Valid Personal Guarantee Template

Document Sample

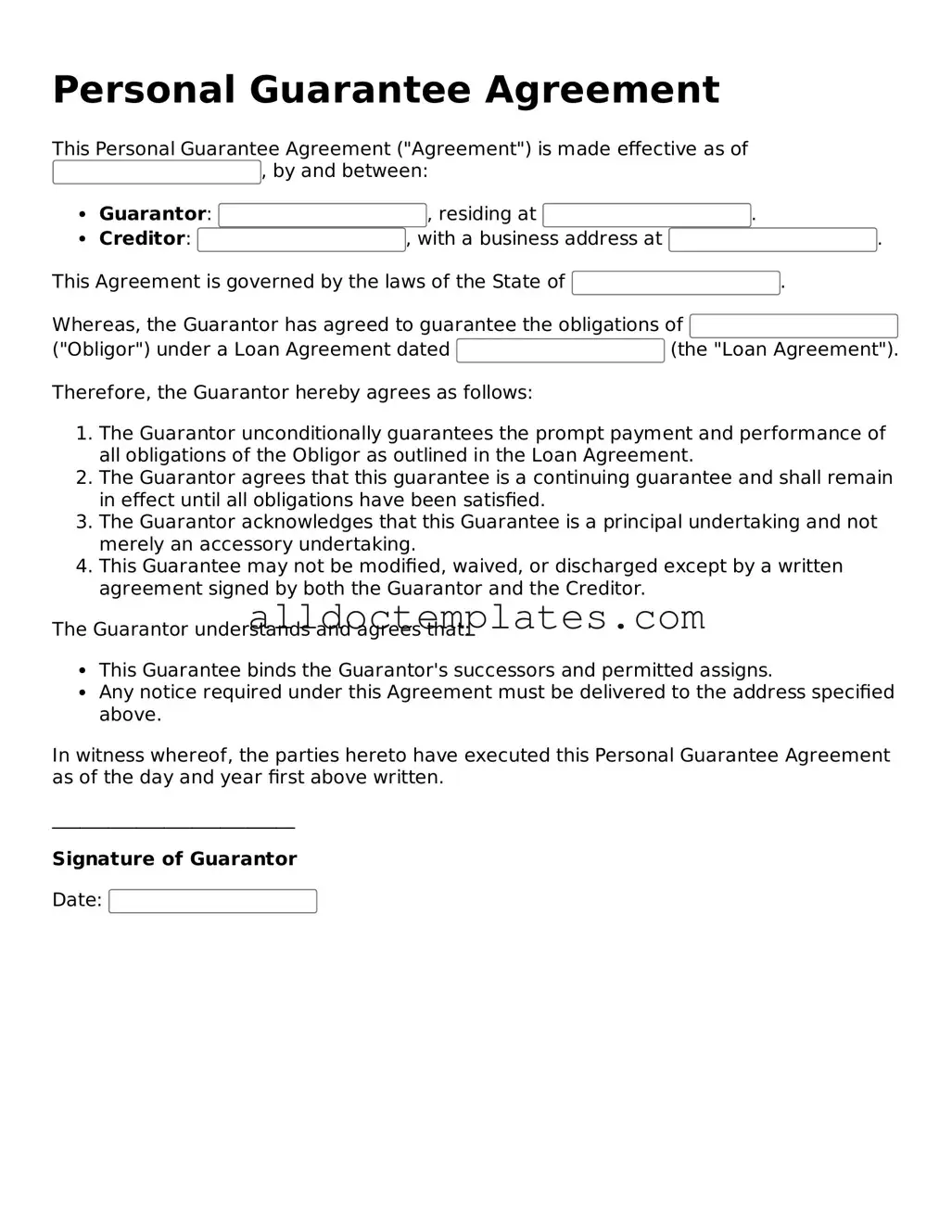

Personal Guarantee Agreement

This Personal Guarantee Agreement ("Agreement") is made effective as of , by and between:

- Guarantor: , residing at .

- Creditor: , with a business address at .

This Agreement is governed by the laws of the State of .

Whereas, the Guarantor has agreed to guarantee the obligations of ("Obligor") under a Loan Agreement dated (the "Loan Agreement").

Therefore, the Guarantor hereby agrees as follows:

- The Guarantor unconditionally guarantees the prompt payment and performance of all obligations of the Obligor as outlined in the Loan Agreement.

- The Guarantor agrees that this guarantee is a continuing guarantee and shall remain in effect until all obligations have been satisfied.

- The Guarantor acknowledges that this Guarantee is a principal undertaking and not merely an accessory undertaking.

- This Guarantee may not be modified, waived, or discharged except by a written agreement signed by both the Guarantor and the Creditor.

The Guarantor understands and agrees that:

- This Guarantee binds the Guarantor's successors and permitted assigns.

- Any notice required under this Agreement must be delivered to the address specified above.

In witness whereof, the parties hereto have executed this Personal Guarantee Agreement as of the day and year first above written.

__________________________

Signature of Guarantor

Date:

Form Data

| Fact Name | Description |

|---|---|

| Definition | A personal guarantee is a legal commitment where an individual agrees to be responsible for a debt or obligation of another party. |

| Purpose | It is commonly used to secure loans or credit for businesses, ensuring lenders that they can recover funds if the business defaults. |

| Legal Nature | This form is a binding contract, meaning that once signed, the individual is legally obligated to fulfill the terms outlined in the document. |

| State-Specific Forms | Some states have specific requirements for personal guarantees. For example, California law requires certain disclosures to be made to the guarantor. |

| Governing Laws | In New York, personal guarantees are governed by the Uniform Commercial Code (UCC) and state contract laws. |

| Risk Involved | Signing a personal guarantee carries significant risk, as it can lead to personal liability for debts incurred by the business. |

| Revocation | Once executed, a personal guarantee generally cannot be revoked without the lender’s consent, making it a long-term commitment. |

| Common Uses | Personal guarantees are frequently used in commercial leases, business loans, and credit applications, providing assurance to creditors. |

Personal Guarantee - Usage Guidelines

Completing the Personal Guarantee form requires careful attention to detail. This document is essential for ensuring that all parties involved understand their obligations. Follow the steps below to accurately fill out the form.

- Begin by entering your full name in the designated field.

- Provide your current address, including street, city, state, and zip code.

- Next, fill in your phone number and email address for contact purposes.

- Indicate the date on which you are completing the form.

- Read through the terms of the guarantee carefully before signing.

- Sign the form in the appropriate space to validate your commitment.

- Print your name below your signature to ensure clarity.

- If required, have a witness sign the form in the designated area.

Once completed, review the form for accuracy before submitting it to the relevant party. Ensure that all information is correct to avoid any delays in processing.

More Types of Personal Guarantee Templates:

Purchase Agreement Addendum - Used to set conditions for any remaining inspections or assessments.

For anyone looking to navigate the complexities of property transactions, our guide to the critical elements of the Real Estate Purchase Agreement process provides valuable insights.

Terminate Real Estate Agent Contract Letter - It helps protect the interests of both buyer and seller by formalizing the cancellation.

Owner Carryback Contract - An Owner Financing Contract allows a property buyer to make payments directly to the seller instead of a bank.

Dos and Don'ts

When filling out the Personal Guarantee form, it's important to be careful and thorough. Here are some guidelines to help you through the process:

- Do: Read the entire form carefully before starting. Understanding what is required will help you avoid mistakes.

- Do: Provide accurate and complete information. This ensures that the guarantee is valid and enforceable.

- Do: Double-check your entries for any errors. A small mistake can lead to big problems later.

- Do: Keep a copy of the completed form for your records. This can be useful for future reference.

- Don't: Rush through the form. Taking your time can prevent unnecessary issues.

- Don't: Leave any sections blank unless instructed. Incomplete forms may be rejected.

- Don't: Sign the form without understanding your obligations. Know what you are agreeing to.

- Don't: Ignore deadlines. Submit the form on time to avoid complications.

Common mistakes

-

Incomplete Information: Many individuals forget to fill out all required fields. Missing information can delay processing or lead to rejection.

-

Incorrect Personal Details: Providing wrong names, addresses, or contact numbers is a common error. Always double-check these details for accuracy.

-

Failure to Sign: Some people overlook the importance of signing the form. A personal guarantee is not valid without a signature.

-

Not Understanding the Terms: It is crucial to read and understand the terms of the guarantee. Many sign without fully grasping their obligations.

-

Using the Wrong Version: Sometimes, individuals use outdated forms. Always ensure you have the most current version of the Personal Guarantee form.

-

Not Providing Supporting Documentation: Some forms require additional documents, such as identification or financial statements. Omitting these can lead to issues.

-

Ignoring Instructions: Each form may come with specific instructions. Failing to follow these can result in errors that could have been easily avoided.

-

Assuming It’s a Standard Form: Many believe that all personal guarantees are the same. Each situation may have unique requirements, so it’s important to review carefully.