Free Deed in Lieu of Foreclosure Document for Pennsylvania State

Document Sample

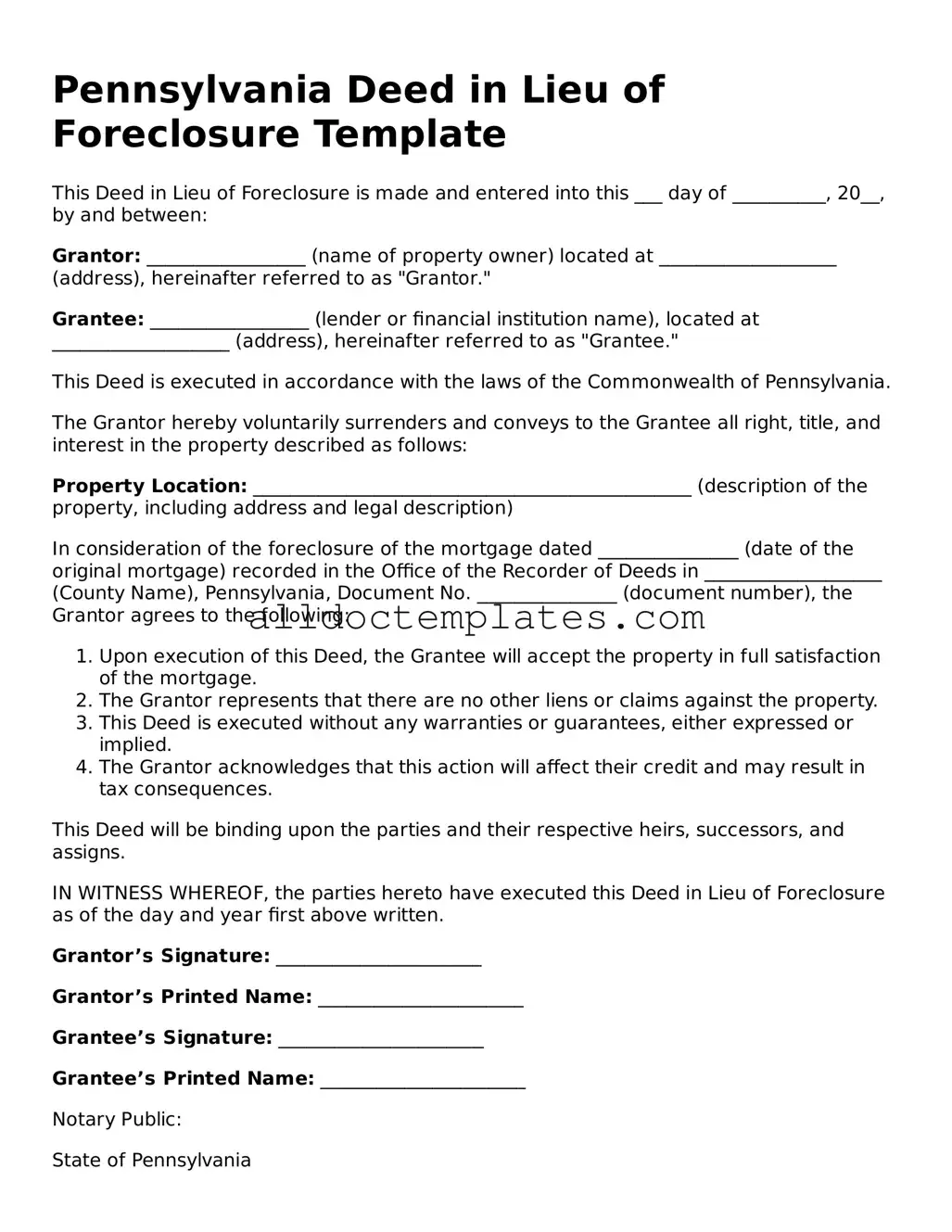

Pennsylvania Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made and entered into this ___ day of __________, 20__, by and between:

Grantor: _________________ (name of property owner) located at ___________________ (address), hereinafter referred to as "Grantor."

Grantee: _________________ (lender or financial institution name), located at ___________________ (address), hereinafter referred to as "Grantee."

This Deed is executed in accordance with the laws of the Commonwealth of Pennsylvania.

The Grantor hereby voluntarily surrenders and conveys to the Grantee all right, title, and interest in the property described as follows:

Property Location: _______________________________________________ (description of the property, including address and legal description)

In consideration of the foreclosure of the mortgage dated _______________ (date of the original mortgage) recorded in the Office of the Recorder of Deeds in ___________________ (County Name), Pennsylvania, Document No. _______________ (document number), the Grantor agrees to the following:

- Upon execution of this Deed, the Grantee will accept the property in full satisfaction of the mortgage.

- The Grantor represents that there are no other liens or claims against the property.

- This Deed is executed without any warranties or guarantees, either expressed or implied.

- The Grantor acknowledges that this action will affect their credit and may result in tax consequences.

This Deed will be binding upon the parties and their respective heirs, successors, and assigns.

IN WITNESS WHEREOF, the parties hereto have executed this Deed in Lieu of Foreclosure as of the day and year first above written.

Grantor’s Signature: ______________________

Grantor’s Printed Name: ______________________

Grantee’s Signature: ______________________

Grantee’s Printed Name: ______________________

Notary Public:

State of Pennsylvania

County of ________________

On this ___ day of __________, 20__, before me, a Notary Public, personally appeared _____________________ (name) known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument and acknowledged that he/she executed the same for the purposes therein contained.

In witness whereof, I have hereunto set my hand and official seal.

______________________________

Notary Public

Form Data

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document where a borrower voluntarily transfers property ownership to the lender to avoid foreclosure proceedings. |

| Governing Law | The deed in lieu of foreclosure in Pennsylvania is governed by state law, particularly under the Pennsylvania Uniform Commercial Code and related statutes. |

| Benefits | This process can help borrowers avoid the lengthy and costly foreclosure process, potentially preserving their credit rating. |

| Requirements | Borrowers must typically be in default on their mortgage and have the lender's consent to execute the deed in lieu of foreclosure. |

Pennsylvania Deed in Lieu of Foreclosure - Usage Guidelines

Once you have the Pennsylvania Deed in Lieu of Foreclosure form, you will need to complete it accurately to ensure a smooth process. After filling out the form, it will be submitted to the appropriate parties, and you will need to follow up to confirm receipt and acceptance.

- Begin by entering the date at the top of the form.

- Provide the names of the grantor(s) (the property owner(s)) in the designated space.

- List the names of the grantee(s) (the entity receiving the property) next.

- Include the full legal description of the property. This can usually be found on your property deed or tax records.

- Fill in the address of the property, ensuring it matches official records.

- State the consideration amount, if applicable. This can often be a nominal amount.

- Sign the form where indicated. All grantors must sign.

- Have the signatures notarized. This step is crucial for the form to be legally binding.

- Make copies of the completed form for your records.

- Submit the original form to the grantee and keep track of any correspondence regarding the submission.

Some Other Deed in Lieu of Foreclosure State Templates

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - The interaction between borrower and lender during this process can lead to more favorable outcomes for both sides.

Foreclosure Deed - Homeowners may have to submit a hardship letter detailing their financial situation.

Deed in Lieu of Forclosure - Obtaining legal advice before signing a Deed in Lieu is recommended to understand all implications.

To efficiently manage the sale process, consider using our straightforward Arizona Tractor Bill of Sale documentation to ensure a smooth transfer of ownership. For further details, check out our informative guide on the Arizona Tractor Bill of Sale.

California Voluntary Property Surrender Document - The lender often considers this deed less costly than going through the full foreclosure process.

Dos and Don'ts

When filling out the Pennsylvania Deed in Lieu of Foreclosure form, it is important to follow specific guidelines to ensure the process goes smoothly. Below are four recommendations, including actions to take and avoid.

- Do: Ensure all personal information is accurate and up-to-date.

- Do: Review the form thoroughly before submission to catch any errors.

- Don't: Rush through the completion of the form; take your time to understand each section.

- Don't: Leave any required fields blank; incomplete forms may delay the process.

Common mistakes

-

Incomplete Information: Failing to provide all required details, such as names, addresses, and property descriptions, can lead to delays or rejection of the form.

-

Incorrect Signatures: Not having all necessary parties sign the document can invalidate the deed. Ensure that all owners and interested parties sign.

-

Not Notarizing the Document: Many forms require notarization. Neglecting this step may render the deed unenforceable.

-

Missing Dates: Omitting the date on which the deed is signed can create confusion regarding the effective date of the transfer.

-

Failure to Review for Accuracy: Mistakes in property descriptions or personal information can lead to legal complications. Always double-check the information provided.

-

Ignoring Lender Requirements: Each lender may have specific requirements for accepting a deed in lieu. Not adhering to these can cause issues in the process.

-

Not Seeking Legal Advice: Skipping the consultation with a legal professional can result in misunderstandings of rights and obligations. It's wise to seek guidance.

-

Overlooking Tax Implications: Failing to consider potential tax consequences of transferring property through a deed in lieu can lead to unexpected financial burdens.