Free Promissory Note Document for Pennsylvania State

Document Sample

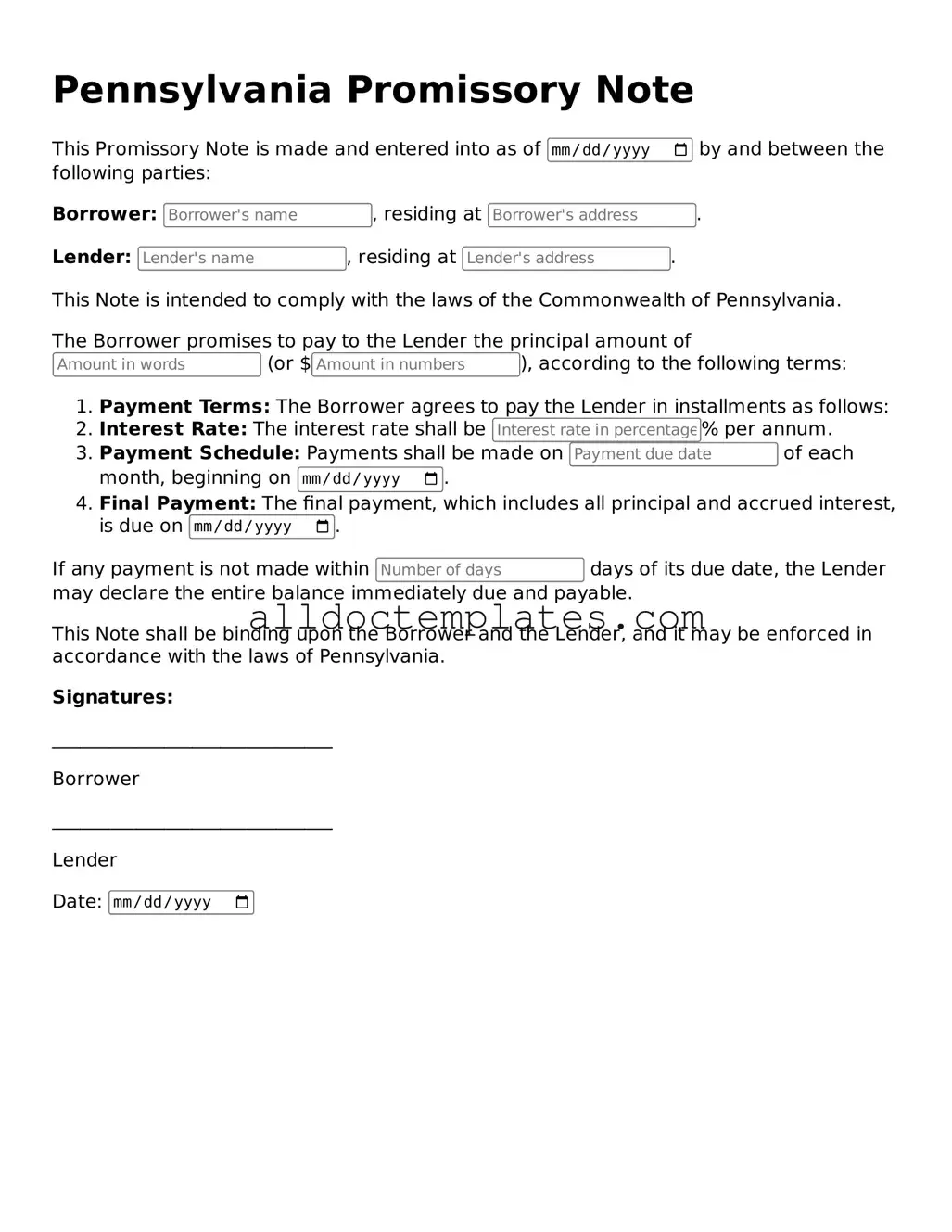

Pennsylvania Promissory Note

This Promissory Note is made and entered into as of by and between the following parties:

Borrower: , residing at .

Lender: , residing at .

This Note is intended to comply with the laws of the Commonwealth of Pennsylvania.

The Borrower promises to pay to the Lender the principal amount of (or $), according to the following terms:

- Payment Terms: The Borrower agrees to pay the Lender in installments as follows:

- Interest Rate: The interest rate shall be % per annum.

- Payment Schedule: Payments shall be made on of each month, beginning on .

- Final Payment: The final payment, which includes all principal and accrued interest, is due on .

If any payment is not made within days of its due date, the Lender may declare the entire balance immediately due and payable.

This Note shall be binding upon the Borrower and the Lender, and it may be enforced in accordance with the laws of Pennsylvania.

Signatures:

______________________________

Borrower

______________________________

Lender

Date:

Form Data

| Fact Name | Description |

|---|---|

| Definition | A Pennsylvania Promissory Note is a written promise to pay a specific amount of money at a designated time or on demand. |

| Governing Law | The Pennsylvania Uniform Commercial Code (UCC) governs promissory notes in Pennsylvania. |

| Essential Elements | The note must include the amount, the parties involved, and the terms of repayment. |

| Enforceability | A properly executed promissory note is legally enforceable in Pennsylvania, provided it meets all legal requirements. |

Pennsylvania Promissory Note - Usage Guidelines

Completing the Pennsylvania Promissory Note form is an important step in establishing a clear understanding between the lender and the borrower regarding the terms of a loan. Once you have gathered the necessary information, follow these steps to ensure that the form is filled out correctly.

- Begin by entering the date at the top of the form. This should be the date on which the promissory note is being created.

- Next, identify the borrower. Write the full legal name of the individual or entity borrowing the money in the designated space.

- Provide the lender's information. Enter the full legal name of the individual or entity lending the money.

- Specify the principal amount. Clearly state the total amount of money being borrowed in numerical form, followed by the written amount in words.

- Outline the interest rate. Indicate the annual interest rate that will apply to the loan, ensuring it is clearly stated as a percentage.

- Define the repayment terms. Specify how and when the borrower will repay the loan, including the payment schedule (e.g., monthly, quarterly) and the final due date.

- Include any late fees or penalties. If applicable, state the consequences for late payments to ensure clarity on this matter.

- Sign and date the form. Both the borrower and lender must sign the document to make it legally binding, and each party should date their signature.

- Consider having the note notarized. While not always required, notarization can add an extra layer of authenticity and may be beneficial in case of disputes.

After completing these steps, the promissory note will be ready for use. It is advisable to keep copies for both parties, ensuring that everyone has access to the agreed-upon terms. This document will serve as a formal record of the loan agreement and can be referenced in the future if necessary.

Some Other Promissory Note State Templates

Promissory Note for Loan - This document is important for record-keeping and financial accountability.

Promissory Note Template Texas - It is advisable for lenders to conduct due diligence before extending funds backed by a promissory note.

A Colorado Last Will and Testament form is a legal document that outlines how a person's assets and responsibilities should be handled after their death. This essential tool ensures that your wishes are honored and that your loved ones are taken care of according to your preferences. For those looking to create this important document, resources like Colorado PDF Templates can provide valuable assistance and guidance in drafting a will that reflects your intentions clearly and effectively.

Promissory Note Template California Word - The terms laid out in the note are critical to avoiding misunderstandings later.

Dos and Don'ts

When filling out the Pennsylvania Promissory Note form, there are some important guidelines to follow. Here are five things you should and shouldn't do:

- Do read the entire form carefully before you start filling it out.

- Don't leave any blank spaces; if a section doesn't apply, write "N/A" or "Not Applicable."

- Do provide clear and accurate information, especially regarding the amount and terms of the loan.

- Don't use unclear language or abbreviations that may confuse the reader.

- Do sign and date the form at the end to make it legally binding.

Common mistakes

-

Incorrect Names: People often misspell their names or the names of the parties involved. Ensure that all names are spelled correctly and match the legal documents.

-

Missing Dates: Failing to include the date of the agreement can lead to confusion about when the terms take effect. Always include the date prominently.

-

Improper Amount: Entering the wrong loan amount is a common error. Double-check that the numerical figure matches the written amount.

-

Omitting Payment Terms: Not specifying the payment schedule can create misunderstandings. Clearly outline when payments are due and the frequency.

-

Ignoring Interest Rates: Forgetting to include the interest rate or miscalculating it can result in disputes. Clearly state the interest rate and how it is applied.

-

Missing Signatures: A promissory note is not valid without signatures from all parties. Ensure that everyone involved has signed the document.

-

Not Notarizing: Some people overlook the need for notarization. Depending on the situation, having the document notarized can add an extra layer of legitimacy.

-

Failure to Include Collateral: If the loan is secured, not specifying the collateral can lead to issues. Clearly identify any collateral tied to the loan.

-

Neglecting to Review: Skipping a thorough review of the document can lead to overlooked errors. Take the time to read through the entire note before finalizing it.