Free Real Estate Purchase Agreement Document for Pennsylvania State

Document Sample

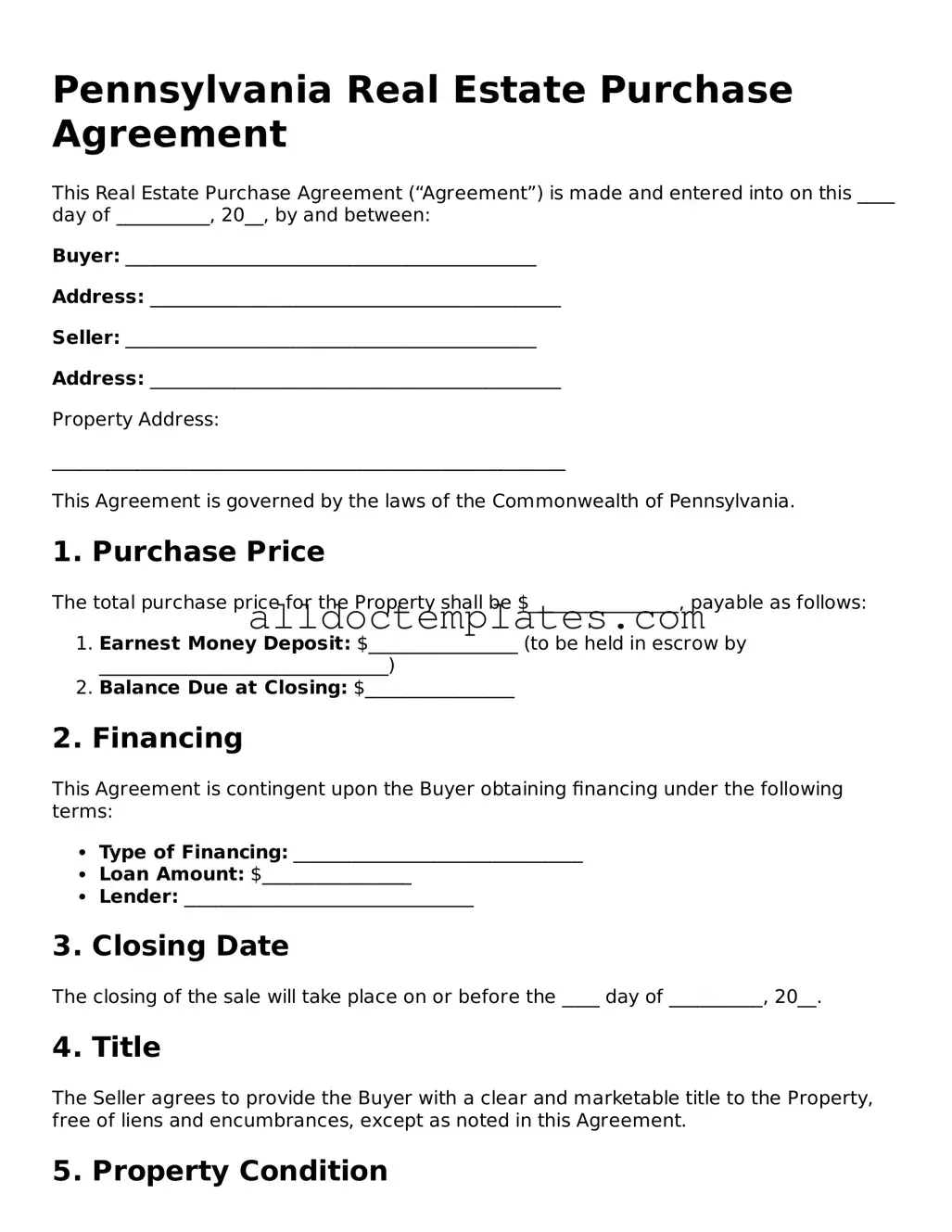

Pennsylvania Real Estate Purchase Agreement

This Real Estate Purchase Agreement (“Agreement”) is made and entered into on this ____ day of __________, 20__, by and between:

Buyer: ____________________________________________

Address: ____________________________________________

Seller: ____________________________________________

Address: ____________________________________________

Property Address:

_______________________________________________________

This Agreement is governed by the laws of the Commonwealth of Pennsylvania.

1. Purchase Price

The total purchase price for the Property shall be $________________, payable as follows:

- Earnest Money Deposit: $________________ (to be held in escrow by _______________________________)

- Balance Due at Closing: $________________

2. Financing

This Agreement is contingent upon the Buyer obtaining financing under the following terms:

- Type of Financing: _______________________________

- Loan Amount: $________________

- Lender: _______________________________

3. Closing Date

The closing of the sale will take place on or before the ____ day of __________, 20__.

4. Title

The Seller agrees to provide the Buyer with a clear and marketable title to the Property, free of liens and encumbrances, except as noted in this Agreement.

5. Property Condition

The Property is being sold in its “as-is” condition, and the Buyer has the right to conduct inspections at their own expense before closing.

6. Contingencies

This Agreement is contingent upon:

- Section 2: Buyer obtaining financing.

- The completion of satisfactory inspections.

7. Default

In the event of default by either party, the non-defaulting party may pursue all legal remedies available under Pennsylvania law.

8. Additional Provisions

_______________________________________________

_______________________________________________

9. Signatures

IN WITNESS WHEREOF, the parties hereto have executed this Real Estate Purchase Agreement as of the date first above written.

_____________________________ Buyer’s Signature

Date: __________________

_____________________________ Seller’s Signature

Date: __________________

This document has been prepared for your convenience. Please review carefully and consider consulting a qualified real estate attorney to ensure your rights and interests are protected under Pennsylvania law.

Form Data

| Fact Name | Description |

|---|---|

| Purpose | The Pennsylvania Real Estate Purchase Agreement is used to outline the terms of a real estate transaction between a buyer and a seller. |

| Governing Law | This agreement is governed by the laws of the Commonwealth of Pennsylvania. |

| Parties Involved | The form includes sections for the buyer and seller to identify themselves and provide contact information. |

| Property Description | A detailed description of the property being sold is required, including the address and any relevant legal descriptions. |

| Purchase Price | The agreement specifies the purchase price and outlines the payment structure, including any deposits. |

| Contingencies | Common contingencies, such as financing, inspections, and appraisal, can be included to protect both parties. |

| Closing Date | The agreement should specify a closing date when the transfer of ownership will occur. |

| Disclosures | Sellers are required to disclose known issues with the property, such as structural problems or environmental hazards. |

| Signatures | Both parties must sign the agreement for it to be legally binding, indicating their acceptance of the terms. |

| Legal Advice | It is recommended that both parties seek legal advice before signing to ensure their rights are protected. |

Pennsylvania Real Estate Purchase Agreement - Usage Guidelines

Filling out the Pennsylvania Real Estate Purchase Agreement is an important step in the home buying process. This document will guide you through the necessary details to ensure a smooth transaction. After completing the form, you will typically move on to discussions regarding contingencies, inspections, and closing arrangements.

- Begin by entering the date at the top of the form.

- Fill in the names of the buyer(s) and seller(s) in the designated sections.

- Provide the property address, including street, city, state, and zip code.

- Specify the purchase price for the property.

- Indicate the amount of the earnest money deposit and the date it will be paid.

- Outline any contingencies, such as financing or inspection requirements.

- Set the closing date or timeframe for when the transaction should be completed.

- Include any additional terms or conditions that are relevant to the sale.

- Have all parties sign and date the agreement at the bottom of the form.

Some Other Real Estate Purchase Agreement State Templates

How to Make a Purchase Agreement - The purchase agreement can clarify the nature of agency relationships.

To streamline the process of buying or selling a tractor, you can utilize a helpful resource that outlines the key elements of a Tractor Bill of Sale, ensuring that both parties are protected in the transaction. For detailed guidance, visit the user-friendly Tractor Bill of Sale form resource.

Real Estate Contract Template - Covers the contingencies necessary for the sale to proceed.

Real Estate Purchase Agreement Pdf - Buyers should review all terms before signing the agreement to ensure clarity.

Home Purchase Agreement - Buyers and sellers should retain a copy of the signed agreement for their records.

Dos and Don'ts

When filling out the Pennsylvania Real Estate Purchase Agreement form, it's essential to approach the task with care. Here are five things you should do and five things you shouldn't do to ensure the process goes smoothly.

- Do read the entire agreement carefully. Understanding each section will help you make informed decisions.

- Do provide accurate information. Ensure that all names, addresses, and financial details are correct to avoid complications.

- Do consult a real estate professional. Their expertise can guide you through the nuances of the agreement.

- Do keep copies of all documents. Having a record of everything submitted can be invaluable later on.

- Do ask questions. If something is unclear, seeking clarification is crucial.

- Don't rush through the form. Taking your time can prevent mistakes that may lead to issues later.

- Don't leave sections blank. Every part of the agreement should be filled out to ensure completeness.

- Don't ignore deadlines. Timeliness is key in real estate transactions.

- Don't make assumptions. Verify all terms and conditions instead of assuming you know what they mean.

- Don't forget to review before submitting. A final check can catch errors you might have overlooked.

Common mistakes

-

Failing to Provide Accurate Property Information: One common mistake is not including the correct address or legal description of the property. This can lead to confusion and complications during the transaction.

-

Not Specifying the Purchase Price: Buyers sometimes forget to clearly state the agreed-upon purchase price. Omitting this detail can create disputes later on.

-

Ignoring Contingencies: Buyers may overlook important contingencies, such as financing or inspection clauses. These contingencies protect buyers and should be clearly outlined in the agreement.

-

Incorrectly Filling Out the Closing Date: Some individuals mistakenly enter an unrealistic or incorrect closing date. This can affect the timeline of the sale and cause frustration for both parties.

-

Not Including Earnest Money Details: Failing to specify the amount of earnest money can lead to misunderstandings. This deposit shows the buyer’s commitment and should be clearly stated.

-

Overlooking Seller Disclosures: Buyers often neglect to ensure that the seller has provided all necessary disclosures about the property’s condition. This can result in unexpected repairs or issues after the sale.

-

Using Vague Language: Some people use ambiguous terms or phrases that can be interpreted in multiple ways. Clear and precise language is essential for avoiding misunderstandings.

-

Not Having All Parties Sign the Agreement: It’s crucial that all involved parties sign the agreement. A missing signature can invalidate the contract and create legal issues.