Fill in a Valid Profit And Loss Form

Document Sample

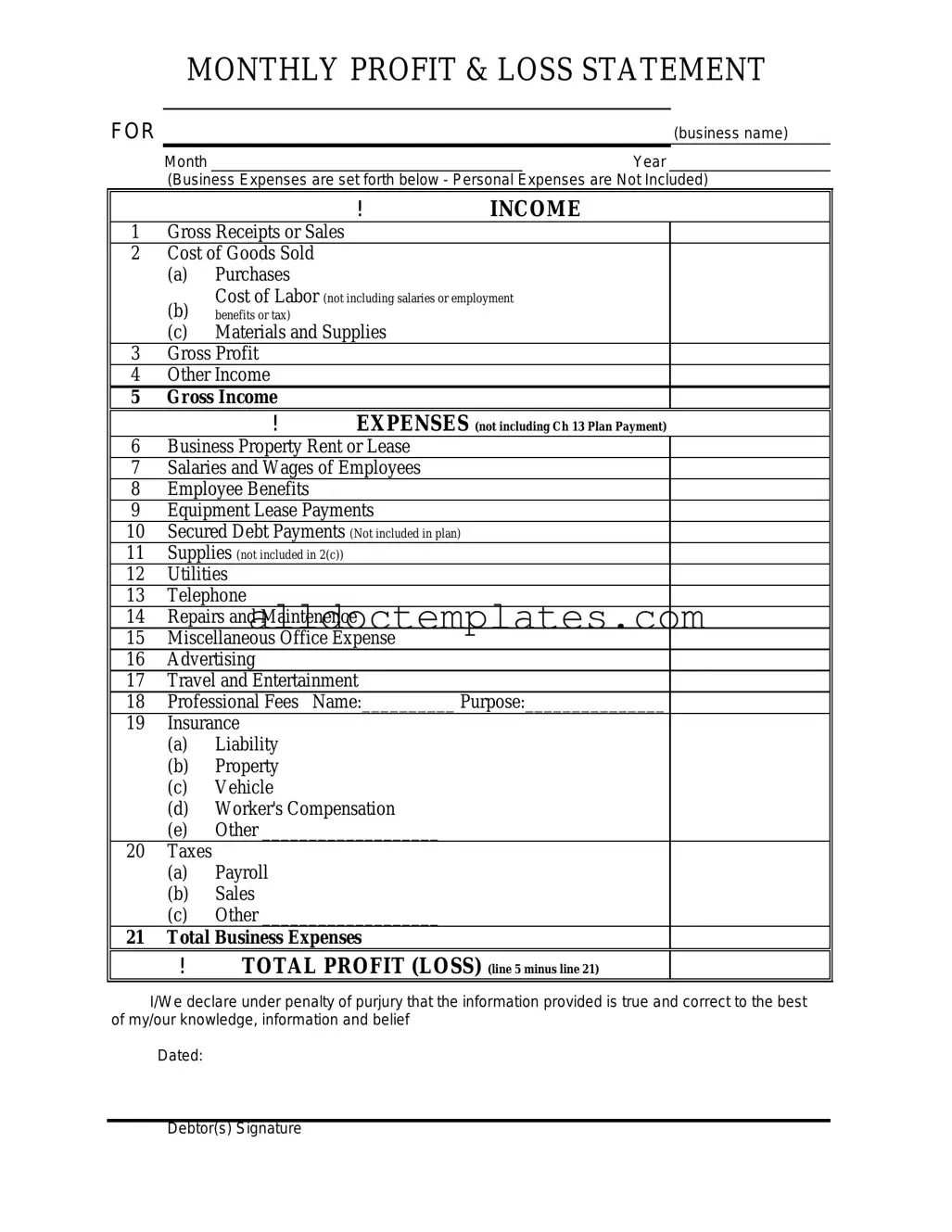

MONTHLY PROFIT & LOSS STATEMENT

FOR |

(business name) |

Month |

Year |

(Business Expenses are set forth below - Personal Expenses are Not Included)

|

|

|

! |

INCOME |

1 |

Gross Receipts or Sales |

|

||

2 |

Cost of Goods Sold |

|

||

|

(a) |

Purchases |

|

|

|

(b) |

Cost of Labor (not including salaries or employment |

||

|

benefits or tax) |

|

|

|

|

(c) |

Materials and Supplies |

|

|

3 |

Gross Profit |

|

|

|

4 |

Other Income |

|

|

|

5 |

Gross Income |

EXPENSES (not including Ch 13 Plan Payment) |

||

|

|

! |

||

6 |

Business Property Rent or Lease |

|

||

7 |

Salaries and Wages of Employees |

|

||

8 |

Employee Benefits |

|

|

|

9 |

Equipment Lease Payments |

|

||

10 |

Secured Debt Payments (Not included in plan) |

|

||

11 |

Supplies (not included in 2(c)) |

|

||

12 |

Utilities |

|

|

|

13 |

Telephone |

|

|

|

14 |

Repairs and Maintenence |

|

||

15 |

Miscellaneous Office Expense |

|

||

16 |

Advertising |

|

|

|

17 |

Travel and Entertainment |

|

||

18 |

Professional Fees |

Name:__________ Purpose:_______________ |

||

19 |

Insurance |

|

|

|

|

(a) |

Liability |

|

|

|

(b) |

Property |

|

|

|

(c) |

Vehicle |

|

|

|

(d) |

Worker's Compensation |

|

|

|

(e) |

Other ___________________ |

|

|

20 |

Taxes |

|

|

|

|

(a) |

Payroll |

|

|

|

(b) |

Sales |

|

|

|

(c) |

Other ___________________ |

|

|

21 |

Total Business Expenses |

|

||

|

! |

TOTAL PROFIT (LOSS) (line 5 minus line 21) |

||

I/We declare under penalty of purjury that the information provided is true and correct to the best of my/our knowledge, information and belief

Dated:

Debtor(s) Signature

Document Information

| Fact Name | Description |

|---|---|

| Purpose | The Profit and Loss form is used to summarize a business's revenues and expenses over a specific period, helping to assess financial performance. |

| Components | This form typically includes sections for total revenue, cost of goods sold, gross profit, operating expenses, and net profit. |

| Frequency | Businesses often prepare Profit and Loss statements monthly, quarterly, or annually, depending on their reporting needs. |

| State-Specific Forms | In some states, such as California, businesses must adhere to specific regulations under the California Corporations Code when preparing these forms. |

| Importance for Stakeholders | Investors, creditors, and management use the Profit and Loss form to make informed decisions regarding the business's financial health. |

Profit And Loss - Usage Guidelines

Completing the Profit and Loss form is essential for tracking your financial performance. Follow these steps carefully to ensure accuracy and clarity in your submission.

- Gather all necessary financial documents, including sales records, expense receipts, and bank statements.

- Start with the Revenue section. Enter total sales income for the period.

- List any other income sources, such as interest or investment income, in the designated area.

- Proceed to the Cost of Goods Sold section. Include all direct costs associated with producing goods sold.

- Calculate the Gross Profit by subtracting the Cost of Goods Sold from total Revenue.

- Move to the Operating Expenses section. Itemize all business expenses, such as rent, utilities, and salaries.

- Sum up all Operating Expenses to find the total.

- Calculate Net Income by subtracting total Operating Expenses from Gross Profit.

- Review all entries for accuracy. Ensure that totals match your records.

- Sign and date the form at the bottom to certify the information is correct.

Common PDF Forms

Section 8 Voucher Expiration - It’s important to communicate any challenges you're facing to the Housing Authority.

When drafting a Colorado Non-disclosure Agreement (NDA), it is vital to refer to comprehensive resources such as Colorado PDF Templates, which provide valuable guidance on how to effectively protect your sensitive information and ensure all parties understand their obligations under the contract.

Gift Letter Template for Mortgage - Using a Gift Letter can build trust in financial transactions involving gifts.

Dos and Don'ts

When filling out a Profit and Loss form, attention to detail is crucial. Here are ten guidelines to help ensure accuracy and completeness.

- Do: Gather all relevant financial documents before starting.

- Do: Use consistent accounting methods throughout the reporting period.

- Do: Double-check all calculations for accuracy.

- Do: Clearly label each section of the form.

- Do: Include all sources of income, no matter how small.

- Don't: Skip any sections of the form, even if they seem irrelevant.

- Don't: Estimate figures without proper documentation.

- Don't: Use jargon or abbreviations that may confuse readers.

- Don't: Forget to update the form for any changes in business structure.

- Don't: Submit the form without a final review for errors.

Common mistakes

-

Omitting Income Sources: One common mistake is not listing all sources of income. It’s essential to include every revenue stream, whether it's sales, services, or investments. Missing even a small amount can distort the overall picture of profitability.

-

Incorrectly Categorizing Expenses: People often misclassify expenses, which can lead to confusion. For instance, mixing personal and business expenses can skew results. Each expense should be categorized accurately to provide a clear understanding of where money is going.

-

Failing to Update Regularly: Some individuals fill out the form infrequently. Regular updates are crucial for accurate tracking of financial health. Monthly or quarterly updates can help identify trends and inform better decision-making.

-

Neglecting to Include Non-Cash Expenses: Non-cash expenses, like depreciation, are sometimes overlooked. These expenses affect profitability but do not involve actual cash outflow. Including them ensures a more accurate representation of financial performance.

-

Not Reconciling with Bank Statements: Many forget to cross-check their Profit and Loss statements with bank statements. This step helps catch discrepancies and ensures that all transactions are accounted for, leading to more reliable financial reporting.

-

Ignoring Seasonal Variations: Some individuals do not consider seasonal fluctuations in income and expenses. Recognizing these variations can provide valuable insights into trends and help with future planning.