Valid Promissory Note for a Car Template

Document Sample

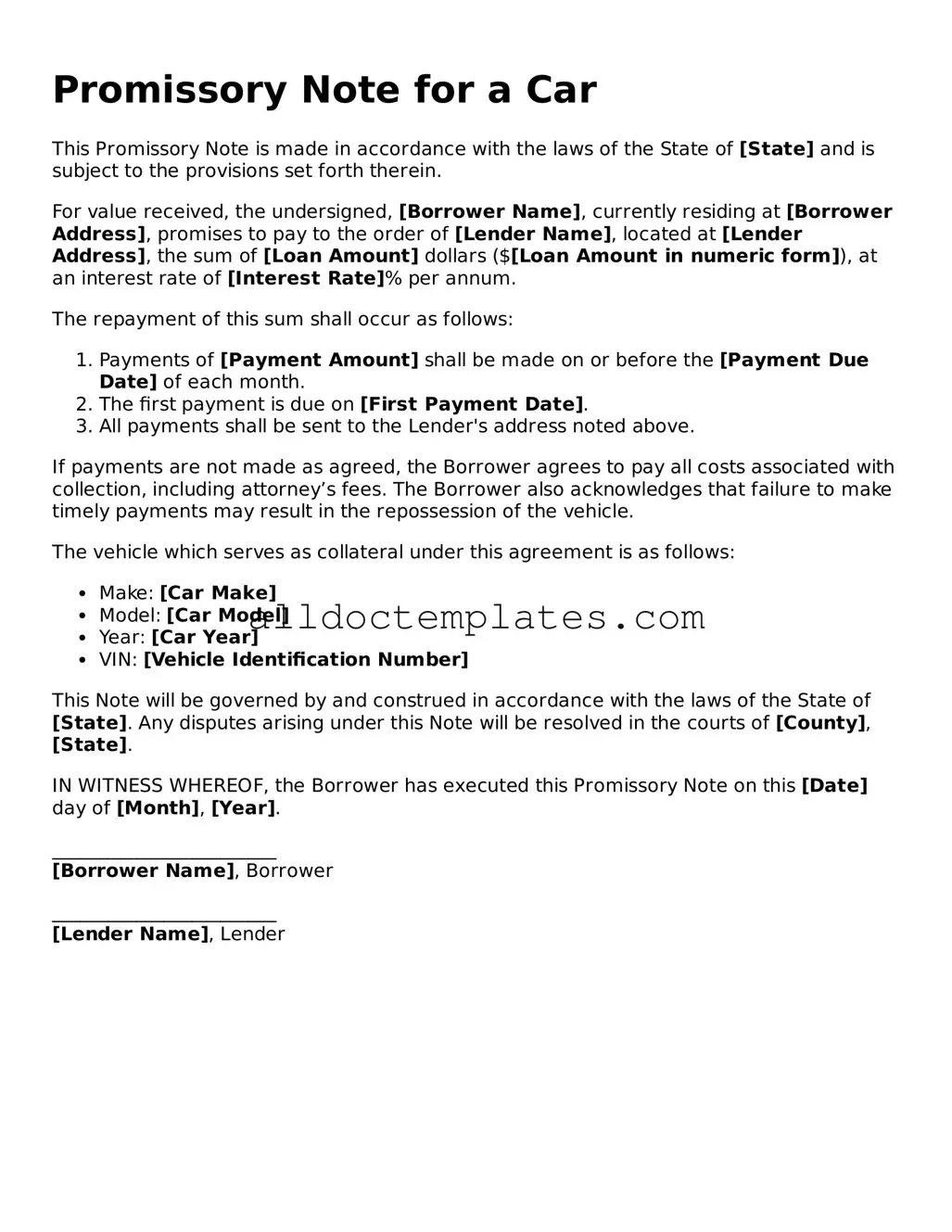

Promissory Note for a Car

This Promissory Note is made in accordance with the laws of the State of [State] and is subject to the provisions set forth therein.

For value received, the undersigned, [Borrower Name], currently residing at [Borrower Address], promises to pay to the order of [Lender Name], located at [Lender Address], the sum of [Loan Amount] dollars ($[Loan Amount in numeric form]), at an interest rate of [Interest Rate]% per annum.

The repayment of this sum shall occur as follows:

- Payments of [Payment Amount] shall be made on or before the [Payment Due Date] of each month.

- The first payment is due on [First Payment Date].

- All payments shall be sent to the Lender's address noted above.

If payments are not made as agreed, the Borrower agrees to pay all costs associated with collection, including attorney’s fees. The Borrower also acknowledges that failure to make timely payments may result in the repossession of the vehicle.

The vehicle which serves as collateral under this agreement is as follows:

- Make: [Car Make]

- Model: [Car Model]

- Year: [Car Year]

- VIN: [Vehicle Identification Number]

This Note will be governed by and construed in accordance with the laws of the State of [State]. Any disputes arising under this Note will be resolved in the courts of [County], [State].

IN WITNESS WHEREOF, the Borrower has executed this Promissory Note on this [Date] day of [Month], [Year].

________________________

[Borrower Name], Borrower

________________________

[Lender Name], Lender

Form Data

| Fact Name | Description |

|---|---|

| Definition | A promissory note for a car is a written promise to pay a specified amount of money for the purchase of a vehicle. |

| Parties Involved | The note typically involves two parties: the borrower (buyer) and the lender (seller or financial institution). |

| Interest Rates | Interest rates on promissory notes can vary and are often negotiated between the borrower and lender. |

| Repayment Terms | The repayment terms, including the duration and installment amounts, must be clearly stated in the note. |

| Governing Law | In the United States, the governing laws for promissory notes are typically state-specific, often following the Uniform Commercial Code (UCC). |

| Default Consequences | If the borrower defaults, the lender may have the right to repossess the vehicle and pursue legal action for the remaining debt. |

| Notarization | While notarization is not always required, having the note notarized can provide additional legal protection. |

Promissory Note for a Car - Usage Guidelines

Once you have gathered all the necessary information, you can begin filling out the Promissory Note for a Car form. This document is essential for establishing the terms of the loan for purchasing a vehicle. After completing the form, ensure all parties involved have a copy for their records.

- Title of the Form: At the top of the form, write "Promissory Note for a Car."

- Date: Enter the date on which you are filling out the form.

- Borrower Information: Fill in the full name and address of the borrower. This is the person who will be responsible for repaying the loan.

- Lender Information: Provide the full name and address of the lender. This could be a bank, credit union, or individual.

- Loan Amount: Clearly state the total amount of money being borrowed to purchase the car.

- Interest Rate: Specify the interest rate that will apply to the loan. This is usually expressed as an annual percentage.

- Payment Schedule: Outline how often payments will be made (e.g., monthly, bi-weekly) and the due date for each payment.

- Maturity Date: Indicate the date when the loan will be fully paid off.

- Collateral Description: Describe the vehicle being purchased, including make, model, year, and Vehicle Identification Number (VIN).

- Signatures: Ensure that both the borrower and lender sign the document. Include the date of each signature.

After completing these steps, double-check all entries for accuracy. Once confirmed, distribute copies to all parties involved. This ensures everyone has the same understanding of the loan terms and conditions.

More Types of Promissory Note for a Car Templates:

Release of Promissory Note - Can enhance creditworthiness by documenting loan fulfillment.

When drafting a New York Promissory Note, it's essential to ensure that all terms are clearly outlined, which can help prevent disputes between the involved parties. Utilizing resources for guidance can be beneficial, and you can find templates that suit your needs, such as those provided in All New York Forms, to facilitate this process and ensure all legal requirements are met.

Dos and Don'ts

When filling out a Promissory Note for a Car, it’s essential to be careful and thorough. Here’s a list of things you should and shouldn’t do to ensure everything goes smoothly.

- Do: Read the entire form carefully before you start filling it out.

- Do: Provide accurate information about the loan amount, interest rate, and repayment terms.

- Do: Sign and date the document in the appropriate spaces.

- Do: Keep a copy of the completed Promissory Note for your records.

- Do: Consult with a trusted advisor if you have any questions about the terms.

- Don’t: Leave any sections blank; incomplete forms can lead to misunderstandings.

- Don’t: Use abbreviations or shorthand that may confuse the reader.

- Don’t: Rush through the process; take your time to ensure accuracy.

- Don’t: Forget to double-check the spelling of names and addresses.

- Don’t: Ignore any state-specific requirements that may apply.

By following these guidelines, you can fill out your Promissory Note with confidence and clarity. A well-completed form helps protect both parties and establishes clear expectations.

Common mistakes

-

Inaccurate Personal Information: Many people forget to double-check their name, address, and contact details. Errors in this information can lead to complications later, especially if the lender needs to reach you.

-

Incorrect Loan Amount: It's crucial to ensure that the loan amount matches the agreed-upon figure. Mistakes here can affect repayment terms and lead to misunderstandings between the borrower and lender.

-

Missing Signatures: Some individuals overlook the need for signatures from all parties involved. Without proper signatures, the document may not be legally binding, which could create issues if disputes arise.

-

Failure to Understand Terms: Not fully grasping the terms of the loan can lead to problems down the line. Borrowers should read and comprehend all clauses, including interest rates and payment schedules, before signing.