Valid Lady Bird Deed Template

Document Sample

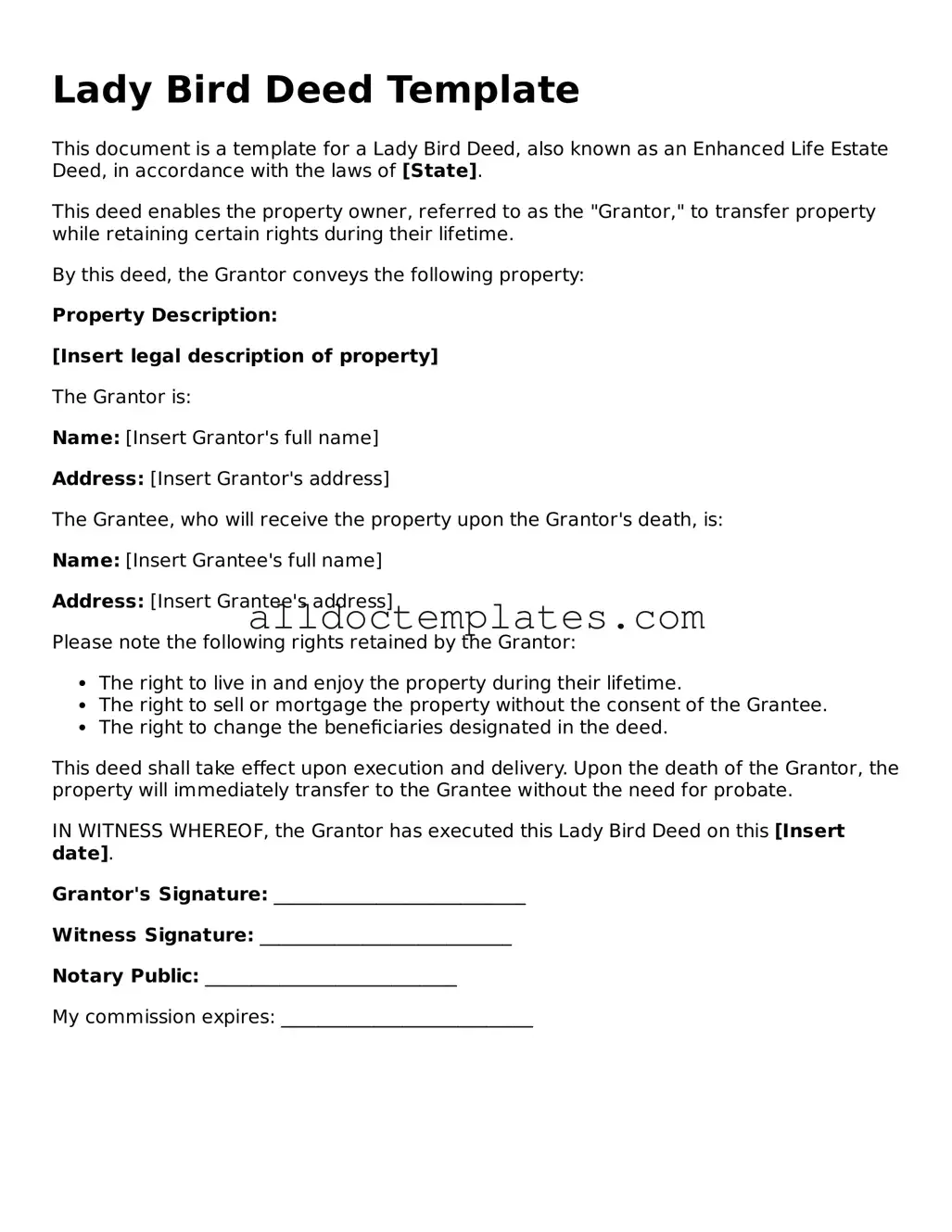

Lady Bird Deed Template

This document is a template for a Lady Bird Deed, also known as an Enhanced Life Estate Deed, in accordance with the laws of [State].

This deed enables the property owner, referred to as the "Grantor," to transfer property while retaining certain rights during their lifetime.

By this deed, the Grantor conveys the following property:

Property Description:

[Insert legal description of property]

The Grantor is:

Name: [Insert Grantor's full name]

Address: [Insert Grantor's address]

The Grantee, who will receive the property upon the Grantor's death, is:

Name: [Insert Grantee's full name]

Address: [Insert Grantee's address]

Please note the following rights retained by the Grantor:

- The right to live in and enjoy the property during their lifetime.

- The right to sell or mortgage the property without the consent of the Grantee.

- The right to change the beneficiaries designated in the deed.

This deed shall take effect upon execution and delivery. Upon the death of the Grantor, the property will immediately transfer to the Grantee without the need for probate.

IN WITNESS WHEREOF, the Grantor has executed this Lady Bird Deed on this [Insert date].

Grantor's Signature: ___________________________

Witness Signature: ___________________________

Notary Public: ___________________________

My commission expires: ___________________________

Form Data

| Fact Name | Description |

|---|---|

| Definition | A Lady Bird Deed allows property owners to transfer their property to beneficiaries while retaining control during their lifetime. |

| Ownership | The property owner retains full ownership rights, including the ability to sell or mortgage the property. |

| Beneficiaries | Beneficiaries can receive the property automatically upon the owner’s death, avoiding probate. |

| State-Specific Use | Commonly used in states like Florida, Texas, and Michigan, where the law recognizes this type of deed. |

| Governing Laws | In Florida, it is governed by Florida Statutes § 689.051. In Texas, it is recognized under Texas Property Code § 5.041. |

| Tax Implications | There are generally no gift tax implications at the time of transfer, as ownership remains with the grantor until death. |

| Revocation | The deed can be revoked or changed at any time by the property owner, ensuring flexibility. |

| Eligibility | Only individuals can create a Lady Bird Deed; it is not available for corporations or partnerships. |

Lady Bird Deed - Usage Guidelines

Once you have the Lady Bird Deed form ready, you can begin filling it out. This process involves providing specific information about the property and the individuals involved. Make sure to have all necessary documents and information at hand to ensure accuracy.

- Begin by entering the date at the top of the form.

- Provide the name of the current property owner. This should match the name on the property title.

- Next, list the address of the property. Include the street number, street name, city, state, and zip code.

- Identify the beneficiaries. Write the names of the individuals who will inherit the property.

- Include the relationship of each beneficiary to the property owner. This helps clarify the intent of the deed.

- Specify any conditions or instructions regarding the transfer of the property. Be clear and concise.

- Sign the form. The property owner must sign the deed in the designated area.

- Have the deed notarized. A notary public must witness the signing and provide their seal.

- Finally, file the completed deed with the appropriate county clerk's office. This ensures the deed is recorded and legally recognized.

More Types of Lady Bird Deed Templates:

Title Companies and Transfer on Death Deeds - It is a straightforward tool for estate planning, simplifying the transfer of assets.

If you're interested in establishing a proper understanding with your tenant, the essential guidelines for creating a Room Rental Agreement are necessary to ensure all parties are protected legally. This document serves as a foundational resource for anyone renting out a room in Arizona, providing clarity on important aspects such as payment terms and maintenance responsibilities. For more information, visit our detailed Room Rental Agreement information page to assist you in the process.

California Correction Deed - The process of drafting a Corrective Deed should involve all original parties to the transaction.

What Does a Trust Deed Look Like - This document outlines the relationship between a borrower and lenders.

Dos and Don'ts

When filling out the Lady Bird Deed form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are ten things to consider:

- Do provide accurate information about the property owner.

- Do clearly identify the property being transferred.

- Do include the names of all beneficiaries.

- Do ensure that the form is signed and dated by the property owner.

- Do have the form notarized to validate it.

- Don't leave any sections of the form blank.

- Don't use vague language when describing the property.

- Don't forget to check local laws regarding the Lady Bird Deed.

- Don't assume that the form is valid without proper execution.

- Don't overlook the need for copies for all parties involved.

Common mistakes

-

Incorrect Property Description: People often fail to provide a complete and accurate description of the property. This can lead to confusion about what is being transferred.

-

Missing Signatures: All required parties must sign the form. Sometimes, individuals forget to sign or do not have all necessary parties sign, which can invalidate the deed.

-

Not Notarizing the Document: Many overlook the requirement for notarization. Without a notary's signature, the deed may not be legally recognized.

-

Failing to Record the Deed: After completing the form, it is essential to record the deed with the appropriate county office. Neglecting this step can result in the deed not being enforceable.