Valid Release of Promissory Note Template

Document Sample

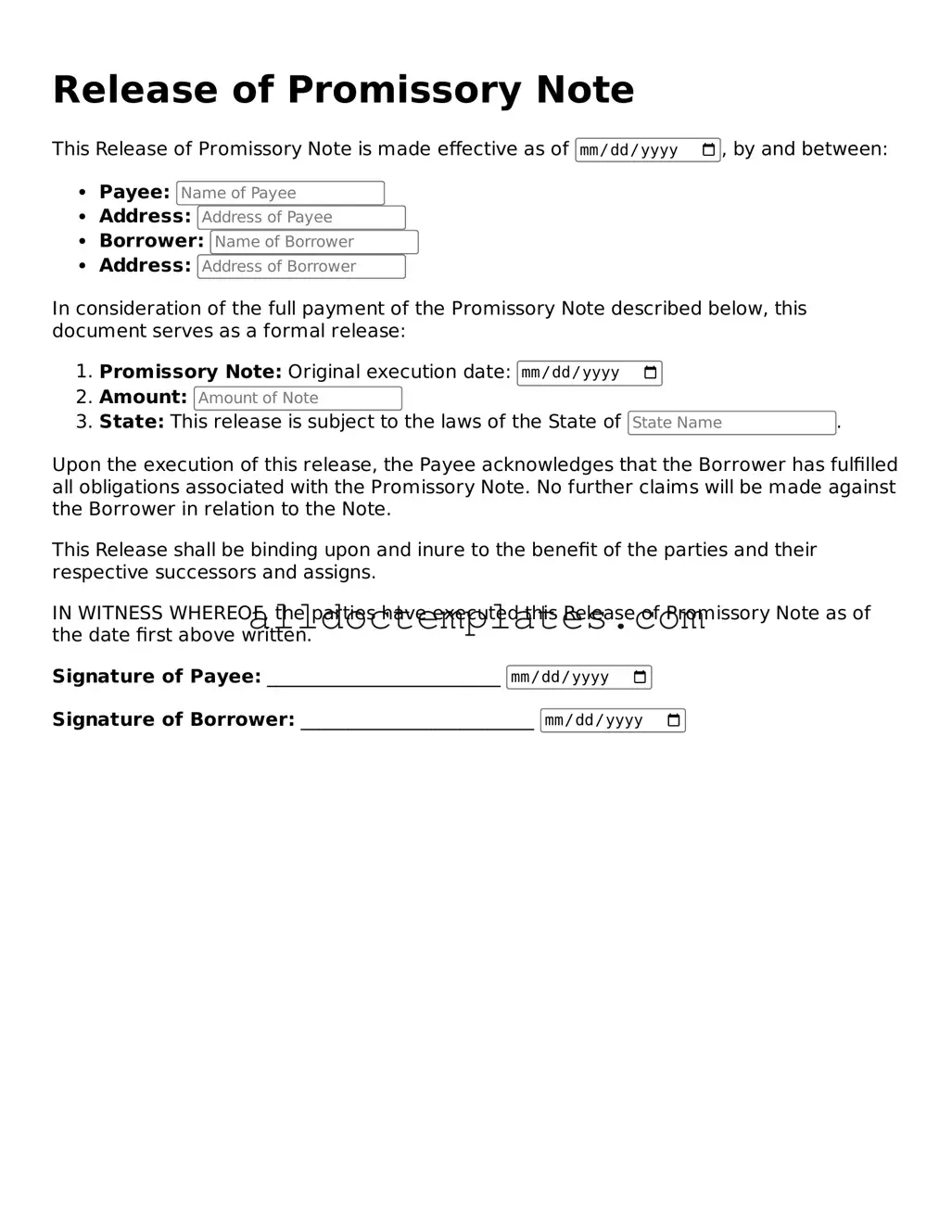

Release of Promissory Note

This Release of Promissory Note is made effective as of , by and between:

- Payee:

- Address:

- Borrower:

- Address:

In consideration of the full payment of the Promissory Note described below, this document serves as a formal release:

- Promissory Note: Original execution date:

- Amount:

- State: This release is subject to the laws of the State of .

Upon the execution of this release, the Payee acknowledges that the Borrower has fulfilled all obligations associated with the Promissory Note. No further claims will be made against the Borrower in relation to the Note.

This Release shall be binding upon and inure to the benefit of the parties and their respective successors and assigns.

IN WITNESS WHEREOF, the parties have executed this Release of Promissory Note as of the date first above written.

Signature of Payee: _________________________

Signature of Borrower: _________________________

Form Data

| Fact Name | Description |

|---|---|

| Definition | A Release of Promissory Note is a document that signifies the cancellation of a promissory note, indicating that the borrower has fulfilled their obligation. |

| Purpose | This form serves to protect both the lender and borrower by providing written proof that the debt has been paid and the note is no longer valid. |

| Governing Law | The laws governing promissory notes and their release vary by state. For example, in California, the relevant laws can be found in the California Civil Code. |

| Signature Requirement | Typically, the release must be signed by the lender to be legally binding, confirming that the debt is settled. |

| Record Keeping | It is advisable for both parties to keep a copy of the signed release for their records, as it may be needed for future reference. |

| State-Specific Forms | Some states may have specific forms for the release of promissory notes. Always check local laws to ensure compliance. |

| Effect on Credit | Once the release is executed, the borrower's credit report should reflect that the debt has been paid, positively impacting their credit score. |

Release of Promissory Note - Usage Guidelines

After completing the Release of Promissory Note form, you will need to submit it to the appropriate parties involved in the transaction. Ensure that all signatures are obtained and keep copies for your records. This will help maintain a clear record of the release.

- Begin by entering the date at the top of the form. This is the date when the release is being executed.

- Provide the names and addresses of both the borrower and the lender. Ensure that all details are accurate.

- Clearly identify the promissory note being released. Include the date of the original note and any relevant identification numbers.

- State the amount of the loan that was originally secured by the promissory note.

- Include a statement that the promissory note is being released and that the borrower has fulfilled their obligations.

- Both parties must sign and date the form. Ensure that signatures are legible.

- Make copies of the signed form for both the borrower and the lender. This will serve as proof of the release.

More Types of Release of Promissory Note Templates:

Promissory Note Auto Loan - May specify terms for early repayment without penalties.

For those seeking to establish formal lending agreements, the essential Promissory Note document is vital for outlining key terms and protecting both parties involved. You can find further information by visiting the reliable source for Promissory Note forms.

Dos and Don'ts

When filling out the Release of Promissory Note form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are some key dos and don'ts to keep in mind:

- Do read the entire form carefully before starting.

- Do provide accurate information, including names and dates.

- Do sign the form in the designated area.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank.

- Don't use correction fluid or tape on the form.

- Don't sign the form without verifying all details.

- Don't submit the form without checking for errors.

Common mistakes

-

Incomplete Information: Many individuals fail to fill out all required fields, such as names, addresses, or dates. Leaving any section blank can delay processing.

-

Incorrect Names: Using the wrong name or misspelling a name can create confusion and may lead to legal complications. Always double-check the spelling.

-

Missing Signatures: Signatures are essential. Not signing the form or having the wrong person sign can invalidate the release.

-

Failure to Date the Form: Forgetting to include the date can lead to issues regarding the timing of the release. Always ensure the date is clearly marked.

-

Not Including Supporting Documents: Some may overlook the necessity of attaching relevant documents, such as the original promissory note. These documents are crucial for verification.

-

Using Incorrect Form Version: Utilizing an outdated version of the form can result in rejection. Always verify that you have the most current form.

-

Ignoring State-Specific Requirements: Each state may have unique requirements. Failing to comply with local regulations can cause delays or rejection.

-

Not Keeping Copies: After submission, individuals often neglect to keep copies of the filled-out form. Retaining copies is important for future reference.