Fill in a Valid Membership Ledger Form

Document Sample

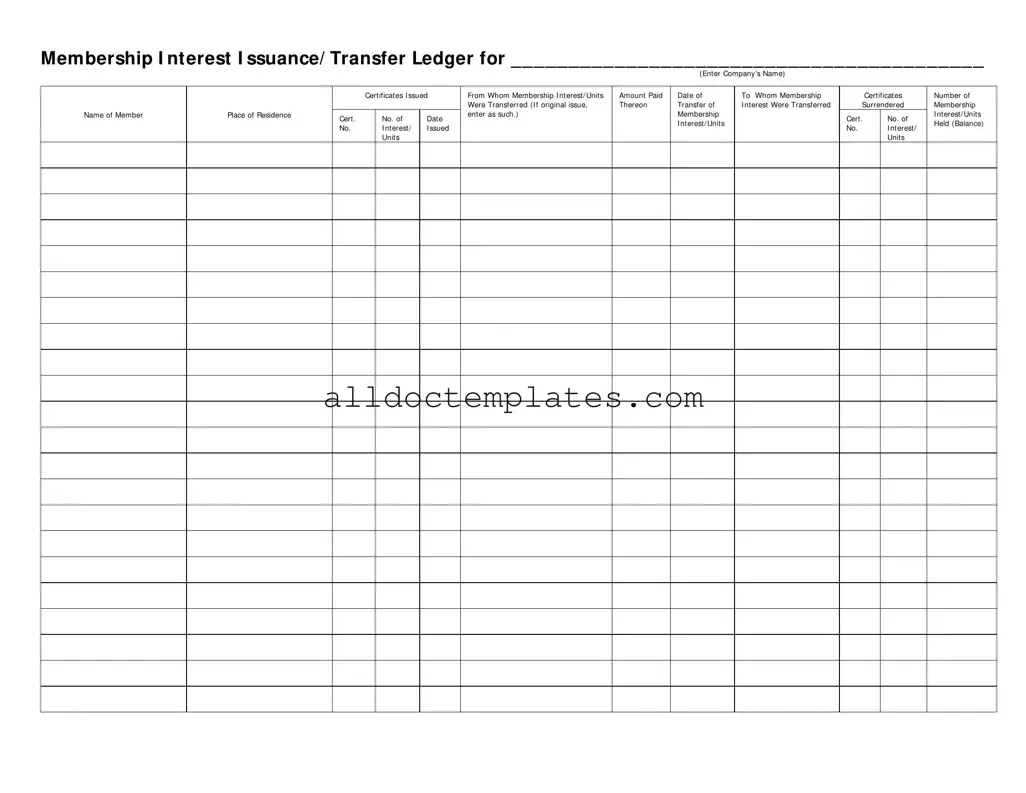

Membership I nt erest I ssuance/ Transfer Ledger for _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

(Enter Company’s Name)

|

|

|

Certificates I ssued |

From Whom Membership I nterest/ Units |

Amount Paid |

Date of |

To Whom Membership |

||

|

|

|

|

|

|

Were Transferred (I f original issue, |

Thereon |

Transfer of |

I nterest Were Transferred |

Name of Member |

Place of Residence |

Cert . |

|

No. of |

Date |

enter as such.) |

|

Membership |

|

|

|

|

|

|

I nterest/ Units |

|

|||

|

|

No. |

|

I nterest/ |

I ssued |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Units |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Certificates

Surrendered

Cert . |

No. of |

No. |

I nterest/ |

|

Units |

|

|

Number of Membership

I nterest/ Units Held (Balance)

Document Information

| Fact Name | Description |

|---|---|

| Purpose | The Membership Ledger form is used to document the issuance and transfer of membership interests or units in a company. |

| Company Name | It requires the name of the company at the top, ensuring clarity about which entity the ledger pertains to. |

| Certificates Issued | This form tracks the certificates issued, detailing from whom the membership interests were originally acquired. |

| Transfer Details | It captures the details of the transfer, including the name of the member to whom the interests were transferred. |

| Amount Paid | The ledger records the amount paid for the membership interests, providing a clear financial history. |

| Date of Transfer | Each transfer is dated, establishing a timeline for ownership changes. |

| Original Issue Tracking | If the membership interest is an original issue, this must be indicated in the ledger. |

| Certificates Surrendered | The form includes a section to note any certificates that have been surrendered during the transfer process. |

| Balance of Interests | The ledger keeps a running total of the number of membership interests or units held by each member. |

| Governing Laws | State-specific laws may govern the use of this form, such as the Uniform Limited Liability Company Act (ULLCA) or specific state corporation laws. |

Membership Ledger - Usage Guidelines

Filling out the Membership Ledger form requires careful attention to detail. This form is essential for tracking membership interests, including issuance and transfers. Following the steps below will help ensure that the information is accurately recorded.

- Begin by entering the Company’s Name at the top of the form in the designated space.

- In the section labeled Certificates Issued, note the name of the individual or entity from whom the membership interest or units are being issued.

- Fill in the Amount Paid for the membership interest or units being issued.

- Record the Date when the membership interest or units were issued.

- In the To Whom Membership Were Transferred section, list the name of the individual or entity to whom the membership interest or units were transferred.

- If this is an original issue, indicate it clearly in the appropriate section.

- Provide the Name of Member who is receiving the membership interest or units.

- Include the Place of Residence for the member.

- In the Cert. No. field, enter the certificate number of the membership interest or units issued.

- Record the Date of transfer of interest, if applicable.

- List the Membership Interest/Units Issued in the next section.

- Document the Certificates Surrendered if any, along with their certificate numbers.

- Indicate the Number of Membership Interest/Units Held (Balance) at the end of the form.

Once you have completed these steps, review the form for any inaccuracies or missing information. This will ensure that all details are correct before submission.

Common PDF Forms

Ncaa Physical Form 2023 - The form will help identify any necessary accommodations for athletes.

When engaging in activities that may carry inherent risks, utilizing a Colorado Hold Harmless Agreement can be crucial. This legal document serves to protect one party from potential liability, allowing individuals or organizations to participate without the looming fear of legal consequences. For those interested in learning more about how to properly implement this agreement, refer to resources like Colorado PDF Templates, which offer guidance on crafting this essential form and ensuring all parties are informed of their responsibilities.

Status Change Form - Document rehires with this form to maintain clear employment history.

Dos and Don'ts

When filling out the Membership Ledger form, there are several important practices to keep in mind. Here’s a concise list of dos and don’ts to ensure accuracy and clarity.

- Do enter the company’s name clearly at the top of the form.

- Do accurately record the details of membership interest or units issued, including the amount paid and the date.

- Do include the names of both the transferor and transferee when a membership interest is transferred.

- Do ensure that all certificate numbers are noted correctly to avoid confusion.

- Do maintain a copy of the completed form for your records.

- Don’t leave any fields blank; incomplete information can lead to issues later.

- Don’t use abbreviations or shorthand that may not be understood by others reviewing the form.

- Don’t forget to double-check for any spelling errors, especially names and addresses.

- Don’t alter the format of the form; it should remain as provided for consistency.

- Don’t submit the form without verifying that all entries are accurate and complete.

Common mistakes

-

Neglecting to enter the company’s name: The form requires the company’s name at the top. Failing to include this information can lead to confusion about which organization the ledger pertains to.

-

Incorrectly filling out the date: Dates should be entered in a consistent format. Using different formats can create discrepancies and make it difficult to track transfers accurately.

-

Omitting the certificate number: Each membership interest or unit must have a corresponding certificate number. Leaving this blank can hinder the verification process.

-

Failing to indicate whether the interest is original or transferred: Clearly stating if the membership interest is being issued for the first time or if it is a transfer is crucial for record-keeping.

-

Not specifying the amount paid: Each entry must include the amount paid for the membership interest or units. Omitting this information can lead to misunderstandings about ownership and value.

-

Leaving out the place of residence: The form requires the place of residence for each member. This information is essential for maintaining accurate records and ensuring proper communication.

-

Inaccurate recording of membership interest/units held: It is important to provide the correct balance of membership interest or units held. Errors in this section can lead to disputes among members.

-

Not updating the ledger promptly: Timely updates are essential after each transaction. Delays can result in outdated information and potential issues with ownership verification.

-

Ignoring the need for signatures: The form should be signed by the appropriate parties. Not obtaining signatures can render the document invalid and complicate future transactions.