Valid Loan Agreement Template

Document Sample

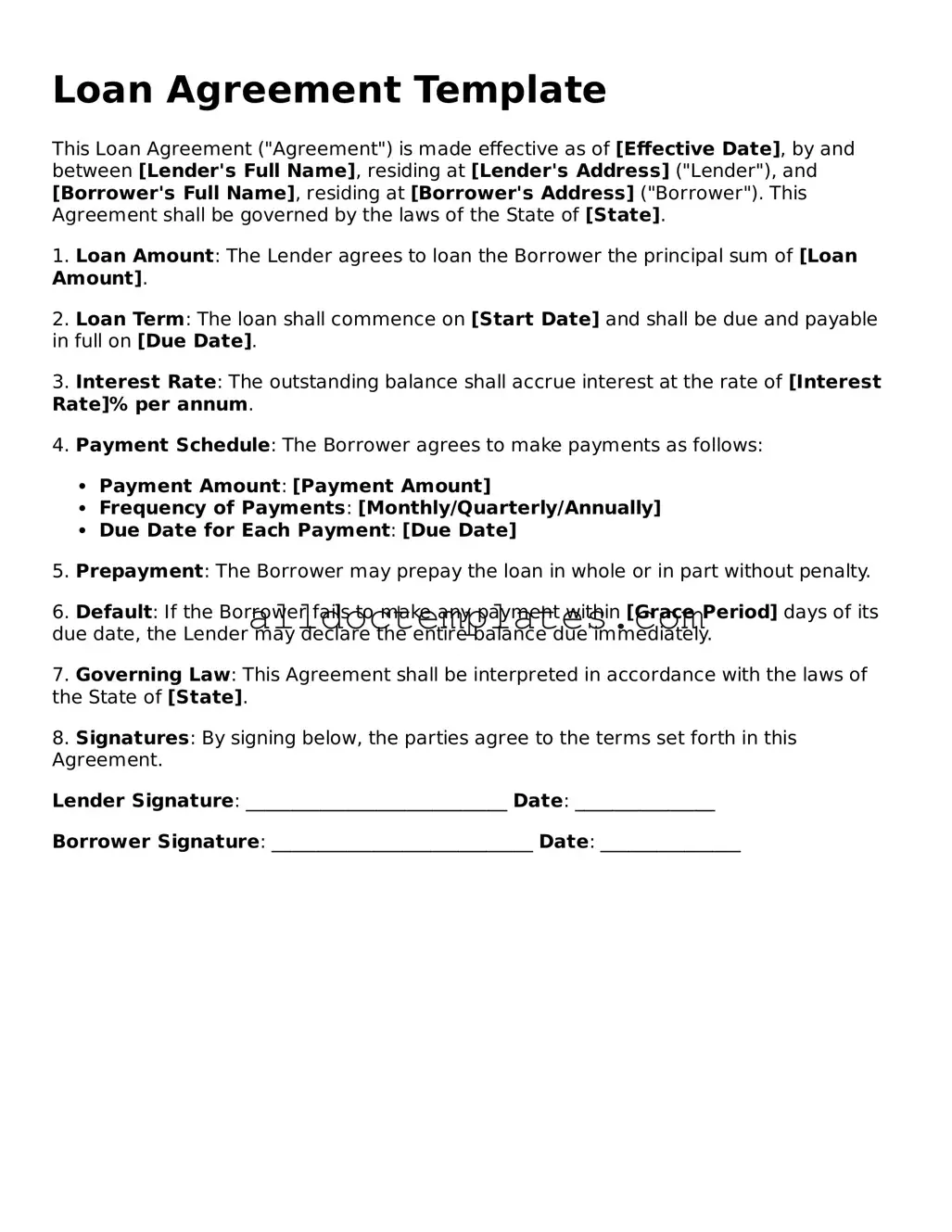

Loan Agreement Template

This Loan Agreement ("Agreement") is made effective as of [Effective Date], by and between [Lender's Full Name], residing at [Lender's Address] ("Lender"), and [Borrower's Full Name], residing at [Borrower's Address] ("Borrower"). This Agreement shall be governed by the laws of the State of [State].

1. Loan Amount: The Lender agrees to loan the Borrower the principal sum of [Loan Amount].

2. Loan Term: The loan shall commence on [Start Date] and shall be due and payable in full on [Due Date].

3. Interest Rate: The outstanding balance shall accrue interest at the rate of [Interest Rate]% per annum.

4. Payment Schedule: The Borrower agrees to make payments as follows:

- Payment Amount: [Payment Amount]

- Frequency of Payments: [Monthly/Quarterly/Annually]

- Due Date for Each Payment: [Due Date]

5. Prepayment: The Borrower may prepay the loan in whole or in part without penalty.

6. Default: If the Borrower fails to make any payment within [Grace Period] days of its due date, the Lender may declare the entire balance due immediately.

7. Governing Law: This Agreement shall be interpreted in accordance with the laws of the State of [State].

8. Signatures: By signing below, the parties agree to the terms set forth in this Agreement.

Lender Signature: ____________________________ Date: _______________

Borrower Signature: ____________________________ Date: _______________

State-specific Information for Loan Agreement Forms

Loan Agreement Document Categories

Form Data

| Fact Name | Description |

|---|---|

| Definition | A Loan Agreement is a legally binding contract between a lender and a borrower outlining the terms of a loan. |

| Key Components | Common elements include the loan amount, interest rate, repayment schedule, and any collateral required. |

| State-Specific Variations | Each state may have specific requirements or forms; for example, California’s Loan Agreement is governed by the California Civil Code. |

| Default Clauses | Most agreements include provisions detailing what happens in case of default, such as late fees or legal action. |

| Importance of Clarity | Clear language helps prevent misunderstandings and disputes, making it essential for both parties to review the terms carefully. |

Loan Agreement - Usage Guidelines

Filling out the Loan Agreement form requires careful attention to detail. Each section must be completed accurately to ensure clarity and compliance. Follow these steps to fill out the form correctly.

- Begin with your personal information. Enter your full name, address, and contact details at the top of the form.

- Provide the loan amount you are requesting. Make sure this number is clear and easy to read.

- Specify the purpose of the loan. Briefly describe what the funds will be used for.

- Include the interest rate. This should be expressed as a percentage and clearly stated.

- Indicate the repayment terms. Specify how long you will take to repay the loan and the frequency of payments (monthly, bi-weekly, etc.).

- Fill in the date when the loan agreement will be effective.

- Review all the information you have entered. Ensure everything is accurate and complete.

- Sign and date the form at the bottom. Your signature indicates your agreement to the terms outlined.

After completing the form, keep a copy for your records. Submit the original to the lender as instructed. Make sure to follow up to confirm receipt and clarify any questions they might have.

Browse Popular Documents

Employee Loan Agreement Pdf - Sets forth the procedure for applying for the loan and approval process.

When completing the sale of a motorcycle, it is crucial to utilize a Colorado Motorcycle Bill of Sale form, which documents the transaction between the buyer and seller. This legally binding document includes important details about the motorcycle, such as its make, model, year, and identification number. For those looking for a reliable source to obtain this form, Colorado PDF Templates is an excellent resource that ensures you have the necessary paperwork to protect both parties and streamline the registration process.

Snowmobile Bill of Sale Template - A record detailing the terms of the sale of a snowmobile.

Dos and Don'ts

When filling out a Loan Agreement form, it's important to approach the task carefully. Here are some guidelines to help you navigate the process effectively.

- Do read the entire agreement thoroughly before starting to fill it out.

- Do provide accurate and complete information to avoid delays.

- Do double-check all numbers and figures for correctness.

- Do ask questions if any part of the agreement is unclear.

- Do keep a copy of the completed form for your records.

- Don't rush through the form; take your time to ensure everything is accurate.

- Don't leave any required fields blank; this could lead to processing issues.

- Don't sign the agreement without fully understanding the terms.

- Don't ignore the deadlines for submission; timely filing is crucial.

By following these guidelines, you can help ensure that your Loan Agreement form is completed correctly and efficiently.

Common mistakes

-

Incorrect Personal Information: Many people enter wrong names, addresses, or contact details. This can lead to delays in processing the loan.

-

Missing Signatures: A common oversight is forgetting to sign the agreement. Without a signature, the document is not valid.

-

Inaccurate Loan Amount: Some individuals miscalculate the loan amount they need. Double-checking figures can prevent issues later.

-

Failure to Read Terms: Not reviewing the terms and conditions is a frequent mistake. Understanding the repayment schedule and interest rates is crucial.