The IRS 1120 form is a tax return used by corporations to report their income, gains, losses, deductions, and credits to the Internal Revenue Service (IRS). This form is essential for C corporations, as it helps determine their tax liability...

The IRS 2553 form is a document that small business owners use to elect S corporation status for their corporation or limited liability company (LLC). This election allows businesses to avoid double taxation on corporate income. Completing the form accurately...

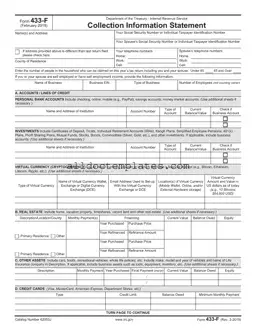

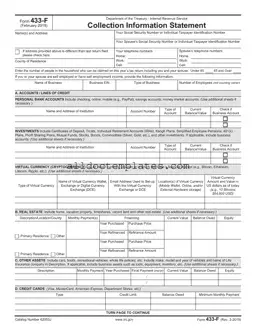

The IRS 433-F form is a financial disclosure form used by taxpayers to provide the Internal Revenue Service with a snapshot of their financial situation. This form is particularly important for individuals seeking to negotiate a payment plan or settle...

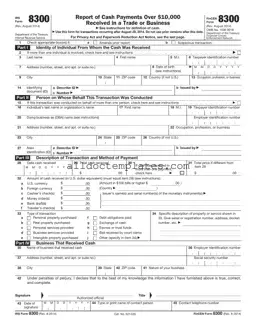

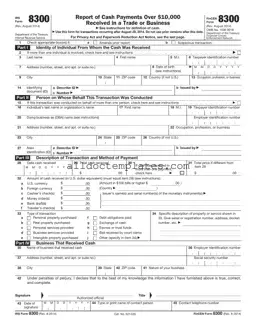

The IRS 8300 form is a document that businesses must file when they receive cash payments exceeding $10,000 in a single transaction or related transactions. This form helps the government track large cash transactions, which can be associated with illegal...

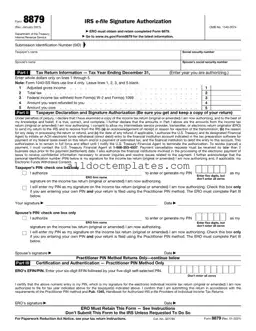

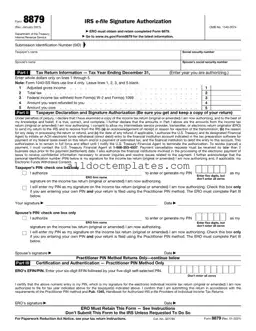

The IRS Form 8879 is a document used to authorize an e-filed tax return. This form allows taxpayers to electronically sign their return, ensuring that it is submitted securely and efficiently. Understanding how to properly complete and submit Form 8879...

The IRS 940 form is an annual tax form used by employers to report their Federal Unemployment Tax Act (FUTA) liabilities. This form helps the IRS track the taxes that employers owe for unemployment benefits. Understanding how to complete and...

The IRS Form 941 is a quarterly tax form that employers use to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. This form is crucial for maintaining compliance with federal tax regulations. Understanding its requirements...

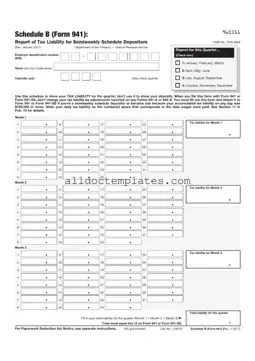

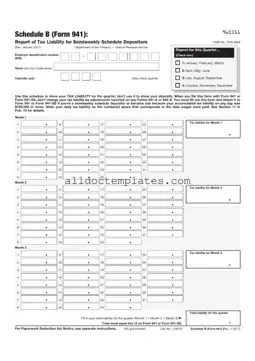

The IRS Schedule B (Form 941) is a crucial document used by employers to report their payroll tax obligations. It details the number of employees and the wages paid, ensuring compliance with federal tax regulations. Accurate completion of this form...

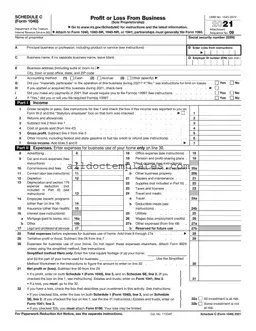

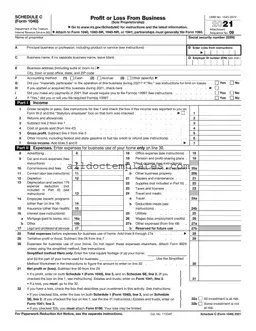

The IRS Schedule C 1040 form is a crucial document used by sole proprietors to report income or loss from their business activities. This form allows individuals to detail their earnings, expenses, and net profit or loss for the tax...

The IRS Schedule C 1040 form is a crucial document for sole proprietors to report income and expenses from their business activities. This form allows individuals to detail their earnings and claim deductions, ultimately impacting their overall tax liability. Understanding...

The IRS W-2 form is a document that employers use to report an employee's annual wages and the taxes withheld from their paycheck. This form plays a crucial role in the tax filing process, as it provides essential information needed...

The IRS W-3 form is a summary of all W-2 forms issued by an employer, providing the Social Security Administration with important information about employee wages and taxes withheld. This form is essential for ensuring accurate reporting and compliance with...