Valid Single-Member Operating Agreement Template

Document Sample

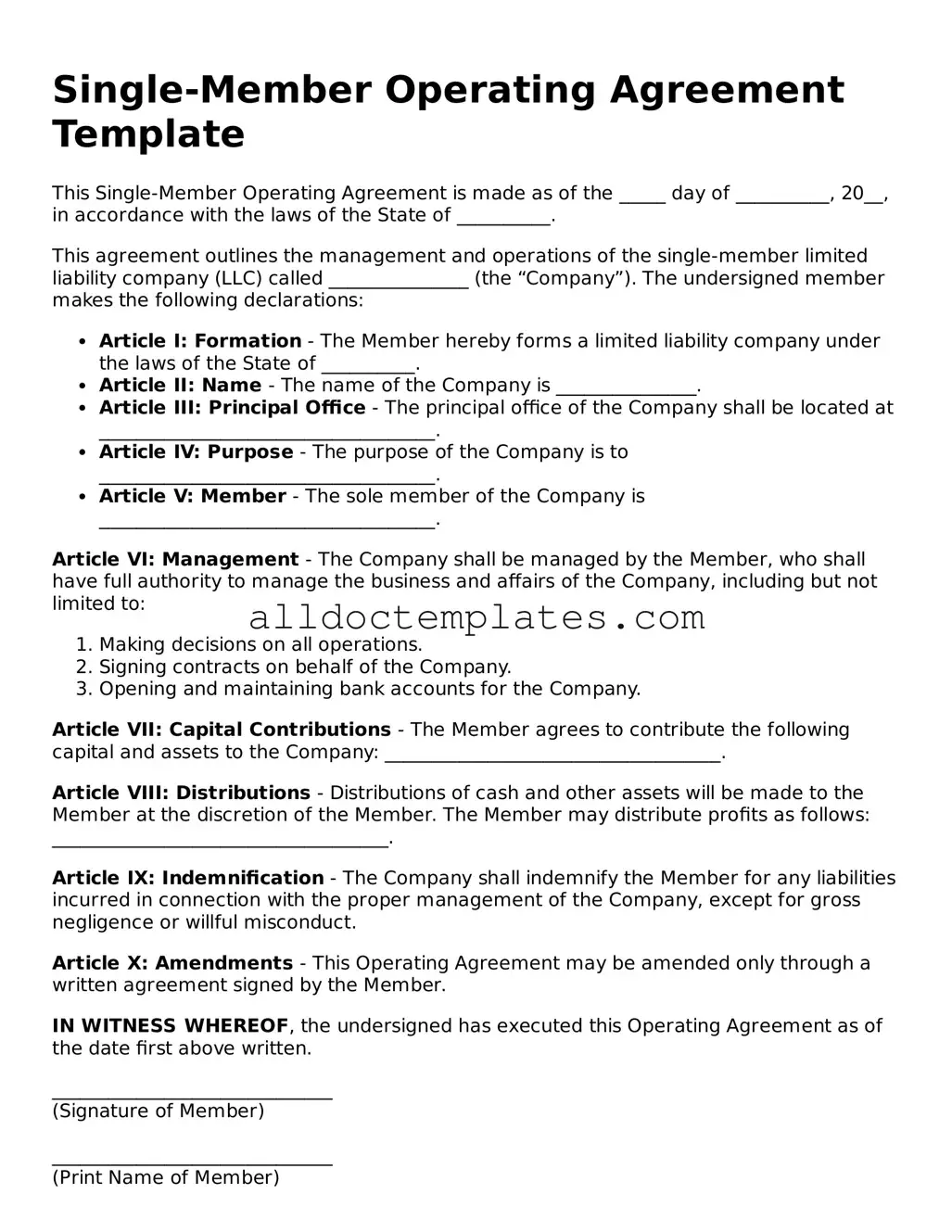

Single-Member Operating Agreement Template

This Single-Member Operating Agreement is made as of the _____ day of __________, 20__, in accordance with the laws of the State of __________.

This agreement outlines the management and operations of the single-member limited liability company (LLC) called _______________ (the “Company”). The undersigned member makes the following declarations:

- Article I: Formation - The Member hereby forms a limited liability company under the laws of the State of __________.

- Article II: Name - The name of the Company is _______________.

- Article III: Principal Office - The principal office of the Company shall be located at ____________________________________.

- Article IV: Purpose - The purpose of the Company is to ____________________________________.

- Article V: Member - The sole member of the Company is ____________________________________.

Article VI: Management - The Company shall be managed by the Member, who shall have full authority to manage the business and affairs of the Company, including but not limited to:

- Making decisions on all operations.

- Signing contracts on behalf of the Company.

- Opening and maintaining bank accounts for the Company.

Article VII: Capital Contributions - The Member agrees to contribute the following capital and assets to the Company: ____________________________________.

Article VIII: Distributions - Distributions of cash and other assets will be made to the Member at the discretion of the Member. The Member may distribute profits as follows: ____________________________________.

Article IX: Indemnification - The Company shall indemnify the Member for any liabilities incurred in connection with the proper management of the Company, except for gross negligence or willful misconduct.

Article X: Amendments - This Operating Agreement may be amended only through a written agreement signed by the Member.

IN WITNESS WHEREOF, the undersigned has executed this Operating Agreement as of the date first above written.

______________________________

(Signature of Member)

______________________________

(Print Name of Member)

Form Data

| Fact Name | Description |

|---|---|

| Definition | A Single-Member Operating Agreement is a document that outlines the management structure and operating procedures for a single-member LLC. |

| Purpose | This agreement helps clarify the owner's rights and responsibilities, protecting personal assets from business liabilities. |

| State-Specific Laws | The governing laws vary by state. For example, in California, it follows the California Corporations Code. |

| Flexibility | The agreement allows the owner to customize management and operational procedures according to their needs. |

| Tax Benefits | Single-member LLCs are typically treated as disregarded entities for tax purposes, simplifying tax filings. |

| Confidentiality | Having an operating agreement can help keep business operations private and confidential. |

| Legal Protection | A well-drafted agreement can provide legal protection in case of disputes or audits. |

Single-Member Operating Agreement - Usage Guidelines

After obtaining the Single-Member Operating Agreement form, you’re ready to start filling it out. This document will help outline the structure and rules for your single-member LLC. Follow these steps to complete the form accurately.

- Provide your name: Write your full legal name at the top of the form.

- Enter your business name: Fill in the name of your LLC as registered with the state.

- Insert the business address: Include the primary address where your business operates.

- State the purpose of the LLC: Briefly describe what your business does or will do.

- List the member: Since it's a single-member agreement, write your name again as the sole member.

- Detail the management structure: Indicate whether you will manage the LLC yourself or appoint someone else.

- Include financial information: Specify how profits and losses will be allocated.

- Sign and date the form: Ensure you sign and date the document to make it official.

Once you’ve completed these steps, review the form for accuracy. Make sure all information is correct and complete. After that, you can move on to filing the document with the appropriate state agency if needed.

More Types of Single-Member Operating Agreement Templates:

How to Create an Operating Agreement for an Llc - This document is a testament to the professionalism and deliberation of the members in forming their business.

The process of forming your business entity is crucial. You can find an easy way to navigate these steps with the basic Operating Agreement guidelines to ensure your LLC is structured properly and operates smoothly.

Dos and Don'ts

When filling out the Single-Member Operating Agreement form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are some do's and don'ts:

- Do provide accurate and complete information about the business and its owner.

- Do clearly state the purpose of the business in the agreement.

- Do include the date the agreement is signed.

- Do keep a copy of the signed agreement for your records.

- Don't leave any sections blank; fill in all required fields.

- Don't use vague language; be specific about terms and conditions.

- Don't forget to review the agreement for errors before signing.

Common mistakes

-

Not Including Basic Information: Many individuals forget to include essential details such as their name, address, and the name of the business. This information is crucial for identifying the owner and the entity.

-

Skipping the Purpose of the Business: It’s common to overlook stating the purpose of the business. This section helps clarify the business’s objectives and can be important for legal and tax reasons.

-

Failing to Define Management Structure: Some people assume that a single-member LLC doesn’t require a management structure. However, outlining how decisions will be made is important for clarity and future reference.

-

Neglecting to Specify Capital Contributions: Not detailing the initial capital contributions can lead to confusion later. Clearly stating how much money or assets the owner is contributing helps establish ownership stakes.

-

Omitting Profit Distribution Terms: Many forget to mention how profits will be distributed. This can lead to misunderstandings about the financial expectations of the business.

-

Ignoring Tax Treatment Clauses: Not addressing how the business will be taxed can result in unexpected tax liabilities. It’s important to specify whether the owner will elect to be taxed as a corporation or as a pass-through entity.

-

Not Including an Indemnification Clause: Some individuals overlook the importance of protecting themselves from personal liability. Including an indemnification clause can provide additional security for the owner.

-

Forgetting to Update the Agreement: After the initial setup, many fail to revisit the operating agreement. Regular updates are necessary to reflect changes in the business structure or operations.

-

Not Seeking Legal Advice: Many people attempt to fill out the form without consulting a legal professional. This can lead to mistakes that may have long-term consequences.

-

Neglecting to Sign and Date the Agreement: Finally, some individuals forget the importance of signing and dating the document. An unsigned agreement may not hold up in legal situations.