Valid Motor Vehicle Bill of Sale Template

Document Sample

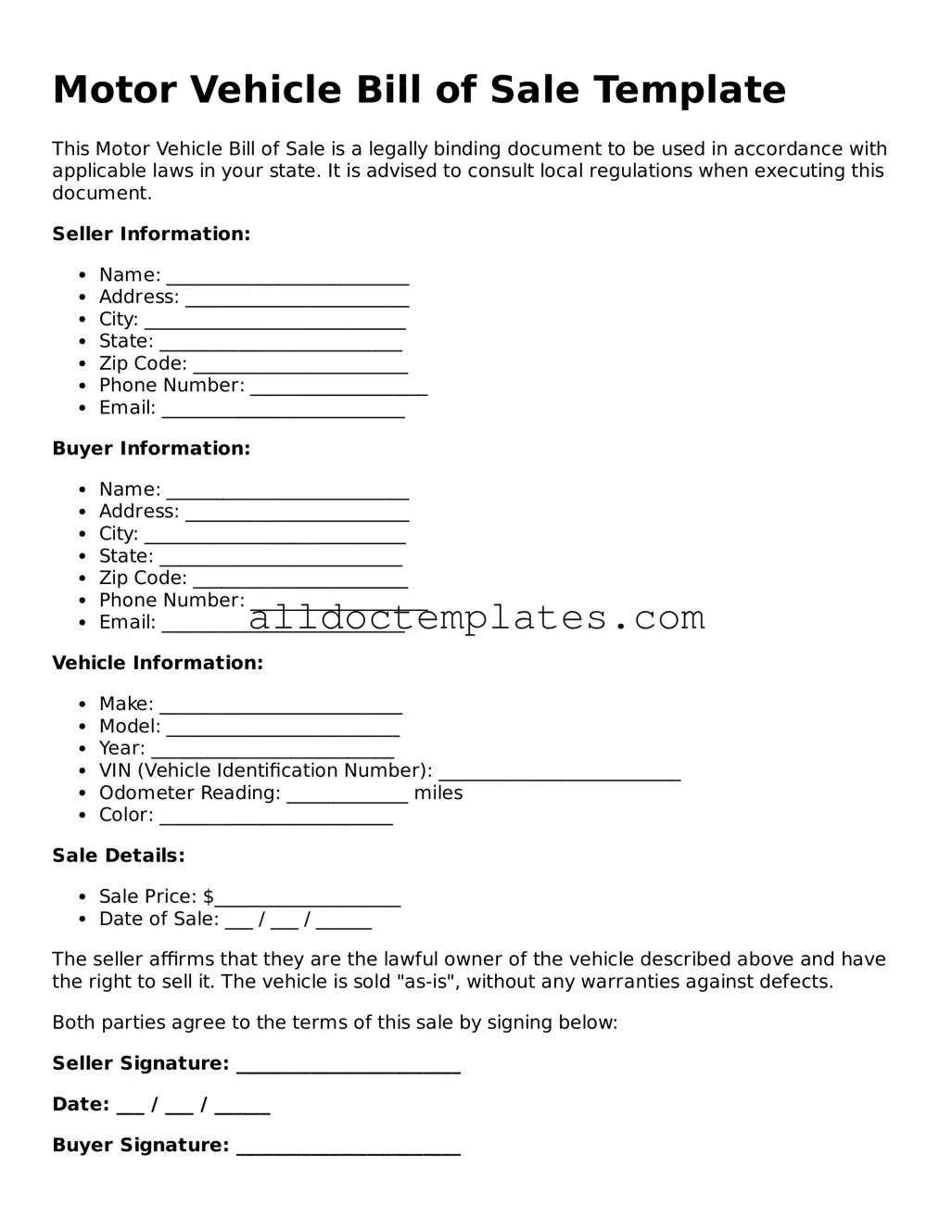

Motor Vehicle Bill of Sale Template

This Motor Vehicle Bill of Sale is a legally binding document to be used in accordance with applicable laws in your state. It is advised to consult local regulations when executing this document.

Seller Information:

- Name: __________________________

- Address: ________________________

- City: ____________________________

- State: __________________________

- Zip Code: _______________________

- Phone Number: ___________________

- Email: __________________________

Buyer Information:

- Name: __________________________

- Address: ________________________

- City: ____________________________

- State: __________________________

- Zip Code: _______________________

- Phone Number: ___________________

- Email: __________________________

Vehicle Information:

- Make: __________________________

- Model: _________________________

- Year: __________________________

- VIN (Vehicle Identification Number): __________________________

- Odometer Reading: _____________ miles

- Color: _________________________

Sale Details:

- Sale Price: $____________________

- Date of Sale: ___ / ___ / ______

The seller affirms that they are the lawful owner of the vehicle described above and have the right to sell it. The vehicle is sold "as-is", without any warranties against defects.

Both parties agree to the terms of this sale by signing below:

Seller Signature: ________________________

Date: ___ / ___ / ______

Buyer Signature: ________________________

Date: ___ / ___ / ______

This Bill of Sale serves as a receipt for the transfer of ownership, and both parties are advised to retain a copy for their records.

State-specific Information for Motor Vehicle Bill of Sale Forms

Form Data

| Fact Name | Description |

|---|---|

| Purpose | The Motor Vehicle Bill of Sale form serves as a legal document that records the sale of a vehicle between a buyer and a seller. |

| Identification | This form typically includes details such as the vehicle identification number (VIN), make, model, year, and odometer reading. |

| Buyer and Seller Information | Both the buyer and seller must provide their names, addresses, and signatures to validate the transaction. |

| State-Specific Forms | Different states may have their own specific Bill of Sale forms, which comply with local laws. |

| Governing Law | In many states, the sale of motor vehicles is governed by the Uniform Commercial Code (UCC) and state-specific vehicle codes. |

| Notarization | Some states require the Bill of Sale to be notarized for it to be legally binding. |

| Tax Implications | The Bill of Sale may be used to determine sales tax obligations for the buyer, depending on state regulations. |

| Record Keeping | It is advisable for both parties to keep a copy of the Bill of Sale for their records, as it serves as proof of the transaction. |

| Transfer of Ownership | The Bill of Sale is often required to complete the transfer of ownership at the Department of Motor Vehicles (DMV). |

| Condition of Vehicle | The form may include a section where the seller can disclose the condition of the vehicle, ensuring transparency in the sale. |

Motor Vehicle Bill of Sale - Usage Guidelines

After obtaining the Motor Vehicle Bill of Sale form, you will need to complete it accurately to ensure a smooth transfer of ownership. Follow these steps to fill out the form correctly.

- Identify the seller and buyer: Write the full names and addresses of both the seller and the buyer at the top of the form.

- Provide vehicle details: Enter the vehicle identification number (VIN), make, model, year, and color of the vehicle.

- State the sale price: Clearly indicate the amount the buyer is paying for the vehicle.

- Include the date of sale: Write the date when the transaction is taking place.

- Sign the form: Both the seller and buyer must sign and date the form to validate the transaction.

Once the form is completed, both parties should keep a copy for their records. This document serves as proof of the sale and can be important for future reference, such as when registering the vehicle or for tax purposes.

More Types of Motor Vehicle Bill of Sale Templates:

Bill of Sale for Puppy - Can help new owners with information about the dog's previous lifestyle.

In addition to understanding the importance of the California Release of Liability form, it is essential to access reliable resources when preparing this document. For those looking for templates and guidance, you can visit All Templates PDF, which provides useful tools to ensure your form is correctly completed and legally sound.

Tractor Bill of Sale - Provides proof of sale for a tractor transaction, ensuring clear ownership rights.

Golf Cart Title - Use this form to document the sale price and terms of a golf cart transaction.

Dos and Don'ts

When filling out the Motor Vehicle Bill of Sale form, it is essential to follow certain guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn't do.

- Do provide accurate information about the vehicle, including make, model, year, and VIN.

- Do include the full names and addresses of both the buyer and seller.

- Do specify the sale price clearly to avoid confusion.

- Do sign and date the form to validate the transaction.

- Do keep a copy of the completed Bill of Sale for your records.

- Don't leave any fields blank; incomplete forms can lead to issues later.

- Don't use abbreviations that could cause misunderstandings.

- Don't forge signatures; all parties must sign willingly.

- Don't forget to check local requirements, as they may vary by state.

Common mistakes

-

Not including the correct vehicle identification number (VIN). This number is crucial for identifying the vehicle and must be accurate.

-

Failing to provide the full name and address of both the buyer and seller. This information is necessary for legal purposes and should be complete.

-

Leaving out the date of the sale. This date marks when the transaction occurred and is important for records.

-

Not indicating the sale price clearly. The amount should be written in both words and numbers to avoid confusion.

-

Using a form that is outdated or not applicable in their state. Always check that the form meets current state requirements.

-

Neglecting to sign the form. Both parties must sign the bill of sale for it to be valid.

-

Forgetting to include any disclosures about the vehicle’s condition. If there are known issues, they should be documented.

-

Not providing a witness signature if required by state law. Some states mandate that a witness be present at the signing.

-

Ignoring local regulations regarding vehicle sales. Each state may have specific rules that need to be followed.

-

Not keeping a copy of the signed bill of sale. Both parties should retain a copy for their records in case of future disputes.