Free Deed Document for New York State

Document Sample

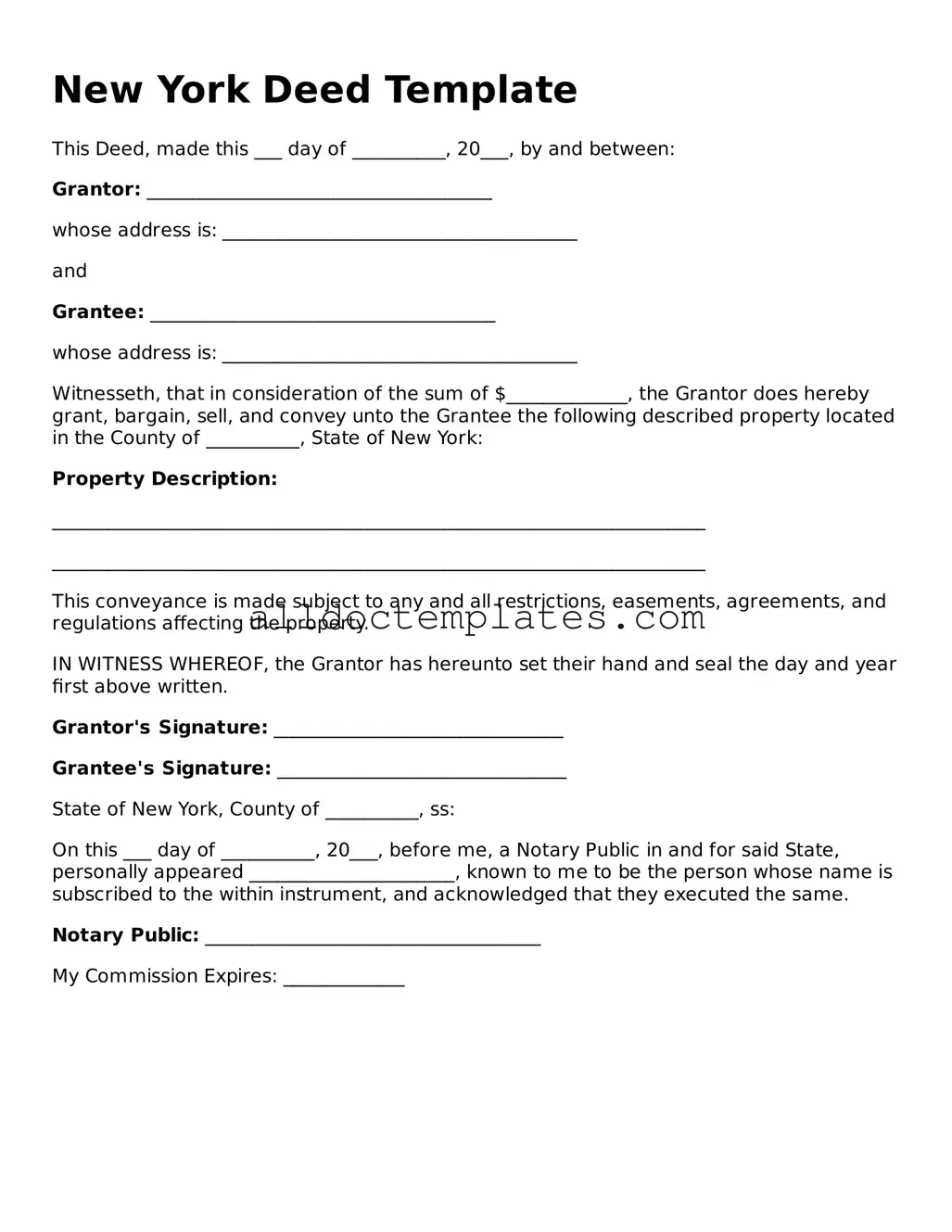

New York Deed Template

This Deed, made this ___ day of __________, 20___, by and between:

Grantor: _____________________________________

whose address is: ______________________________________

and

Grantee: _____________________________________

whose address is: ______________________________________

Witnesseth, that in consideration of the sum of $_____________, the Grantor does hereby grant, bargain, sell, and convey unto the Grantee the following described property located in the County of __________, State of New York:

Property Description:

______________________________________________________________________

______________________________________________________________________

This conveyance is made subject to any and all restrictions, easements, agreements, and regulations affecting the property.

IN WITNESS WHEREOF, the Grantor has hereunto set their hand and seal the day and year first above written.

Grantor's Signature: _______________________________

Grantee's Signature: _______________________________

State of New York, County of __________, ss:

On this ___ day of __________, 20___, before me, a Notary Public in and for said State, personally appeared ______________________, known to me to be the person whose name is subscribed to the within instrument, and acknowledged that they executed the same.

Notary Public: ____________________________________

My Commission Expires: _____________

Form Data

| Fact Name | Description |

|---|---|

| Definition | A New York Deed is a legal document used to transfer property ownership from one party to another. |

| Types of Deeds | Common types include Warranty Deed, Quitclaim Deed, and Bargain and Sale Deed. |

| Governing Laws | The transfer of property in New York is governed by the New York Real Property Law. |

| Execution Requirements | The deed must be signed by the grantor in the presence of a notary public. |

| Recording | To be effective against third parties, the deed must be recorded in the county clerk's office where the property is located. |

| Consideration | A nominal consideration is often included, but it is not always required for the deed to be valid. |

| Transfer Tax | New York imposes a real estate transfer tax on the sale of property, which must be paid at the time of recording. |

| Legal Description | The deed must include a legal description of the property being transferred. |

| Revocation | Once executed and delivered, a deed cannot be revoked unilaterally; both parties must agree to any changes. |

New York Deed - Usage Guidelines

Once you have the New York Deed form ready, it's time to fill it out accurately. This form is essential for transferring property ownership, and completing it correctly is crucial for ensuring a smooth transaction. Follow these steps carefully to ensure all necessary information is included.

- Begin by entering the date at the top of the form.

- Provide the name of the grantor (the person transferring the property). Include their address and any other required identifying information.

- List the name of the grantee (the person receiving the property) along with their address.

- Describe the property being transferred. Include the full address and any relevant details such as lot number or section number.

- Indicate the consideration, or the amount paid for the property. This is often a dollar amount.

- Sign the form in the designated area. Make sure the signature matches the name of the grantor.

- Have the form notarized. A notary public will verify your identity and witness your signature.

- Submit the completed form to the appropriate county office for recording. Check local requirements for any additional documentation needed.

Some Other Deed State Templates

Texas Deed Transfer Form - Deeds play a crucial role in estate planning and inheritance.

Broward County Quit Claim Deed - Necessary for recording property ownership history.

Grant Deed California - Deeds must be signed, dated, and often notarized to be valid.

The importance of a clear and detailed divorce settlement cannot be overstated, and utilizing resources such as the Colorado PDF Templates can significantly aid in drafting an effective agreement that protects the interests of both parties involved.

Pennsylvania Deed Transfer Form - Property owners can benefit from reviewing their Deeds during refinancing.

Dos and Don'ts

When filling out the New York Deed form, it’s essential to follow certain guidelines to ensure that the document is completed correctly. Here’s a helpful list of what to do and what to avoid.

- Do ensure accurate information: Double-check that all names, addresses, and property details are correct.

- Do sign in the presence of a notary: Your signature must be notarized to validate the deed.

- Do include a legal description of the property: This should be precise to avoid any confusion in the future.

- Do provide the correct tax identification number: This is necessary for the tax records.

- Do keep a copy for your records: Always retain a copy of the completed deed for your personal files.

- Don't leave any blanks: All sections of the form must be filled out completely.

- Don't use white-out: If you make a mistake, cross it out and write the correct information above.

- Don't forget to check local requirements: Different counties may have additional rules or forms to submit.

- Don't rush the process: Take your time to ensure everything is accurate and complete.

- Don't forget to pay the required fees: Ensure that all applicable fees are paid when submitting the deed.

Common mistakes

-

Incorrect Names: People often misspell names or use incorrect legal names. Ensure that the names match the ones on identification documents.

-

Wrong Property Description: Failing to provide a clear and accurate description of the property can lead to issues. Use the legal description from the property deed or tax records.

-

Missing Signatures: All required parties must sign the deed. Omitting a signature can invalidate the document.

-

Improper Notarization: The deed must be notarized correctly. Make sure the notary's information is complete and that they sign and seal the document.

-

Incorrect Date: Entering the wrong date can create confusion. Double-check that the date reflects when the deed was signed.

-

Failure to Include Consideration: Not stating the amount of consideration (payment) can lead to complications. Always include this information, even if it’s a nominal amount.

-

Not Filing the Deed: After completing the deed, some forget to file it with the county clerk’s office. This step is crucial for the deed to be legally recognized.