Fill in a Valid Payroll Check Form

Document Sample

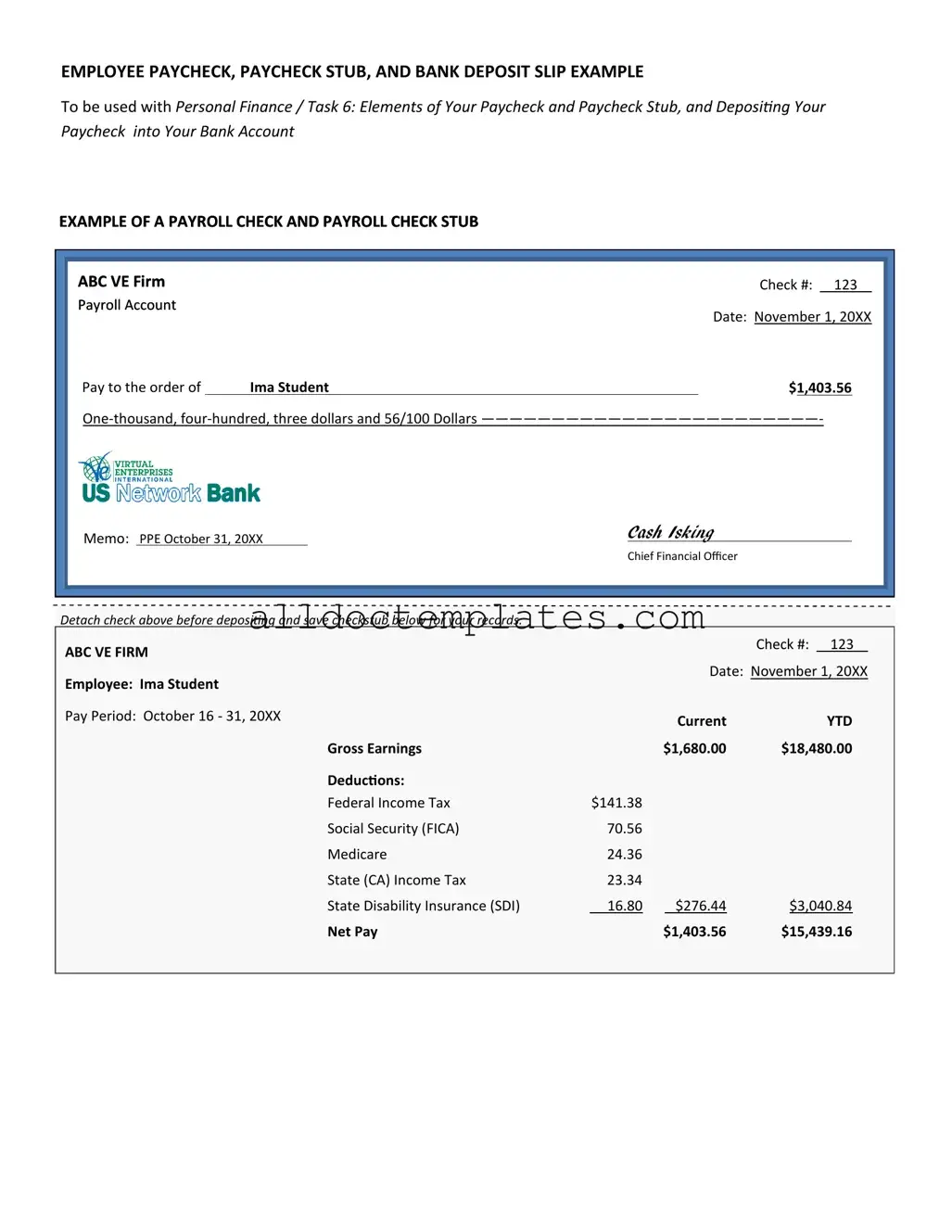

EMPLOYEE PAYCHECK, PAYCHECK STUB, AND BANK DEPOSIT SLIP EXAMPLE

To be used with Personal Finance / Task 6: Elements of Your Paycheck and Paycheck Stub, and Depositing Your Paycheck into Your Bank Account

EXAMPLE OF A PAYROLL CHECK AND PAYROLL CHECK STUB

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ABC VE Firm |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

Payroll Account |

|

|

|

|

|

|

Date: November 1, 20XX |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Pay to the order of |

|

Ima Student |

|

|

|

|

|

|

$1,403.56 |

|

|

|

||||||

|

|

|

|

|

|

||||||||||||||

|

Memo: PPE October 31, 20XX |

|

Cash Isking |

|

|

|

|

|

|

|

|

||||||||

|

|

Chief Financial Officer |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Detach check above before depositing and save checkstub below for your records. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

ABC VE FIRM |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

|

|

|

|

|

|

Date: November 1, 20XX |

||||||||||||

|

Employee: Ima Student |

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Pay Period: October 16 - 31, 20XX |

|

|

|

Current |

|

|

|

YTD |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

Gross Earnings |

|

|

$1,680.00 |

|

$18,480.00 |

|

|

|

||||||

|

|

|

|

|

Deductions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal Income Tax |

$141.38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security (FICA) |

70.56 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Medicare |

24.36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State (CA) Income Tax |

23.34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State Disability Insurance (SDI) |

16.80 |

|

$276.44 |

|

$3,040.84 |

|

|

|

||||||

|

|

|

|

|

Net Pay |

|

|

$1,403.56 |

|

$15,439.16 |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

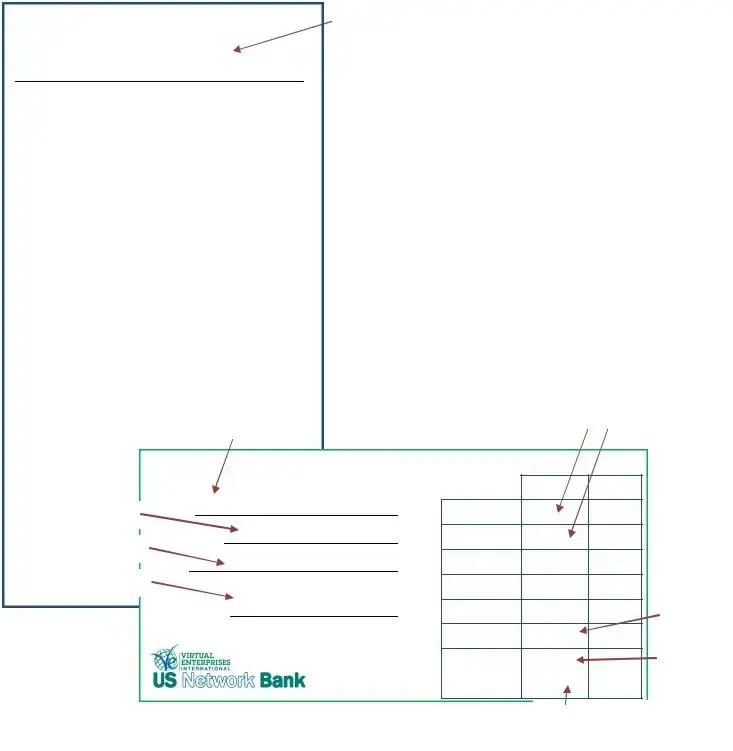

BACK OF PAYCHECK |

|

|

|

|

|

ENDORSE HERE |

|

Recipient’s signature |

|

|

|

DO NOT WRITE, STAMP OR SIGN BELOW THIS LINE |

|

|

|

|

|

|

|

|

List amount of each item that |

||

|

|

|

is being depositing. Checks |

||

|

|

BANK DEPOSIT SLIP |

are entered separately; do |

||

|

|

not combine. |

|

||

|

|

|

|

||

|

Customer’s name |

|

|

|

|

|

|

DEPOSIT SLIP |

|

|

|

|

|

|

dollars |

cents |

|

Customer’s account # |

NAME |

CASH |

|

. |

|

|

|

|

|||

Current date |

ACCOUNT # |

CHECKS |

|

. |

|

|

|

|

|

|

|

|

DATE |

|

|

. |

|

|

|

|

|

|

|

Customer’s Signature |

|

|

|

. |

|

|

|

|

|

|

|

|

SIGNATURE: |

|

|

. |

Sum of items to |

|

|

Subtotal |

|

. |

be deposited |

|

|

|

|

||

Less Cash |

. |

Cash that you |

|

|

|

want back |

|

TOTAL |

. |

||

|

Total amount being deposited into your account

Document Information

| Fact Name | Details |

|---|---|

| Purpose | The Payroll Check form is used to distribute employee wages for work performed during a specific pay period. |

| Components | This form typically includes the employee's name, hours worked, pay rate, and total wages. |

| Frequency of Use | Employers issue payroll checks on a regular schedule, commonly weekly, bi-weekly, or monthly. |

| State-Specific Requirements | Some states have specific laws governing payroll checks, including minimum wage and timing of payments. |

| Record Keeping | Employers must keep records of payroll checks issued for tax and compliance purposes. |

| Tax Deductions | Payroll checks may include deductions for federal and state taxes, Social Security, and Medicare. |

Payroll Check - Usage Guidelines

Filling out the Payroll Check form is an important task that ensures employees receive their earnings accurately and on time. Once you have completed the form, it will be submitted to the appropriate department for processing. Follow these steps to fill out the form correctly.

- Begin by entering the date in the designated field. This is usually the date the check is being issued.

- Next, provide the employee's name. Ensure the spelling is correct to avoid any confusion.

- Fill in the employee's ID number or Social Security Number, if required. This helps in identifying the employee's record.

- Indicate the pay period for which the payment is being made. This should reflect the start and end dates of the pay period.

- Enter the gross pay amount. This is the total earnings before any deductions.

- List any deductions that apply, such as taxes or benefits. Make sure to specify the amounts clearly.

- Calculate the net pay by subtracting the total deductions from the gross pay.

- Provide the signature of the authorized person who is issuing the check. This is typically a supervisor or manager.

- Finally, review all entries for accuracy before submitting the form.

Common PDF Forms

What Is a W4 Tax Form - Consider the initiative the employee takes in their job responsibilities.

Completing a transaction involving a mobile home in Virginia requires the proper documentation to safeguard both the buyer and seller. The Virginia Mobile Home Bill of Sale form is essential for this process, ensuring that all parties are aware of the terms and conditions of the sale. This legal document can be easily accessed through resources like mobilehomebillofsale.com/blank-virginia-mobile-home-bill-of-sale, which provides a comprehensive guide to filling it out accurately and efficiently.

Florida Realtors Lease Agreement - It offers guidance for handling disagreements through the included legal references.

Dos and Don'ts

When filling out the Payroll Check form, it is important to follow specific guidelines to ensure accuracy and compliance. Here are some do's and don'ts to consider:

- Do double-check all personal information for accuracy.

- Do ensure that the payment amount is clearly stated.

- Don't leave any required fields blank.

- Don't use correction fluid on the form.

Common mistakes

Filling out a Payroll Check form may seem straightforward, but many people encounter pitfalls that can lead to delays or errors in payment. Here are four common mistakes to watch out for:

-

Incorrect Employee Information:

One of the most frequent errors is providing inaccurate employee details. This includes misspellings of names, wrong Social Security numbers, or outdated addresses. Double-checking this information can save time and prevent complications.

-

Missing Signatures:

Another common oversight is forgetting to sign the form. Without a signature, the payroll process may be stalled. Always ensure that the required signatures are present before submission.

-

Improper Calculation of Hours:

Calculating hours worked can be tricky. Some individuals mistakenly record overtime or leave hours incorrectly. Always verify calculations to ensure accurate payment.

-

Neglecting Deductions:

Many people forget to account for deductions, such as taxes, benefits, or retirement contributions. These deductions can significantly affect the final amount. Reviewing the deductions carefully will help in providing a clear picture of the net pay.

By being mindful of these common mistakes, you can ensure that your Payroll Check form is filled out accurately and efficiently. Taking the time to review each section can lead to smoother payroll processing and timely payments.