Free Loan Agreement Document for New York State

Document Sample

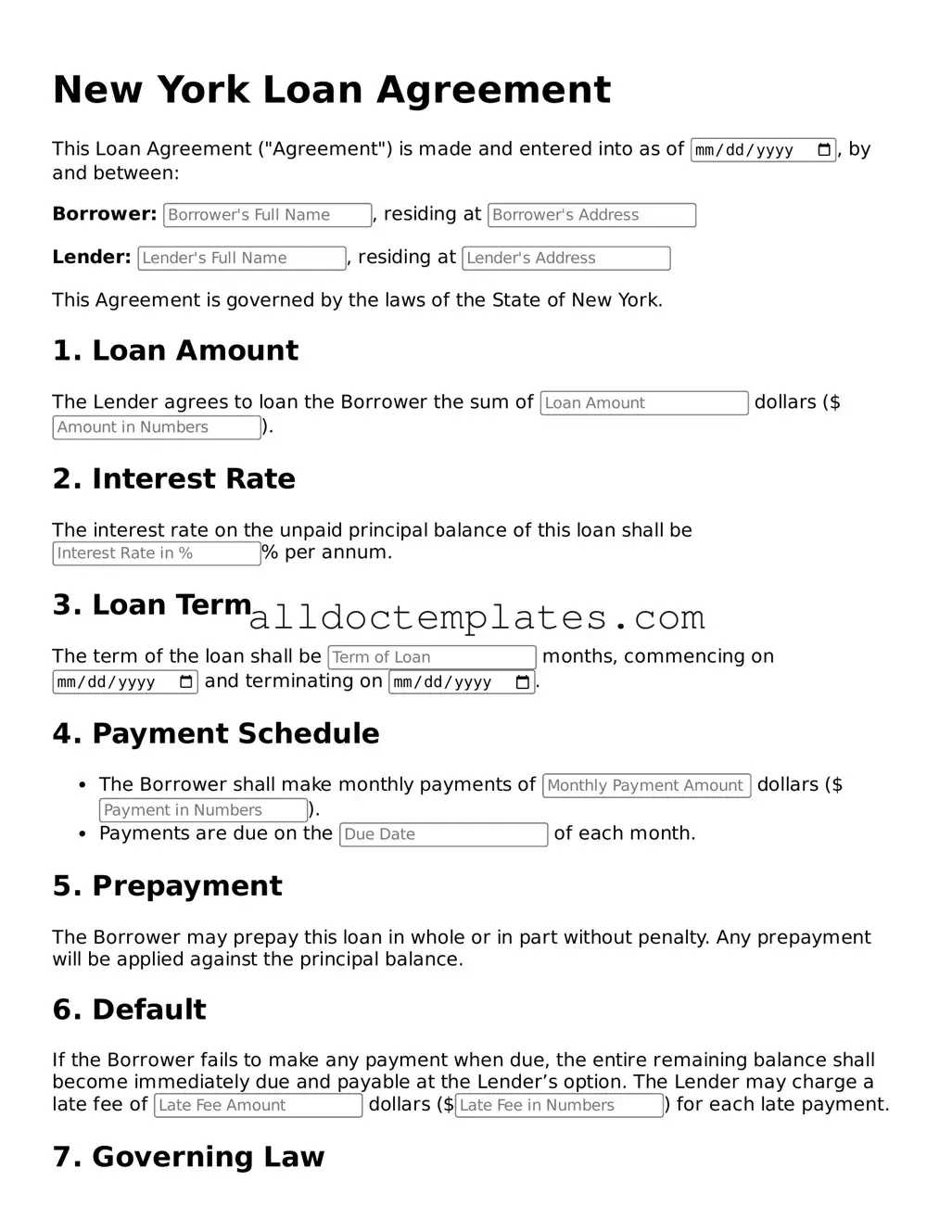

New York Loan Agreement

This Loan Agreement ("Agreement") is made and entered into as of , by and between:

Borrower: , residing at

Lender: , residing at

This Agreement is governed by the laws of the State of New York.

1. Loan Amount

The Lender agrees to loan the Borrower the sum of dollars ($).

2. Interest Rate

The interest rate on the unpaid principal balance of this loan shall be % per annum.

3. Loan Term

The term of the loan shall be months, commencing on and terminating on .

4. Payment Schedule

- The Borrower shall make monthly payments of dollars ($).

- Payments are due on the of each month.

5. Prepayment

The Borrower may prepay this loan in whole or in part without penalty. Any prepayment will be applied against the principal balance.

6. Default

If the Borrower fails to make any payment when due, the entire remaining balance shall become immediately due and payable at the Lender’s option. The Lender may charge a late fee of dollars ($) for each late payment.

7. Governing Law

This Agreement shall be governed by the laws of the State of New York without regard to its conflict of laws principles.

8. Entire Agreement

This Agreement constitutes the entire understanding between the parties concerning the subject matter hereof and supersedes all prior agreements and understandings.

9. Signatures

In witness whereof, the Borrower and Lender hereto have executed this Agreement as of the date first above written.

Borrower Signature: ___________________________ Date:

Lender Signature: ___________________________ Date:

Form Data

| Fact Name | Description |

|---|---|

| Governing Law | The New York Loan Agreement is governed by the laws of the State of New York. |

| Parties Involved | The agreement typically involves a lender and a borrower. |

| Loan Amount | The specific amount of money being loaned is clearly stated in the agreement. |

| Interest Rate | The agreement specifies the interest rate applicable to the loan. |

| Repayment Terms | Details about how and when the borrower will repay the loan are included. |

| Default Conditions | The agreement outlines what constitutes a default and the consequences of defaulting. |

| Collateral | If applicable, the agreement may specify any collateral securing the loan. |

| Governing Language | The agreement is typically written in English, which is the governing language. |

| Amendments | Any changes to the agreement must be made in writing and agreed upon by both parties. |

New York Loan Agreement - Usage Guidelines

Once you have the New York Loan Agreement form ready, you can begin filling it out. This process involves providing accurate information to ensure that the agreement is clear and legally binding. Follow these steps to complete the form properly.

- Start by entering the date at the top of the form.

- Fill in the name of the borrower. Make sure to include the full legal name.

- Provide the address of the borrower. Include the street address, city, state, and zip code.

- Next, enter the lender's name. This should also be the full legal name.

- Fill in the lender's address, including street address, city, state, and zip code.

- Specify the loan amount in numerical and written form. Be precise to avoid any misunderstandings.

- Indicate the interest rate for the loan. Ensure it is clear whether it is fixed or variable.

- Outline the repayment terms. Include the number of payments, frequency, and due dates.

- Detail any collateral that secures the loan, if applicable.

- Include any additional terms or conditions that are relevant to the agreement.

- Both the borrower and lender should sign and date the form at the bottom.

Some Other Loan Agreement State Templates

Sample Promissory Note California - Can outline any insurance requirements related to the loan.

When engaging in the purchase or sale of an all-terrain vehicle in Colorado, it is essential to utilize the Colorado ATV Bill of Sale form, which provides a comprehensive record of the transaction. To simplify this process, you can find a reliable template at Colorado PDF Templates, ensuring all necessary details are properly documented for a seamless transfer of ownership.

Dos and Don'ts

When filling out the New York Loan Agreement form, it's essential to approach the process with care. Here are some important dos and don'ts to keep in mind:

- Do read the entire form carefully before starting.

- Do provide accurate and complete information.

- Do double-check all figures and calculations.

- Do sign and date the form where required.

- Don't leave any sections blank unless instructed.

- Don't rush through the process; take your time to ensure accuracy.

- Don't ignore the terms and conditions; understand what you are agreeing to.

Common mistakes

-

Incorrect Personal Information: Many people fail to provide accurate names, addresses, or contact details. This can lead to delays or complications.

-

Missing Signatures: Some individuals overlook signing the agreement. Without a signature, the document may be considered invalid.

-

Inaccurate Loan Amount: Entering the wrong loan amount can cause confusion and disputes later on. Always double-check this figure.

-

Failure to Read Terms: Skimming through the terms and conditions is common. Understanding the obligations is crucial before signing.

-

Neglecting to Include Co-Signers: If applicable, not listing co-signers can affect the loan's approval. Ensure all necessary parties are included.

-

Incorrect Dates: Some people mistakenly enter the wrong date for the agreement or repayment schedule. This can lead to misunderstandings.

-

Not Providing Financial Information: Failing to include necessary financial details can hinder the loan process. Be thorough in this section.

-

Ignoring Required Documentation: Many forget to attach supporting documents, such as proof of income or identification. This can delay processing.