Free Transfer-on-Death Deed Document for Pennsylvania State

Document Sample

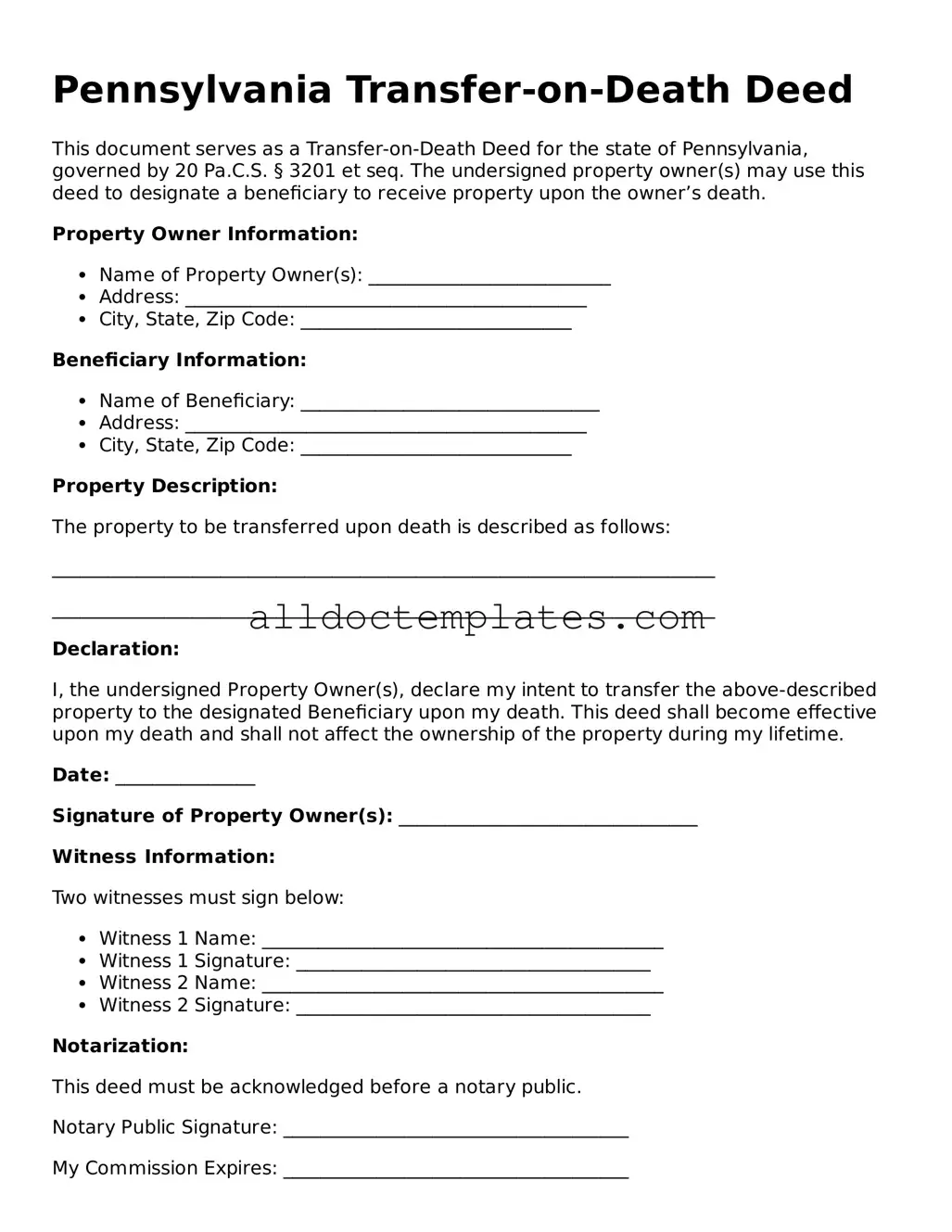

Pennsylvania Transfer-on-Death Deed

This document serves as a Transfer-on-Death Deed for the state of Pennsylvania, governed by 20 Pa.C.S. § 3201 et seq. The undersigned property owner(s) may use this deed to designate a beneficiary to receive property upon the owner’s death.

Property Owner Information:

- Name of Property Owner(s): __________________________

- Address: ___________________________________________

- City, State, Zip Code: _____________________________

Beneficiary Information:

- Name of Beneficiary: ________________________________

- Address: ___________________________________________

- City, State, Zip Code: _____________________________

Property Description:

The property to be transferred upon death is described as follows:

_______________________________________________________________________

_______________________________________________________________________

Declaration:

I, the undersigned Property Owner(s), declare my intent to transfer the above-described property to the designated Beneficiary upon my death. This deed shall become effective upon my death and shall not affect the ownership of the property during my lifetime.

Date: _______________

Signature of Property Owner(s): ________________________________

Witness Information:

Two witnesses must sign below:

- Witness 1 Name: ___________________________________________

- Witness 1 Signature: ______________________________________

- Witness 2 Name: ___________________________________________

- Witness 2 Signature: ______________________________________

Notarization:

This deed must be acknowledged before a notary public.

Notary Public Signature: _____________________________________

My Commission Expires: _____________________________________

Form Data

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows a property owner to transfer real estate to a beneficiary upon their death without going through probate. |

| Governing Law | The Pennsylvania Transfer-on-Death Deed is governed by 20 Pa.C.S. § 6111.3. |

| Eligibility | Any individual who owns real estate in Pennsylvania can create a Transfer-on-Death Deed. |

| Beneficiaries | Property owners can designate one or more beneficiaries, including individuals or organizations. |

| Revocation | The deed can be revoked at any time by the property owner, provided they follow the proper legal procedures. |

| Filing Requirement | The Transfer-on-Death Deed must be recorded with the county recorder of deeds in the county where the property is located. |

| Tax Implications | There may be tax implications for beneficiaries, including potential inheritance tax, depending on the value of the property. |

| Limitations | This type of deed cannot be used for certain types of property, such as those held in a trust or properties with existing liens. |

Pennsylvania Transfer-on-Death Deed - Usage Guidelines

After obtaining the Pennsylvania Transfer-on-Death Deed form, individuals should carefully fill it out to ensure proper designation of beneficiaries. This process involves providing specific information about the property and the individuals involved. Following the completion of the form, it will need to be filed with the appropriate county office to be effective.

- Obtain the Pennsylvania Transfer-on-Death Deed form from an official source or legal website.

- Fill in the name and address of the property owner in the designated section.

- Provide a detailed description of the property, including its address and any relevant identifiers, such as parcel number.

- Identify the beneficiaries by providing their full names and addresses. Ensure that the information is accurate.

- Include any additional instructions or conditions for the transfer, if applicable.

- Sign and date the form in the presence of a notary public to validate the deed.

- File the completed form with the county recorder of deeds in the county where the property is located.

Some Other Transfer-on-Death Deed State Templates

What Is a Transfer on Death - This form simplifies the process of transferring property, avoiding the need for probate court.

For those navigating their healthcare choices, it is important to understand the implications of a Colorado Do Not Resuscitate (DNR) Order form, which allows individuals to refuse resuscitation efforts during a medical emergency, ensuring their wishes are honored. To assist in this process, resources such as Colorado PDF Templates can provide valuable templates and guidance.

Where Can I Get a Tod Form - A properly managed Transfer-on-Death Deed can provide a legacy that reflects your values and intentions for your loved ones.

Transfer on Death Deed Florida Form - Legislation surrounding Transfer-on-Death Deeds is constantly evolving as more people utilize them.

Dos and Don'ts

When filling out the Pennsylvania Transfer-on-Death Deed form, it is important to approach the task with care. Here are five key things to do and avoid:

- Do ensure that you have the correct legal description of the property.

- Do clearly identify the beneficiaries you wish to designate.

- Do sign the form in the presence of a notary public.

- Do file the deed with the appropriate county office after completion.

- Do keep a copy of the filed deed for your records.

- Don't leave any sections of the form blank; complete all required fields.

- Don't use vague language when describing the property or beneficiaries.

- Don't forget to check for any state-specific requirements before submission.

- Don't submit the form without proper notarization.

- Don't assume that verbal agreements about the deed are sufficient; everything must be in writing.

Common mistakes

-

Not including a legal description of the property: It's essential to provide a precise legal description of the property being transferred. A simple address may not suffice. Instead, refer to the property’s deed or consult a real estate professional to ensure accuracy.

-

Forgetting to sign the form: The Transfer-on-Death Deed must be signed by the owner. If the form is not signed, it will be considered invalid, which can lead to complications down the line.

-

Failing to have the deed notarized: In Pennsylvania, this deed must be notarized to be legally binding. Without notarization, the transfer will not be recognized, potentially leaving the property in limbo.

-

Neglecting to record the deed: After completing the form, it must be recorded with the county recorder of deeds. If you skip this step, the transfer won’t be effective, and your intended beneficiaries may not receive the property.

-

Not considering the implications of transfer: Some individuals overlook the potential tax implications or effects on government benefits. It’s wise to consult with a financial advisor or attorney to understand how this deed might impact your estate and your beneficiaries.

-

Choosing the wrong beneficiaries: Make sure to clearly identify the beneficiaries. Ambiguity can lead to disputes among family members or unintended consequences. Double-check names and relationships to avoid confusion.