Valid Operating Agreement Template

Document Sample

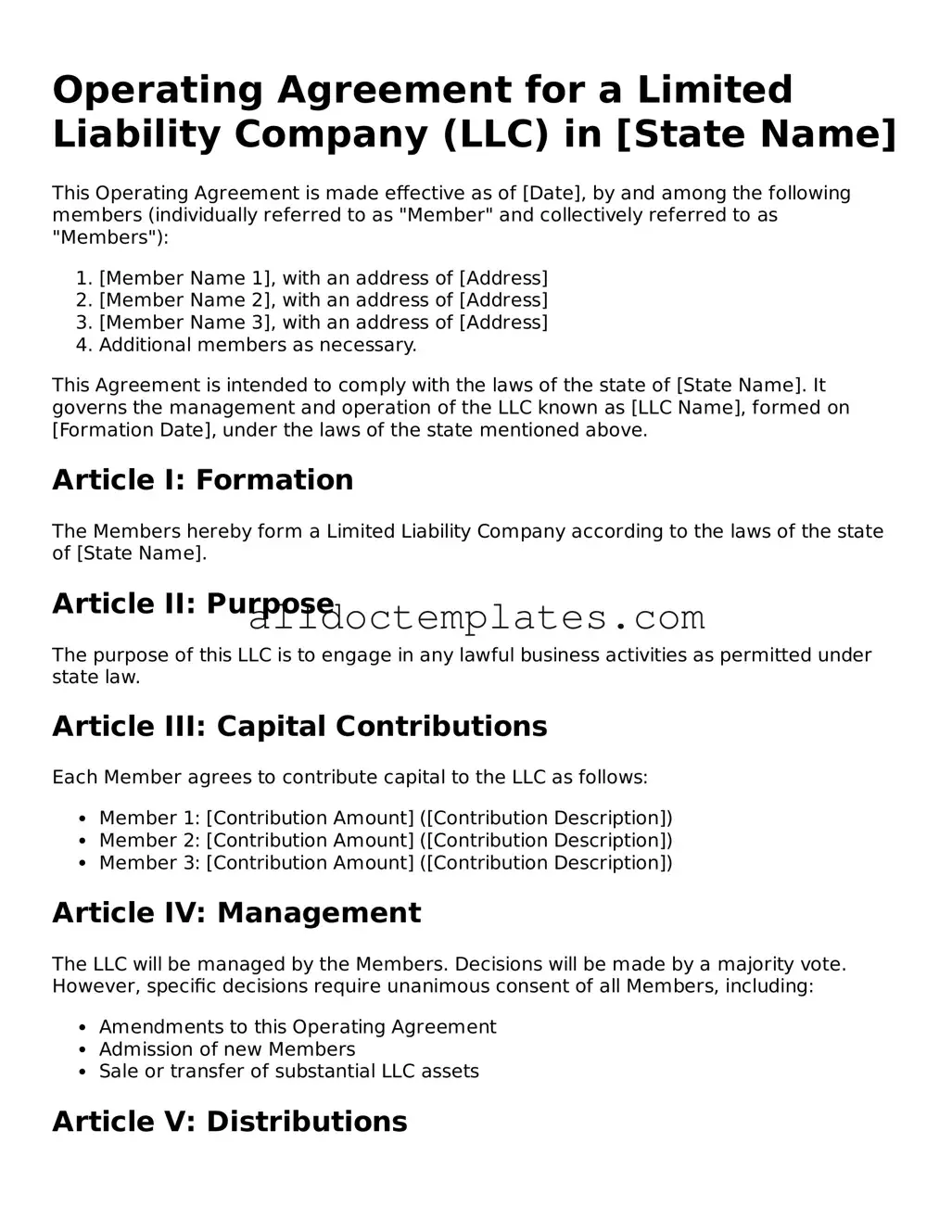

Operating Agreement for a Limited Liability Company (LLC) in [State Name]

This Operating Agreement is made effective as of [Date], by and among the following members (individually referred to as "Member" and collectively referred to as "Members"):

- [Member Name 1], with an address of [Address]

- [Member Name 2], with an address of [Address]

- [Member Name 3], with an address of [Address]

- Additional members as necessary.

This Agreement is intended to comply with the laws of the state of [State Name]. It governs the management and operation of the LLC known as [LLC Name], formed on [Formation Date], under the laws of the state mentioned above.

Article I: Formation

The Members hereby form a Limited Liability Company according to the laws of the state of [State Name].

Article II: Purpose

The purpose of this LLC is to engage in any lawful business activities as permitted under state law.

Article III: Capital Contributions

Each Member agrees to contribute capital to the LLC as follows:

- Member 1: [Contribution Amount] ([Contribution Description])

- Member 2: [Contribution Amount] ([Contribution Description])

- Member 3: [Contribution Amount] ([Contribution Description])

Article IV: Management

The LLC will be managed by the Members. Decisions will be made by a majority vote. However, specific decisions require unanimous consent of all Members, including:

- Amendments to this Operating Agreement

- Admission of new Members

- Sale or transfer of substantial LLC assets

Article V: Distributions

Distributions will be made to Members according to their respective percentage interests in the LLC:

- [Member Name 1]: [Percentage Interest]

- [Member Name 2]: [Percentage Interest]

- [Member Name 3]: [Percentage Interest]

Article VI: Indemnification

The LLC shall indemnify and hold harmless each Member from any losses, claims, or damages incurred in connection with the LLC’s activities, provided that such Member acted in good faith and in the best interests of the LLC.

Article VII: Amendments

This Operating Agreement may be amended only with the written consent of all Members.

Article VIII: Miscellaneous

This Agreement constitutes the entire understanding between the Members. Any prior agreements, whether written or verbal, are superseded by this Operating Agreement.

Members hereby indicate their agreement by signing below:

__________________________

[Member Name 1], Member

__________________________

[Member Name 2], Member

__________________________

[Member Name 3], Member

Date: ________________

State-specific Information for Operating Agreement Forms

Operating Agreement Document Categories

Form Data

| Fact Name | Description |

|---|---|

| Definition | An Operating Agreement is a key document used by LLCs to outline the management structure and operating procedures of the business. |

| Purpose | This agreement helps to clarify the roles and responsibilities of members, ensuring smooth operations and reducing potential conflicts. |

| State-Specific Requirements | Each state has its own laws governing LLCs, which may dictate certain provisions that must be included in the Operating Agreement. |

| Flexibility | Operating Agreements can be customized to meet the specific needs of the business, allowing for unique provisions that reflect the members' intentions. |

| Governing Law | The governing law for the Operating Agreement is typically based on the state where the LLC is formed. For example, California law governs LLCs formed in California. |

| Not Mandatory | While not required in every state, having an Operating Agreement is highly recommended to provide clarity and legal protection for the members. |

Operating Agreement - Usage Guidelines

Completing the Operating Agreement form is an important step in establishing the framework for your business. This document outlines the ownership and operating procedures of your company. Following these steps will help ensure that all necessary information is accurately provided.

- Gather Necessary Information: Collect details about your business, including the name, address, and type of business structure (LLC, partnership, etc.).

- List Members: Identify all members or partners involved in the business. Include their names, addresses, and percentage of ownership.

- Define Management Structure: Decide how the business will be managed. Specify whether it will be member-managed or manager-managed.

- Outline Voting Rights: Determine how voting will occur among members. Specify the voting percentages required for decisions.

- Detail Profit and Loss Distribution: Explain how profits and losses will be distributed among members.

- Include Additional Provisions: Consider adding clauses regarding member withdrawal, new member admission, and dispute resolution.

- Review the Document: Carefully check for accuracy and completeness. Ensure that all members agree with the terms outlined.

- Sign and Date: Have all members sign and date the agreement to make it official.

Browse Popular Documents

Social Security Medicare - This form can help streamline your transition away from Medicare Part B.

The California Power of Attorney form is essential for individuals to legally empower someone they trust to act on their behalf regarding financial and health-related matters. When the principal cannot make decisions due to various circumstances, this document can ensure that their choices are respected and followed through. To simplify the process of obtaining this vital form, you can visit All Templates PDF for easy access and guidance.

Nursing Reference Example - Detail the applicant's initiative in seeking out learning opportunities.

Dos and Don'ts

When filling out an Operating Agreement form, it’s essential to get it right. Here’s a handy list of dos and don’ts to guide you through the process.

- Do clearly define the roles and responsibilities of each member.

- Do include details about the management structure of your business.

- Do outline the process for making decisions, including voting rights.

- Do specify how profits and losses will be distributed among members.

- Do address what happens if a member wants to leave the company.

- Don't leave any sections blank; every part is important.

- Don't use vague language; clarity is key.

- Don't overlook the importance of signatures; they validate the agreement.

- Don't forget to review the agreement regularly as your business evolves.

By following these guidelines, you can create a solid Operating Agreement that protects everyone involved and sets a clear path for your business’s future.

Common mistakes

-

Neglecting to Define Roles and Responsibilities: One common mistake is failing to clearly outline the roles and responsibilities of each member. Without this clarity, misunderstandings can arise, leading to conflicts down the line.

-

Ignoring Profit Distribution Methods: Many people overlook the importance of specifying how profits and losses will be distributed among members. Not addressing this can result in disputes over financial matters, which can be detrimental to the business.

-

Omitting a Buy-Sell Agreement: A buy-sell agreement is crucial for outlining what happens if a member wants to leave the business or if an unexpected event occurs. Failing to include this can create uncertainty and tension among members.

-

Not Updating the Agreement Regularly: Some individuals believe that once the Operating Agreement is completed, it doesn't need to be revisited. However, as the business evolves, it’s important to update the agreement to reflect changes in structure, membership, or goals.