Fill in a Valid Release Of Lien Texas Form

Document Sample

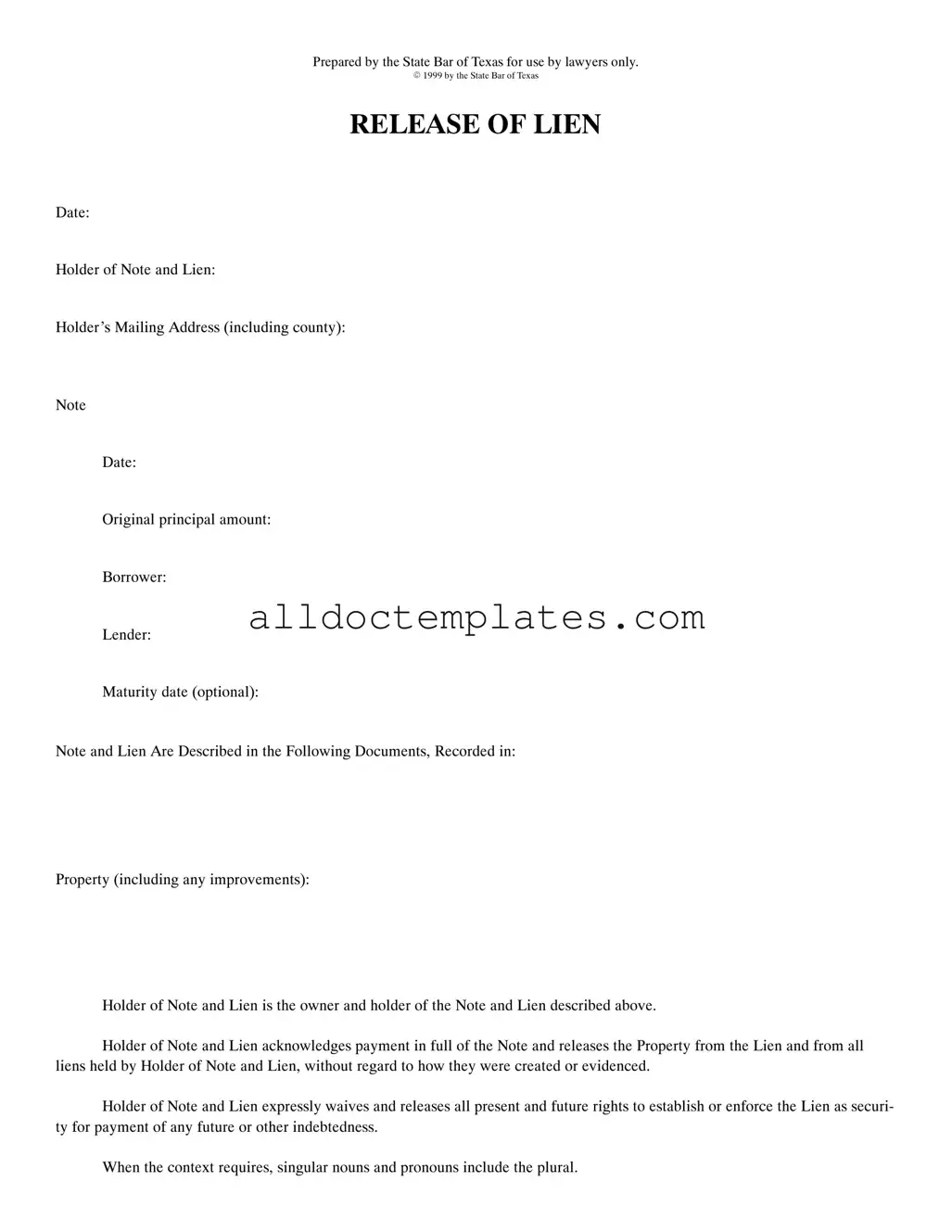

Prepared by the State Bar of Texas for use by lawyers only.

E 1999 by the State Bar of Texas

RELEASE OF LIEN

Date:

Holder of Note and Lien:

Holder’s Mailing Address (including county):

Note

Date:

Original principal amount:

Borrower:

Lender:

Maturity date (optional):

Note and Lien Are Described in the Following Documents, Recorded in:

Property (including any improvements):

Holder of Note and Lien is the owner and holder of the Note and Lien described above.

Holder of Note and Lien acknowledges payment in full of the Note and releases the Property from the Lien and from all liens held by Holder of Note and Lien, without regard to how they were created or evidenced.

Holder of Note and Lien expressly waives and releases all present and future rights to establish or enforce the Lien as securi- ty for payment of any future or other indebtedness.

When the context requires, singular nouns and pronouns include the plural.

|

(Acknowledgment) |

|

STATE OF TEXAS |

|

|

COUNTY OF |

|

|

This instrument was acknowledged before me on |

, |

|

by |

. |

|

|

|

|

|

Notary Public, State of Texas |

|

|

Notary’s name (printed): |

|

|

Notary’s commission expires: |

|

|

(Corporate Acknowledgment) |

|

STATE OF TEXAS |

|

|

COUNTY OF |

|

|

This instrument was acknowledged before me on |

, |

|

by |

, |

|

of |

|

|

a |

|

corporation, on behalf of said corporation. |

|

|

|

|

Notary Public, State of Texas |

|

|

Notary’s name (printed): |

|

|

Notary’s commission expires: |

|

AFTER RECORDING RETURN TO: |

PREPARED IN THE LAW OFFICE OF: |

Document Information

| Fact Name | Description |

|---|---|

| Purpose of the Form | The Release of Lien form is used to officially release a lien on a property once the debt has been paid in full. |

| Governing Law | This form is governed by Texas property law, specifically the Texas Property Code. |

| Prepared By | The form is prepared by the State Bar of Texas for use by licensed attorneys only. |

| Key Information Required | Essential details include the date, holder of the note and lien, borrower, lender, and property description. |

| Acknowledgment Section | The form includes an acknowledgment section that must be signed by a notary public to verify the authenticity of the signatures. |

| Waiver of Future Rights | By signing, the holder of the lien waives any future rights to enforce the lien for other debts. |

| Property Description | The form requires a detailed description of the property, including any improvements made. |

| Recording Requirement | After completion, the form must be recorded in the appropriate county office to be effective. |

| Notary Information | The notary public must provide their name and commission expiration date, ensuring the document's validity. |

| Return Instructions | After recording, the form should be returned to the law office that prepared it for proper filing. |

Release Of Lien Texas - Usage Guidelines

Filling out the Release of Lien form in Texas is a straightforward process. After completing the form, it must be properly acknowledged and recorded to ensure that the lien is officially released. The following steps will guide you through the process of filling out the form correctly.

- Date: Write the current date at the top of the form.

- Holder of Note and Lien: Enter the name of the individual or entity that holds the lien.

- Holder’s Mailing Address: Provide the complete mailing address of the lien holder, including the county.

- Note Date: Indicate the date on which the original note was signed.

- Original Principal Amount: Fill in the original amount of the loan or note.

- Borrower: Write the name of the borrower who took out the loan.

- Lender: Enter the name of the lender who provided the loan.

- Maturity Date (optional): If applicable, include the date when the loan is due.

- Note and Lien Are Described in the Following Documents, Recorded in: Specify the details of the documents that describe the lien.

- Property: Describe the property that is subject to the lien, including any improvements.

- Holder of Note and Lien Acknowledgment: Include a statement that the holder acknowledges payment in full and releases the property from the lien.

- Acknowledgment Section: Leave space for the notary public’s acknowledgment, including the state and county.

- Notary Public Section: Provide space for the notary's name and commission expiration date.

- Corporate Acknowledgment (if applicable): If a corporation is involved, include the corporate acknowledgment section with the necessary details.

- After Recording: Indicate where the form should be returned after it has been recorded.

Common PDF Forms

Annual Physical Examination Form Pdf - Provide dates for TB tests and follow-up chest x-ray results.

A Colorado Do Not Resuscitate (DNR) Order form is a legal document that allows individuals to refuse resuscitation efforts in the event of a medical emergency. This form ensures that a person's wishes regarding life-sustaining treatment are respected by healthcare providers. For those seeking guidance on this process, resources such as Colorado PDF Templates can provide valuable assistance. Understanding how to properly complete and utilize this form is essential for anyone considering their end-of-life care options.

Aoa Rental Application - Applicants must provide their current and previous residence addresses.

Dos and Don'ts

When filling out the Release Of Lien Texas form, it is essential to follow specific guidelines to ensure accuracy and compliance. Here are seven things you should and shouldn't do:

- Do provide accurate information for all required fields, including the holder of the note and lien.

- Don't leave any sections blank. Each part of the form must be completed to avoid delays.

- Do double-check the spelling of names and addresses to prevent errors.

- Don't use abbreviations or shorthand that could lead to confusion.

- Do ensure that the acknowledgment section is signed in front of a notary public.

- Don't forget to include the date of acknowledgment; it is a crucial part of the process.

- Do keep a copy of the completed form for your records after submission.

By following these guidelines, you can help ensure that your Release Of Lien form is processed smoothly and efficiently.

Common mistakes

-

Failing to include the date of the release. This is crucial as it establishes when the lien was officially released.

-

Not providing the holder's mailing address, including the county. This information is necessary for future correspondence and legal purposes.

-

Omitting the original principal amount of the note. This detail is important to clarify the scope of the lien being released.

-

Neglecting to specify the property involved. The form must clearly identify the property, including any improvements, to avoid confusion.

-

Not acknowledging payment in full of the note. The release must state that the holder acknowledges full payment to validate the lien's removal.

-

Failing to include the notary's acknowledgment. This step is essential for the document to be legally binding and recognized.

-

Leaving out the signature of the holder of the note and lien. Without a signature, the document lacks authenticity and cannot be enforced.

-

Not returning the document to the appropriate office after recording. This can lead to delays in updating public records and may cause legal complications.