Free Deed in Lieu of Foreclosure Document for New York State

Document Sample

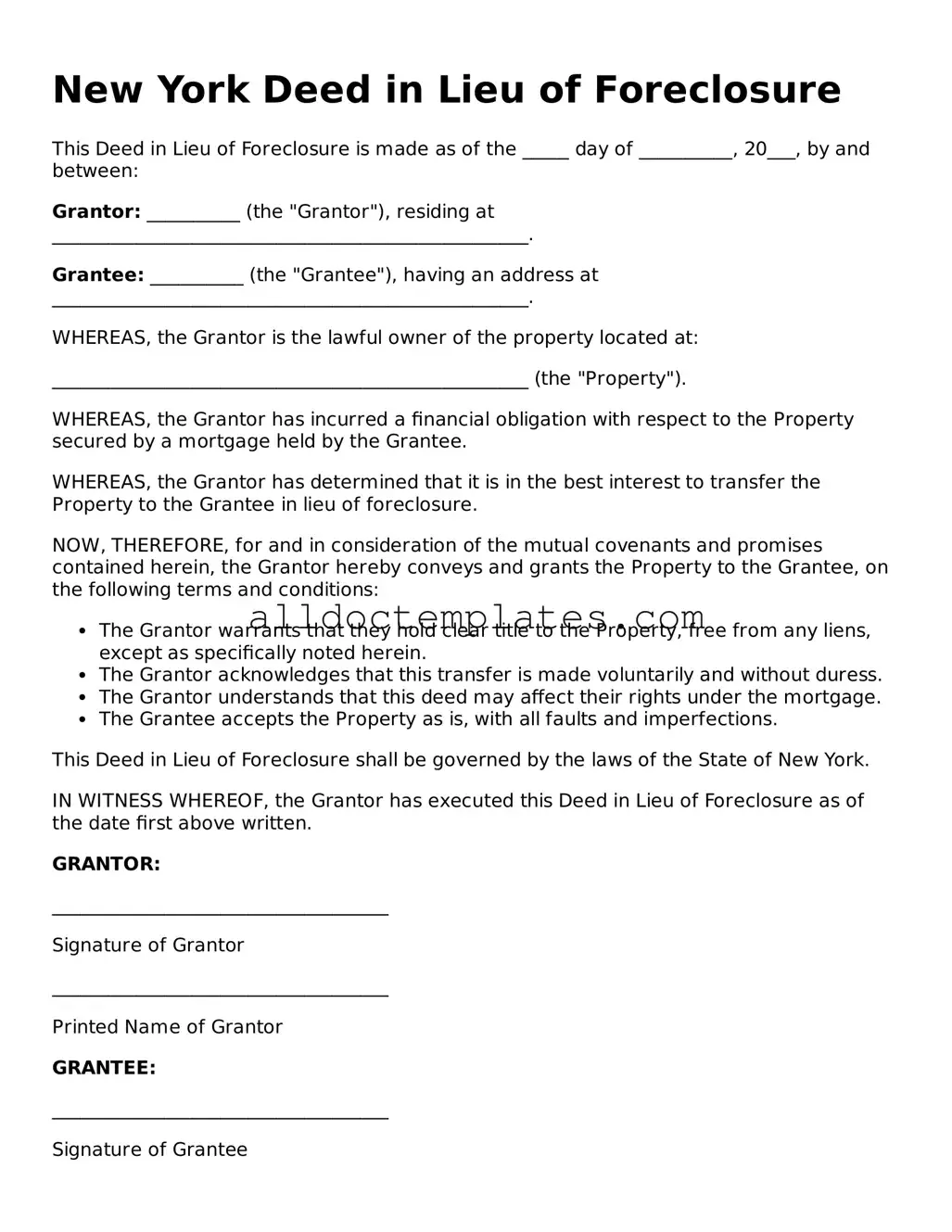

New York Deed in Lieu of Foreclosure

This Deed in Lieu of Foreclosure is made as of the _____ day of __________, 20___, by and between:

Grantor: __________ (the "Grantor"), residing at ___________________________________________________.

Grantee: __________ (the "Grantee"), having an address at ___________________________________________________.

WHEREAS, the Grantor is the lawful owner of the property located at:

___________________________________________________ (the "Property").

WHEREAS, the Grantor has incurred a financial obligation with respect to the Property secured by a mortgage held by the Grantee.

WHEREAS, the Grantor has determined that it is in the best interest to transfer the Property to the Grantee in lieu of foreclosure.

NOW, THEREFORE, for and in consideration of the mutual covenants and promises contained herein, the Grantor hereby conveys and grants the Property to the Grantee, on the following terms and conditions:

- The Grantor warrants that they hold clear title to the Property, free from any liens, except as specifically noted herein.

- The Grantor acknowledges that this transfer is made voluntarily and without duress.

- The Grantor understands that this deed may affect their rights under the mortgage.

- The Grantee accepts the Property as is, with all faults and imperfections.

This Deed in Lieu of Foreclosure shall be governed by the laws of the State of New York.

IN WITNESS WHEREOF, the Grantor has executed this Deed in Lieu of Foreclosure as of the date first above written.

GRANTOR:

____________________________________

Signature of Grantor

____________________________________

Printed Name of Grantor

GRANTEE:

____________________________________

Signature of Grantee

____________________________________

Printed Name of Grantee

STATE OF NEW YORK

COUNTY OF ______________

On this _____ day of __________, 20___, before me, a Notary Public, personally appeared ________________________, known to me or satisfactorily proven to be the person whose name is subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

IN WITNESS WHEREOF, I hereunto set my hand and official seal.

____________________________________

Notary Public

Form Data

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Governing Law | In New York, the process is governed by New York Real Property Actions and Proceedings Law. |

| Eligibility | Homeowners facing financial difficulties may be eligible for a Deed in Lieu of Foreclosure if they cannot keep up with mortgage payments. |

| Mutual Agreement | Both the borrower and lender must agree to the terms outlined in the deed for it to be valid. |

| Property Condition | The property must be free of liens or judgments to ensure a smooth transfer of ownership. |

| Impact on Credit | A Deed in Lieu of Foreclosure may negatively impact the borrower's credit score, but it is typically less damaging than a foreclosure. |

| Tax Implications | Borrowers should consult a tax professional, as there may be tax consequences related to forgiven debt. |

| Timeframe | The process can be quicker than a traditional foreclosure, often taking a few months to complete. |

| Release of Liability | In some cases, lenders may release the borrower from any further liability on the mortgage after the deed is transferred. |

| Alternative Options | Homeowners should explore other options, such as loan modifications or short sales, before deciding on a Deed in Lieu of Foreclosure. |

New York Deed in Lieu of Foreclosure - Usage Guidelines

Once you have decided to proceed with the Deed in Lieu of Foreclosure, it’s important to fill out the form accurately. This process involves providing specific information about the property and the parties involved. Following these steps will help ensure that you complete the form correctly.

- Obtain the Form: Start by downloading the New York Deed in Lieu of Foreclosure form from a reliable source or your lender’s website.

- Identify the Parties: Fill in the names and addresses of the borrower (the property owner) and the lender (the bank or financial institution).

- Property Description: Provide a detailed description of the property. This includes the address, county, and any relevant parcel identification numbers.

- Consideration: State the consideration, which is often the amount of debt being forgiven or any other agreement made between the parties.

- Signatures: Ensure that the borrower signs the form. If there are multiple borrowers, all must sign. The lender’s representative may also need to sign.

- Notarization: Have the signatures notarized. This step is crucial for the form to be legally binding.

- Record the Deed: Submit the completed form to the county clerk’s office where the property is located to have it officially recorded.

After completing the form, keep copies for your records. The next steps will involve waiting for confirmation from the lender regarding the acceptance of the deed and any further actions that may be required on your part. This process can take some time, so patience is key.

Some Other Deed in Lieu of Foreclosure State Templates

California Voluntary Property Surrender Document - Benefits may include avoiding legal fees associated with foreclosure actions.

Deed in Lieu of Forclosure - Homeowners may need to demonstrate their financial hardships to qualify for a Deed in Lieu agreement.

For those looking to understand the essentials of the Tractor Bill of Sale, the form available can facilitate a smooth transaction. Don't miss out on this crucial document that ensures the legal transfer of ownership by referencing the important Arizona Tractor Bill of Sale requirements.

Will I Owe Money After a Deed in Lieu of Foreclosure - This option usually requires compliance with lender guidelines and possible evaluations.

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - The Deed in Lieu form can also help prevent further debt accumulation from ongoing mortgage payments.

Dos and Don'ts

When filling out the New York Deed in Lieu of Foreclosure form, it's important to approach the process with care. Here are ten things to keep in mind:

- Do ensure all information is accurate and up-to-date.

- Don't leave any sections blank; fill in all required fields.

- Do consult with a legal professional if you have questions.

- Don't rush through the form; take your time to review each detail.

- Do sign the document in the presence of a notary public.

- Don't forget to keep copies of the completed form for your records.

- Do provide any additional documentation requested by your lender.

- Don't submit the form without confirming that all parties involved agree to the terms.

- Do check for any specific instructions from your lender regarding the submission process.

- Don't ignore deadlines; submit the form promptly to avoid complications.

Common mistakes

-

Incomplete Information: Failing to provide all required details can lead to delays or rejection of the deed. Ensure that all sections are filled out accurately.

-

Incorrect Property Description: A vague or incorrect description of the property can create confusion. Always double-check the legal description to ensure it matches public records.

-

Not Signing the Document: Omitting signatures can invalidate the deed. All parties involved must sign where indicated.

-

Neglecting Notarization: Some forms require notarization. Failing to have the document notarized can hinder its acceptance.

-

Ignoring Lien Information: Not disclosing existing liens can complicate the process. Be transparent about any liens against the property.

-

Missing Dates: Forgetting to include important dates can create legal issues. Ensure that all necessary dates are filled in correctly.

-

Overlooking Local Requirements: Each jurisdiction may have specific rules. Research local regulations to ensure compliance with all requirements.