Free Deed Document for Pennsylvania State

Document Sample

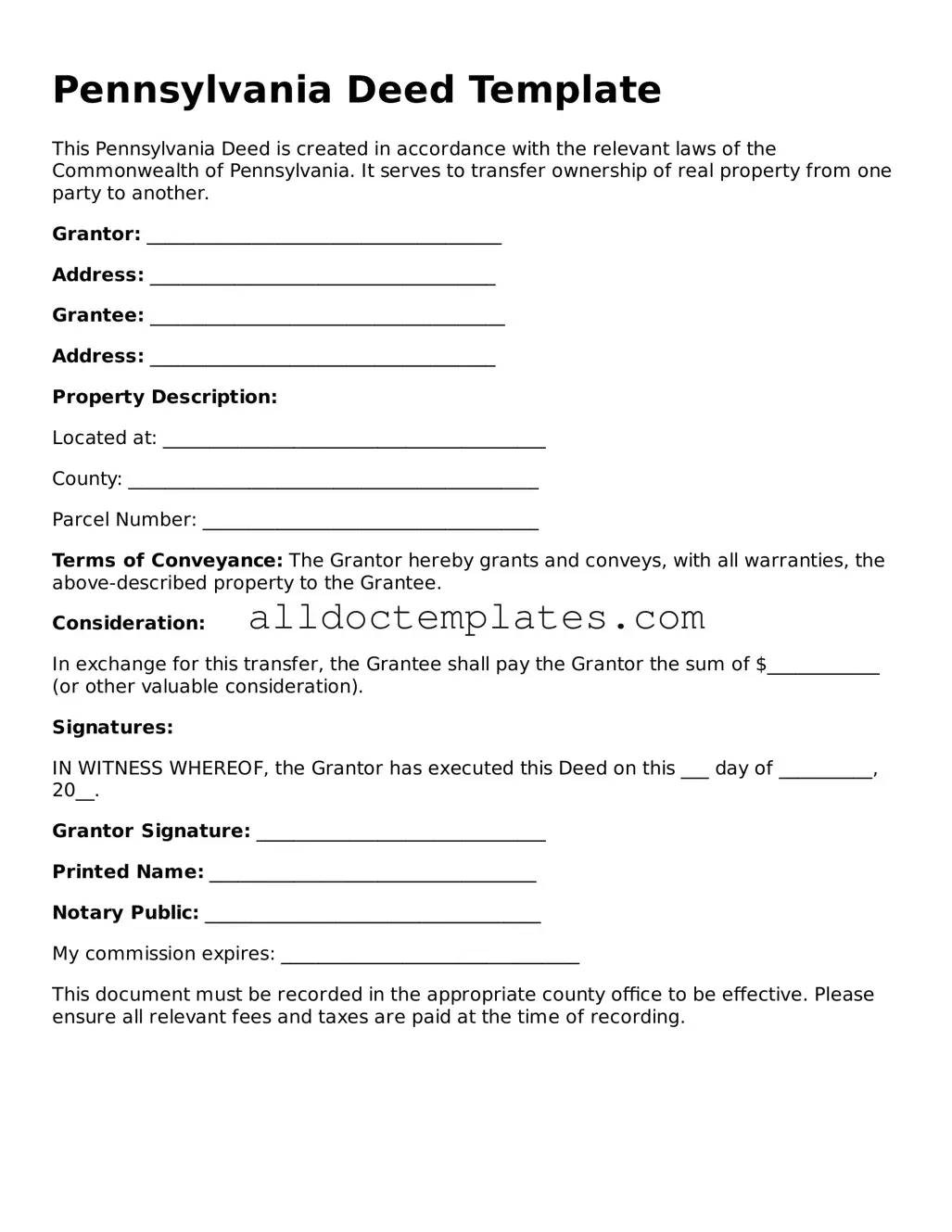

Pennsylvania Deed Template

This Pennsylvania Deed is created in accordance with the relevant laws of the Commonwealth of Pennsylvania. It serves to transfer ownership of real property from one party to another.

Grantor: ______________________________________

Address: _____________________________________

Grantee: ______________________________________

Address: _____________________________________

Property Description:

Located at: _________________________________________

County: ____________________________________________

Parcel Number: ____________________________________

Terms of Conveyance: The Grantor hereby grants and conveys, with all warranties, the above-described property to the Grantee.

Consideration:

In exchange for this transfer, the Grantee shall pay the Grantor the sum of $____________ (or other valuable consideration).

Signatures:

IN WITNESS WHEREOF, the Grantor has executed this Deed on this ___ day of __________, 20__.

Grantor Signature: _______________________________

Printed Name: ___________________________________

Notary Public: ____________________________________

My commission expires: ________________________________

This document must be recorded in the appropriate county office to be effective. Please ensure all relevant fees and taxes are paid at the time of recording.

Form Data

| Fact Name | Description |

|---|---|

| Governing Law | The Pennsylvania Deed form is governed by Title 21, Chapter 1 of the Pennsylvania Consolidated Statutes. |

| Types of Deeds | Pennsylvania recognizes various types of deeds, including warranty deeds, quitclaim deeds, and special purpose deeds. |

| Signature Requirement | For a deed to be valid, it must be signed by the grantor, the person transferring the property. |

| Recording | Deeds should be recorded in the county where the property is located to provide public notice of ownership. |

Pennsylvania Deed - Usage Guidelines

Once you have your Pennsylvania Deed form, it’s time to fill it out carefully. This is an important step in transferring property ownership. Take your time and ensure that all information is accurate to avoid any issues later.

- Start by entering the date at the top of the form. This is the date when the deed is executed.

- Fill in the names of the grantor(s) (the person(s) transferring the property). Make sure to include their full legal names.

- Next, list the names of the grantee(s) (the person(s) receiving the property). Again, use their full legal names.

- Provide the property address. Include the street number, street name, city, and zip code.

- Describe the property. This may include the lot number, block number, or any other identifying information.

- Indicate the consideration amount. This is typically the purchase price or value of the property.

- Include any additional terms or conditions, if applicable. This could involve details about easements or restrictions.

- Sign the form. The grantor(s) must sign in the designated area, and it’s best to have the signature notarized.

- Finally, check the form for any missing information or errors before submitting it.

Some Other Deed State Templates

New York State Deed Form - A deed includes details such as the parties involved and the date of transfer.

Grant Deed California - When selling property, a clear title should be established before drafting a deed.

For anyone looking to complete a transaction involving personal property, it's essential to utilize a Colorado Bill of Sale, which is not only a formal record but also helps avoid misunderstandings. To simplify the process, you can find customizable documents through Colorado PDF Templates, ensuring all necessary details are captured and the transfer is legally sound.

Broward County Quit Claim Deed - Document illustrating the change of property title.

Texas Deed Transfer Form - A deed form is a legal document used to transfer property ownership.

Dos and Don'ts

When filling out the Pennsylvania Deed form, it’s important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn’t do:

- Do double-check all information for accuracy before submitting.

- Do ensure that the names of all parties involved are clearly printed.

- Do include the correct legal description of the property.

- Do sign the deed in the presence of a notary public.

- Don't leave any required fields blank; incomplete forms can lead to delays.

- Don't use correction fluid or erase any mistakes; instead, cross out errors and initial them.

By adhering to these guidelines, you can help facilitate a smoother process when dealing with property transactions in Pennsylvania.

Common mistakes

-

Incorrect Grantee Information: One common mistake is failing to provide accurate information about the grantee. This includes ensuring the name is spelled correctly and that the address is complete. Missing or incorrect details can lead to delays or complications in property transfer.

-

Omitting the Legal Description: The legal description of the property must be included. This is more than just the address; it involves a detailed description that identifies the specific parcel of land. Skipping this step can result in legal disputes or challenges in ownership.

-

Not Signing the Deed: A deed must be signed by the grantor to be valid. Forgetting to sign or having the wrong person sign can invalidate the document. It’s essential to ensure that all required signatures are present.

-

Failure to Have the Deed Notarized: In Pennsylvania, a deed typically needs to be notarized. Not having a notary public witness the signing can render the deed unenforceable. This step is crucial for legal recognition.

-

Ignoring Local Recording Requirements: Each county in Pennsylvania may have specific requirements for recording deeds. Ignoring these can lead to issues with the transfer of ownership. Always check with local authorities to ensure compliance.

-

Inaccurate Tax Information: Providing incorrect tax identification numbers or failing to include them can cause complications. It’s important to verify that all tax-related information is accurate to avoid future issues.

-

Not Consulting a Professional: Many people attempt to fill out the deed form without seeking advice. This can lead to errors that may have been easily avoided. Consulting a real estate attorney or a qualified professional can provide peace of mind and ensure the form is completed correctly.