Free Transfer-on-Death Deed Document for New York State

Document Sample

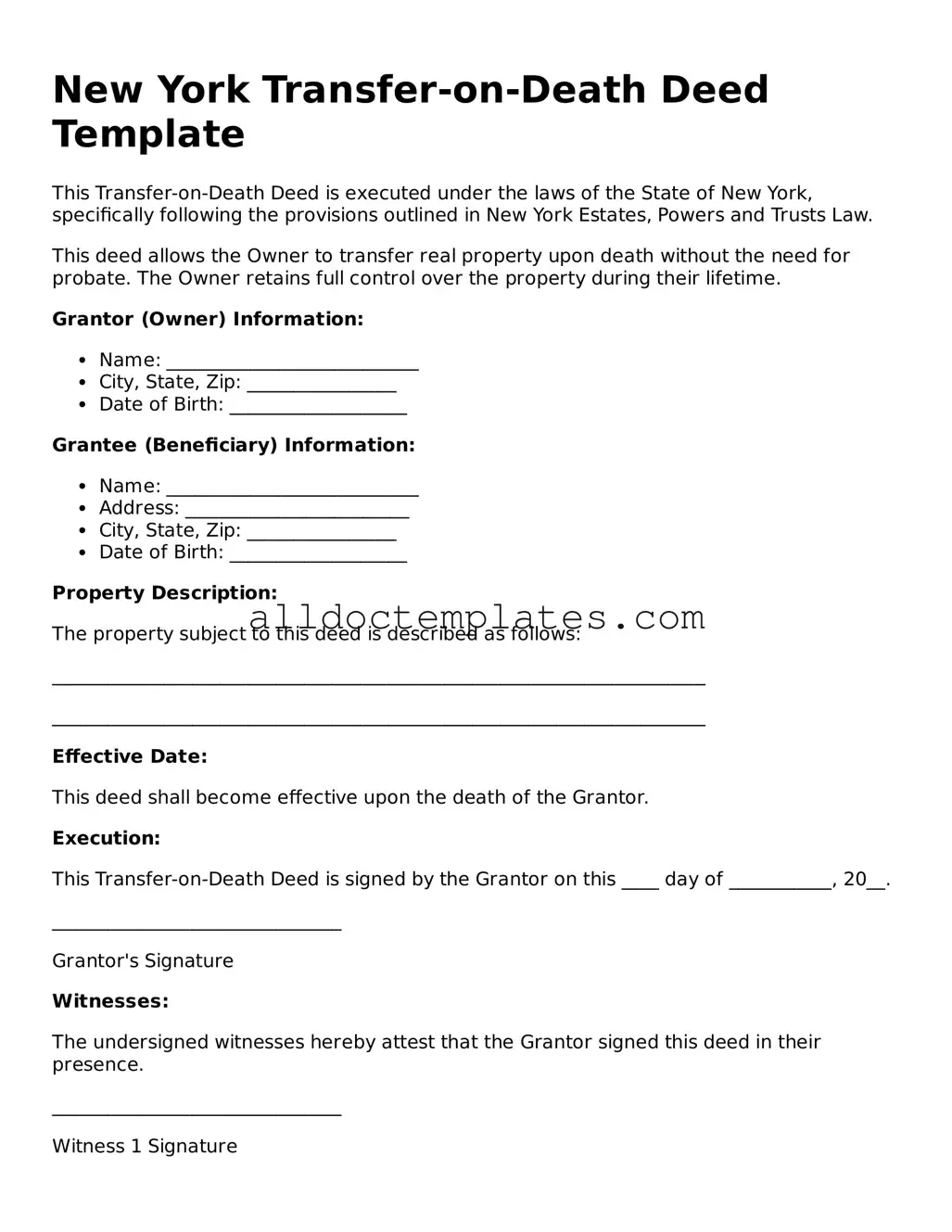

New York Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed under the laws of the State of New York, specifically following the provisions outlined in New York Estates, Powers and Trusts Law.

This deed allows the Owner to transfer real property upon death without the need for probate. The Owner retains full control over the property during their lifetime.

Grantor (Owner) Information:

- Name: ___________________________

- City, State, Zip: ________________

- Date of Birth: ___________________

Grantee (Beneficiary) Information:

- Name: ___________________________

- Address: ________________________

- City, State, Zip: ________________

- Date of Birth: ___________________

Property Description:

The property subject to this deed is described as follows:

______________________________________________________________________

______________________________________________________________________

Effective Date:

This deed shall become effective upon the death of the Grantor.

Execution:

This Transfer-on-Death Deed is signed by the Grantor on this ____ day of ___________, 20__.

_______________________________

Grantor's Signature

Witnesses:

The undersigned witnesses hereby attest that the Grantor signed this deed in their presence.

_______________________________

Witness 1 Signature

Name: ___________________________

_______________________________

Witness 2 Signature

Name: ___________________________

Notary Acknowledgment:

State of New York, County of _______________.

On this ____ day of ___________, 20__, before me personally appeared the Grantor, known to me to be the person whose name is subscribed above, and acknowledged that they executed this deed.

_______________________________

Notary Public Signature

My Commission Expires: _____________

Form Data

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death (TOD) deed allows a property owner to transfer real estate to a beneficiary upon their death without going through probate. |

| Governing Law | New York Consolidated Laws, Real Property Law, Article 13. |

| Eligibility | Any individual who owns real estate in New York can create a TOD deed. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries to receive the property upon their death. |

| Revocability | The deed can be revoked or changed at any time during the owner's lifetime. |

| Filing Requirement | The TOD deed must be filed with the county clerk's office where the property is located. |

| Effect on Creditors | Transfer-on-Death deeds do not protect the property from creditors' claims during the owner's lifetime. |

New York Transfer-on-Death Deed - Usage Guidelines

After completing the New York Transfer-on-Death Deed form, it is essential to ensure that it is properly executed and recorded. This will help in transferring property to the designated beneficiary upon the death of the property owner. Follow these steps to fill out the form accurately.

- Obtain the New York Transfer-on-Death Deed form from a reliable source, such as a legal website or your local county clerk's office.

- Fill in the name of the property owner in the designated section. This should match the name on the property title.

- Provide the address of the property being transferred. Ensure that it is complete and accurate to avoid any issues.

- Identify the beneficiary or beneficiaries. Include their full names and addresses. If there are multiple beneficiaries, list them clearly.

- Specify the relationship between the property owner and the beneficiary. This helps clarify the intent of the deed.

- Sign the form in the presence of a notary public. The signature must be dated.

- Have the notary public complete their section, which includes their signature and seal.

- Make copies of the completed and notarized form for your records.

- File the original deed with the appropriate county clerk’s office where the property is located. Check if there are any filing fees.

Once the form is filed, it will be recorded in the public records, ensuring that your wishes regarding the property are clear and legally binding.

Some Other Transfer-on-Death Deed State Templates

Transfer on Death Deed Florida Form - States vary in their acceptance and specific requirements for Transfer-on-Death Deeds.

Transfer Upon Death Deed Texas - Transferring property this way may prevent disputes among beneficiaries by clearly stating your intent.

Transfer on Death Deed Form Pennsylvania - It can help ensure that a loved one receives a property without delays after the owner's passing.

To successfully establish a corporation in Colorado, one must complete the Colorado Articles of Incorporation form, which details the corporation's name, purpose, and structure. For those seeking assistance with this important legal document, resources like Colorado PDF Templates can be invaluable in ensuring accurate and efficient filing.

What Is a Transfer on Death - This form eliminates potential disputes among heirs by clarifying the intended property distribution.

Dos and Don'ts

When filling out the New York Transfer-on-Death Deed form, it is important to follow specific guidelines to ensure accuracy and compliance. Below are six things you should and shouldn't do.

- Do provide complete and accurate information about the property.

- Do include the full names and addresses of all beneficiaries.

- Do sign the form in front of a notary public.

- Do ensure the deed is recorded with the county clerk's office.

- Don't leave any sections blank; all fields must be filled out.

- Don't use outdated forms; always use the most current version available.

Common mistakes

-

Incorrect Property Description: Failing to provide a complete and accurate description of the property can lead to confusion or disputes. Ensure that the legal description matches the one on the property deed.

-

Not Naming Beneficiaries: Omitting or incorrectly naming beneficiaries can cause delays or legal challenges. Double-check that all names are spelled correctly and include all intended beneficiaries.

-

Improper Signatures: The deed must be signed by the owner(s) of the property. If the signature is missing or not properly executed, the deed may be deemed invalid.

-

Failure to Notarize: Not having the deed notarized can invalidate the document. Ensure that a notary public witnesses the signing to meet legal requirements.

-

Not Recording the Deed: After filling out the form, it must be recorded with the appropriate county office. Failing to do so means the deed is not effective, and the transfer will not occur.

-

Ignoring State-Specific Rules: Each state may have unique requirements regarding Transfer-on-Death Deeds. Familiarize yourself with New York's specific regulations to avoid mistakes.