Free Articles of Incorporation Document for Pennsylvania State

Document Sample

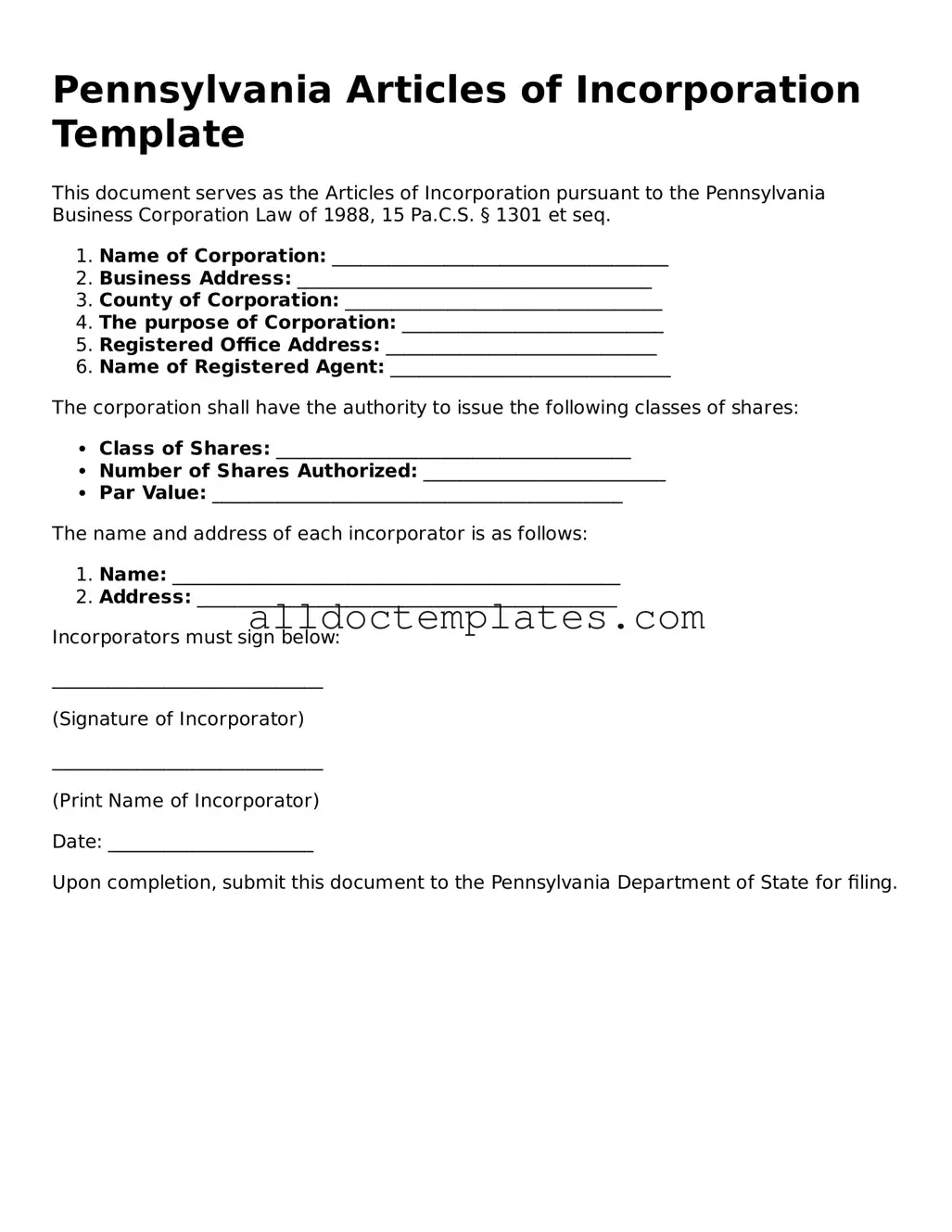

Pennsylvania Articles of Incorporation Template

This document serves as the Articles of Incorporation pursuant to the Pennsylvania Business Corporation Law of 1988, 15 Pa.C.S. § 1301 et seq.

- Name of Corporation: ____________________________________

- Business Address: ______________________________________

- County of Corporation: __________________________________

- The purpose of Corporation: ____________________________

- Registered Office Address: _____________________________

- Name of Registered Agent: ______________________________

The corporation shall have the authority to issue the following classes of shares:

- Class of Shares: ______________________________________

- Number of Shares Authorized: __________________________

- Par Value: ____________________________________________

The name and address of each incorporator is as follows:

- Name: ________________________________________________

- Address: _____________________________________________

Incorporators must sign below:

_____________________________

(Signature of Incorporator)

_____________________________

(Print Name of Incorporator)

Date: ______________________

Upon completion, submit this document to the Pennsylvania Department of State for filing.

Form Data

| Fact Name | Description |

|---|---|

| Governing Law | The Pennsylvania Articles of Incorporation are governed by the Pennsylvania Business Corporation Law of 1988. |

| Purpose | The form is used to officially establish a corporation in the state of Pennsylvania. |

| Filing Requirement | Filing the Articles of Incorporation is mandatory for any corporation wishing to operate legally in Pennsylvania. |

| Information Needed | Key information required includes the corporation's name, registered office address, and the names of the incorporators. |

| Filing Fee | A filing fee must be paid upon submission of the Articles of Incorporation, which varies based on the type of corporation. |

| Duration | The corporation formed will have perpetual existence unless stated otherwise in the Articles. |

| Amendments | Changes to the Articles can be made through a formal amendment process, which also requires filing and fees. |

| Public Record | Once filed, the Articles of Incorporation become part of the public record and can be accessed by anyone. |

Pennsylvania Articles of Incorporation - Usage Guidelines

Once you have the Pennsylvania Articles of Incorporation form in hand, you’re ready to start filling it out. This form is essential for establishing your business as a corporation in Pennsylvania. Make sure you have all the necessary information handy, as this will help streamline the process.

- Gather Required Information: Collect details such as the name of your corporation, the purpose of your business, and the registered office address.

- Choose a Name: Ensure that the name you select for your corporation is unique and complies with Pennsylvania naming requirements.

- Fill in the Form: Start with the corporation name at the top of the form. Follow the prompts to enter the necessary details accurately.

- Designate a Registered Agent: Identify a registered agent who will receive legal documents on behalf of the corporation. Include their name and address.

- State the Purpose: Clearly outline the purpose of your corporation. This can be a general statement or a specific business activity.

- List Incorporators: Provide the names and addresses of the incorporators. These individuals are responsible for filing the Articles of Incorporation.

- Review the Information: Double-check all entries for accuracy. Ensure that everything is complete and correctly filled out.

- Sign and Date the Form: The incorporators must sign the form, certifying that the information is true and correct.

- Submit the Form: File the completed Articles of Incorporation with the Pennsylvania Department of State. This can usually be done online or via mail.

- Pay the Filing Fee: Include the required filing fee, which can vary based on the type of corporation you are forming.

After submitting the Articles of Incorporation, you will await confirmation from the state. Once approved, your corporation will officially exist, allowing you to move forward with your business plans.

Some Other Articles of Incorporation State Templates

Florida Department of State Division of Corporations - This document helps outline the governance structure of the corporation.

To facilitate the homeschooling process, parents can refer to resources that provide guidance on preparing the necessary documentation, including the Colorado PDF Templates which offers a useful template for the Homeschool Letter of Intent.

Texas Corporation - Once filed, the corporation becomes a distinct legal entity.

Dos and Don'ts

When filling out the Pennsylvania Articles of Incorporation form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are five things to do and five things to avoid.

Things You Should Do:

- Read the instructions carefully before starting.

- Provide accurate information about your corporation's name and purpose.

- Include the names and addresses of all incorporators.

- Double-check all entries for spelling and accuracy.

- File the form with the appropriate state office and pay the required fee.

Things You Shouldn't Do:

- Do not leave any required fields blank.

- Avoid using a name that is already taken by another corporation.

- Do not provide misleading or false information.

- Refrain from submitting the form without a proper review.

- Do not forget to keep a copy of the filed form for your records.

Common mistakes

-

Incomplete Information: One common mistake is failing to provide all required information. Each section of the form must be filled out completely to avoid delays in processing.

-

Incorrect Entity Name: Choosing a name that is too similar to an existing business can lead to rejection. It's essential to check name availability before submission.

-

Improper Designation of Registered Agent: Not designating a registered agent or providing incorrect information can cause issues. The registered agent must be a resident or a business entity authorized to conduct business in Pennsylvania.

-

Failure to Include Purpose Statement: The Articles of Incorporation require a purpose statement. Omitting this can lead to complications or rejection of the application.

-

Not Specifying Share Structure: If the corporation will issue shares, the form must specify the number of shares and their par value. Failing to do this can result in incomplete filings.

-

Ignoring Filing Fees: Each submission requires a fee. Not including the correct payment can delay the incorporation process.

-

Not Seeking Professional Help: Many individuals attempt to complete the form without assistance. Consulting a professional can help avoid common pitfalls and ensure compliance with state laws.