Free Quitclaim Deed Document for Pennsylvania State

Document Sample

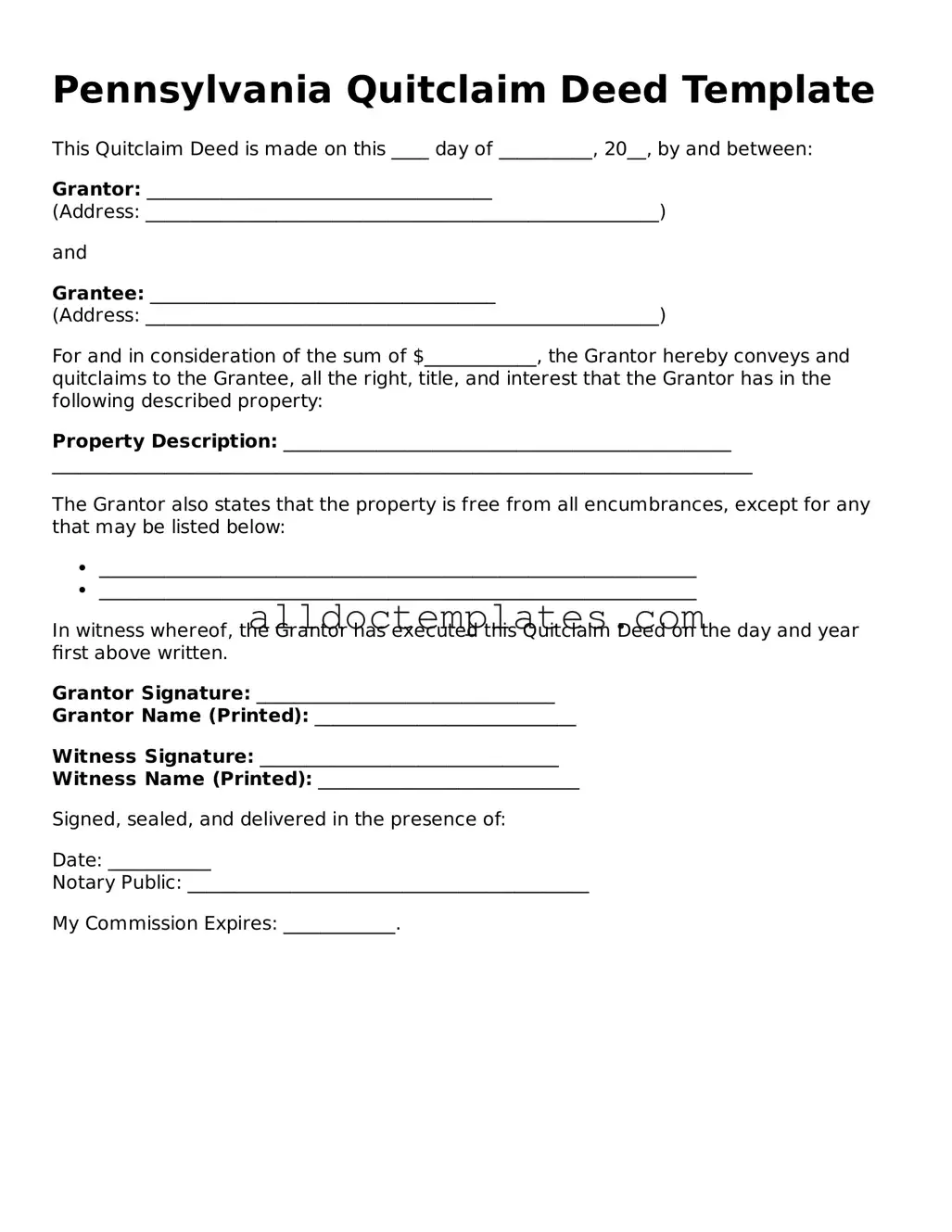

Pennsylvania Quitclaim Deed Template

This Quitclaim Deed is made on this ____ day of __________, 20__, by and between:

Grantor: _____________________________________

(Address: _______________________________________________________)

and

Grantee: _____________________________________

(Address: _______________________________________________________)

For and in consideration of the sum of $____________, the Grantor hereby conveys and quitclaims to the Grantee, all the right, title, and interest that the Grantor has in the following described property:

Property Description: ________________________________________________

___________________________________________________________________________

The Grantor also states that the property is free from all encumbrances, except for any that may be listed below:

- ________________________________________________________________

- ________________________________________________________________

In witness whereof, the Grantor has executed this Quitclaim Deed on the day and year first above written.

Grantor Signature: ________________________________

Grantor Name (Printed): ____________________________

Witness Signature: ________________________________

Witness Name (Printed): ____________________________

Signed, sealed, and delivered in the presence of:

Date: ___________

Notary Public: ___________________________________________

My Commission Expires: ____________.

Form Data

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real estate without any warranties. |

| Governing Law | The Pennsylvania Quitclaim Deed is governed by Title 21 of the Pennsylvania Consolidated Statutes. |

| Purpose | This form is typically used to transfer property between family members or to clear up title issues. |

| Consideration | While consideration is often included, it is not required for a quitclaim deed to be valid in Pennsylvania. |

| Signature Requirement | The grantor must sign the deed in the presence of a notary public for it to be legally effective. |

| Recording | To protect the interests of the grantee, the deed should be recorded in the county where the property is located. |

| Tax Implications | Transfer taxes may apply when recording a quitclaim deed in Pennsylvania, depending on the county. |

| Limitations | A quitclaim deed does not guarantee that the grantor has clear title to the property being transferred. |

| Use Cases | Common scenarios include divorce settlements, estate transfers, and adding or removing a co-owner. |

Pennsylvania Quitclaim Deed - Usage Guidelines

After you have gathered all necessary information, it’s time to complete the Pennsylvania Quitclaim Deed form. Ensure that you have the required details about the property and the parties involved. This will help streamline the process and avoid any delays.

- Begin by downloading the Pennsylvania Quitclaim Deed form from a reliable source or obtain a physical copy.

- In the top section, fill in the name of the current owner (the grantor) and their address. Ensure that the name is spelled correctly.

- Next, provide the name of the new owner (the grantee) along with their address. Double-check for accuracy.

- Locate the section for the legal description of the property. This may include the lot number, block number, and any relevant details that identify the property. You can usually find this information on the property deed or tax records.

- Indicate the consideration amount, which is the value exchanged for the property. This could be a dollar amount or a statement indicating that it is a gift.

- Sign and date the form in the designated area. The grantor must sign the document in the presence of a notary public.

- Have the form notarized. This step is crucial, as a notary public will verify the identities of the signers and witness the signing.

- Once notarized, make copies of the completed Quitclaim Deed for your records and for the grantee.

- Finally, file the original Quitclaim Deed with the county recorder’s office where the property is located. There may be a filing fee, so check with the office for details.

Some Other Quitclaim Deed State Templates

Florida Quit Claim Deed - A Quitclaim Deed is not typically used for selling property to strangers.

Understanding the significance of a General Power of Attorney is crucial for anyone looking to manage their affairs effectively. This document empowers a designated agent to handle a range of financial responsibilities, ensuring that decisions are made in line with your preferences. For those interested in discovering how this form can facilitate your financial planning, consider exploring the informative resource on creating a General Power of Attorney effectively.

How Much Does a Quick Deed Cost - The grantee should conduct due diligence on the property’s title status.

Dos and Don'ts

When filling out the Pennsylvania Quitclaim Deed form, it's important to be careful and thorough. Here are some dos and don'ts to keep in mind:

- Do include the names of all parties involved in the transaction.

- Do provide a clear legal description of the property being transferred.

- Do sign the deed in front of a notary public.

- Do file the completed deed with the appropriate county office.

- Don't leave any sections of the form blank; incomplete forms can cause delays.

- Don't use vague language when describing the property.

- Don't forget to check for any local regulations that might apply.

- Don't assume that a Quitclaim Deed is the best option without consulting a professional.

Common mistakes

-

Incomplete Information: Many individuals neglect to fill out all required fields. This can lead to delays or even rejection of the deed. Each section, including names, addresses, and property descriptions, must be fully completed.

-

Incorrect Property Description: A common mistake involves providing an inaccurate or vague description of the property. It is essential to include the correct legal description, which can often be found in previous deeds or property tax records.

-

Not Notarizing the Document: Some individuals forget to have their signatures notarized. A quitclaim deed must be notarized to be legally valid. Without this step, the document may not be accepted by the county recorder’s office.

-

Failing to Check for Liens: Before transferring property, it is vital to check for any existing liens. Ignoring this can lead to complications for the new owner, who may inherit unresolved debts attached to the property.

-

Omitting the Consideration Amount: Many people overlook the necessity of including the consideration amount, which is the value exchanged for the property. This amount does not need to be large but must be stated on the form.

-

Incorrect Signatures: It is crucial that all parties involved sign the deed. If one party fails to sign, the deed may be rendered invalid. Ensuring that all necessary signatures are present is vital for a successful transfer.

-

Not Filing the Deed: After completing the quitclaim deed, some individuals forget to file it with the appropriate county office. This step is essential, as filing officially records the transfer of ownership and protects the new owner's rights.