Valid Promissory Note Template

Document Sample

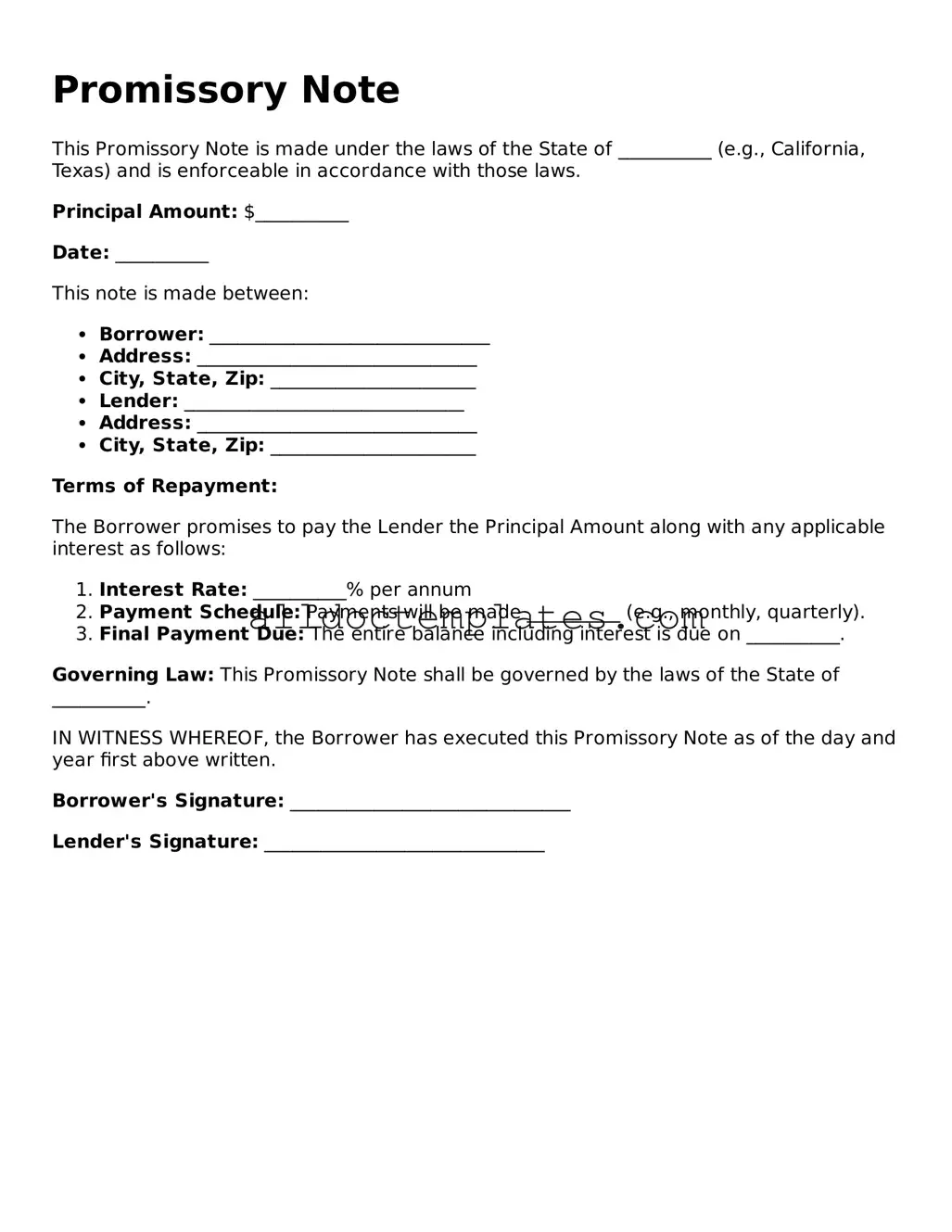

Promissory Note

This Promissory Note is made under the laws of the State of __________ (e.g., California, Texas) and is enforceable in accordance with those laws.

Principal Amount: $__________

Date: __________

This note is made between:

- Borrower: ______________________________

- Address: ______________________________

- City, State, Zip: ______________________

- Lender: ______________________________

- Address: ______________________________

- City, State, Zip: ______________________

Terms of Repayment:

The Borrower promises to pay the Lender the Principal Amount along with any applicable interest as follows:

- Interest Rate: __________% per annum

- Payment Schedule: Payments will be made __________ (e.g., monthly, quarterly).

- Final Payment Due: The entire balance including interest is due on __________.

Governing Law: This Promissory Note shall be governed by the laws of the State of __________.

IN WITNESS WHEREOF, the Borrower has executed this Promissory Note as of the day and year first above written.

Borrower's Signature: ______________________________

Lender's Signature: ______________________________

State-specific Information for Promissory Note Forms

Promissory Note Document Categories

Form Data

| Fact Name | Details |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person at a particular time. |

| Parties Involved | Typically, there are two parties: the maker (who promises to pay) and the payee (who receives the payment). |

| Governing Law | In the United States, promissory notes are governed by the Uniform Commercial Code (UCC), particularly Article 3. |

| Key Elements | A valid promissory note must include the amount to be paid, the interest rate (if any), and the payment due date. |

| Enforceability | For a promissory note to be enforceable, it must be signed by the maker and must be clear and unambiguous. |

| State-Specific Forms | Some states may have specific requirements or forms. For instance, California requires certain disclosures for consumer loans. |

| Transferability | Promissory notes can be transferred to others. This is known as negotiation and can be done through endorsement. |

Promissory Note - Usage Guidelines

Once you have the Promissory Note form in front of you, it is essential to fill it out accurately to ensure that all parties understand their obligations. After completing the form, it will need to be signed by both the borrower and the lender. This ensures that everyone is on the same page regarding the terms of the agreement.

- Begin by entering the date at the top of the form. This is the date when the note is being created.

- Next, write the name and address of the borrower. This identifies who is responsible for repaying the loan.

- Then, enter the name and address of the lender. This indicates who is providing the loan.

- Specify the principal amount of the loan. This is the total amount borrowed.

- Indicate the interest rate. This is the rate at which the loan will accrue interest over time.

- Outline the repayment schedule. Include details such as the frequency of payments (e.g., monthly, quarterly) and the due date of the first payment.

- Include any late fees or penalties for missed payments. This section clarifies what happens if payments are not made on time.

- State the terms of prepayment, if applicable. This allows the borrower to pay off the loan early without penalties.

- Finally, provide space for signatures. Both the borrower and lender should sign and date the document to make it legally binding.

Browse Popular Documents

Family Law Financial Affidavit (short Form Pdf) - Essentially, the affidavit serves to level the playing field in disputes over financial issues in divorce cases.

In Colorado, having a properly completed Horse Bill of Sale is crucial for both buyers and sellers, ensuring clarity in the transaction and providing legal proof of ownership transfer. For those looking for a reliable template, Colorado PDF Templates offers an accessible solution that meets all necessary requirements.

Child Travel Consent Form - The form can specify the destinations, duration of travel, and accompanying adults.

Basketball Player Evaluation Form Pdf - Rate the player's ability to shoot from 2-point range.

Dos and Don'ts

When filling out a Promissory Note form, attention to detail is crucial. The following list outlines important dos and don’ts to ensure that the document is completed accurately and effectively.

- Do clearly state the names of all parties involved in the agreement.

- Do specify the amount of money being borrowed, including any interest rates.

- Do include the repayment schedule, detailing when payments are due.

- Do ensure that the note is signed and dated by all parties.

- Do keep a copy of the completed note for your records.

- Don't use vague language; be as specific as possible to avoid misunderstandings.

- Don't forget to include any applicable fees or penalties for late payments.

- Don't leave any sections blank; this can lead to confusion or disputes later.

- Don't ignore state laws that may affect the terms of the note.

By adhering to these guidelines, individuals can help ensure that their Promissory Note serves its intended purpose effectively and minimizes potential conflicts in the future.

Common mistakes

-

Missing Signatures: One common mistake is forgetting to sign the document. Both the borrower and lender must sign the note for it to be valid.

-

Incorrect Dates: Entering the wrong date can lead to confusion. Always double-check that the date of the agreement is accurate.

-

Ambiguous Loan Amount: Writing the loan amount incorrectly or using vague terms can create misunderstandings. Specify the exact amount clearly.

-

Omitting Payment Terms: Not detailing the payment schedule is a frequent oversight. Include the due dates and amount of each payment.

-

Ignoring Interest Rates: Failing to state the interest rate can lead to disputes. Clearly outline whether the loan is interest-free or includes a specific rate.

-

Not Including Consequences for Default: Leaving out what happens if the borrower defaults can lead to complications. Specify the actions that will be taken in such an event.

-

Using Inconsistent Language: Using different terms for the same parties or amounts can cause confusion. Be consistent throughout the document.

-

Failing to Keep Copies: Not making copies of the signed note for both parties is a common mistake. Always ensure both the borrower and lender have their own copies.