Fill in a Valid Netspend Dispute Form

Document Sample

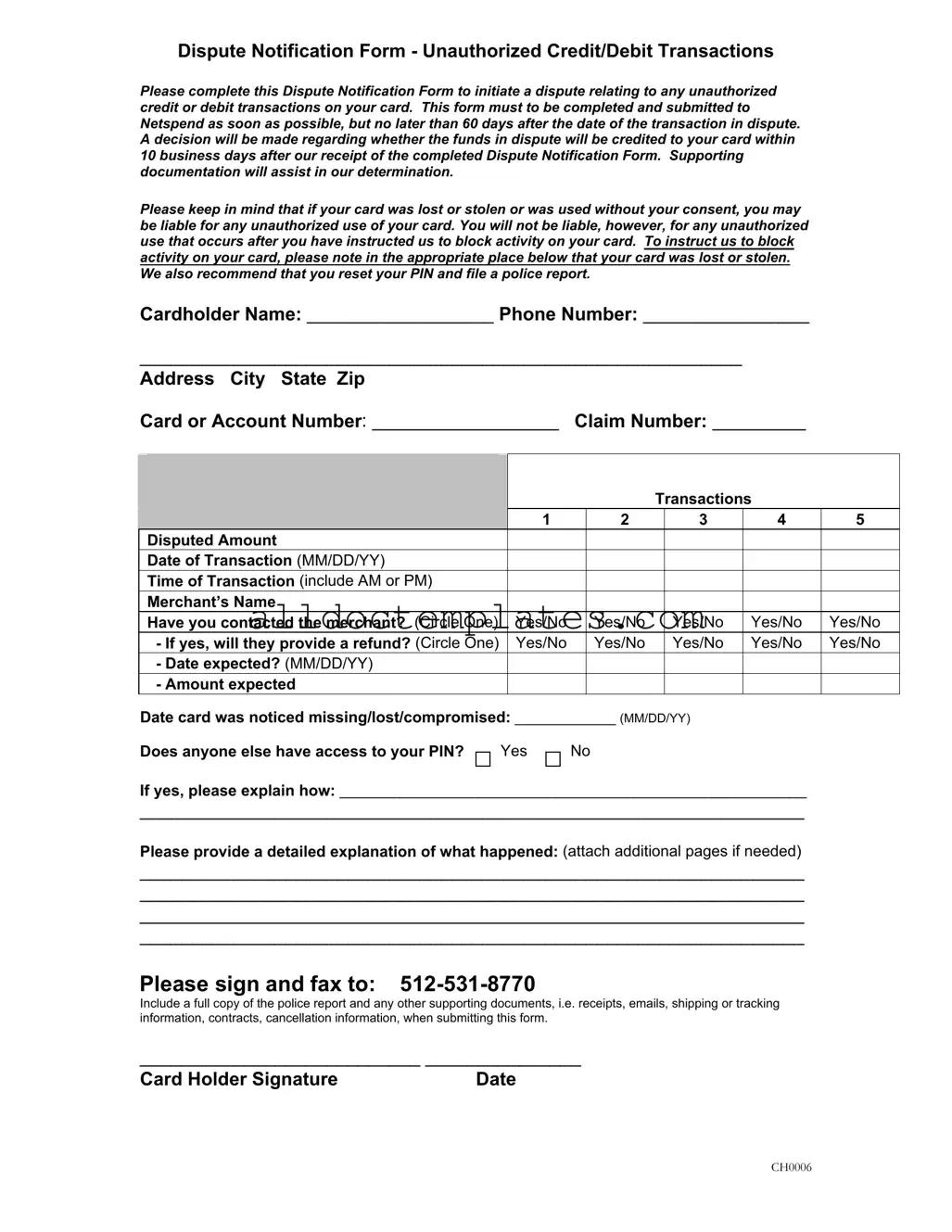

Dispute Notification Form - Unauthorized Credit/Debit Transactions

Please complete this Dispute Notification Form to initiate a dispute relating to any unauthorized credit or debit transactions on your card. This form must to be completed and submitted to Netspend as soon as possible, but no later than 60 days after the date of the transaction in dispute. A decision will be made regarding whether the funds in dispute will be credited to your card within 10 business days after our receipt of the completed Dispute Notification Form. Supporting documentation will assist in our determination.

Please keep in mind that if your card was lost or stolen or was used without your consent, you may be liable for any unauthorized use of your card. You will not be liable, however, for any unauthorized use that occurs after you have instructed us to block activity on your card. To instruct us to block activity on your card, please note in the appropriate place below that your card was lost or stolen. We also recommend that you reset your PIN and file a police report.

Cardholder Name: __________________ Phone Number: ________________ |

|

||||||||

__________________________________________________________ |

|

|

|||||||

Address City State Zip |

|

|

|

|

|

|

|

||

Card or Account Number: __________________ |

Claim Number: _________ |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

Please provide information for each |

|

|

|

|

|

|

|

|

|

transaction you are disputing (submit up to 5 |

|

|

|

|

|

|

|

|

|

on one form) |

|

|

|

|

Transactions |

|

||

|

|

|

1 |

|

2 |

|

3 |

4 |

5 |

Disputed Amount |

|

|

|

|

|

|

|

||

Date of Transaction (MM/DD/YY) |

|

|

|

|

|

|

|

||

Time of Transaction (include AM or PM) |

|

|

|

|

|

|

|

||

Merchant’s Name |

|

|

|

|

|

|

|

||

Have you contacted the merchant? (Circle One) |

Yes/No |

|

Yes/No |

|

Yes/No |

Yes/No |

Yes/No |

||

|

- If yes, will they provide a refund? (Circle One) |

Yes/No |

|

Yes/No |

|

Yes/No |

Yes/No |

Yes/No |

|

|

- Date expected? (MM/DD/YY) |

|

|

|

|

|

|

|

|

|

- Amount expected |

|

|

|

|

|

|

|

|

Date card was noticed missing/lost/compromised: _____________ (MM/DD/YY)

Does anyone else have access to your PIN?

Yes

No

If yes, please explain how: ______________________________________________________

________________________________________________________________

Please provide a detailed explanation of what happened: (attach additional pages if needed)

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

Please sign and fax to:

Include a full copy of the police report and any other supporting documents, i.e. receipts, emails, shipping or tracking information, contracts, cancellation information, when submitting this form.

___________________________ _______________

Card Holder Signature |

Date |

CH0006

Document Information

| Fact Name | Details |

|---|---|

| Form Purpose | This form is used to dispute unauthorized credit or debit transactions on a Netspend card. |

| Submission Deadline | Complete and submit the form within 60 days of the disputed transaction date. |

| Decision Timeline | Netspend will decide on the dispute and notify you within 10 business days of receiving the form. |

| Liability Information | If your card was lost or stolen, you may be liable for unauthorized transactions unless you reported the loss. |

| Supporting Documents | Attach any relevant documents, such as police reports or receipts, to strengthen your dispute claim. |

Netspend Dispute - Usage Guidelines

Once you have gathered all necessary information, you are ready to fill out the Netspend Dispute form. This form is essential for formally addressing any unauthorized transactions on your card. Completing it accurately and promptly is crucial, as it helps expedite the review process. You will need to provide personal details, transaction information, and any relevant documentation to support your claim.

- Download the Dispute Notification Form: Obtain the form from the Netspend website or your account dashboard.

- Fill in your personal information: Enter your name, phone number, and address, including city, state, and zip code.

- Provide card details: Write your card or account number and any claim number if applicable.

- List disputed transactions: For each transaction you are disputing (up to five), fill in the following details:

- Disputed amount

- Date of transaction (MM/DD/YY)

- Time of transaction (include AM or PM)

- Merchant’s name

- Have you contacted the merchant? (Circle Yes or No)

- If yes, will they provide a refund? (Circle Yes or No)

- Date expected for refund (MM/DD/YY)

- Amount expected

- Indicate if your card was lost or stolen: Provide the date you noticed your card was missing or compromised.

- PIN access: State whether anyone else has access to your PIN and explain if applicable.

- Detailed explanation: Write a thorough description of the situation. Attach additional pages if necessary.

- Sign the form: Include your signature and the date at the bottom of the form.

- Submit the form: Fax the completed form to 512-531-8770. Ensure you include a full copy of the police report and any supporting documents such as receipts or emails.

Common PDF Forms

Medication Administration Record Pdf Fillable - Often checked for accuracy during audits and reviews.

A comprehensive understanding of the Medical Power of Attorney form is vital for safeguarding one's healthcare preferences, and resources such as Colorado PDF Templates can provide essential guidance on how to correctly complete this important legal document.

Baseball Tryout Form - This standardized format streamlines the evaluation process.

What Is Veteran Designation - A veterans service office representative verifies the applicant's status.

Dos and Don'ts

When filling out the Netspend Dispute form, there are several important steps to follow. Here is a list of things you should and shouldn't do:

- Do complete the form as soon as possible, ideally within 60 days of the disputed transaction.

- Do provide accurate and detailed information about each transaction you are disputing.

- Do include any supporting documentation, such as receipts or police reports, to strengthen your case.

- Do sign the form before submitting it to ensure it is valid.

- Do keep a copy of the completed form and any attachments for your records.

- Don't leave any sections of the form blank; incomplete forms may delay the processing of your dispute.

- Don't submit the form without checking for errors or missing information.

- Don't forget to indicate if your card was lost or stolen; this information is crucial.

- Don't ignore the importance of contacting the merchant first, if applicable.

- Don't delay in submitting the form, as time is of the essence in these situations.

Common mistakes

-

Failing to Submit Within the Deadline: Many individuals do not realize that the form must be submitted within 60 days of the transaction date. Missing this deadline can result in the dispute being denied.

-

Incomplete Information: Some people leave sections of the form blank. Providing complete information, such as the cardholder name, address, and transaction details, is essential for processing the dispute.

-

Incorrect Transaction Details: Errors in the disputed amount, date, or merchant name can lead to confusion. Ensure that all transaction details are accurate to avoid delays.

-

Not Including Supporting Documentation: Failing to attach necessary documents like receipts or police reports can hinder the dispute process. Supporting evidence strengthens the claim.

-

Neglecting to Contact the Merchant: Some individuals do not check with the merchant before submitting the dispute. Contacting the merchant may resolve the issue more quickly.

-

Ignoring PIN Access: Not disclosing if someone else has access to the PIN can complicate the dispute. This information is crucial for understanding potential liability.

-

Inadequate Explanation: Providing a vague or unclear description of what happened can lead to misunderstandings. A detailed account helps clarify the situation.

-

Not Following Up: After submitting the form, some people fail to follow up on the status of their dispute. Regularly checking can provide updates and ensure timely processing.

-

Submitting Multiple Disputes on One Form: The form allows for up to five transactions, but some submitters may not realize that each transaction should be clearly separated and detailed.

-

Forgetting to Sign the Form: Omitting a signature can result in delays or rejections. Always double-check that the form is signed before submission.