Free Bill of Sale Document for Pennsylvania State

Document Sample

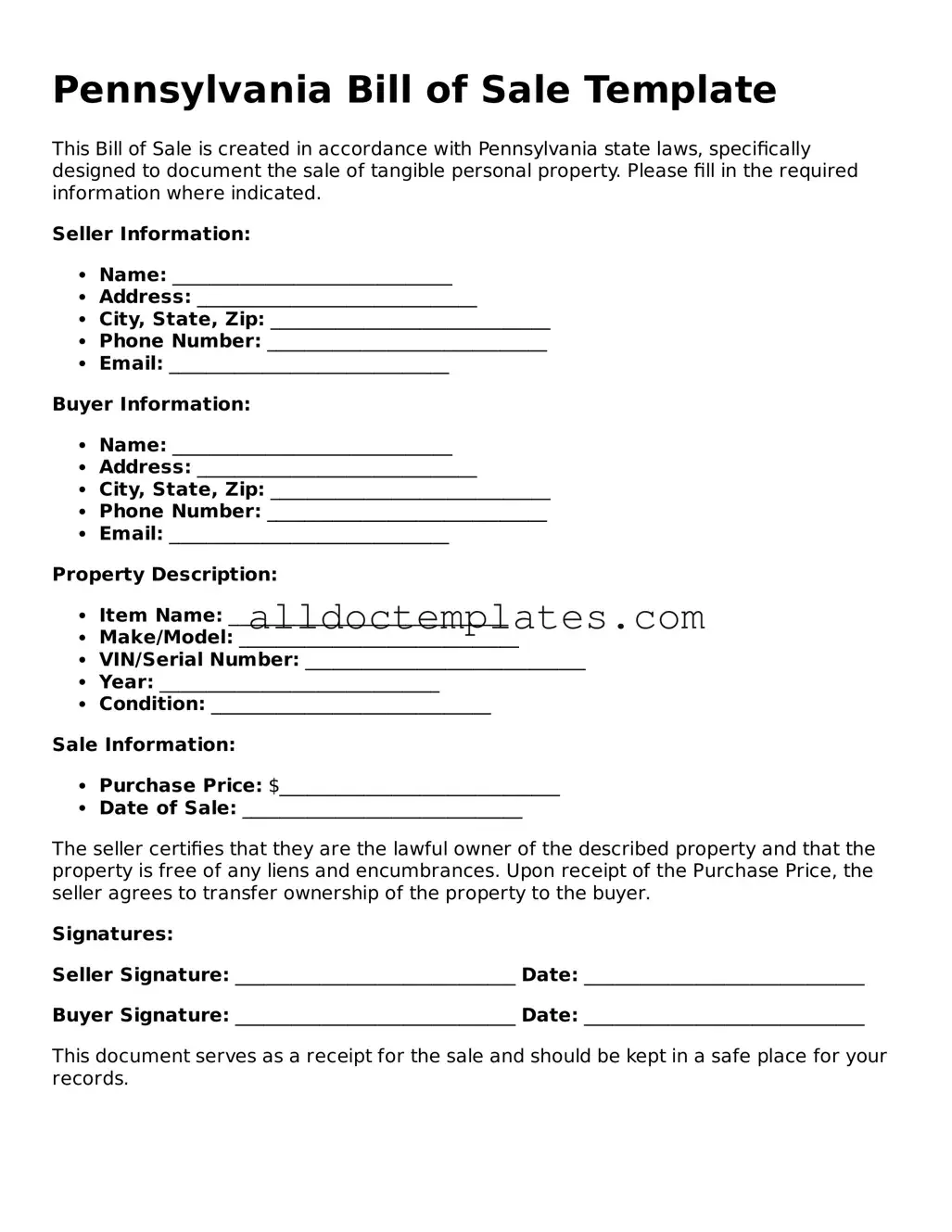

Pennsylvania Bill of Sale Template

This Bill of Sale is created in accordance with Pennsylvania state laws, specifically designed to document the sale of tangible personal property. Please fill in the required information where indicated.

Seller Information:

- Name: ______________________________

- Address: ______________________________

- City, State, Zip: ______________________________

- Phone Number: ______________________________

- Email: ______________________________

Buyer Information:

- Name: ______________________________

- Address: ______________________________

- City, State, Zip: ______________________________

- Phone Number: ______________________________

- Email: ______________________________

Property Description:

- Item Name: ______________________________

- Make/Model: ______________________________

- VIN/Serial Number: ______________________________

- Year: ______________________________

- Condition: ______________________________

Sale Information:

- Purchase Price: $______________________________

- Date of Sale: ______________________________

The seller certifies that they are the lawful owner of the described property and that the property is free of any liens and encumbrances. Upon receipt of the Purchase Price, the seller agrees to transfer ownership of the property to the buyer.

Signatures:

Seller Signature: ______________________________ Date: ______________________________

Buyer Signature: ______________________________ Date: ______________________________

This document serves as a receipt for the sale and should be kept in a safe place for your records.

Form Data

| Fact Name | Description |

|---|---|

| Purpose | The Pennsylvania Bill of Sale serves as a legal document to transfer ownership of personal property from one party to another. |

| Governing Law | This form is governed by Pennsylvania law, specifically the Uniform Commercial Code (UCC) as it pertains to personal property transactions. |

| Types of Property | The Bill of Sale can be used for various types of personal property, including vehicles, boats, and equipment. |

| Notarization | While notarization is not required for all Bill of Sale forms in Pennsylvania, it is recommended for vehicle transactions to ensure authenticity. |

| Identification Requirements | Both the buyer and seller should provide valid identification to complete the Bill of Sale accurately. |

| Consideration | The document must specify the consideration, or payment, exchanged for the property to validate the transaction. |

| Record Keeping | It is advisable for both parties to keep a copy of the Bill of Sale for their records, as it serves as proof of the transaction. |

| Usage in Disputes | The Bill of Sale can be used as evidence in legal disputes regarding ownership or terms of sale. |

Pennsylvania Bill of Sale - Usage Guidelines

Filling out the Pennsylvania Bill of Sale form is a straightforward process that requires careful attention to detail. Once completed, this document serves as a record of the transaction between the buyer and the seller, ensuring both parties have clear terms regarding the sale. Below are the steps to guide you through the process of filling out the form.

- Begin by entering the date of the sale at the top of the form. Use the format MM/DD/YYYY for clarity.

- Next, provide the full name and address of the seller. Make sure to include the street address, city, state, and ZIP code.

- Then, fill in the buyer's full name and address in the same manner as the seller's information.

- In the section for the item being sold, describe the item clearly. Include details such as make, model, year, color, and Vehicle Identification Number (VIN) if applicable.

- Indicate the sale price of the item. This should be the total amount agreed upon by both parties.

- Next, check the box that indicates whether the item is being sold "as is" or if there are any warranties associated with the sale.

- Both the seller and buyer should sign and date the form at the bottom. Ensure that signatures are legible.

- If required, have the form notarized to add an extra layer of authenticity. This may depend on the type of item being sold.

After completing these steps, review the form to ensure all information is accurate and complete. Both parties should keep a copy for their records. This will help prevent any misunderstandings in the future.

Some Other Bill of Sale State Templates

Do You Need a Bill of Sale to Register a Car in Florida - This form is often simple and straightforward, making it easy to use.

Auto Bill of Sale Form - Keep a Bill of Sale for tax purposes or proof of acquisition.

The California Release of Liability form is essential for both individuals and organizations as it helps clarify the risks involved in various activities while ensuring that participants are aware and accept these risks. By using this legal document, you can significantly reduce the chances of facing legal action due to accidents that may occur during the event. For more information and to obtain the necessary documentation, you can visit All Templates PDF.

Sell a Car Without Title - In real estate, a Bill of Sale can be used to transfer personal property within the property purchased.

Dos and Don'ts

When filling out the Pennsylvania Bill of Sale form, it's important to ensure accuracy and completeness. Here are some essential do's and don'ts to keep in mind:

- Do provide accurate information about the buyer and seller, including full names and addresses.

- Do include a detailed description of the item being sold, including make, model, and VIN or serial number if applicable.

- Do sign and date the form to validate the transaction.

- Do keep a copy of the completed Bill of Sale for your records.

- Don't leave any fields blank; ensure all required information is filled in.

- Don't use white-out or other correction methods on the form; any errors should be crossed out and corrected clearly.

Common mistakes

-

Incomplete Information: Failing to fill out all required fields can lead to delays or invalidation of the document. Ensure every section is completed.

-

Incorrect Dates: Entering the wrong date of sale can cause confusion. Double-check to ensure the date accurately reflects when the transaction occurred.

-

Missing Signatures: Both the seller and buyer must sign the document. Omitting a signature can render the Bill of Sale ineffective.

-

Wrong Vehicle Identification Number (VIN): For vehicle sales, the VIN must be correct. An error here can lead to ownership disputes.

-

Failure to Include Payment Details: Not specifying the payment method or amount can create ambiguity. Always include clear payment terms.

-

Not Notarizing the Document: While notarization isn’t always required, it can add an extra layer of authenticity. Consider having the document notarized for added security.

-

Using Abbreviations: Avoid using abbreviations or shorthand. Clarity is key, and full terms should be used to prevent misunderstandings.

-

Ignoring Local Laws: Familiarize yourself with local regulations regarding Bill of Sale forms. Each state may have specific requirements that must be met.

-

Not Keeping a Copy: Failing to retain a copy for personal records can lead to issues later. Always keep a signed copy for both parties.

-

Overlooking Additional Terms: If there are specific conditions or warranties, they should be clearly stated. Leaving them out can lead to disputes after the sale.