Free Promissory Note Document for New York State

Document Sample

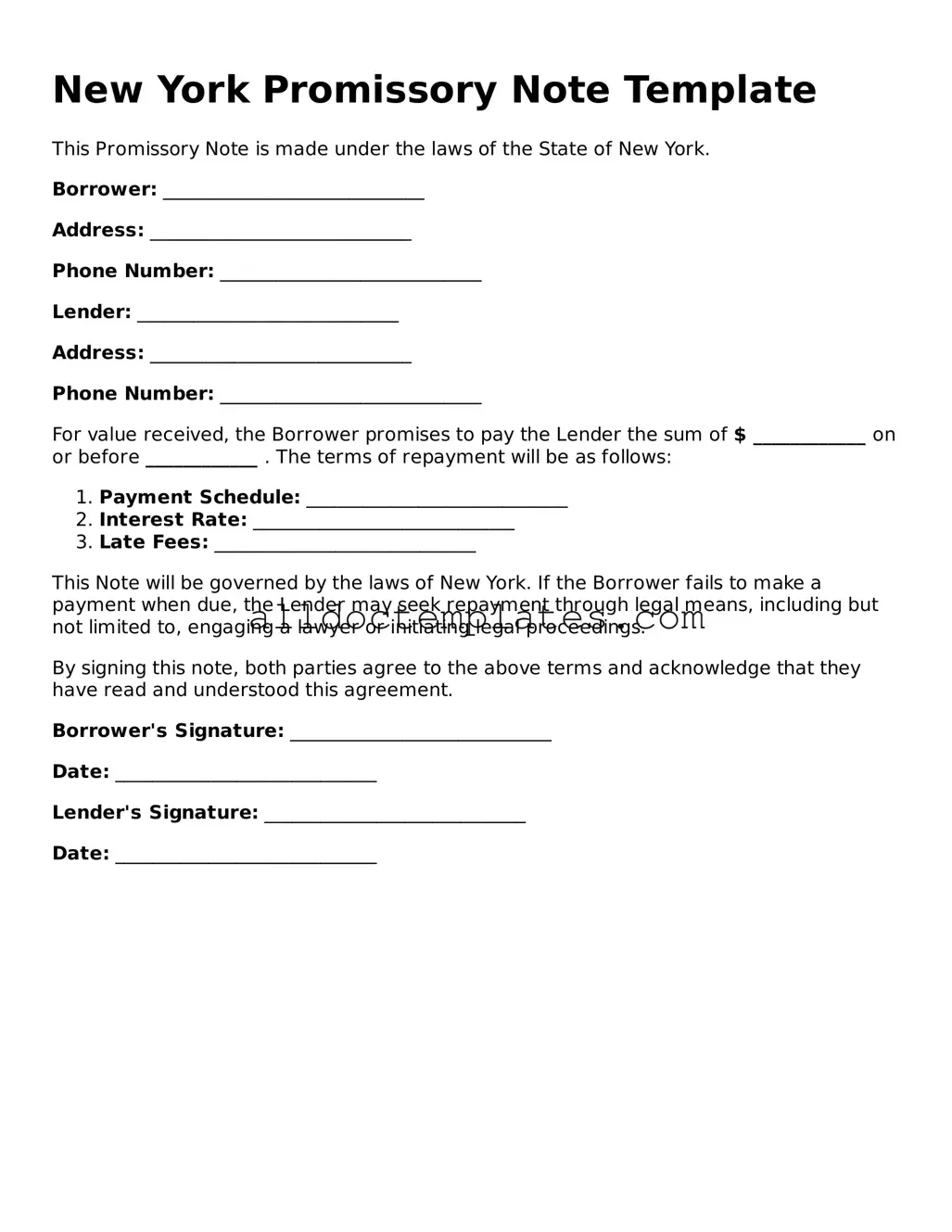

New York Promissory Note Template

This Promissory Note is made under the laws of the State of New York.

Borrower: ____________________________

Address: ____________________________

Phone Number: ____________________________

Lender: ____________________________

Address: ____________________________

Phone Number: ____________________________

For value received, the Borrower promises to pay the Lender the sum of $ ____________ on or before ____________ . The terms of repayment will be as follows:

- Payment Schedule: ____________________________

- Interest Rate: ____________________________

- Late Fees: ____________________________

This Note will be governed by the laws of New York. If the Borrower fails to make a payment when due, the Lender may seek repayment through legal means, including but not limited to, engaging a lawyer or initiating legal proceedings.

By signing this note, both parties agree to the above terms and acknowledge that they have read and understood this agreement.

Borrower's Signature: ____________________________

Date: ____________________________

Lender's Signature: ____________________________

Date: ____________________________

Form Data

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a future date. |

| Governing Law | In New York, promissory notes are governed by the Uniform Commercial Code (UCC), specifically Article 3, which deals with negotiable instruments. |

| Essential Elements | A valid promissory note must include the principal amount, interest rate, payment schedule, and the signatures of the parties involved. |

| Enforceability | To be enforceable, a promissory note must be clear and unambiguous, ensuring that both parties understand their obligations. |

New York Promissory Note - Usage Guidelines

Once you have your New York Promissory Note form ready, it's important to fill it out carefully to ensure all necessary information is included. This will help avoid any misunderstandings or disputes later on. Follow the steps below to complete the form accurately.

- Title the Document: At the top of the form, write "Promissory Note" to clearly identify the purpose of the document.

- Enter the Date: Write the date when the note is being executed. This is typically the date you are signing the document.

- Identify the Borrower: Fill in the full legal name and address of the person or entity borrowing the money. This should be clear and complete.

- Identify the Lender: Provide the full legal name and address of the person or entity lending the money. Ensure this information is accurate.

- Specify the Amount: Clearly state the amount of money being borrowed. Use numerals and words to avoid confusion.

- Detail the Interest Rate: If applicable, indicate the interest rate that will be charged on the borrowed amount. This can be a fixed or variable rate.

- Set the Repayment Terms: Outline how and when the borrower will repay the loan. Include details such as payment schedule and due dates.

- Include Late Fees: If there are any penalties for late payments, specify these fees in this section.

- Sign the Document: Both the borrower and lender must sign the note. Ensure that signatures are dated and printed names are included for clarity.

- Witness or Notary (if required): Depending on the situation, you may need a witness or notary to sign the document as well.

After completing the form, review it carefully to ensure all information is accurate and complete. Once satisfied, distribute copies to all parties involved for their records. Keeping a signed copy is essential for future reference.

Some Other Promissory Note State Templates

Promissory Note Template Texas - Promissory notes can be used alongside other contracts, like security agreements or purchase agreements.

Free Promissory Note Template Florida - The promissory note remains a critical tool in ensuring formalized loans.

A Colorado Medical Power of Attorney form is a legal document that allows an individual to designate someone else to make medical decisions on their behalf if they become unable to do so. This important tool ensures that a person's healthcare preferences are honored, even when they cannot communicate them. For those interested in obtaining or learning more about this essential document, resources like Colorado PDF Templates can provide valuable assistance in navigating the process.

Promissory Note Template California Word - Potential investors should conduct due diligence before purchasing a promissory note.

Dos and Don'ts

When filling out the New York Promissory Note form, it is important to follow certain guidelines to ensure accuracy and legality. Here are some dos and don'ts to keep in mind:

- Do read the entire form carefully before starting.

- Do provide clear and accurate information.

- Do include the full names and addresses of all parties involved.

- Do specify the loan amount clearly.

- Do indicate the interest rate, if applicable.

- Don't leave any sections blank unless instructed.

- Don't use vague terms; be specific in your language.

- Don't forget to date and sign the document.

- Don't overlook the need for witnesses or notarization if required.

Common mistakes

-

Missing Date: Many individuals forget to include the date on the promissory note. This can lead to confusion about when the loan agreement was made, which may affect its enforceability.

-

Incorrect Names: It's crucial to accurately spell the names of all parties involved. Errors can create legal complications and might make the document invalid.

-

Vague Loan Amount: Some people write the loan amount in a vague manner. Always state the amount clearly, both in numbers and words, to avoid misunderstandings.

-

Omitting Payment Terms: Failing to specify the repayment terms, such as the interest rate and payment schedule, can lead to disputes later on. Clearly outline these terms to ensure both parties are on the same page.

-

Not Including Signatures: A common oversight is neglecting to sign the document. Without signatures, the note may not hold up in court, as it lacks the necessary consent of the parties involved.

-

Ignoring Witnesses or Notarization: Depending on the situation, some notes may require witnesses or notarization. Failing to include these can weaken the document's legal standing.

-

Not Keeping Copies: After filling out the promissory note, it's essential to keep copies for all parties. This ensures everyone has access to the same information and can refer back to the agreement if needed.