Fill in a Valid Mortgage Statement Form

Document Sample

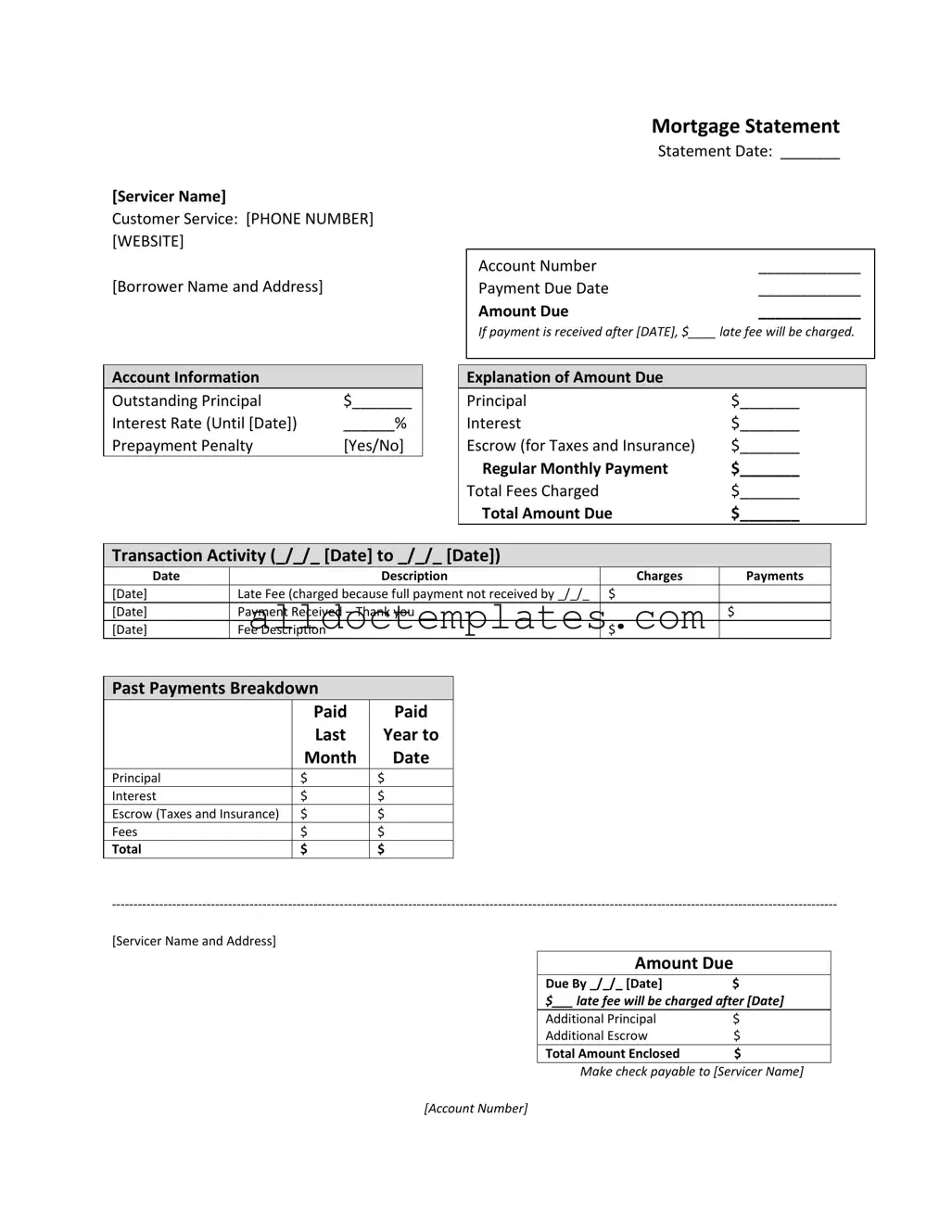

[Servicer Name]

Customer Service: [PHONE NUMBER] [WEBSITE]

[Borrower Name and Address]

Mortgage Statement

Statement Date: _______

Account Number |

____________ |

Payment Due Date |

____________ |

Amount Due |

____________ |

If payment is received after [DATE], $____ late fee will be charged.

Account Information

Outstanding Principal |

$_______ |

Interest Rate (Until [Date]) |

______% |

Prepayment Penalty |

[Yes/No] |

Explanation of Amount Due

Principal |

$_______ |

Interest |

$_______ |

Escrow (for Taxes and Insurance) |

$_______ |

Regular Monthly Payment |

$_______ |

Total Fees Charged |

$_______ |

Total Amount Due |

$_______ |

Transaction Activity (_/_/_ [Date] to _/_/_ [Date])

Date |

Description |

Charges |

Payments |

[Date] |

Late Fee (charged because full payment not received by _/_/_ |

$ |

|

[Date] |

Payment Received – Thank you |

|

$ |

[Date] |

Fee Description |

$ |

|

Past Payments Breakdown

|

Paid |

Paid |

|

Last |

Year to |

|

Month |

Date |

Principal |

$ |

$ |

Interest |

$ |

$ |

Escrow (Taxes and Insurance) |

$ |

$ |

Fees |

$ |

$ |

Total |

$ |

$ |

[Servicer Name and Address]

Amount Due

Due By _/_/_ [Date]$

$___ late fee will be charged after [Date]

Additional Principal |

$ |

Additional Escrow |

$ |

Total Amount Enclosed |

$ |

Make check payable to [Servicer Name]

[Account Number]

[Additional tables to be translated]

Important Messages

*Partial Payments: Any partial payments that you make are not applied to your mortgage, but instead are held in a separate suspense account. If you pay the balance of a partial payment, the funds will then be applied to your mortgage.

**Delinquency Notice**

You are late on your mortgage payments. Failure to bring your loan current may result in fees and foreclosure – the loss of your home. As of [Date], you are __ days delinquent on your mortgage loan.

Recent Account History

·Payment due [Date]: Fully paid on time

·Payment due [Date]: Fully paid on [Date]

·Payment due [Date]: Unpaid balance of $________

·Current payment due [Date]: $_______

·Total: $_______ due. You must pay this amount to bring your loan current.

If you are Experiencing Financial Difficulty: See back for information about mortgage counseling or assistance.

Document Information

| Fact Name | Description |

|---|---|

| Servicer Information | The mortgage statement includes the servicer's name, customer service phone number, and website for borrower inquiries. |

| Payment Details | It specifies the payment due date, amount due, and any applicable late fees if payment is not received by the stated date. |

| Account Information | Outstanding principal, interest rate, and whether a prepayment penalty applies are detailed in this section. |

| Transaction Activity | This section records the date and description of charges and payments made during the specified period. |

| Delinquency Notice | A warning is provided if the borrower is late on payments, indicating potential fees and the risk of foreclosure. |

Mortgage Statement - Usage Guidelines

Completing the Mortgage Statement form is an essential step in managing your mortgage account. By following the instructions carefully, you can ensure that all necessary information is accurately provided. This will help in maintaining clear communication with your mortgage servicer and facilitate any required actions regarding your account.

- Start with the Servicer Information: Fill in the name of the mortgage servicer, their customer service phone number, and website at the top of the form.

- Borrower Information: Enter your name and address in the designated fields.

- Statement Details: Record the statement date, your account number, payment due date, and the amount due.

- Late Fee Information: Note the date after which a late fee will be charged and the amount of that fee.

- Account Information: Fill in the outstanding principal, interest rate (along with the applicable date), and whether there is a prepayment penalty.

- Explanation of Amount Due: Break down the amount due into principal, interest, escrow for taxes and insurance, regular monthly payment, total fees charged, and total amount due.

- Transaction Activity: List the date range for transaction activity. Include any charges, payments, and late fees that have occurred during this period.

- Past Payments Breakdown: Document the payments made last year, detailing amounts for principal, interest, escrow, fees, and total payments.

- Final Amount Due: Indicate the total amount due, the due date, and any late fee details.

- Payment Instructions: Specify how to make the payment, including the servicer name and account number for check payments.

- Important Messages: Review the important messages regarding partial payments and delinquency notices, and take note of any recommendations for financial assistance if needed.

Common PDF Forms

Vs4 Form - The relationship of the parties involved is clearly outlined for clarity.

To effectively manage the transaction, it is important to utilize resources like the Colorado PDF Templates which provide the necessary forms and guidelines for completing the Colorado Mobile Home Bill of Sale.

Progress Notes Should Be Written - Emergency evaluation; patient presenting with chest pain.

Dos and Don'ts

When filling out the Mortgage Statement form, there are important dos and don’ts to keep in mind. Following these guidelines can help ensure your submission is accurate and processed efficiently.

- Do read the entire form carefully before starting.

- Do provide accurate personal information, including your name and address.

- Do double-check the payment due date and amount due.

- Do keep a copy of the completed form for your records.

- Do contact customer service if you have questions about the form.

- Don't leave any required fields blank.

- Don't ignore the late fee information; it’s crucial to avoid unnecessary charges.

- Don't submit the form without verifying the total amount due.

- Don't forget to sign and date the form if required.

- Don't use abbreviations or unclear language when filling out the form.

Common mistakes

-

Incorrect Servicer Information: Failing to include the correct servicer name, phone number, or website can lead to communication issues. Always double-check this information before submitting.

-

Missing Borrower Details: Omitting the borrower's name and address can result in delays. Ensure that these details are accurate and complete.

-

Neglecting Important Dates: Forgetting to fill in the statement date, payment due date, or the date after which a late fee applies can create confusion. Take your time to fill in these dates correctly.

-

Inaccurate Amounts: Providing incorrect figures for outstanding principal, interest rate, or total amount due can lead to payment issues. Double-check all amounts listed on the form.

-

Ignoring Prepayment Penalty: Not indicating whether a prepayment penalty applies can lead to unexpected fees. Be sure to clarify this information if applicable.

-

Overlooking Transaction Activity: Failing to record transaction activity accurately may result in misunderstandings about payments made. Keep a detailed account of all transactions.

-

Submitting Partial Payments: If you make a partial payment, it won’t be applied to your mortgage. Understand this policy and ensure you pay the full amount due.

-

Ignoring Delinquency Notices: Not paying attention to delinquency notices can lead to serious consequences, including foreclosure. Make sure to address any overdue payments promptly.

-

Forgetting to Include Payment: Not enclosing the payment or providing the correct account number can delay processing. Always include a check made out to the servicer and verify the account number is correct.