Free Real Estate Purchase Agreement Document for New York State

Document Sample

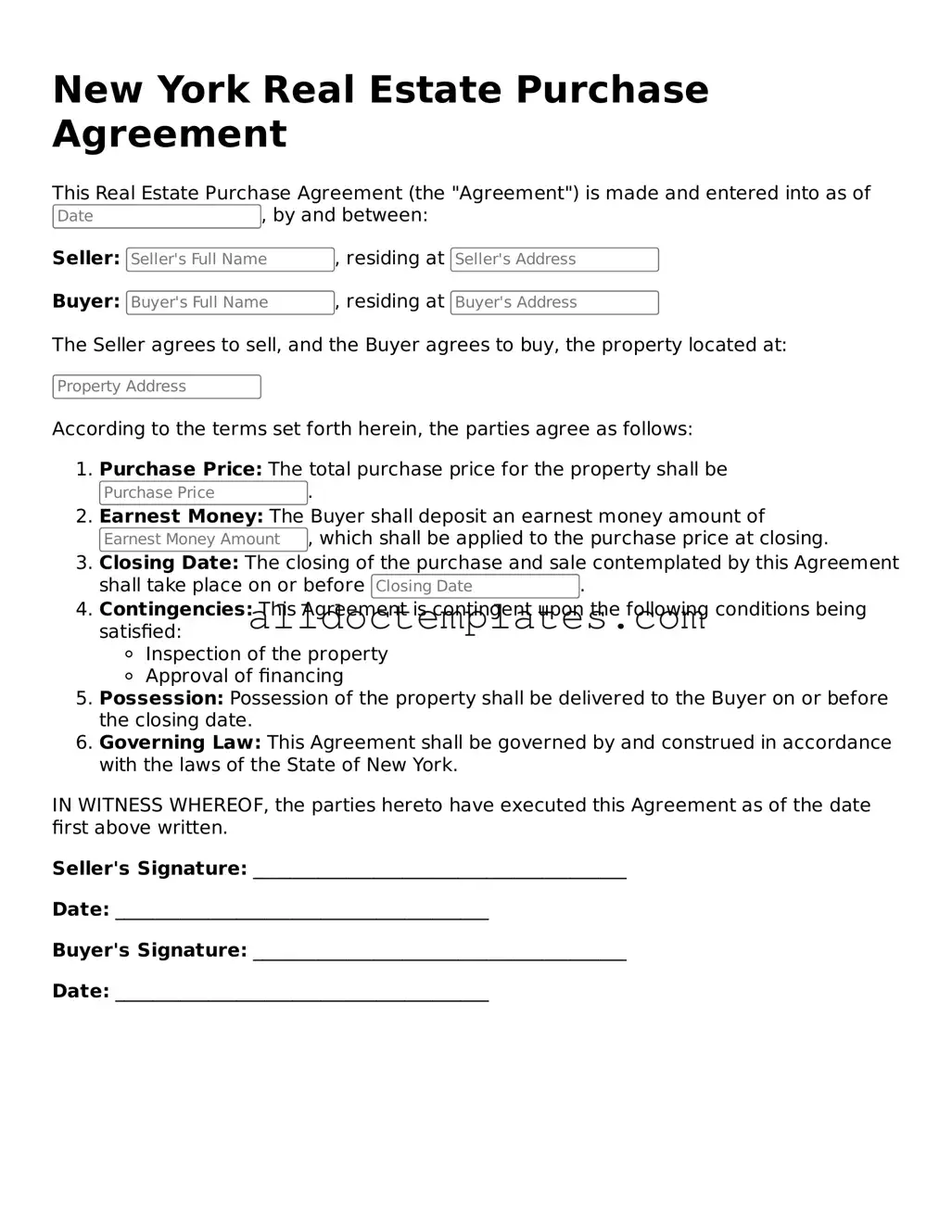

New York Real Estate Purchase Agreement

This Real Estate Purchase Agreement (the "Agreement") is made and entered into as of , by and between:

Seller: , residing at

Buyer: , residing at

The Seller agrees to sell, and the Buyer agrees to buy, the property located at:

According to the terms set forth herein, the parties agree as follows:

- Purchase Price: The total purchase price for the property shall be .

- Earnest Money: The Buyer shall deposit an earnest money amount of , which shall be applied to the purchase price at closing.

- Closing Date: The closing of the purchase and sale contemplated by this Agreement shall take place on or before .

- Contingencies: This Agreement is contingent upon the following conditions being satisfied:

- Inspection of the property

- Approval of financing

- Possession: Possession of the property shall be delivered to the Buyer on or before the closing date.

- Governing Law: This Agreement shall be governed by and construed in accordance with the laws of the State of New York.

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the date first above written.

Seller's Signature: ________________________________________

Date: ________________________________________

Buyer's Signature: ________________________________________

Date: ________________________________________

Form Data

| Fact Name | Details |

|---|---|

| Governing Law | The New York Real Estate Purchase Agreement is governed by New York State law. |

| Purpose | This agreement outlines the terms and conditions for the sale of real property in New York. |

| Parties Involved | The agreement typically involves a seller and a buyer, both of whom must be identified. |

| Property Description | A detailed description of the property being sold is required, including the address and any legal descriptions. |

| Purchase Price | The total purchase price must be clearly stated, along with any deposit amounts. |

| Contingencies | Common contingencies include financing, inspections, and the sale of the buyer's current home. |

| Closing Date | The agreement specifies a closing date, which is the date when ownership is officially transferred. |

| Disclosures | Sellers are required to disclose known issues with the property, such as lead paint or structural problems. |

| Signatures | Both parties must sign the agreement for it to be legally binding. |

| Legal Advice | It is strongly recommended that both parties seek legal advice before signing the agreement. |

New York Real Estate Purchase Agreement - Usage Guidelines

Completing the New York Real Estate Purchase Agreement is a crucial step in the property transaction process. Once the form is filled out, both parties can proceed with negotiations and finalize the sale. Follow these steps carefully to ensure accuracy and compliance.

- Identify the Parties: Begin by entering the full names and addresses of both the buyer and the seller. Ensure that all names are spelled correctly.

- Property Description: Provide a detailed description of the property being sold. Include the address, type of property, and any relevant parcel numbers.

- Purchase Price: Clearly state the total purchase price for the property. Be specific about the amount and any deposit being made.

- Financing Details: Indicate how the buyer intends to finance the purchase. Specify if it will be through a mortgage, cash, or other means.

- Closing Date: Set a target closing date for the transaction. This should be a mutually agreed-upon date that allows time for necessary inspections and financing arrangements.

- Contingencies: List any contingencies that must be met for the sale to proceed, such as home inspections, financing approvals, or the sale of another property.

- Signatures: Both the buyer and seller must sign and date the agreement. Ensure that all parties involved have signed before proceeding.

After completing the form, review all entries for accuracy. It’s advisable to have legal counsel or a real estate professional review the agreement to ensure all terms are clear and enforceable. Once finalized, copies should be distributed to all parties involved.

Some Other Real Estate Purchase Agreement State Templates

Real Estate Contract Template - Defines responsibilities for closing costs and other fees.

A Colorado Do Not Resuscitate (DNR) Order form is a legal document that allows individuals to refuse resuscitation efforts in the event of a medical emergency. This form ensures that a person's wishes regarding life-sustaining treatment are respected by healthcare providers. For those looking to better understand the process, resources like Colorado PDF Templates can provide valuable guidance on completing and utilizing this important document, which is essential for anyone considering their end-of-life care options.

Pa Real Estate Contract - A legal document outlining the terms for buying a property.

Real Estate Purchase Agreement Pdf - The form can include clauses that protect against unforeseen issues arising before closing.

Dos and Don'ts

When filling out the New York Real Estate Purchase Agreement form, it is crucial to follow specific guidelines to ensure accuracy and legality. Here are four things to do and not to do:

- Do: Review all sections of the form carefully before filling it out.

- Do: Provide accurate and complete information regarding the property and parties involved.

- Do: Consult with a real estate attorney if you have any questions or concerns.

- Do: Sign and date the agreement in the appropriate spaces to validate it.

- Don't: Rush through the form; taking your time can prevent mistakes.

- Don't: Leave any fields blank; incomplete forms may lead to legal issues.

- Don't: Use ambiguous language; clarity is essential for all terms and conditions.

- Don't: Forget to keep a copy of the signed agreement for your records.

Common mistakes

-

Incorrect Property Description: Failing to provide a complete and accurate description of the property can lead to significant issues. Ensure that the address, lot number, and any relevant identifiers are included.

-

Missing Signatures: All parties involved must sign the agreement. Overlooking a signature can invalidate the entire contract.

-

Neglecting Contingencies: Not including necessary contingencies, such as financing or inspection clauses, can leave buyers vulnerable. These contingencies protect buyers in case certain conditions are not met.

-

Inadequate Earnest Money Deposit: The amount of earnest money should reflect the seriousness of the offer. A deposit that is too low may raise concerns for the seller.

-

Vague Closing Date: Specifying a closing date is crucial. A vague or unspecified date can lead to confusion and potential delays.

-

Ignoring Local Laws: Each locality may have specific requirements. Failing to adhere to local regulations can jeopardize the transaction.

-

Not Disclosing Known Issues: Sellers are obligated to disclose any known defects or issues with the property. Not doing so can lead to legal repercussions.

-

Overlooking Financing Details: Clearly outlining the financing terms is essential. This includes the type of loan, interest rate, and any other relevant financial information.

-

Failure to Review Terms: Parties often rush through the terms without fully understanding them. Taking the time to read and comprehend each clause is vital.

-

Not Seeking Professional Help: Many individuals attempt to navigate the process without legal or real estate advice. Consulting with a professional can provide valuable guidance and prevent costly mistakes.