Fill in a Valid IRS Schedule B 941 Form

Document Sample

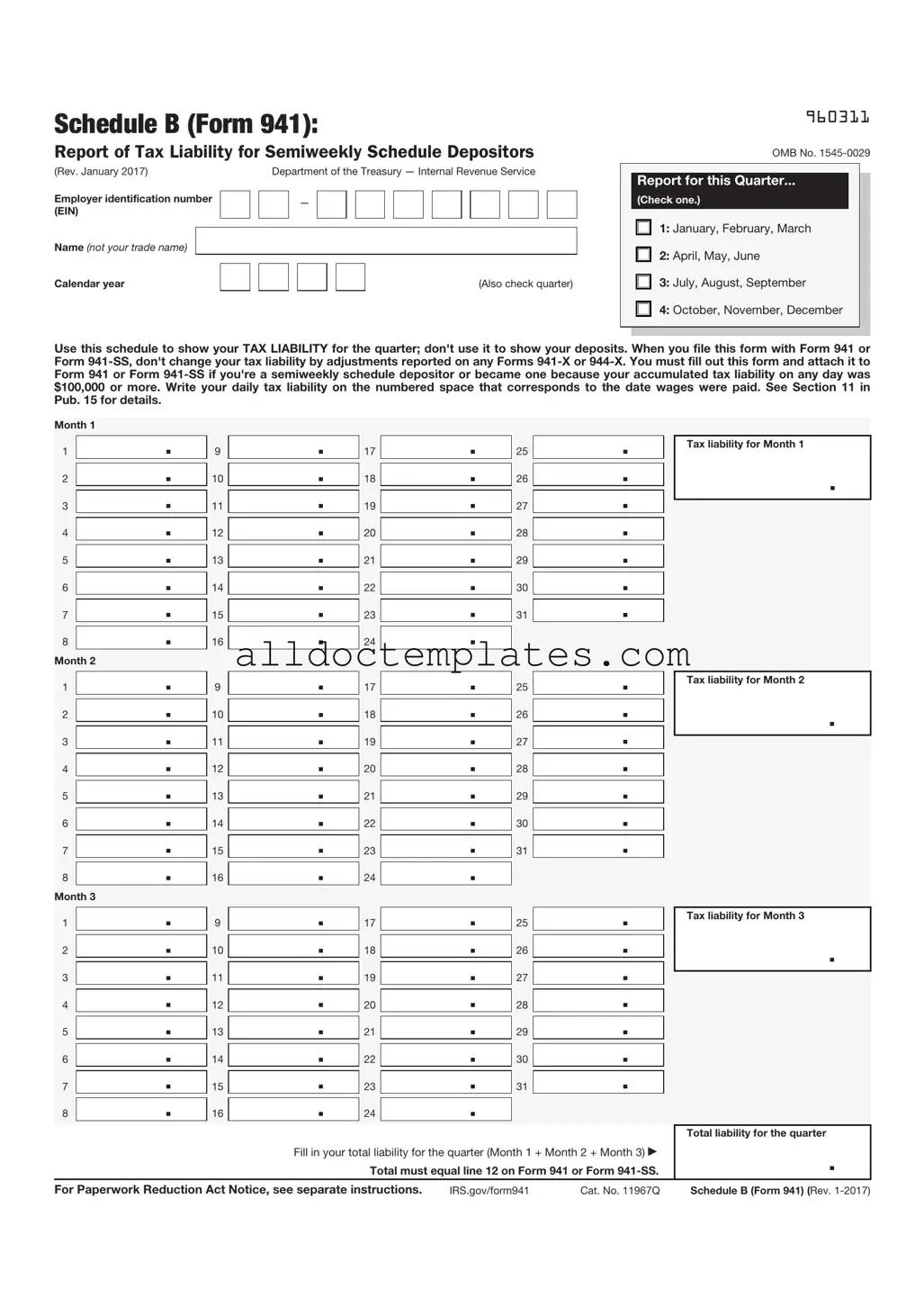

Schedule B (Form 941):

Report of Tax Liability for Semiweekly Schedule Depositors

(Rev. January 2017) |

|

|

Department of the Treasury — Internal Revenue Service |

|||||||||||||||||||

Employer identification number |

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

(EIN) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name (not your trade name) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Calendar year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Also check quarter) |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

960311

OMB No.

Report for this Quarter...

(Check one.)

1: January, February, March

2: April, May, June

3: July, August, September

4: October, November, December

Use this schedule to show your TAX LIABILITY for the quarter; don't use it to show your deposits. When you file this form with Form 941 or Form

Month 1

1 .

.

2 .

.

3 .

.

4 .

.

5 .

.

6 .

.

7 .

.

8 .

.

Month 2

1 .

.

2 .

.

3 .

.

4 .

.

5 .

.

6 .

.

7 .

.

8 .

.

Month 3

9 .

.

10 .

.

11 .

.

12 .

.

13 .

.

14 .

.

15 .

.

16 .

.

9 .

.

10 .

.

11 .

.

12 .

.

13 .

.

14 .

.

15 .

.

16 .

.

17 .

.

18 .

.

19 .

.

20 .

.

21 .

.

22 .

.

23 .

.

24 .

.

17 .

.

18 .

.

19 .

.

20 .

.

21 .

.

22 .

.

23 .

.

24 .

.

25 .

.

26 .

.

27 .

.

28 .

.

29 .

.

30 .

.

31 .

.

25 .

.

26 .

.

27 .

.

28 .

.

29 .

.

30 .

.

31 .

.

Tax liability for Month 1

.

Tax liability for Month 2

.

1 |

|

. |

9 |

|

. |

17 |

|

|

. |

25 |

|

. |

|

Tax liability for Month 3 |

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

2 |

|

. |

10 |

|

. |

18 |

|

|

. |

26 |

|

. |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

. |

11 |

|

. |

19 |

|

|

. |

27 |

|

. |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

. |

12 |

|

. |

20 |

|

|

. |

28 |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

. |

13 |

|

. |

21 |

|

|

. |

29 |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

. |

14 |

|

. |

22 |

|

|

. |

30 |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|

. |

15 |

|

. |

23 |

|

|

. |

31 |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

. |

16 |

|

. |

24 |

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liability for the quarter |

|

|

|

|

Fill in your total liability for the quarter (Month 1 + Month 2 + Month 3) |

. |

|||||||||

|

|

|

|

|

|

Total must equal line 12 on Form 941 or Form |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For Paperwork Reduction Act Notice, see separate instructions. |

IRS.gov/form941 |

Cat. No. 11967Q |

Schedule B (Form 941) (Rev. |

|||||||||||

Document Information

| Fact Name | Description |

|---|---|

| Purpose | The IRS Schedule B (Form 941) is used by employers to report their tax liability for federal income tax withheld and Social Security and Medicare taxes. |

| Filing Frequency | This form must be filed quarterly. Employers need to submit it along with Form 941 for each quarter of the year. |

| Who Must File | All employers who withhold federal income tax, Social Security tax, or Medicare tax from employee wages are required to file this form. |

| Governing Laws | The requirements for filing Schedule B are outlined in the Internal Revenue Code (IRC) and the regulations set forth by the IRS. |

IRS Schedule B 941 - Usage Guidelines

Once you have gathered all necessary information, you can begin filling out the IRS Schedule B (Form 941). This form is used for reporting certain tax-related details. Ensure that you have your employer identification number (EIN) and other relevant information at hand before starting the process.

- At the top of the form, enter your business name, address, and EIN.

- Indicate the quarter for which you are filing the form by checking the appropriate box.

- In Part I, provide the total number of employees who received wages during the quarter.

- List the total wages paid to employees during the quarter in the designated space.

- In Part II, report any adjustments to your tax liability, if applicable.

- Complete the section for tax deposits made during the quarter. This includes any payments made to the IRS.

- Calculate the total tax liability for the quarter and ensure all figures are accurate.

- Sign and date the form at the bottom, certifying that the information provided is correct.

After completing the form, review it for accuracy. Once satisfied, submit it to the IRS by the deadline specified for the quarter. Keep a copy for your records.

Common PDF Forms

Tansania Visa - List any other countries you have visited recently.

Profits or Loss From Business - The form facilitates the documentation of all necessary deductions to optimize tax outcomes.

Having a proper understanding of the Colorado Horse Bill of Sale is critical for ensuring a smooth transaction when selling or purchasing a horse. This document not only legitimizes the change of ownership but also protects both parties involved by clearly stating the terms of the sale. For those looking for a convenient way to obtain this essential legal form, Colorado PDF Templates offers a user-friendly solution.

Alabama High School Physical Form - The physical examination component assesses the overall fitness of the student.

Dos and Don'ts

When completing the IRS Schedule B (Form 941), it is important to follow certain guidelines to ensure accuracy and compliance. Below is a list of five things to do and five things to avoid when filling out this form.

- Do: Review the form instructions carefully before beginning.

- Do: Provide accurate information regarding your payroll tax liabilities.

- Do: Ensure that all required signatures are present on the form.

- Do: Double-check all calculations for accuracy.

- Do: Submit the form by the due date to avoid penalties.

- Don't: Leave any sections of the form blank unless instructed.

- Don't: Use outdated versions of the form; always use the current version.

- Don't: Provide estimates; use actual figures based on payroll records.

- Don't: Forget to keep a copy of the submitted form for your records.

- Don't: Ignore any correspondence from the IRS regarding the form.

Common mistakes

-

Incorrect Reporting of Tax Liability: Many individuals fail to accurately report their tax liability on the form. This can happen if they do not calculate the total payroll taxes owed properly or if they overlook any adjustments or credits that may apply.

-

Missing Information: It’s common for people to forget to fill out certain fields or provide necessary details. Missing information can lead to delays in processing or even penalties. Ensure that all required sections are complete, including employer identification numbers and dates.

-

Improper Signature: Some filers neglect to sign the form, which is a crucial step. Without a signature, the form is considered incomplete. Make sure to review the signature requirements and ensure that the appropriate person signs the document.

-

Filing Late: Timeliness is essential when submitting the Schedule B. Many people underestimate the deadlines, leading to late submissions. This can result in penalties and interest on unpaid taxes. Always check the filing schedule to avoid these issues.