Valid Mortgage Lien Release Template

Document Sample

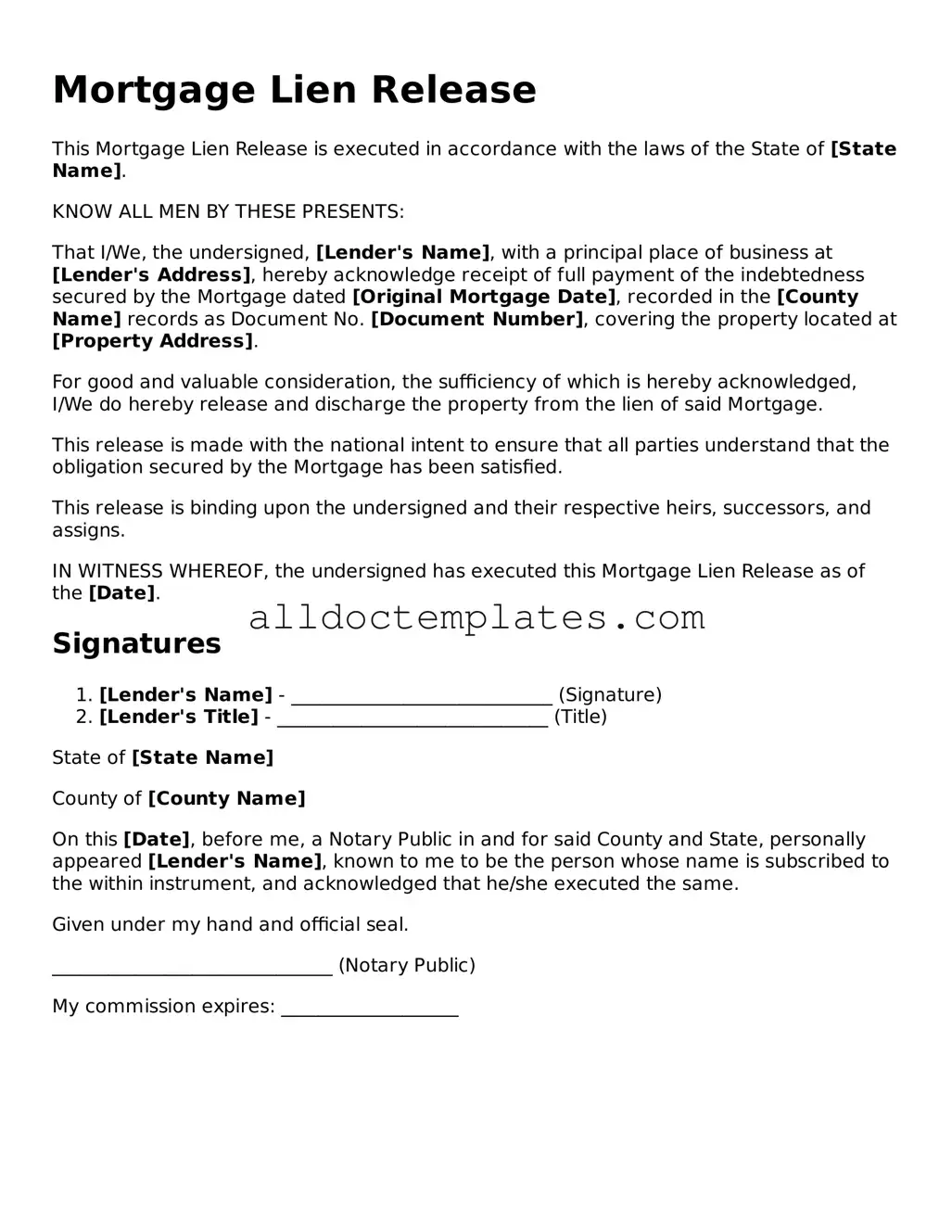

Mortgage Lien Release

This Mortgage Lien Release is executed in accordance with the laws of the State of [State Name].

KNOW ALL MEN BY THESE PRESENTS:

That I/We, the undersigned, [Lender's Name], with a principal place of business at [Lender's Address], hereby acknowledge receipt of full payment of the indebtedness secured by the Mortgage dated [Original Mortgage Date], recorded in the [County Name] records as Document No. [Document Number], covering the property located at [Property Address].

For good and valuable consideration, the sufficiency of which is hereby acknowledged, I/We do hereby release and discharge the property from the lien of said Mortgage.

This release is made with the national intent to ensure that all parties understand that the obligation secured by the Mortgage has been satisfied.

This release is binding upon the undersigned and their respective heirs, successors, and assigns.

IN WITNESS WHEREOF, the undersigned has executed this Mortgage Lien Release as of the [Date].

Signatures

- [Lender's Name] - ____________________________ (Signature)

- [Lender's Title] - _____________________________ (Title)

State of [State Name]

County of [County Name]

On this [Date], before me, a Notary Public in and for said County and State, personally appeared [Lender's Name], known to me to be the person whose name is subscribed to the within instrument, and acknowledged that he/she executed the same.

Given under my hand and official seal.

______________________________ (Notary Public)

My commission expires: ___________________

Form Data

| Fact Name | Description |

|---|---|

| Definition | A Mortgage Lien Release form is a legal document that officially removes a mortgage lien from a property once the debt has been paid in full. |

| Purpose | The main purpose of this form is to provide clear evidence that the borrower has fulfilled their obligations, thus allowing for the free transfer or sale of the property. |

| Governing Law | The laws governing the Mortgage Lien Release form vary by state. For example, in California, it is governed by the California Civil Code Section 2941. |

| Filing Requirements | After the form is completed, it must be filed with the appropriate county recorder's office to make the release official. |

| Signature Requirement | The form typically requires the signature of the lender or their authorized representative to validate the release. |

| Impact on Credit | Once the lien is released, it can positively impact the borrower's credit score, as it reflects that the debt has been settled. |

| Timeframe | The timeframe for processing a Mortgage Lien Release can vary, but it generally takes a few weeks after submission to the county office. |

| Importance for Buyers | For potential buyers, ensuring that a Mortgage Lien Release has been filed is crucial to avoid inheriting any debts associated with the property. |

Mortgage Lien Release - Usage Guidelines

Once you have the Mortgage Lien Release form, it's important to fill it out accurately to ensure the release is processed smoothly. Follow these steps to complete the form correctly.

- Start with the date at the top of the form. Write the date you are filling out the form.

- Enter the name of the borrower. This should be the person who took out the mortgage.

- Next, provide the name of the lender. This is the financial institution that issued the mortgage.

- Fill in the property address. Include the street address, city, state, and zip code.

- Locate the mortgage details section. Write the original loan amount and the date the mortgage was executed.

- In the section for the release, indicate that the mortgage is being released. You may need to check a box or write a statement.

- Sign the form in the designated area. If there are multiple borrowers, each must sign.

- Include the printed names of all signers below their signatures.

- Have the form notarized if required. This may vary by state.

- Make copies of the completed form for your records before submitting it.

After completing the form, submit it to the appropriate county office where the property is located. This will officially record the release of the lien. Keep an eye on any confirmation or receipt provided after submission.

More Types of Mortgage Lien Release Templates:

Permission to Use Artwork Form - It is important for exhibitions, publications, and promotions.

For those looking to understand the importance of the Vehicle Release of Liability form in vehicle transactions, it's crucial to recognize how this document safeguards both parties involved. By utilizing this form, sellers can ensure they are no longer liable for any claims post-transfer, fostering a secure exchange of ownership.

Media Release Statement - Allows individuals to share their story through media.

Release Form for Filming - This document serves to protect both the actor's rights and the production’s ability to proceed.

Dos and Don'ts

When filling out the Mortgage Lien Release form, it is important to follow certain guidelines to ensure accuracy and compliance. Here is a list of things to do and not to do:

- Do read the entire form carefully before starting.

- Do provide accurate and complete information.

- Do sign and date the form in the appropriate sections.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank.

- Don't use correction fluid or tape on the form.

- Don't submit the form without verifying all details are correct.

Common mistakes

-

Incorrect Property Information: One common mistake is failing to provide accurate details about the property. This includes the address, parcel number, or legal description. Even a small error can cause delays in processing the release.

-

Missing Signatures: Another frequent error is neglecting to include all required signatures. Both the lender and the borrower must sign the form. If any signature is missing, the release may not be valid.

-

Improper Notarization: Some people overlook the notarization requirement. The form must be notarized to confirm the identities of the signers. Without proper notarization, the release may face challenges in enforcement.

-

Failure to Submit on Time: Timing is crucial. Submitting the form too late can complicate matters. It’s important to file the release promptly after the mortgage is paid off to avoid potential legal issues.