Valid Quitclaim Deed Template

Document Sample

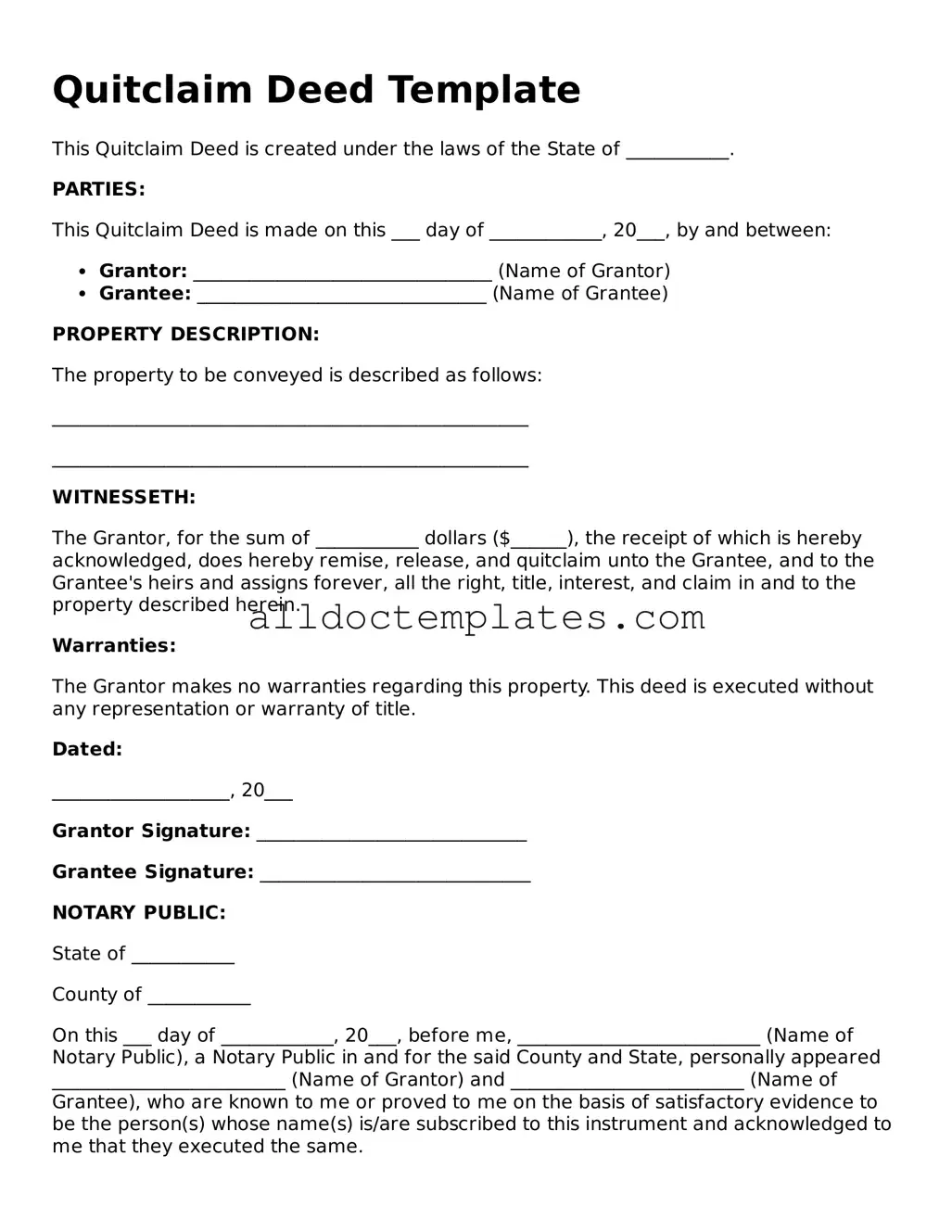

Quitclaim Deed Template

This Quitclaim Deed is created under the laws of the State of ___________.

PARTIES:

This Quitclaim Deed is made on this ___ day of ____________, 20___, by and between:

- Grantor: ________________________________ (Name of Grantor)

- Grantee: _______________________________ (Name of Grantee)

PROPERTY DESCRIPTION:

The property to be conveyed is described as follows:

___________________________________________________

___________________________________________________

WITNESSETH:

The Grantor, for the sum of ___________ dollars ($______), the receipt of which is hereby acknowledged, does hereby remise, release, and quitclaim unto the Grantee, and to the Grantee's heirs and assigns forever, all the right, title, interest, and claim in and to the property described herein.

Warranties:

The Grantor makes no warranties regarding this property. This deed is executed without any representation or warranty of title.

Dated:

___________________, 20___

Grantor Signature: _____________________________

Grantee Signature: _____________________________

NOTARY PUBLIC:

State of ___________

County of ___________

On this ___ day of ____________, 20___, before me, __________________________ (Name of Notary Public), a Notary Public in and for the said County and State, personally appeared _________________________ (Name of Grantor) and _________________________ (Name of Grantee), who are known to me or proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to this instrument and acknowledged to me that they executed the same.

____________________________________

Notary Public

My Commission Expires: ___________

State-specific Information for Quitclaim Deed Forms

Form Data

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real estate from one party to another without any warranties regarding the title. |

| Usage | Commonly used in situations such as divorce settlements, transferring property between family members, or clearing up title issues. |

| Governing Law | In the United States, the laws governing quitclaim deeds vary by state. For example, in California, it is governed by California Civil Code Section 1092. |

| Limitations | A quitclaim deed does not guarantee that the grantor has valid ownership of the property. The grantee takes on the risk of any existing liens or claims. |

| Recording | It is advisable to record the quitclaim deed with the appropriate county office to provide public notice of the transfer and protect the grantee's interest. |

| Tax Implications | Transferring property via a quitclaim deed may have tax implications, including potential gift tax considerations if the transfer is not for fair market value. |

Quitclaim Deed - Usage Guidelines

After obtaining the Quitclaim Deed form, the next steps involve accurately completing the document to ensure it reflects the necessary information for the transfer of property. It is crucial to provide precise details to avoid any complications in the future.

- Begin by entering the name of the grantor, the person transferring the property. Include their full legal name as it appears on official documents.

- Next, write the name of the grantee, the individual or entity receiving the property. Ensure the name is complete and correct.

- In the designated space, provide the address of the property being transferred. Include the street address, city, state, and zip code.

- Include a legal description of the property. This may be found on the property deed or tax records. It should detail the boundaries and any identifying features.

- Specify the date of the transfer. This is the date when the grantor intends for the transfer to take effect.

- Have the grantor sign the form in the appropriate section. The signature must match the name provided at the beginning of the form.

- In some cases, a notary public may need to witness the signature. If required, arrange for notarization and ensure the notary signs and stamps the document.

- Finally, check that all information is complete and accurate before submitting the form to the appropriate local government office for recording.

More Types of Quitclaim Deed Templates:

Deed of Gift Property - Gift Deeds can help avoid probate issues in the future.

For those looking to understand the importance of a Power of Attorney for a Child, it serves as a vital document that empowers designated individuals to make crucial decisions regarding a child's health, education, and well-being when a parent or guardian cannot be present. This legal arrangement ensures a child's needs are adequately addressed in such situations.

Title Companies and Transfer on Death Deeds - This legal document can be an essential part of a comprehensive estate planning strategy.

What Does a Trust Deed Look Like - The trustee acts on behalf of the lender to manage the property.

Dos and Don'ts

When filling out a Quitclaim Deed form, it's important to approach the process carefully. Here’s a helpful list of things you should and shouldn’t do:

- Do ensure all parties involved are clearly identified. Include full names and addresses.

- Don’t leave any sections blank. Every part of the form needs to be completed.

- Do double-check the legal description of the property. Accuracy is key.

- Don’t use abbreviations for property descriptions. Write everything out clearly.

- Do sign the form in front of a notary public. This adds an important layer of validity.

- Don’t forget to keep a copy of the completed form for your records.

- Do file the Quitclaim Deed with the appropriate county office to make it official.

Common mistakes

-

Incorrect Names: Failing to use the full legal names of all parties involved can lead to complications. Ensure that names match exactly as they appear on legal documents.

-

Missing Signatures: All required parties must sign the deed. Omitting a signature can invalidate the document.

-

Inaccurate Property Description: Providing an unclear or incorrect description of the property can create confusion. Use the legal description found in previous deeds or tax records.

-

Failure to Notarize: A quitclaim deed often requires notarization. Not having the document notarized can prevent it from being accepted by the county recorder.

-

Improper Execution: Each state has specific rules regarding how the deed must be executed. Ignoring these rules can result in rejection.

-

Neglecting to Record: After completing the quitclaim deed, it must be filed with the appropriate county office. Failing to record it can leave the transfer unprotected.

-

Not Understanding Tax Implications: Not considering potential tax consequences of the transfer can lead to unexpected financial burdens. Consult a tax professional if unsure.