allowable Expenses - IRS 433-F can be submitted by individuals or businesses facing tax issues.

Dos and Don'ts

When filling out the SSA SSA-44 form, it's important to approach the task with care. This form is used to request a reduction in your income-related monthly adjustment amount (IRMAA) for Medicare. Here are some guidelines to consider:

- Do ensure accuracy: Double-check all information entered on the form. Incorrect details can lead to delays or denial of your request.

- Do provide supporting documentation: Include any necessary documents that support your claim for a reduction in your IRMAA. This may include tax returns or proof of income changes.

- Do submit on time: Make sure to file the form by the deadline to avoid any potential issues with your Medicare coverage.

- Do keep a copy: Retain a copy of the completed form and any attachments for your records. This can be helpful for future reference.

- Don't rush through the form: Take your time to read each section carefully. Rushing can lead to mistakes that may complicate your application.

- Don't leave fields blank: Fill out every required field. Leaving information incomplete can result in processing delays.

- Don't ignore instructions: Follow the guidelines provided with the form. Each instruction is designed to help you complete it correctly.

- Don't hesitate to ask for help: If you're unsure about any part of the form, consider reaching out for assistance. It's better to ask than to submit an incorrect application.

Common mistakes

-

Incorrect personal information: Many individuals fail to provide accurate personal details such as their name, Social Security number, or date of birth.

-

Missing signatures: Some applicants neglect to sign the form, which can lead to delays in processing.

-

Inadequate explanation of circumstances: Failing to clearly explain why they believe their benefits should be adjusted can result in confusion or denial.

-

Not providing supporting documentation: Many forget to include necessary documents that support their claims, which can hinder the review process.

-

Incorrectly calculating income: Some individuals misreport their income, either by overstating or understating it, which can affect their eligibility.

-

Ignoring deadlines: Failing to submit the form within the required time frame can lead to the loss of benefits.

-

Using outdated forms: Submitting an older version of the SSA-44 can result in rejection, as only the most current form is accepted.

-

Not reviewing the form before submission: Many applicants overlook the importance of double-checking their entries for errors or omissions.

-

Assuming all questions are optional: Some individuals mistakenly believe that they can skip questions they find difficult or irrelevant, which can lead to incomplete submissions.

-

Failing to keep a copy: Not retaining a copy of the submitted form can create difficulties if there are follow-up questions or issues.