Valid Owner Financing Contract Template

Document Sample

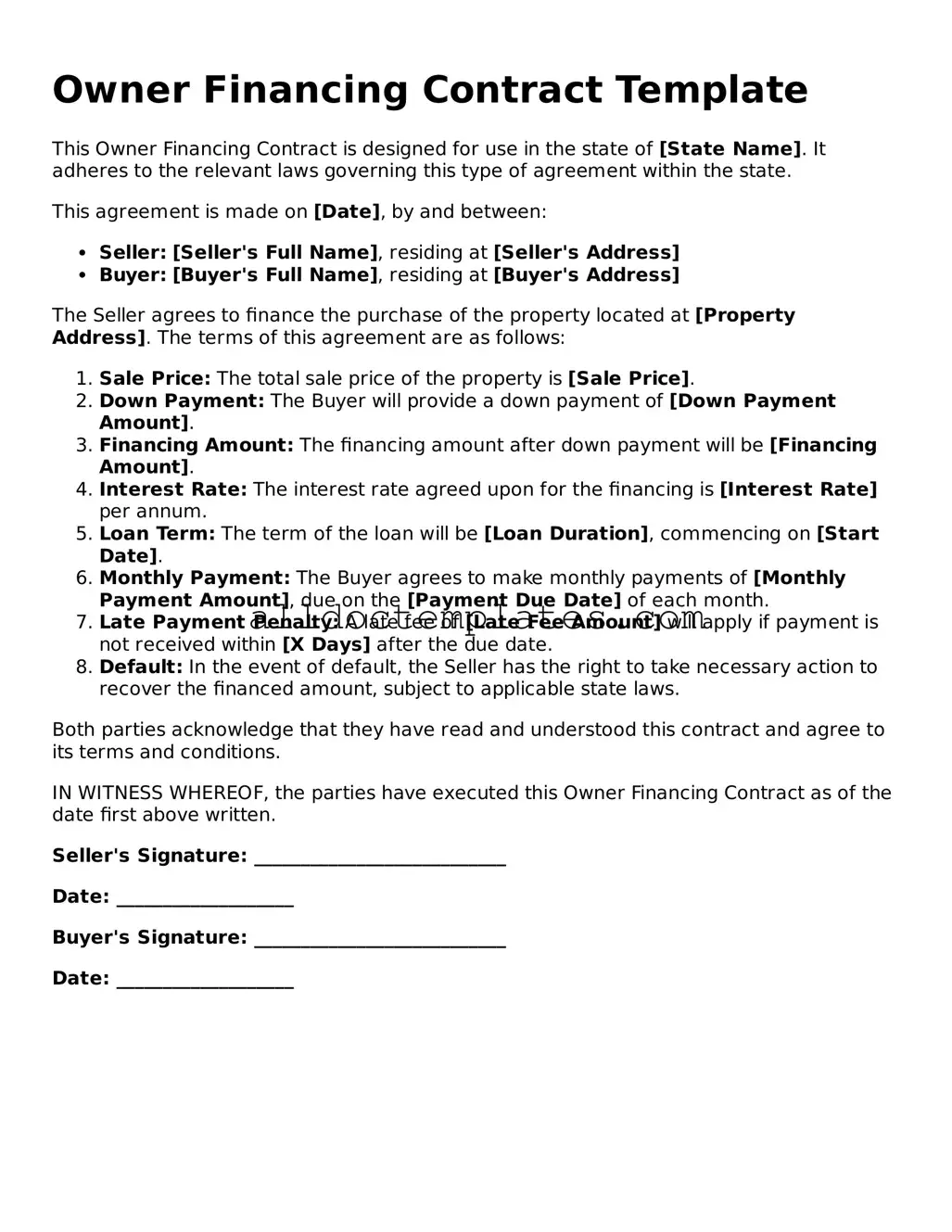

Owner Financing Contract Template

This Owner Financing Contract is designed for use in the state of [State Name]. It adheres to the relevant laws governing this type of agreement within the state.

This agreement is made on [Date], by and between:

- Seller: [Seller's Full Name], residing at [Seller's Address]

- Buyer: [Buyer's Full Name], residing at [Buyer's Address]

The Seller agrees to finance the purchase of the property located at [Property Address]. The terms of this agreement are as follows:

- Sale Price: The total sale price of the property is [Sale Price].

- Down Payment: The Buyer will provide a down payment of [Down Payment Amount].

- Financing Amount: The financing amount after down payment will be [Financing Amount].

- Interest Rate: The interest rate agreed upon for the financing is [Interest Rate] per annum.

- Loan Term: The term of the loan will be [Loan Duration], commencing on [Start Date].

- Monthly Payment: The Buyer agrees to make monthly payments of [Monthly Payment Amount], due on the [Payment Due Date] of each month.

- Late Payment Penalty: A late fee of [Late Fee Amount] will apply if payment is not received within [X Days] after the due date.

- Default: In the event of default, the Seller has the right to take necessary action to recover the financed amount, subject to applicable state laws.

Both parties acknowledge that they have read and understood this contract and agree to its terms and conditions.

IN WITNESS WHEREOF, the parties have executed this Owner Financing Contract as of the date first above written.

Seller's Signature: ___________________________

Date: ___________________

Buyer's Signature: ___________________________

Date: ___________________

Form Data

| Fact Name | Description |

|---|---|

| Definition | An Owner Financing Contract is an agreement where the seller finances the purchase of their property directly to the buyer. |

| Benefits | This type of financing can make it easier for buyers who may not qualify for traditional loans. |

| Interest Rates | Interest rates in owner financing can be flexible and are often negotiated between the buyer and seller. |

| Down Payment | Typically, a down payment is required, but the amount can vary based on the agreement. |

| Governing Law | The contract is governed by state laws, which can vary. For example, in California, it follows the California Civil Code. |

| Payment Terms | Payment terms, including the duration of the loan and payment schedule, are outlined in the contract. |

| Default Consequences | If the buyer defaults on the payments, the seller has the right to reclaim the property. |

| Legal Considerations | It is advisable for both parties to seek legal advice before signing to ensure all terms are clear and enforceable. |

Owner Financing Contract - Usage Guidelines

After obtaining the Owner Financing Contract form, you will need to fill it out carefully. This process ensures that all necessary information is accurately recorded, which helps in creating a clear agreement between the buyer and seller. Follow these steps to complete the form effectively.

- Start by entering the date at the top of the form.

- Fill in the names and addresses of both the buyer and the seller in the designated sections.

- Provide a detailed description of the property being financed, including the address and any relevant identifiers.

- Specify the purchase price of the property in the appropriate field.

- Indicate the amount of the down payment, if applicable, and ensure it is clear.

- Outline the terms of the financing, including the interest rate and payment schedule.

- Include any additional terms or conditions that both parties have agreed upon.

- Sign and date the form at the bottom, ensuring both parties do the same.

- Make copies of the completed form for both the buyer and seller for their records.

More Types of Owner Financing Contract Templates:

Terminate Real Estate Agent Contract Letter - The Termination of Real Estate Purchase Agreement form allows parties to officially end a real estate transaction.

The Colorado Real Estate Purchase Agreement is an essential legal tool for facilitating property transactions in Colorado. Utilizing a well-structured agreement helps to eliminate any potential ambiguities, making it paramount for both buyers and sellers to familiarize themselves with its terms. For a comprehensive resource on this document, you can visit Colorado PDF Templates, which provides valuable insights to ensure a seamless real estate experience.

Personal Guarantee Form - Many entrepreneurs use personal guarantees as a strategic tool to secure necessary funding to grow their businesses.

Dos and Don'ts

When filling out an Owner Financing Contract form, attention to detail is crucial. Here are some important dos and don’ts to consider:

- Do ensure all parties involved are clearly identified with full names and contact information.

- Do specify the terms of the financing, including interest rates and payment schedules.

- Do include a detailed description of the property being financed.

- Do consult with a legal professional to review the contract before signing.

- Don't leave any blank spaces on the form; all sections should be completed.

- Don't use vague language; clarity is essential to avoid misunderstandings.

- Don't forget to include the consequences of defaulting on the loan.

- Don't rush through the process; take your time to ensure accuracy.

Common mistakes

-

Failing to provide accurate property details. It's essential to include the correct address and legal description of the property.

-

Not specifying the purchase price. Clearly stating the total amount is crucial for both parties.

-

Omitting the down payment amount. This figure should be clearly defined to avoid misunderstandings.

-

Neglecting to outline the interest rate. Both parties need to agree on the rate to avoid future disputes.

-

Leaving out the loan term. This indicates how long the buyer has to repay the loan.

-

Not including payment schedule details. Specify when payments are due and the frequency of those payments.

-

Failing to address late payment penalties. Clearly outline any fees that will apply if payments are missed.

-

Overlooking the consequences of default. The contract should detail what happens if the buyer fails to make payments.

-

Not having the contract reviewed by a legal professional. It's advisable to seek legal advice to ensure all terms are clear and enforceable.